‘Bonds and Climate Change: State of the Market 2016’ Mexico Edition launched in Mexico City.

Published in Spanish for the first time. Mexico holds great potential for green bond issuance, particularly in the energy, transportation and water sectors. Until now, only one labeled green bond has been issued in Mexico.

This is the first time this report has been translated and published in Spanish. The report includes an additional section that focuses on the state of green bonds in Mexico and future prospects

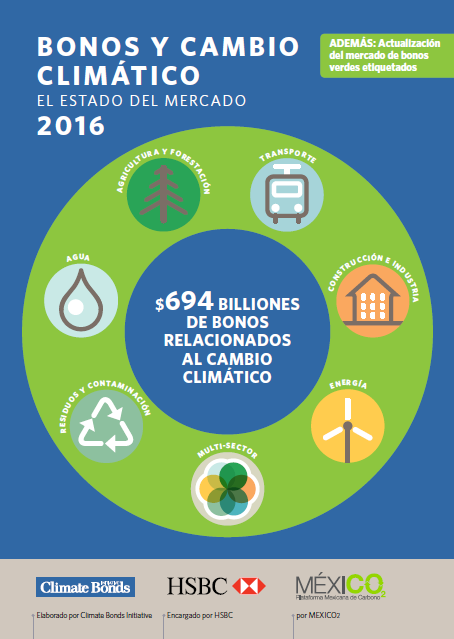

The report estimates that there is approximately $649bn in climate-aligned bonds outstanding globally, a dramatic increase from 2015’s estimate of $96bn. This estimate includes both labeled green bonds with defined use of proceeds and non-labeled climate-aligned bonds.

The $649bn USD climate-aligned bond universe encompasses 6 crucial sectors for the transition to a climate-resilient and low-carbon economy: transport (67%), energy (19%), multi-sector (8%), water (3%), buildings and industry (2%) and agriculture and forestry (1%).

Mexico - Ambitious Climate Goals

In Mexico, there are $1.3bn in climate-aligned bonds outstanding; including the country’s only labeled green bond ($500 million) issued by Nacional Financiera (NAFIN). Although climate-aligned issuances in the country have been small, the potential for future issuances is vast, considering Mexico’s ambitious climate goals.

In Mexico, there are $1.3bn in climate-aligned bonds outstanding; including the country’s only labeled green bond ($500 million) issued by Nacional Financiera (NAFIN). Although climate-aligned issuances in the country have been small, the potential for future issuances is vast, considering Mexico’s ambitious climate goals.

The report identifies a range of policy measures that would stimulate green bond investments to fund low carbon energy, transport, building and water infrastructure development & pollution reduction plans.

Tell me more about MEXICO2

The Mexican Carbon Platform, MÉXICO2, is an initiative that responds to the country’s needs on climate change. It provides an efficient mechanism that contributes to reducing GHG emissions, supporting projects whose mission is to protect and increase the country’s natural and social capital.

The Mexican Carbon Platform, MÉXICO2, is an initiative that responds to the country’s needs on climate change. It provides an efficient mechanism that contributes to reducing GHG emissions, supporting projects whose mission is to protect and increase the country’s natural and social capital.

MÉXICO2 is the country’s first platform for environmental markets, supporting Mexico’s transition to a green economy through market mechanisms.

MÉXICO2 is a market initiative jointly supported by the Mexican Stock Exchange and SIF ICAP; the British Embassy in Mexico, the United Nations Environment Programme (UNEP), the Ministry of Environment and Natural Resources (SEMARNAT), the National Forestry Commission (CONAFOR) and the National Institute of Ecology and Climate Change (INECC). Read more at www.mexico2.com.mx

The Last Word:

Eduardo Piquero, MÉXICO2 CEO:

“Given the need for climate-resilient infrastructure; substantial amounts of capital will be required in all sectors of the economy to help the country comply with its targeted GHG reductions. Just to comply with clean energy generation, Mexico needs over $5bn per year.”

“Given the need for climate-resilient infrastructure; substantial amounts of capital will be required in all sectors of the economy to help the country comply with its targeted GHG reductions. Just to comply with clean energy generation, Mexico needs over $5bn per year.”

“Se requerirán grandes inversiones de capital en todos los sectores de la economía para asegurar el éxito en las metas de reducción de emisiones de gases de efecto invernadero en nuestro país. Sólo para cumplir sus objetivos de generación en energía limpia, México necesitará más de 5 mil MDD por año.”

Sean Kidney, Climate Bonds CEO:

“Este reporte representa un paso más hacia el financiamiento de bonos verdes en México. Un sector financiero apropiado fondos de pensiones, las carteras de proyectos, claros y el liderazgo nacional comprometida con la acción climática creciente significa que todos los elementos están ahí para México para liderar en el desarrollo de modelos de financiación verde LATAM.”

Disclaimer: The information contained in this media release does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.