Highlights:

- China giants ICBC & BoC issue Certified Bonds in record month for Certification, year to date

- Global firsts: green bond from a pension fund (Canada) and Hydro ABS (China)

- 6 new issuers from 5 countries to date this month

- Australia's NAB issues 4th Cert GB

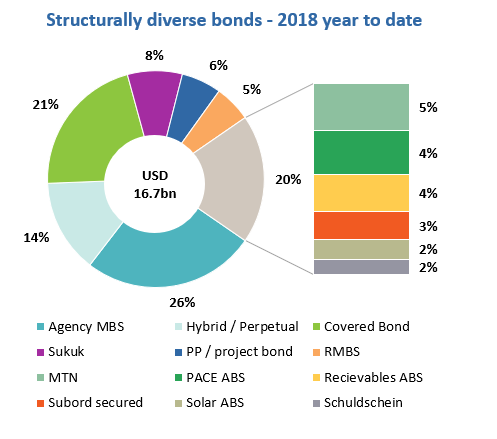

- Agency MBS, covered bonds, hybrids & perpetuals and other structurally diverse deals amount to USD16.7bn in 2018 so far

Go here to see the full list of new and repeat issuers in June.

At a glance

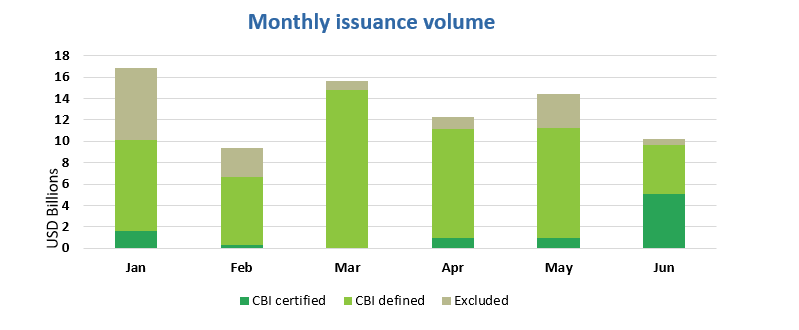

Industrial and Commercial Bank of China (ICBC), and Bank of China (Boc), 1st and 4th largest in the world by assets, issued Certified Climate Bonds from their respective London Branches in June, capping off record certification volumes. Certified issuance accounts for 52% of the USD9.5bn volume to 20 June and also includes two Norwegian covered bonds, as well as NAB’s first SDG Green Bond.

68% of monthly issuance to date has come from Developed Markets. Debut issuers Canada Pension Plan Investment Board (CPPIB) and DNB Boligkreditt made up almost a third of June figures so far.

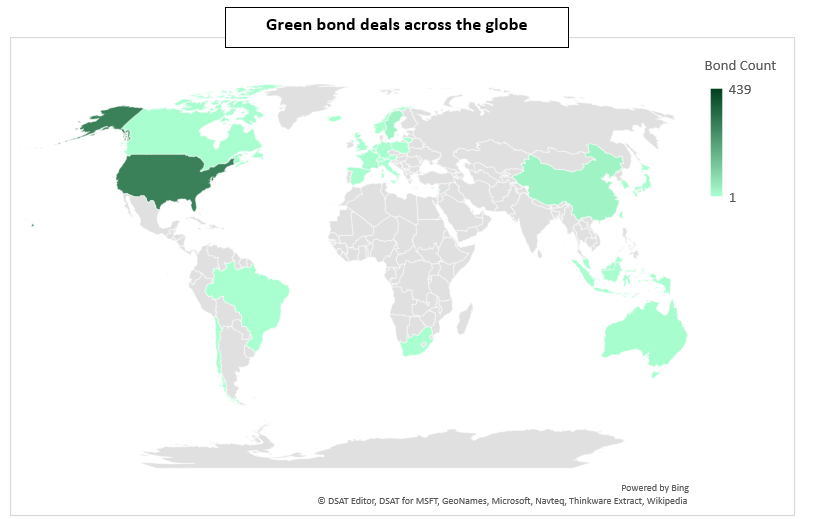

Emerging Markets issuance to date this month has come solely from China. China is also leading country issuance for the month at this stage (32%), with ICBC’s and Bank of China’s offshore issuance accounting for 84% of the nation’s green bonds. With an additional dual-currency green bond from ICBC Asia already in the market, China is well positioned to stay high in the rankings.

EUR and USD-denominated issuance prevails at 74% so far this month, partly driven by Chinese offshore deals, followed by CAD-denominated green bonds at 12%.

And a special shout out to Australia’s NAB and NZ Auckland Council, both finalising new and innovative certified green bond deals.

