Climate Bonds Blog

In Brussels on Monday 17th September?

Have time to spare in the morning?

Join us for an exclusive, pre-launch preview of the Climate Bonds Taxonomy: a guide to climate aligned assets & projects, kindly hosted by Burson, Cohn & Wolfe.

This is a special opportunity for EU based issuers, investors, verifiers and regulators to attend a pre-launch briefing on the updated Climate Bonds Taxonomy, prior to the official launch at Climate Week in New York.

Highlights:

The Climate Bonds team will be in the Americas, Europe & Asia this month.

We'll also have a big team at GCAS in San Francisco talking up green finance and the Green Bond Pledge.

And don't our Director of Market Development, Justine Leigh-Bell speaking at Moody's 3rd Climate Week Briefing as part of CWNYC. It's one of the highlights of Climate Week.

AUD10.2 billion in green bonds issued to date

Need for acceleration to address coming climate impacts

Seats filling fast for next week’s triple treat of Australian & New Zealand green finance events.

What's it all about

Australia & NZ’s low-carbon transition will provide extensive opportunities for institutional investors looking to increase portfolio exposure to green and ESG related investment.

Climate Bonds will be launching two major reports in Australia and New Zealand next week focused on green investment.

MARKET NEWS

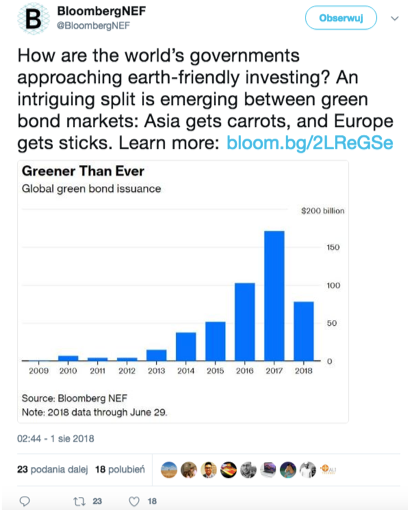

Bloomberg Opinion, How the World’s Governments Are Approaching Earth-Friendly Investing, Nathaniel Bullard and Daniel Shurey

Article analyses tactics of governments, in different regions of the world, aimed at scaling up green finance.

Proposals made by the companies will be presented to Brazil’s Green Finance Initiative (BGFI) for a discussion with investors at its next meeting, in September.

What’s it all about?