First USD 100bn Certified against the Climate Bonds Standard

A Global Milestone for Robust Green Investment Frameworks

LONDON 05/12/19 12:00 GMT: Cumulative Certified green issuance under the Climate Bonds Standard has reached USD100bn, a significant market milestone for the international assurance scheme established by the Climate Bonds Initiative in 2011. Certified green bonds and loans have been issued by over 100 organisations from over 30 nations across 21 currencies, shaping the direction of global green finance markets in both developed and emerging economies.

Certified green bonds and loans have originated from Australia, Barbados, Belgium, Brazil, Chile, China Colombia, France, Germany, Greece, Hong Kong, India, Italy, Japan, Kenya, Luxembourg, Mauritius, Mexico, Morocco, Netherlands, New Zealand, Nigeria, Norway, Philippines, Poland, Singapore, South Africa, Russia, Thailand, United Arab Emirates, United Kingdom and the United States.

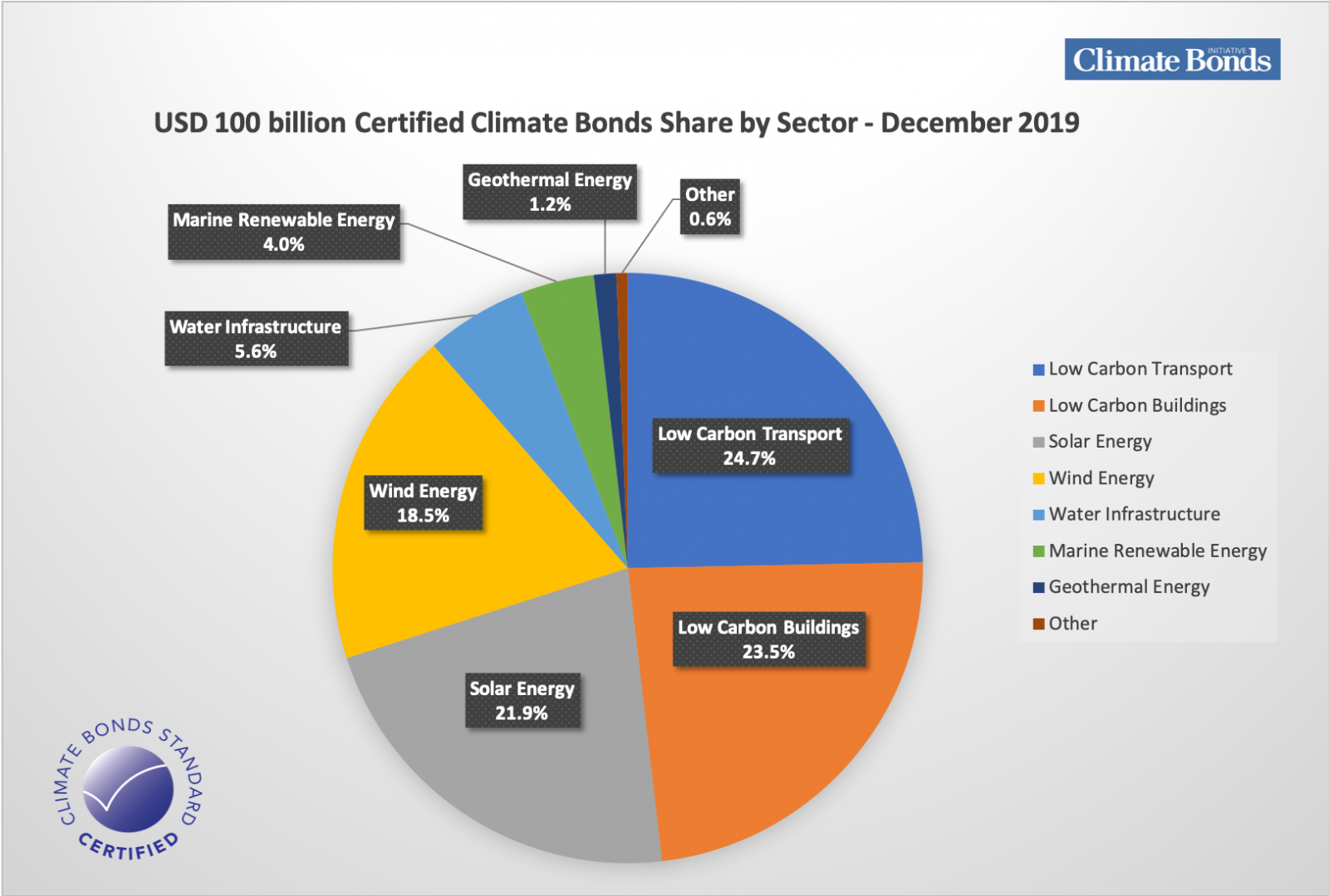

The US leads on overall Certified issuance by volume against the Standard, followed by Australia, France, India, Netherlands and Germany. (See Chart 1.)

