Mkt update: roaring wk in GB mkt -Renovate America 1st labeled Green ABS $201m +2nd review! Big demand HSBC €500m 4x oversub; Oslo NOK1.5bn, CN’s $65m water, Repeats from EDC, EIB, OPIC, detail on SocGen; & gossip!

Submitted on Tue, 2015-12-08 00:00Corporate

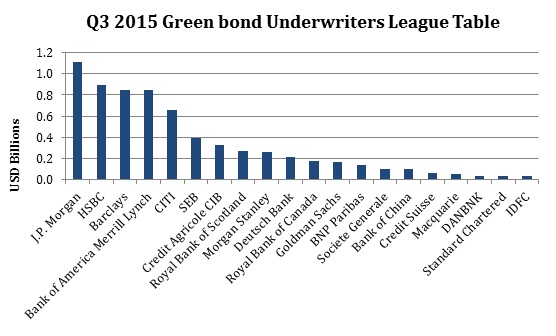

HSBC inaugural €500m ($547m) green bond is BIG success with 4x oversubscribed (0.625%, AAA, 10 yrs)