Don’t miss! Climate Bonds Conference2020, 5-7th May, London.

Don’t miss the premier green finance event on next year’s calendar. More information & registration is here.

Indonesia GIIO, Update Report

The Green Infrastructure Investment Opportunities Indonesia, Update Report builds on the inaugural Green Infrastructure Investment Opportunities, Indonesia report released in May 2018. It provides updated content to help meet the growing demand for green investment opportunities, including green bonds, as well as to support the country’s transition to a low-carbon economy.

The Green Infrastructure Investment Opportunities Indonesia, Update Report builds on the inaugural Green Infrastructure Investment Opportunities, Indonesia report released in May 2018. It provides updated content to help meet the growing demand for green investment opportunities, including green bonds, as well as to support the country’s transition to a low-carbon economy.

Climate Bonds has released Version 3.0 of the international Climate Bonds Standard. V3.0 incorporates major upgrades to the existing umbrella of guidance and requirements for Climate Bonds Certification to meet market demand for enhanced reporting, transparency and harmonisation around green definitions.

Climate Bonds has released Version 3.0 of the international Climate Bonds Standard. V3.0 incorporates major upgrades to the existing umbrella of guidance and requirements for Climate Bonds Certification to meet market demand for enhanced reporting, transparency and harmonisation around green definitions.

Over $100bn of green investment has been Certified by Climate Bonds. Read the full story and Sean Kidney’s comments in our special blog post.

Alongside the Version 3.0 of the Standard, Climate Bonds also launched new Criteria for green debt instruments in the Waste Management sector expanding the suite of industry sectors available for Certification. The launch marks a major turning point in best practice for low carbon and climate resilient investment in waste management assets and projects. Full statement and links are here.

Alongside the Version 3.0 of the Standard, Climate Bonds also launched new Criteria for green debt instruments in the Waste Management sector expanding the suite of industry sectors available for Certification. The launch marks a major turning point in best practice for low carbon and climate resilient investment in waste management assets and projects. Full statement and links are here.