Bond diversity increasing

Senior unsecured bonds continue to dominate the green bond market, but bond structures are becoming increasingly diverse. So far in 2018 we have tracked USD16.7bn of structurally diverse deals. Agency MBS are the most popular format within this universe (26%), driven by Fannie Mae’s green issuance (only Q1 issuance is included at this stage). Covered green bond issuance come in second (21%), boosted by deals from three Nordic mortgage banks: SpareBank 1 Boligkreditt, Landshypotek Bank and DNB Boligkreditt.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issuer deal sheet in the online bond library.

Certified Climate Bonds

SpareBank 1 Boligkreditt - EUR1bn (USD1.2bn), Norway, obtained post-issuance certification in June under the Low Carbon Buildings (Residential) Criteria of the Climate Bonds Standard for its green covered bond issued in January 2018. Multiconsult provided the Post-Issuance Verification Report.

The certification complies with Climate Bonds’ newly approved proxy for the Norwegian residential market:

- EPC C label for houses and apartments

- Building codes 2007 (TEK07) for houses

- Building codes 2010 (TEK10) or 2017 (TEK17) for apartments. Apartments under TEK07 do not qualify unless they have an EPC label of C or higher.

DNB Boligkreditt (EUR1.5bn/USD1.7bn), Norway, issued a 7-year green covered bond and obtained certification under the Low Carbon Buildings (Residential) Criteria of the Climate Bonds Standard. Proceeds will finance new or existing residential buildings that comply with Norwegian building codes TEK10 or TEK17 and comply with CBI’s proxy methodology for Norwegian residential buildings.

Sustainalytics provided the Pre-Issuance Verification Report.

Existing issuers with issuance under new Criteria of the Climate Bonds Standard

Bank of China (USD1bn) issued a 5-year Certified Climate Bond.The deal is Certified against the criteria for Marine Renewable Energy (newly added to the framework), Low Carbon Transport, Water Infrastructure and Wind. The bond will finance 8 onshore and offshore wind projects in the Netherlands and Southern China, 2 sewage treatment renovation projects in Eastern China and 6 metro projects in Eastern and Northern China.

EY provided the Pre-Issuance Verification Report.

ICBC (USD1bn; EUR500m/USD578m) issued its second Certified Climate Bond in a dual-currency, three-tranche deal (longest dated bond: 5-year term) – more details available here. Issued by ICBC London branch, it is the largest green bond listed on the London Stock Exchange and the first Chinese issuance on LSE’s International Securities Market. The deal is Certified under the criteria for Solar, Wind, Marine Renewable Energy (newly added to the framework) and Low Carbon Transport. The bond will finance 3 railways in China, onshore wind and solar farms in China and Pakistan, and the Beatrice Offshore Windfarm project in Scotland.

Zhongcai Green Financing provided the Pre-Issuance Verification Report.

National Australia Bank (NAB) (USD750m) issued the 5-year bond under its new SDG Green Bond Framework and as part of a wider USD1.6bn offering. The bond is Certified under the criteria for Wind, Solar, Marine Renewable Energy (newly added), Low Carbon Transport and Low Carbon Buildings (Commercial). This is the fourth NAB-related Certified Climate Bond, reflecting the high levels of best practice in the Australian banking sector. Proceeds will be allocated to offshore and onshore wind and solar farms (Australia, New Zealand, UK, Ireland, Europe), electrified passenger rail infrastructure and rolling stock (Australia, UK), and commercial buildings (Australia).

DNV GL provided the Pre-Issuance Verification Report.

NAB’s new framework links category eligibility to the existence of Certification Criteria under the Climate Bonds Standard AND aligns the categories to SDGs. Climate mitigation and adaptation underpin meeting the UN Sustainable Development Goals. Green bonds can serve as a bridge to achieving SDGs.

> Climate Bonds views on the link between green bonds and SDGs will be explored in a series of briefings. The first briefing entitled Green bonds as a bridge to the SDGs was published yesterday.

New issuers

Canada Pension Plan Investment Board (CAD1.5bn/USD1.1bn) issued a 10-year green bond, becoming the first pension fund to enter the market. This is also the largest green bond from a Canadian issuer. CICERO provided a Second Party Opinion. Proceeds will be allocated to solar and wind assets, sustainable water and wastewater management, and LEED Platinum certified green buildings. CICERO notes the issuer has not implemented a system to measure the environmental impacts of the financed projects, which has implications on transparency.

Climate Bonds view: Pension funds have a critical role to play in mobilising capital flows towards green and climate-related investments through their asset allocations and fixed income portfolios. CPPIB has a flexibility many pension funds don’t in being able to issue bonds directly and is paving the way for the Canadian market. We agree with CICERO that impact reporting is essential to provide evidence on the investment projects’ green credentials and hope to see issuers committing to high reporting standards going forward.

