Media Release

Climate Bonds launches Green Criteria for Waste Management Investment

New industry sector under Climate Bonds Standard

LONDON 11/12/19 13:00 GMT: The Waste Management Criteria of the international Climate Bonds Standard has been formally launched marking a major turning point in best practice for low carbon and climate resilient investment in waste management industry and sectors and expanding the sector reach of the scheme which has now passed $100bn in certifications.

Developed via a Technical Working Group (TWG) process with Terry Coleman of RWSP as Lead Technical Consultant, the new Criteria defines and evaluates low carbon and climate resilient waste management projects by encompassing two broad components:

- Climate mitigation

- Climate adaptation and resilience

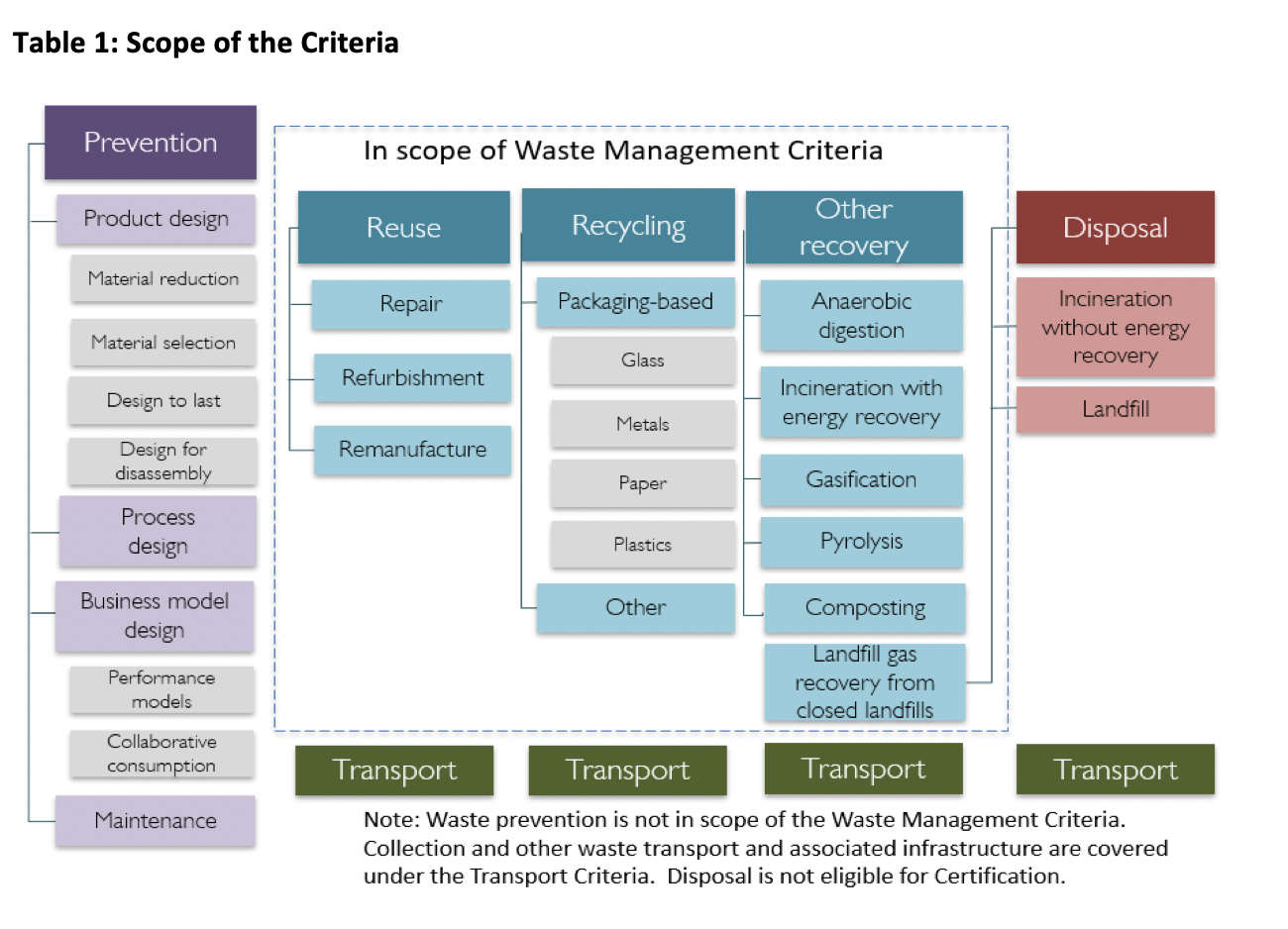

These Criteria are restricted to the eligibility of assets that deal with waste and focus on equipment, facilities and vehicles in the following activities:

- Collection (including collection infrastructure, containers);

- Transportation (covered by Climate Bonds Low Carbon Transport Criteria);

- Sorting to separate recyclables;

- Reuse and recycling (including processing into secondary raw materials and repair);

- Composting & anaerobic digestion of green/garden/yard and food waste;

- Thermal treatment with energy recovery of residual waste (outside of the EU);

- The installation of gas recovery systems for landfill sites (for non-operational landfill sites only).