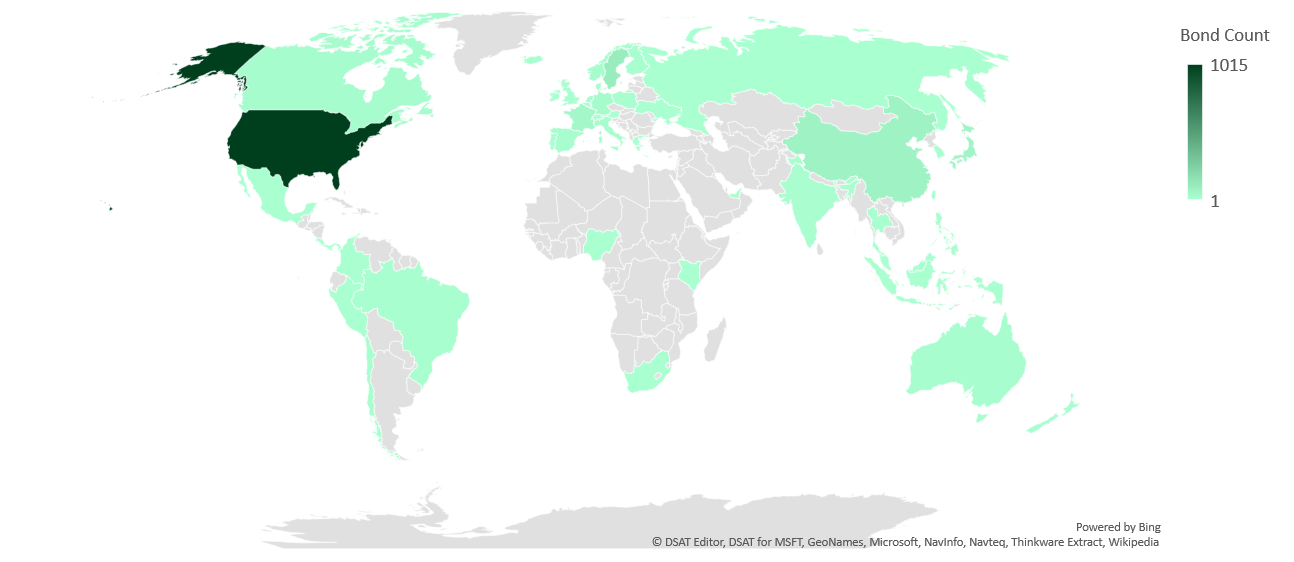

Green bond deals across the globe: 1 Jan – 13 Dec 2019

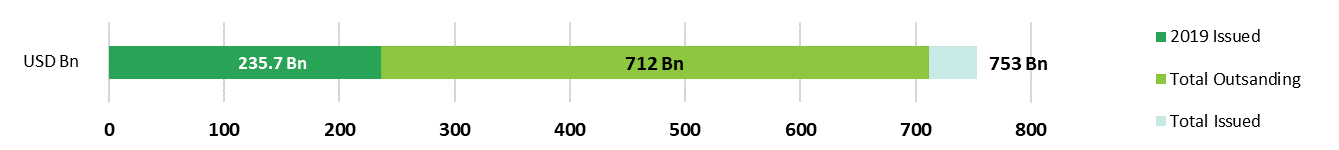

2019 issuance as of 13th December reached USD235.7bn, bringing the total global issuance to USD753bn. So far December saw 6 new issuers, making up 37% of total recorded volume for the month up to 13th December. Of 19 issuers in total, 8 were non-financial corporates and 4 financial corporates. Italian Bank Intesa Sanpaolo returned to the market with its second green bond. The EUR750m (USD831m) deal will finance circular economy initiatives across several sectors, adding to the small group of European financial institutions – including Dutch peers ING and ABN AMRO and Finland’s OP - to raise funds for projects in this emerging theme.