Louisiana Local Government Environmental Facilities and Community Development Community (USD12m) issued a green US Muni bond with a 19.4-year tenor. The deal will finance the placement of granite rock barriers approx. 100-150 yards off the coast of the Cameron Parish Gulf Shoreline to address and prevent the effects of coastal erosion. In the official statement, the issuer states that a Parish-specific Coastal Erosion Master Plan was developed by the Corps of Engineers in 2017. They found that several locations are experiencing significant erosion rates and around 1.5 to 2 miles of structural protection is needed to provide critical coastal defence.

Climate Bonds view: This is the first green bond from Louisiana and is also one of the few bonds with proceeds allocated towards resilience projects/assets.

Vacse (SEK500m/USD58m), Sweden, issued a 4-year green bond which benefits from a CICERO SPO. The deal will finance green buildings, solar or geothermal energy and clean transportation infrastructure. The minimum eligibility criteria for properties are: i) green building certification of LEED Gold, BREEAM-SE Excellent or Miljöbyggnad Silver for new buildings, and BREEAM-In use Very Good or Miljöbyggnad Silver for existing buildings, and ii) at least 20% lower energy usage for new and 25% for existing properties than is required by the Swedish National Building Code. Other assets/projects related to improving the energy performance of existing buildings – such as LED lighting, geothermal heating/cooling and ventilation system upgrades – are also eligible.

Climate Bonds view: Combining high green building certification levels with a minimum energy usage improvement threshold provides a better assurance of the energy performance levels of the financed properties.

Macquarie Group(GBP500m/USD669m), Australia, issued a GBP2bn loan facility which includes two GBP250m green tranches: a 3-year revolver and a 5-year term loan. This is the first green loan deal from an Australian asset manager. Proceeds will be allocated to:

- renewable energy (solar, wind, tidal, sustainable biomass),

- waste management (recycling, solid waste incineration, organic waste treatment, power generation, landfill gas collection),

- clean transportation and

- green buildings with at least a GBCA 6 star, BREEAM Excellent, LEED Gold certification or an equivalent regional standard.

Investments in technology, products or systems which enhance the energy performance of assets within these categories are also eligible. Projects directly related to fossil fuels, nuclear and biomass suitable for food production are explicitly excluded from the Green Bond Framework.

Climate Bonds view: The list of indicators that will be used in the issuer’s Impact Report includes “additional energy saving or operational performance data” under the green building category. This will provide more transparency around the actual environmental sustainability and mitigation benefits of the financed projects.

For waste-related projects, we are starting to see the need for more information to ensure that the financed projects and assets are compliant with a low-carbon transition. In this case, we would like to see details related to landfill gas collection projects to ensure that this process is not used to extend the lifetime of a landfill facility. Climate Bonds is in the process of developing more stringent eligibility requirements for including waste-related bonds in its database.

> Climate Bonds Criteria for recycling and waste management sectors are under development. Our next newsletter due out in July will have an update.

Chouzhou Commercial Bank (CNY1.5bn/USD235m), China, issued a 3-year green bond which benefits from an EY assurance report. The proceeds will be allocated to 3 major areas under PBOC’s green bond catalogue: resource conservation and recycling, low-carbon transport, and ecological protection and adaptation. More than 50% of the proceeds will finance ecological protection and adaptation. In the bond prospectus, the issuer gives two examples of eligible projects: a wastewater treatment project, which is expected to improve regional biodiversity and a land rehabilitation project, converting abandoned limestone mines into sustainable agricultural land by filling the pits with earth and water.

Climate Bonds view: Specifying if agricultural land would be used for crops or livestock would help assess the level of environmental benefit better. In any event, though, we support issuance that aims to renew local resource use, address the environmental impact of disused land and assets and increase climate resilience. The issuer has made the promise to implement a stringent due diligence process, which we strongly support and would hope to see detailed environmental impact reporting on the back of this.

Hengan Electrical Engineering Co., Ltd (CNY400m/USD63m), China, issued a 9-year, two-tranche green ABS, with two subsidiaries as originators. The deal is secured by 9 years worth of feed-in tariff receivables from 5 hydropower stations owned by the two subsidiaries. The proceeds are to be used for hydro power generation in the Yunnan region. CECEP provided an external review for this deal and disclosed the expected climate impact of the projects to be financed, including the avoidance of 111.1K tce and the reduction of 187.5K tons of CO2.

Climate Bonds view: In spite of the limited details available due to the deal being a private placement, we believe in its green credentials as both the underlying asset and use of proceeds are green.