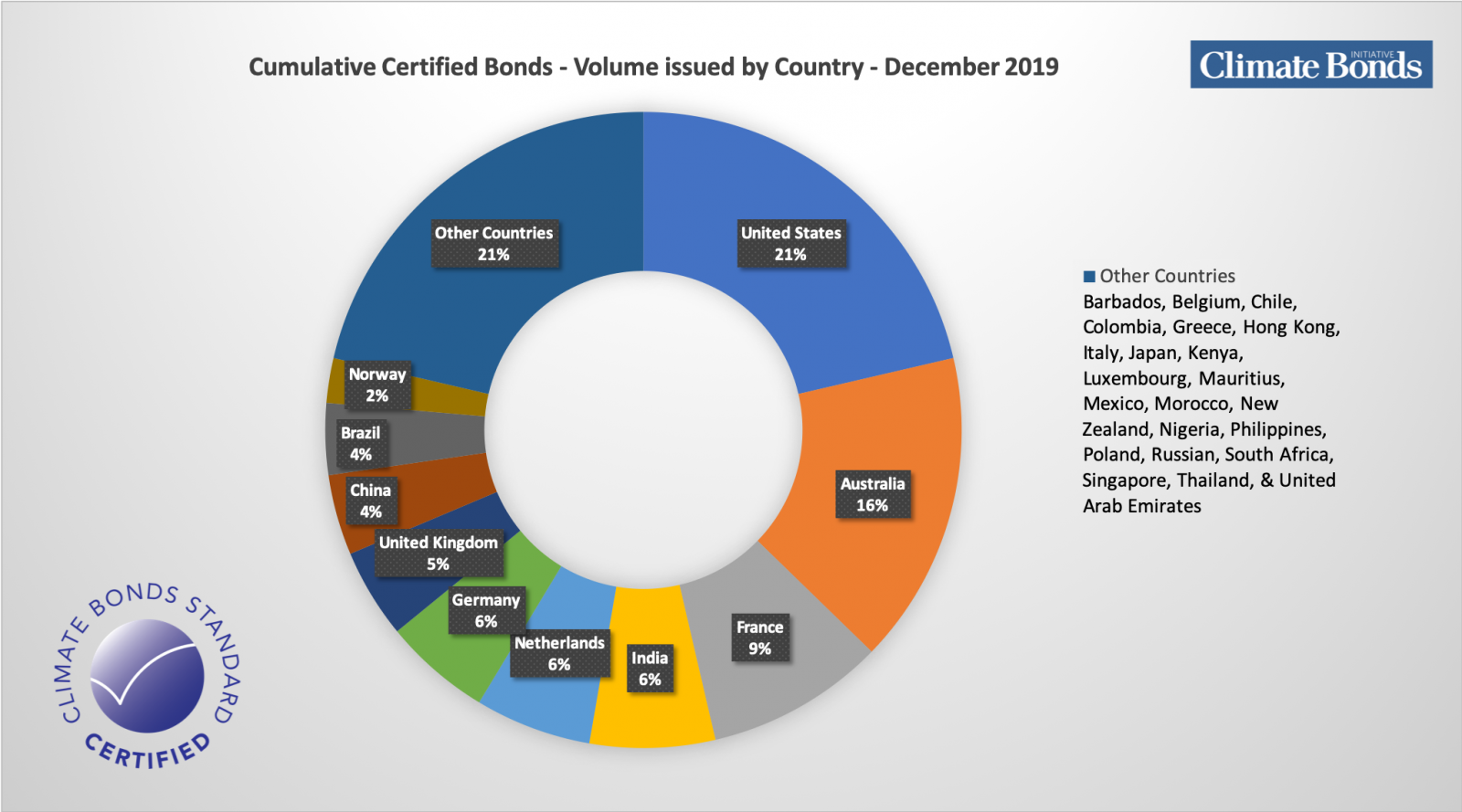

Of the $100.87bn Certified issuance to date, largest sector share was Low Carbon Transport (24.7%) followed by Low Carbon Buildings (23.5%), Solar Energy (21.9%), Wind Energy (18.5%) and Water Infrastructure (5.6%). Marine Renewables, Geothermal Energy, Protected Agriculture & Forestry Sectors have a combined share of just over 5.8%. (See Chart 2.)

High profile institutions that are Certifying green investments against the Standard include some of the world’s biggest banks: Industrial & Commercial Bank of China (ICBC), Bank of China (BOC), China Construction Bank (CCB) & China Development Bank (CDC) and Industrial Bank Co., Ltd (IBC).