Sean Kidney, CEO, Climate Bonds Initiative:

"The waste sector has the potential to contribute a 10-15% reduction in global greenhouse gas emissions and improving international waste management practices and processes has multiple sustainability benefits.”

“The addition of Waste Criteria to the Climate Bonds Standard opens up another science-based investment pathway for capital to be applied in this sector and deliver a range of positive environmental impacts."

Samantha Arnold, Senior Atmospheric Scientist, Golder Associates (UK) Ltd:

"Because we care deeply about our lasting impact on the world, Golder is proud to be an active member and participant in the Climate Bonds Initiative (CBI) Waste Management Technical Working Group (TWG).”

“Climate Bonds assembled a diverse team of global waste management experts to provide a framework for waste management climate funding opportunities, which directly aligns with the carbon emissions lowering objectives set out by the Paris Agreement."

"We are pleased that Golder’s WRATE life cycle assessment tool was utilised in the numerical analysis. Golder supports the aims of CBI and looks forward to continued participation in this important initiative as we strive to achieve a more sustainable future.”

Criteria Scope

Energy from Waste (EfW) is included in the scope of the Criteria outside of the European Union (EU). The Technical Expert Group convened by the European Commission to support its proposed draft Regulation on sustainable investment is working on a Sustainability Taxonomy. It is highly likely that the EU Sustainability Taxonomy currently under development will not recognize EfW facilities.

Therefore, Climate Bonds has decided that it will not currently regard EfW facilities within the EU as eligible, because it does not wish to undermine those objectives and guidelines within the EU.

The decision to have EfW as potentially eligible outside of the EU was taken because there is currently no prospect of recycling everything. There is a need to manage residual waste in the way that has least impact on the climate. With that in mind, Climate Bonds have proposed criteria that impose a tighter threshold on emissions intensity by requiring higher performance and allowing recycling to develop.

Our criteria are global, and many places do not have infrastructure in place for extensive recycling yet, and EfW (particularly under these conditions) remains a better option than landfill.

Climate Bonds see EfW as a transitional activity and will be reviewing the Criteria after 3 years with the view to potentially removing this from the Criteria in alignment with most climate-friendly waste management practices at that moment in time.

<Ends>

For more information, please contact:

Leena Fatin

Communications and Media Officer

Climate Bonds Initiative (London)

Notes for Journalists:

About the Climate Bonds Initiative: Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low carbon economy. Climate Bonds undertakes advocacy and outreach to inform and stimulate the market, provides policy models and government advice, market data and analysis, and administers an international Standard & Certification Scheme for best practice in green bonds issuance. For more information, please visit www.climatebonds.net.

About Climate Bonds Standard: It is an overarching science-based, multi-sector standard overseen by the Climate Bonds Standards Board that allows investors and intermediaries to easily assess the climate credentials and environmental integrity of bonds and other green debt products.

Launched in 2011, with periodic updates, the Climate Bonds Standard is the most detailed climate aligned investment criteria available in the market and provides guidance to issuers, investors, governments and regulators.

Release of Standard V3.0 is part of Climate Bonds Initiative’s development programme to improve the Standard, extend underlying Criteria to additional industry sectors, strengthen overarching Adaptation and Resilience (A&R) factors in each Criteria and update the core Climate Bonds Taxonomy.

Criteria Development: The Climate Bonds Initiative assembled a Waste Management Technical Working Group (TWG) that consisted of 19 experts across 16 organisations including universities, NGOs, consultancies, and industry associations. Details on TWG members can be found here.

Launched in January 2017, the Waste Management TWG considered the types of waste and the technologies to be in scope and the priorities for criteria development. The Waste Management TWG developed mitigation & adaptation criteria for waste management activities and infrastructure, which incorporated feedback from an Industry Working Group (IWG). The Criteria underwent public consultation from June to August 2019.

Climate Bonds extends its thanks to the dedicated TWG and IWG members for their instrumental role in developing the Criteria.

-------------------------------------------------------------------

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.

---------------------------------------------