A label of trust for green investment

Climate Bonds has released Version 3.0 of the international Climate Bonds Standard; a significant development for green finance.

Climate Bonds has released Version 3.0 of the international Climate Bonds Standard; a significant development for green finance.

Standard V3.0 incorporates major upgrades to the existing umbrella guidance for Climate Bonds Certification to meet market growth and demand for enhanced reporting, transparency and harmonisation around green definitions.

Climate Bonds Certification provides assurance for issuers and investors that a green debt product meets labelling requirements for major global jurisdictions, is science-based and is aligned with the goals of the Paris Climate Agreement to limit warming to under 2 degrees.

Standard V3.0 aims to support the expansion of the green investment market – forecast to reach up to $250bn of green debt issuance in 2019, $350-400bn in 2020 and accelerate the mainstreaming of green bonds, green loans and other products via a simple label which investors can trust.

Universality & Compatibility

Standard V3.0 is a major upgrade to the Climate Bonds Standard, designed to ensure compatibility with the new EU Green Bond Standard (EU GBS), the latest version of the Green Bond Principles (GBP), Green Loan Principles and recent market developments including guidelines adopted by India, ASEAN and Japan.

The new Standard V3.0 provides guidance for:

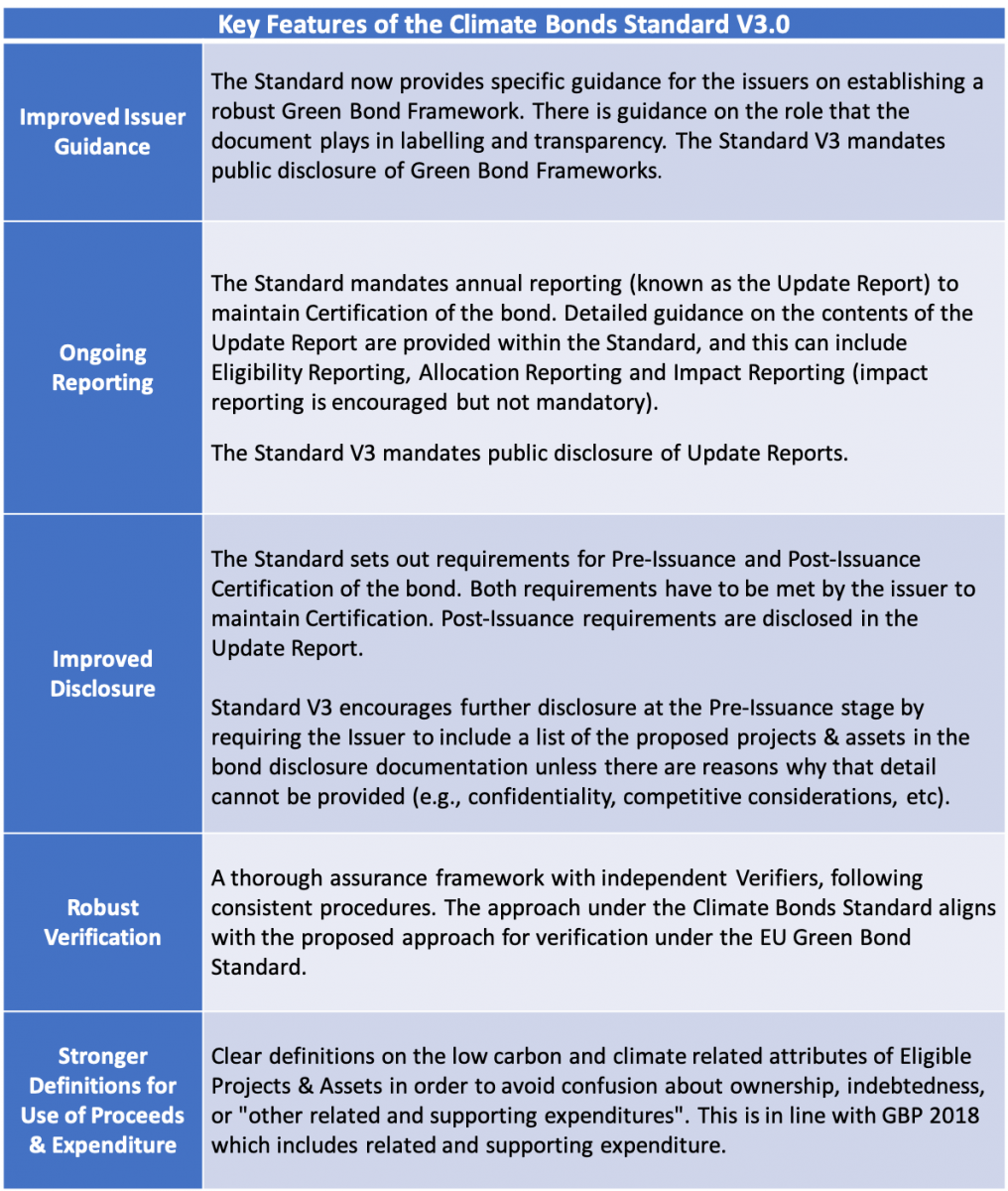

- Robust Green Bond Frameworks: Standard V3.0 provides issuers with detailed requirements for what their Green Bond Framework document must contain.

- Ongoing Reporting: Standard V3.0 reporting requirements are more clearly defined via a formal annual Update Report which covers Allocation, Eligibility and Impact Reporting.

- Expenditures & Debt Instruments Definitions: Standard V3.0 provides detailed definitions on which type of expenditures are eligible and an expansion in the list of debt instruments which can be Certified, including loans, sukuk, deposit products and other investments.

Table 1: Key Features

Standard V2.1 and transition

The current Climate Bonds Standard V2.1 as utilised by Issuers & Verifiers will remain operative for new Certifications in parallel with Standard V3.0 till June 30, 2020 subject to Verifier and market readiness. Existing Certified transactions can continue to use V2.1 or can choose to adopt Standard V3.0 for their ongoing reporting.

We welcome input from stakeholders on Standard V3.0 and we look forward to developing an enhanced V3.1 in the future.