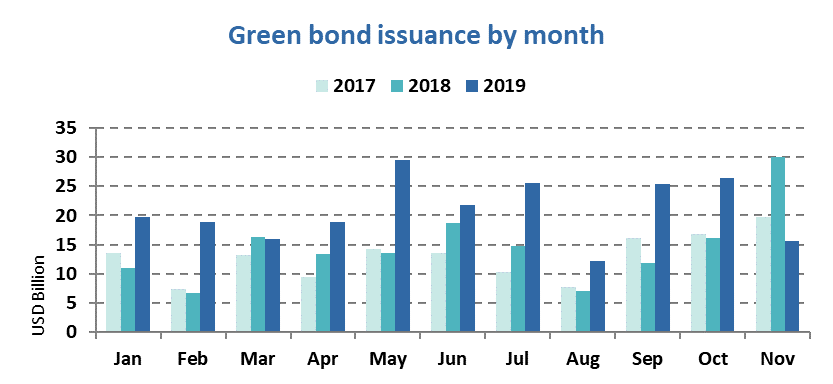

Monthly snapshot: November

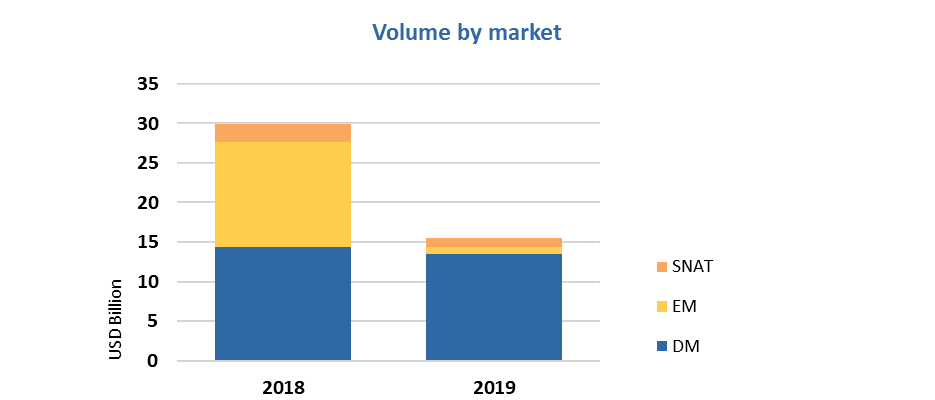

Overall issuance in November 2019 amounted to USD15.5bn, down from USD30bn in November 2018 and equating to a decrease of 48% year on year. Volume also saw a drop compared to October 2019 when USD26.4bn of green bonds were issued. USD15.5bn is the second lowest monthly figure in 2019 after August. As of 30th November, 2019 issuance had reached a total of USD229.8bn.

November issuance came mainly from developed markets (DM), which accounted for 87% (USD13.5bn) of the overall monthly figure with instruments from 14 different countries. Green bonds from the USA, Germany and Sweden made up most of the volume. Emerging markets (EM) totalled 5% of the overall volume with contributions from 4 countries. China and Ukraine took the lead in this category with around USD359m each.

The reason for the sharp decrease in monthly volume compared to last year is a lag in Chinese issuance. In November 2018, Chinese entities issued green bonds worth USD12.8bn making up 43% of the overall volume, boosting EM issuance to USD13.3bn. This was rooted in two major deals from the Industrial Bank of China with CNY30bn (USD3.4bn) each.

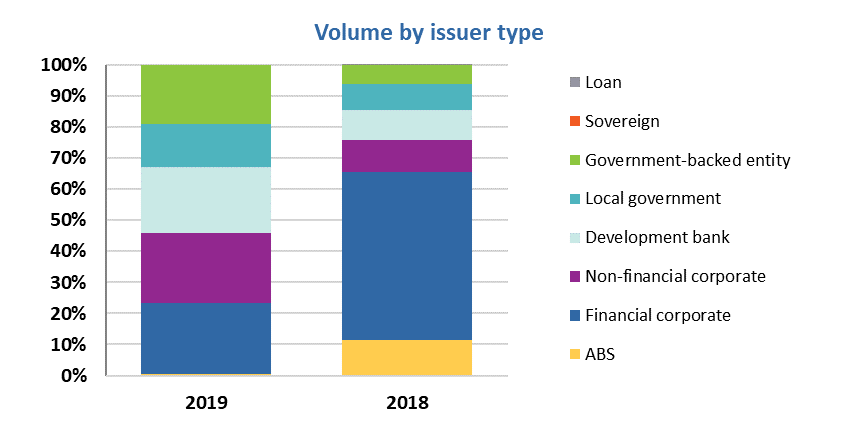

Looking at issuer types for November 2019, we can see an almost equal distribution (ranging from local governments with USD2.1bn to financial and non-financial corporates with USD3.5bn). There was no activity from sovereigns or green loan issuers in either year. China’s Industrial Bank issuance explains the difference in the share of financial corporates between 2018 and 2019.

Around one third of the funds in November 2019 went towards Energy (USD4.9bn) and Building projects (USD4.4bn) with 32% and 28% shares of total allocations, respectively. Transport and Water accounted for USD2bn and USD2.3bn. Waste, Land Use and ICT made up the rest of the month’s volume.

