Why Green Transport Counts

Transport is the second largest contributor to global GHG emissions after electricity generation; responsible for 23% of all energy-related CO2 emissions globally.

Why Green Transport Counts

Transport is the second largest contributor to global GHG emissions after electricity generation; responsible for 23% of all energy-related CO2 emissions globally.

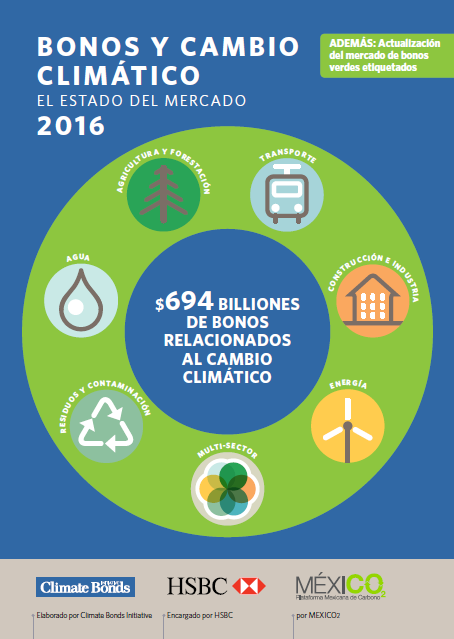

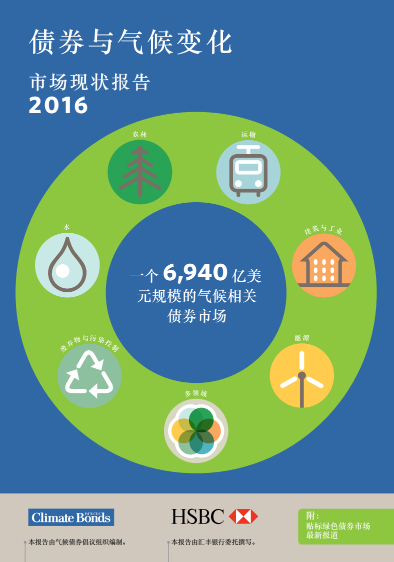

‘Bonds and Climate Change: State of the Market 2016’ Mexico Edition launched in Mexico City.

Published in Spanish for the first time. Mexico holds great potential for green bond issuance, particularly in the energy, transportation and water sectors. Until now, only one labeled green bond has been issued in Mexico.

Mexico and Colombia launches are up next week, following our high profile Brazil launch in Sao Paulo.

You’re invited to attend or send a local representative.

LSX & SGX Dual Listed Green Masala: Solar & Wind Certified Climate Bond

Invitation: Shanghai: Friday 12th: Launch of Climate Bonds Green Bond Market Annual Report & Roundtable: Discussion on Chinese Green Bonds Market

Investment in wind energy assets is growing as costs come down, technology improves and energy policies shift towards renewables. As part of this trend we are seeing wind based green bonds being Climate Certified from Australia to India to Mexico.

Halfway in 2016: Issuance Up on 2015: New Underwriters from China: And Where Will Green Bonds Land by Dec 31st?

The Headline Figures:

Certified Climate Bonds

Alert: Certified Climate, Masala Bond from NTPC out soon