Understanding Certification

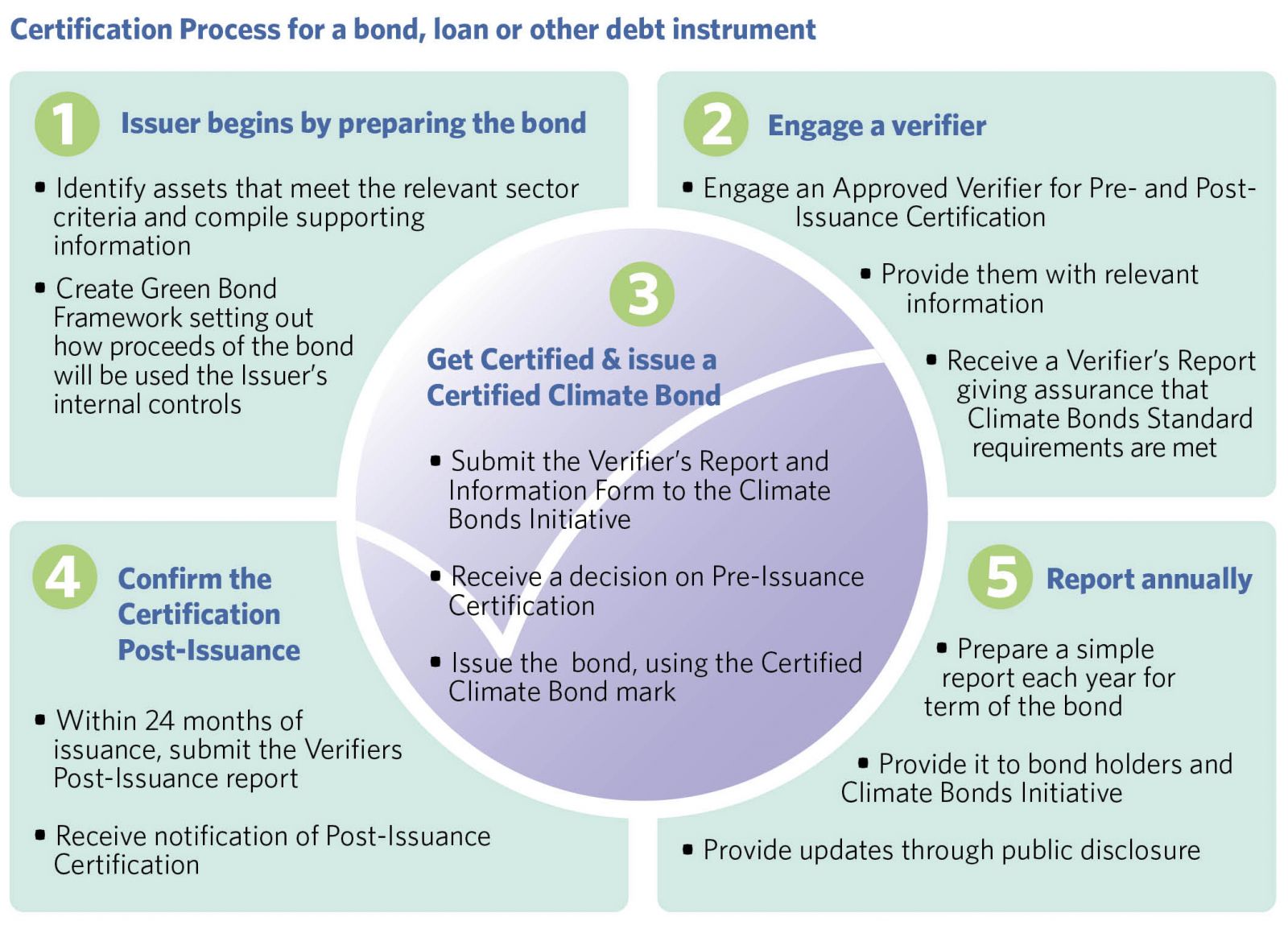

The Climate Bonds Certification framework has been designed to work in parallel with the normal bond issuance process. It has 2 phases, Pre-Issuance and Post-Issuance Certification. Certification of a Climate Bond at the Pre-Issuance phase enables the issuer and underwriters to market the bond as a Certified Climate Bond. In the Post-Issuance phase further assurance activities must be undertaken to maintain the Certification.

Figure 1.

$100bn in cumulative Certifications

The volume of Certified transactions has exceeded a cumulative total of USD 100bn and is growing with issuance from over 30 countries in 21 currencies. Sovereign Issuers include the Netherlands (EUR5.98bn), Chile’s Sovereign bonds (EUR861m & USD1.418bn) and Nigeria.

The Certified Bonds Database with all issuers can be found here.

The last word

Standard V3.0 aims to support the rapid expansion of green investment and accelerate the mainstreaming of green finance via a simple label which investors can trust in a dynamically changing market.

Its been a long journey from the 2011 launch of the original 'bare bones' Standard, which was more concept than finished construction.The first Working Group was established in 2012, the NAB AUD300m Certified green bond of 2014 was pivotal (a multiple world first from Australia), all the way to today where giant urban rail operators and water utilities are mainstreaming repeat green issuance via Programmatic Certification.

Sean Kidney’s assessment paints the picture at the end of 2019:

“The Climate Bonds Standard now underpins Certification of over USD100 billion worth of green bonds and debt products around the world and is growing.”

“The Climate Bonds Standard now underpins Certification of over USD100 billion worth of green bonds and debt products around the world and is growing.”

“Climate Bonds Certification has emerged as a universal adaptor for issuers and investors in both developed and emerging economies.”

“It’s a simple pathway to best practice that provides recognition and compatibility in multiple jurisdictions.”

“Standard V3.0 strengthens disclosure & green definitions and is another step in the maturation of the green bond market that’s growing towards a trillion dollars in annual issuance.”

‘Till next time,

Climate Bonds.