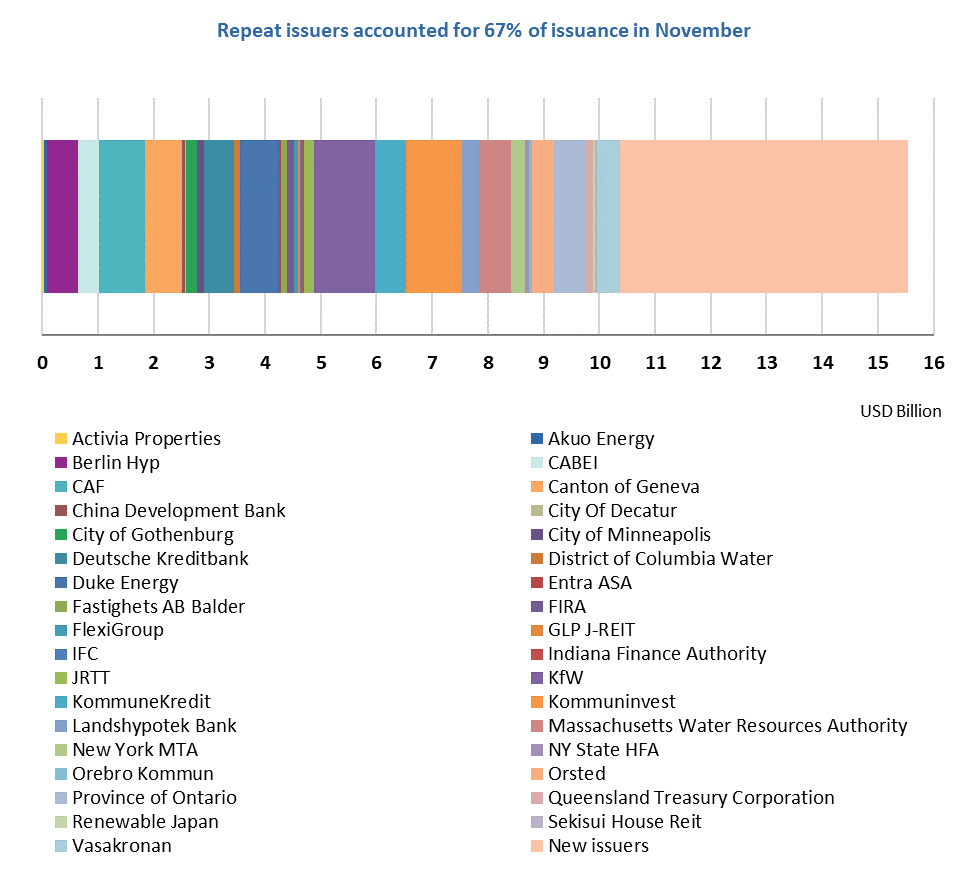

The largest deals came from KfW, Germany, with EUR1bn (USD1.1bn), Kommuninvest, Sweden, with USD1bn and Development Bank of Latin America (CAF), Supranational, with EUR750m (USD830m). All of them financed multiple project categories.

Smaller deals came from Shizen Energy, Japan, (JPY300m/USD3m), Center-invest Bank, Russia, (RUB250m/USD4m) and Grenergy Renovables (EUR22m/USD24m). All three issuers directed at least part of the funds to renewable energy projects.

Overall, 67% of green bonds in November 2019 came from repeat issuers.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

New issuers 1 November to 13 December (and issuers not previously included)

Public sector

Patrimonio Autónomo Titularización TMAS-1 (FDN), (COP131.5bn/USD41m), Colombia, had its inaugural issuance with a sustainability bond in August 2019. It is the first of its kind from Colombia and the first labelled bond from a Colombian development bank in 2019. As per the SPO from Sustainalytics, the proceeds will be used by the concessionaires to purchase compressed natural gas buses to operate on four “corridors” of TransMilenio’s BRT system. The vehicles will be compliant with EURO VI emissions standards.

Annual allocation reporting will be provided, including the average value of financing provided to each of the four acquisition concessionaires. The framework also specifies key environmental and social impact indicators for annual reporting, including the number of buses purchased, a measure of local air quality and the number of passengers from disadvantaged groups using the four BRT corridors.

Climate Bonds view: The Latin American region is in serious need of investment in low-carbon infrastructure, particularly in low-carbon mass transport. As highlighted in our recent LAC State of the Market report, this sustainable bond issuance complements other similar investments made in Colombian cities this year, which include a fleet of 125 electric buses in Cali and new 64 electric buses in Medellín.

More issuance in the public sector:

- Dormitory Authority of the State of New York (USD73m), USA, 30.6Y original term, no third-party review.

- City of Santa Cruz (USD21m), USA, 29.1Y original term, no third-party review.