Other banks have also been prominent including the State Bank of India (SBI), Australia’s ANZ, CBA, NAB and Westpac and European based ABN AMRO, ING & Société Générale.

Large scale transport authorities including Indian Railway Finance Corporation (IRFC), New York MTA, Société du Grand Paris (SGP), San Francisco BART, SNCF Réseau & Japan’s JRTT majority of whom are repeat issuers having adopted Programmatic Certification. The governments of Nigeria and Chile have also issued sovereign green bonds Certified against the Standard.

In 2019 to date the global green bonds & loans market has reached a record USD228.6bn, 19% of that issuance Certified against the Standard.

Highlights include Kenya’s first green bond, issuance from the automobile giant Porsche and a 100-year green bond, part of a Programmatic Certification series from French rail conglomerate SNCF Réseau. The largest green bond of 2019 and the second largest green bond ever issued to date was the Climate Bonds Certified sovereign bond from the Netherlands for EUR 5.98bn (USD 6.68bn). (See Table 1.)

Sean Kidney, CEO, Climate Bonds Initiative:

“This significant market development achievement belongs squarely with the issuers, underwriters, verifiers and advisors who’ve pioneered best practice in green finance.”

“The milestone is also a tribute to the work of numerous individuals and organisations participating in Technical and Industry Working Groups, ensuring the underlying Sector Criteria to the Climate Bonds Standard is soundly science-based and aligned with the goals of the Paris Climate Agreement.”

“Through the Standard we have established robust approach to transparency, disclosure and assurance, anchored firmly to climate science as best practice for both green debt issuers and institutional investors.”

“Our collective challenge is to now embed these foundations in every financial market and place them at the core of new climate change investment models which we require in facing the climate emergency.”

<Ends>

For more information, please contact:

|

Head of Communications & Media, Climate Bonds Initiative (London) +44 (0) 7914 159 838 |

Communications & Media Officer, Climate Bonds Initiative +44 (0) 7593 320 198 |

Notes for journalists:

About the Climate Bonds Initiative: Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low carbon economy. Climate Bonds undertakes advocacy and outreach to inform and stimulate the market, provides policy models and government advice, market data and analysis, and administers an international Standard & Certification Scheme for best practice in green bonds issuance. For more information, please visit www.climatebonds.net.

About Climate Bonds Certification: Climate Bonds Certification framework has been designed to work in parallel with the normal bond issuance process. It has 2 phases; Pre-Issuance and Post-Issuance. Certification of a Climate Bond at the pre-issuance phase enables the issuer and underwriters to market the bond as Climate Bond Certified. Further assurance activities in the post-issuance phase must be undertaken to maintain the Certification. Climate Bonds analysis calculates 100.87bn of Certifications as at 02/12/19.

The full Climate Bonds Database of Certified issuance can be found here.

About Verification: Verification is an assurance based process carried out by a Climate Bond Standards Board approved independent organisation (Approved Verifier) to assure that a climate bond issuance, the nature of the associated low carbon projects or activities and the associated financial accounting systems are in conformance with the Climate Bond Standard.

The full Climate Bonds Directory of Approved Verifiers can be found here.

Table 1 Top 10 Certified Climate Bonds in USD Equivalent

|

Top 10 Certified Climate Bonds in USD Equivalent |

|||||

|

Issuer Name |

Issue Date |

Amount USDbn |

Country |

Sector Criteria |

Approved Verifier |

|

Netherlands Sovereign Green |

May-19 |

6.68 |

Netherlands |

Low Carbon Buildings Transport, Marine Renewable Energy, Solar, Water Infrastructure |

Sustainalytics |

|

ING Group N.V. |

Nov-18 |

2.95 |

Netherlands |

Low Carbon Buildings |

Oekom Research |

|

Acwa Power |

Jan-19 |

2.69 |

UAE |

Solar |

Sustainalytics |

|

Société du Grand Paris |

Mar-19 |

2.27 |

France |

Low Carbon Transport |

Sustainalytics |

|

New York MTA |

Dec-17 |

2.17 |

United States |

Low Carbon Transport |

Sustainalytics |

|

Industrial & Commercial Bank of China |

Oct-17 |

2.14 |

China |

Solar Wind |

Beijing Zhongcai Green Financing Consultant Ltd. |

|

Société du Grand Paris |

Oct-18 |

2.01 |

France |

Low Carbon Transport |

Sustainalytics |

|

DNB Boligkreditt |

Jun-18 |

1.77 |

Norway |

Low Carbon Buildings |

Sustainalytics |

|

SNCF Réseau |

Jul-19 |

1.70 |

France |

Low Carbon Transport |

Sustainalytics |

|

China Development Bank |

Nov-17 |

1.62 |

China |

Low Carbon Transport |

EY Asia Pacific |

Chart 1.

Chart 2.