Repeat issuers: June 6th – June 20th

- MTR: HKD200m/USD25m

- Jernhusen AB: SEK150m/USD17m

Trends

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Basque Government |

EUR500m |

15/06/2018 |

Sustainability/Social bond |

|

Ile de France |

EUR500m/USD584m |

14/03/2017 |

Sustainability/Social bond |

|

Ile de France |

EUR500m |

20/06/2018 |

Sustainability/Social bond |

|

Huzhou Municipal Construction Investment Group |

CNY500m/USD80m |

03/04/2018 |

Insufficient information |

|

Xinjiang Tianye (Group) Co.,Ltd. |

CNY220m/USD35m |

19/04/2018 |

Not aligned |

|

Guangdong Guangye Group Co.,Ltd. |

CNY900m/USD142m |

28/04/2018 |

Working capital |

|

Region Skåne |

SEK700m/USD81m |

12/06/2018 |

Pending |

|

Region Skåne |

SEK300m/USD35m |

12/06/2018 |

Pending |

|

TMB Bank |

USD60m |

07/06/2018 |

Pending |

Green bonds in the market

- ICBC (Asia): closing 21 June

- Alexandria Real Estate Equities: closing 21 June

- Renew Financial: closing 22 June

- IFC (private placement Philippines): closing 22 June

- Mitsubishi Estate: closing 26 June

- Auckland Council: closing 27 June

Investing News

37 of the largest European banks launched a new green mortgage scheme aimed at testing the World Green Building Council's new European energy efficiency criteria.

The ClimateWise Insurance advisory council launched a tool to help investors and regulators quantify the potential financial impact of the transition to a low-carbon economy.

The Monetary Authority of Singapore (MAS) and IFC signed a Memorandum of Understanding to grow the Asian green bond market.

The Shanghai Stock Exchange and Luxembourg Stock Exchange launched the Green Bond Channel, enabling international investors to access information on Chinese domestic green bonds listed in Shanghai.

The Securities and Exchange Commission of Nigeria is preparing to launch guidelines to facilitate the issuance of green bonds.

UBS Global Wealth Management has partnered with Hermes Investment Management to develop an SDG fund as part of what is expected to be the UK’s first 100% sustainable portfolio.

Wilmar International signed a USD200m loan with the Oversea-Chinese Banking Corporation that pegs its interest rates to its sustainability performance, the second deal of the kind from the Singapore-based agribusiness company. The meeting of the targets will be assessed annually by Sustainalytics.

Michigan company CMS Energy entered into syndicated sustainability-linked revolving credit facilities this week, with interest rates mainly linked to the company’s renewable energy generation targets.

Green Bond Gossip

North American Development Bank has arranged meetings with investors on 25 June to discuss a debut Swiss franc green bond.

LBBW has mandated lead managers for its first green Pfandbrief secured on green mortgages.

Korea East-Power established a Sustainability Bond Framework in preparation of its debut sustainability bond.

Hong Kong MTR’s new Green Finance Framework expands the scope of their green bond program to include green revolving and term loans. The company is discussing with HSBC the arrangement of a debut green loan.

Société Générale obtained approval from Taiwan’s Financial Supervisory Commission to issue Taiwan dollar-denominated green bonds.

Nigeria’s Debt Management Office plans to issue a second sovereign green bond by the end of the year.

In a digital poll at Environmental Finance’s Fixed Income Conference in London this week, 33% of participants said they believed that the green bond market will grow to between USD200bn to USD225bn this year. A further 40% of the market expected annual issuance of more than USD225bn. The audience polls also revealed that 56% consider green bonds as being an "additional" form of finance.

Reading and Reports

PRI’s “ESG, Credit Risk and Ratings: Part 2 – Exploring the Disconnects” reports the findings of roundtable discussions between investors and credit rating agencies focused on the role of ESG factors in credit risk analysis.

The Nature Conservancy and Climate Bonds Initiative have published a paper on sustainable land bonds entitled “Sustainable Land Bonds: How governments can finance climate commitments and strengthen rural economies”.

The International Capital Market Association (ICMA) released guidelines to help issuers and investors identify how green, social and sustainability bonds contribute to the Sustainable Development Goals.

Don’t miss this ESG podcast where the Securities Commission Malaysia outlines plans for green Islamic finance (part 2).

Moving Pictures

Take 1:12min to find out about Microsoft’s underwater data centre which uses zero energy to cool servers.

Take 1:19min to discover the 10 rivers responsible for 90% of plastic in the world’s oceans. And then you may want to watch this experiment demonstrating the impact of environmental degradation (4:20min).

‘Till next time,

Climate Bonds