Financial corporates

CNP Assurances (EUR750m/USD826m), France, came to market with a 30.7-year green bond. The issuance, which is only the second green bond from an insurance company globally, received an SPO from Vigeo EIRIS. The framework covers a range of eligible project categories, including green buildings, sustainable forestry, and green infrastructure. All categories contribute to at least one of three main environmental objectives: climate change mitigation, biodiversity protection and pollution prevention.

Allocation and impact reporting will be published on an annual basis until the bond matures. For the allocation side this includes a description of eligible assets, amounts allocated to each category, a financing-refinancing split (and the issuer’s share of total project financing), and unallocated proceeds. The impact report will contain metrics including avoided CO2 emissions and an estimated amount of CO2 sequestrated.

Climate Bonds view: CNP Assurance is the first French insurance company, and only the second ever globally, to join the green bond market. The insurance industry has huge potential to combat climate change, both through the core business of insurance provision as well as the assets that insurance companies hold. This is the first insurer green bond that covers multiple eligible categories and scale approaching USD1bn. Well done! The green bond in conjunction with CNP’s overall sustainability strategy shows a strong commitment to green business practices.

More deals issued by financial corporates:

- Daiwa House Industry (JPY6bn/USD55m), Japan, 10Y original term, SPO provided by Sustainalytics.

- Gunma Bank (JPY10bn/USD92m), Japan, 10Y original term, SPO provided by Sustainalytics.

- Welltower (USD500m), USA, 7.2Y original term, SPO provided by Sustainalytics.

Non-financial corporates

Citycon (EUR350m/USD388m), Finland, became a new green bond market entrant with a senior unsecured perpetual bond benefiting from a CICERO Second Party Opinion. The bond’s proceeds can be allocated to several project categories aimed at improving the environmental performance and climate mitigation credentials of buildings, broadly classified under green buildings, energy efficiency, renewable energy and waste management. Each category comes with its own set of specific eligibility criteria, such as certification levels or energy performance standards.

Citycon has committed to regular reporting for as long as the company has green financing instruments outstanding. The annual report will be published on Citycon’s website and cover use of proceeds and impact indicators.

Climate Bonds view: Citycon’s green bond framework includes a good level of detail and ambition with regards to use of proceeds as well as impact. Citycon has also specified the types of instruments it can issue under its Green Financing Framework, including labelled green bonds, commercial paper, loans, hybrid bonds or private placements.

The company has provided an estimate of its total eligible asset pool (EUR2.7bn), helpful for understanding the scale of potential future green issuance. It has also contextualised the financing with a net neutrality goal by 2030, which speaks to broader efforts in transitioning from brown to green. We look forward to seeing more of such positive ambition in the market along with accompanying strategies.

More deals issued by non-financial corporates:

- Ceetrus (EUR300m/USD330m), France, 7Y original term, SPO provided by Vigeo Eiris.

- Clearway Energy Operating LLC (USD600m), USA, 8.3Y original term, SPO provided by Sustainalytics.

- Ecosolutions (USD3.5m), Costa Rica, 12Y original term, no third-party review.

- Norske Tog As (NOK1.3bn/USD143m), Norway, 10Y original term, SPO provided by CICERO.

- Seibu Holdings (JPY10bn/USD92m), Japan, 10Y original term, no third-party review.

- Shimizu Corporation (JPY10bn/USD92m), Japan, 5Y original term, assigned GA1 rating by R&I.

- Shizen Energy Inc. (JPY300m/USD3m), Japan, 3Y original term, assigned Green1 rating by JCRA.

Visit our Bond Library for more details on November and December deals.

Repeat issuers 1 November – 13 December

- AC Energy Finance Ltd (AC Energy): USD400m

- AEON REIT Investment Corporation: JPY1.2bn/USD11m

- Activia Properties: JPY4bn/USD36.9m

- Akuo Energy: EUR45m/USD49.8m

- CAF (Corporacion Andina de Fomento): EUR750m/USD830m

- Canton of Geneva: CHF660m/USD660.9m

- City of Gothenburg: SEK2bn/USD208.1m

- City of Minneapolis: USD114.4m

- City of Portland: USD58.5m

- Duke Energy: USD700m

- EIB (European Investment Bank): EUR150m/USD166.1m

- FlexiGroup: AUD102.8m/USD69.7m - Certified Climate Bond

- Fondo Especial para Financiamientos Agropecuarios (FEFA): MXN2.5bn/USD129m - Certified Climate Bond

- GLP J-REIT: JPY5bn/USD45.8m

- Hyundai Capital Services: KRW130bn/USD109.6m

- Intesa Sanpaolo: EUR750m/USD830.9m

- JRTT (Japan Railway Construction, Transport and Technology Agency): JPY20bn/USD183m

- KBN (Kommunalbanken Norway): SEK1bn/USD104.6m

- KommuneKredit: EUR500m/USD553.8m

- Kommuninvest: USD1bn

- Kungsleden AB: SEK200m/USD21.1m

- Landshypotek Bank: SEK3bn/USD311.2m

- NorgesGruppen: NOK500m/USD54.8m

- Orsted: USD1.1bn (2 bonds – TWD/EUR)

- PKO Bank: PLN250m/USD63.8m

- Province of Ontario: CAD750m/USD563.9m

- Renewable Japan: JPY3.1bn/USD28.2m

- Stockton Public Financing Authority: USD54.8m

- Vasakronan: USD409.1m (5 bonds – various currencies)

- Zhuhai Huafa Comprehensive Development: CNY500m/USD70.9m

- Wuhan Metro Group Co.,Ltd: CNY1bn/USD108m

Repeat issuers: January – October 2019 (not previously included)

- ADB (Asian Development Bank): GBP250m/USD321m - October 2019

- EUROFIMA: EUR500m/USD548.6m - October 2019

- KBN (Kommunalbanken Norway): SEK2bn/USD206.9m - August2019

- Kommuninvest: SEK3bn/USD309.5m - October 2019

- NedBank: ZAR1bn/USD68.2m - October 2019

- Orebro Kommun: SEK500m/USD50.4m - October 2019

- Vasakronan: EUR30m/USD33.3m - October 2019

- Fannie Mae: USD3.4bn - October 2019

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

LKAB |

SEK550m/USD57.9m SEK550m/USD57.9m |

09/12/2019 09/12/2019 |

Excluded (Not aligned) |

|

World Bank (IBRD) |

CAD66m/USD49.8m |

05/12/2019 |

Excluded (Sustainability/Social bond) |

|

Laiwu Minsheng Industrial Co.,Ltd. |

CNY500m/USD71.1m |

29/11/2019 |

Excluded (Working capital) |

|

National Housing Finance and Investment Corporation |

AUD315m/USD213.6m AUD315m/USD215m AUD315m/USD223.5m |

27/11/2019 18/11/2019 26/03/2019 |

Excluded (Sustainability/Social bond) |

|

California Health Facilities Financing Authority |

USD500m |

21/11/2019 |

Excluded (Sustainability/Social bond) |

|

E.ON SE |

EUR750m/USD834.2m EUR750m/USD834.2m |

24/10/2019 24/10/2019 |

Excluded (Unlabelled) |

|

Chengdu Xingrong Environment Co., Ltd. |

TBC |

28/11/2019 |

Excluded (Working capital) |

|

Rongsheng Petrochemical Co., Ltd. |

TBC |

26/11/2019 |

Excluded (Not aligned) |

|

YANCHENG TRAFFIC HOLDING GROUP Co.,Ltd |

TBC |

25/11/2019 |

Excluded (Working capital) |

|

Zhejiang Deqing Transportation Investment And Construction Co., Ltd |

CNY250m/USD35.6m |

14/11/2019 |

Excluded (Working capital) |

|

ANZ Bank |

EUR1bn/USD1.1bn |

21/11/2019 |

Excluded (Sustainability/Social bond) |

|

Treasury Corp New South Wales (TCorp) |

AUD1.8bn/USD1.2bn |

21/11/2019 |

Excluded (Sustainability/Social bond) |

|

BNG Bank NV |

EUR750m/USD830.6m |

20/11/2019 |

Excluded (Sustainability/Social bond) |

|

Ferde |

NOK800m/USD87.4m NOK200m/USD21.9m NOK400m/USD43.7m |

13/11/2019 |

Excluded (Not aligned) |

|

NORTH-RHINE WESTPHALIA |

EUR1bn/USD1.1bn EUR1.5bn/USD1.7bn |

26/11/2019 |

Excluded (Sustainability/Social bond) |

|

Yorkshire Water |

GBP300m/USD386.3m |

26/11/2019 |

Excluded (Sustainability/Social bond) |

|

Shandong Hi-Speed Group Co.,Ltd |

CNY1bn/USD140.5m |

12/09/2019 |

Excluded (Not aligned) |

|

FCC Servicios Medio Ambiente Holding (FCCMA) |

EUR600m/USD664.7m EUR500m/USD553.9m |

04/12/2019 |

Excluded (Not aligned) |

|

Credit Agricole CIB |

EUR100m/USD110.2m |

27/11/2019 |

Excluded (Not aligned) |

|

Taiwan Power |

TWD5.9bn/USD193.4m |

16/12/2019 |

Pending (Waiting for more info) |

|

OCBC |

AUD500m/USD341.9m |

05/12/2019 |

Pending (Waiting for more info) |

|

Ivanhoé Cambridge |

CAD300m/USD227.7m |

13/12/2019 |

Pending (Waiting for more info) |

|

CPPIB Capital |

USD500m |

04/12/2019 |

Pending (Waiting for more info) |

|

Swedavia |

SEK1bn/USD105.8m |

12/12/2019 |

Pending (Waiting for more info) |

|

Neo Energy |

EUR10m/USD1.1m |

06/12/2019 |

Pending (Waiting for more info) |

|

BPCE |

EUR500m/USD52.4m |

04/12/2019 |

Pending (Waiting for more info) |

|

Islamic Development Bank |

USD500m |

27/11/2019 |

Pending (Waiting for more info) |

|

Guizhou Water Investment Group Co., Ltd. |

CNY3.2bn/USD454.8m |

27/11/2019 |

Pending (Waiting for more info) |

|

Guangxi Beibu Gulf Bank Co., Ltd. |

CNY1bn/USD142.2m |

29/11/2019 |

Pending (Waiting for more info) |

|

Nidec Corporation |

JPY20bn/USD183m JPY30bn/USD274.5m JPY50bn/USD457.5m |

28/11/2019 28/11/2019 28/11/2019 |

Pending (Waiting for more info) |

|

Massachusetts Housing Finance Agency Housing |

USD108.06m |

12/12/2019 |

Pending (Waiting for more info) |

|

Ecosolutions |

USD3.5m |

01/08/2019 |

Pending (Waiting for more info) |

|

Credit Agricole CIB |

EUR3bn/USD3.3bn |

21/11/2019 |

Pending (Waiting for more info) |

|

AfDB (African Development Bank) |

SEK750m/USD78m |

04/11/2019 |

Pending (Waiting for more info) |

|

Mori Building |

JPY15bn/USD137.7m |

14/11/2019 |

Pending (Waiting for more info) |

Green bonds in the market

- Sagax AB - closed 16 December

- Welltower - closed 16 December

- Fana Sparebank Boligkreditt - closed 18 December

- New York State Housing Finance Agency - closed 18 December

- California Infrastructure and Economic Development Bank (CalSTRS) - closed 19 December

- Nexity – closing 20 December

- The Metropolitan Government of Lynchburg, Moore County – closing 20 December

- Public Utilities Commission of The City and County of San Francisco - closing 9 January

Investing news

This week, the European Council and the European Parliament reached agreement on the Sustainable Finance Taxonomy Regulation. A world first, it introduces a comprehensive “green list”: a system for classifying environmentally sustainable economic activities based on technical criteria. It also stipulates reporting and disclosure requirements.

Other European institutions also continue to be active: New chair of the European Central Bank (ECB) Christine Lagarde is pushing for a key role of climate change on the Bank’s agenda. Elsewhere, the European Banking Authority (EBA) published an action plan on sustainable finance.

Central Banks are making green moves: The Bank of England is beginning its first climate stress tests in 2021 and inviting feedback from the public, whilst Danmarks Nationalbank is working with the Danish Ministry of Finance on a new model for sovereign green bonds that enables smaller issuance sizes without comprising on liquidity. The Swiss Central Bank may have to divest from fossil fuels as lawmakers are incorporating fighting climate change as a key policy objective.

China-led Asian Infrastructure Investment Bank (AIIB) is in the process of launching an investment framework to mobilise capital for green infrastructure projects to help nations in the region meet their Paris Agreement goals.

The Zimbabwe Stock Exchange (ZSE) has started working on guidelines for green and social bonds in order to provide investors in Zimbabwe with a broader spectrum of instruments.

The Islamic Development Bank (IsDB) has teamed up with Japan’s Government Pension Investment Fund (GPIF) to foster further development of the Sustainable and Green Sukuk markets.

Forbes highlights an emerging structure in the impact investing space: Société Générale issued a credit linked note where the bank gets rewarded with lower credit protection rates if the freed-up capital goes to green lending.

Repsol became the first oil and gas company globally to commit to net zero carbon emissions. A large portion of the remuneration of the firm’s senior management will be linked to the target.

Green bond gossip

Italy is likely to enter the sovereign green bond market in the second half of 2020. The country plans to finance environmentally friendly projects with around EUR4bn (USD4.5bn) between 2020 and 2023.

The government of Germany has solidified its intent to join the growing group of sovereign green bond issuers with the first Green Bund. The multi-billion-euro deal will hit the market in the second half of 2020.

Indian power generation operator NTPC will likely issue a green bond in order to acquire the government's stake in hydro-power generators THDC India Ltd and North Eastern Electric Power Corporation Ltd.

According to the Bangkok Post, the Thai market will see increased bond issuance in the ESG space next year. It reports that over 10 firms will issue bonds financing sustainability-related projects in 2020.

Nasdaq has launched a Nasdaq Sustainability Bond Network (NSBN) improve transparency in the market for green, social and sustainable bonds. We are very pleased to be represented on the Advisory Board.

Readings & reports

In a new paper, Danmarks Nationalbank acknowledges the risks that climate change poses to financial stability and explores the financial sector’s potential of contributing to the transition to a green economy.

The UN Environment Programme published the Emissions Gap Report 2019, which presents the latest data on the expected shortfall in 2030 on the targets of limiting temperature rise to 1.5°C or 2°C in line with the Paris Agreement.

AXA Investment Managers proposes a European Climate Emergency Fund, similar in structure to the European Stability Mechanism. They point out advantages, including long-risk and low-cost funding, as well as the differences, such as front-loading issuance.

SolAbility produced another edition of the Global Sustainable Competitiveness Index. The report measures the competitiveness of countries with an index comprised of five sub-indices: Natural Capital, Resource Efficiency & Intensity, Intellectual Capital, Governance Efficiency, and Social Cohesion.

In a guest blog post for the International Institute for Environment and Development, Pernille Holtedahl illustrates the role that green bonds can play in achieving sustainable development, and argues that the function of these instruments is partly misunderstood in the market.

Don’t forget, registrations are now open for Climate Bonds Conference2020.

This is our last Market Blog for 2019. We hope you’ve enjoyed reading all the developments in green finance through this year as much as we have in preparing each post. We’ll be back in January with some tweaks to make the Climate Bonds Market Blog even better in 2020!

Till then, Merry Christmas and best wishes for the New Year!

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.