Opportunities for Green Issuers in Belgium, England & Wales, France, Germany, Netherlands, Norway, Poland and Czech Republic

This is 2nd of our special 3 part Low Carbon Buildings (LCB) Blog Series: The first looked at Germany, this time we look more broadly at the growing number of European cities and jurisdictions where Climate Bonds Certification is available for LCB investments.

Why an EU Green Buildings Focus?

Buildings are responsible for approximately 40% of energy consumption and 36% of CO2 emissions in the EU. The Climate Bonds LCB Criteria is designed to assist the transition, with its focus on investment that has overall emissions reductions in the built environment and a pathway towards Net Zero Carbon buildings as its objectives.

Some investors have already taken this path. One example is ING Group N.V.’s recent USD2.95bn in green bonds (the largest Climate Bonds Certified to date), where approximatley 35% of proceeds will be funding both Low Carbon Residential and Commercial buildings in Europe.

Previous multiple LCB Certifications from ABN AMRO stretching back to 2015 and more recently Obvion and OVG Real Estate are pointers of leading green investment in the buildings space.

In yesterday's Germany Blog we noted both LBBW and Volkswagen Immobilien as LCB Certified issuers.

Commercial Buildings Methodology

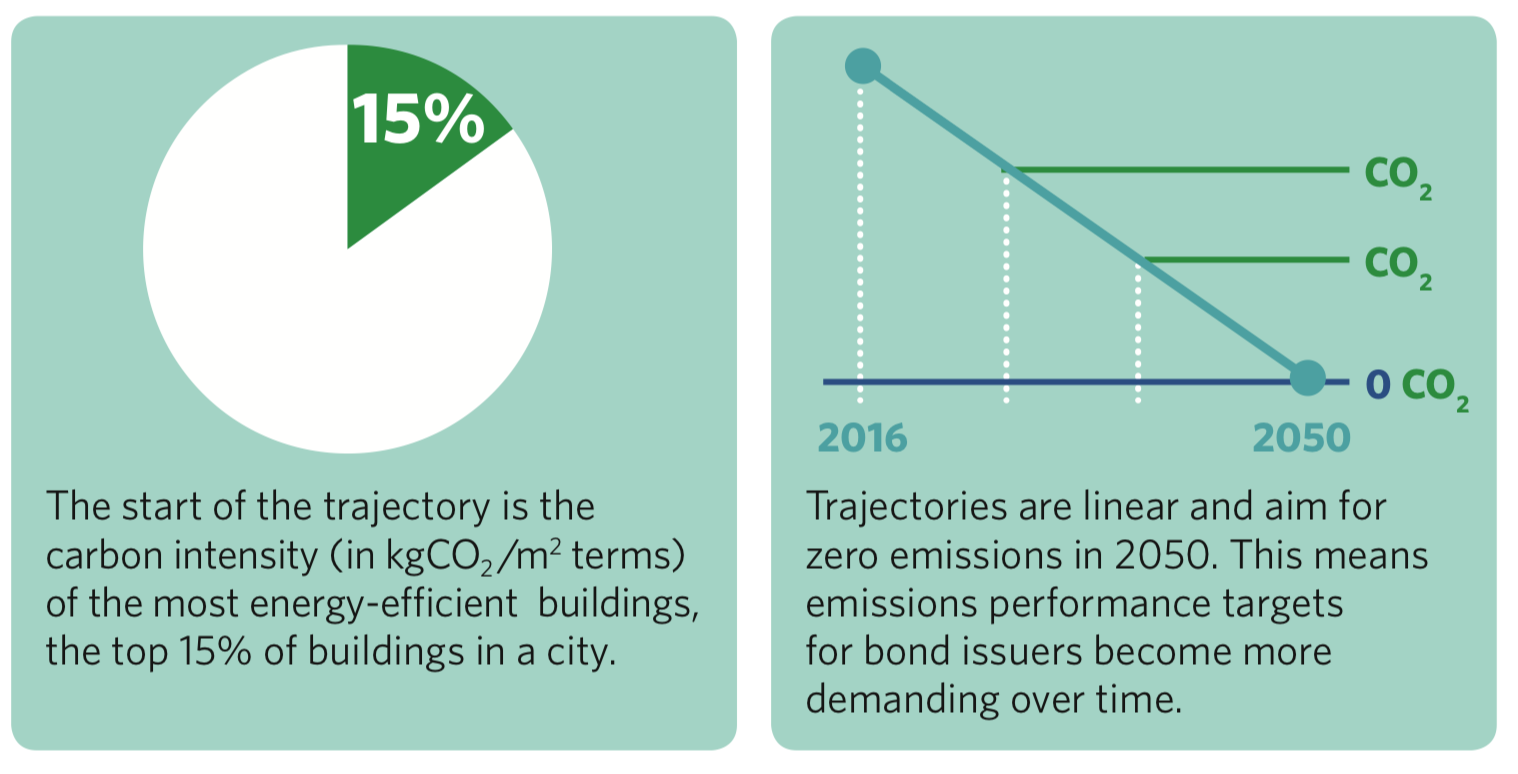

The trajectory (expressed in a kgCO2e/m2calculation) is established by taking the emissions intensity performance of the top 15% of buildings in the selected locations (the baseline) and drawing a straight line to hit Net-Zero Carbon by 2050.

Regional variations in emissions intensity, and hence in the baseline, make these trajectories location or city specific.

A building or portfolio of buildings can demonstrate eligibility for Certification if their emissions intensity is at or below an emissions intensity target, calculated using the trajectory and the term of the relevant bond. Specifically, the target is equal to the value of the trajectory in the year that corresponds to the mid-point of the bond’s tenor.

Depending on the city, the top 15% of the buildings establish the rate at which net reductions in emissions have to be achieved to hit the 2050 zero emissions target. This follows as a linear trajectory that determines the emissions performance targets for the issuer.

Commercial Buildings Thresholds & Proxies across Europe

At present Certification opportunities for Commercial buildings are available across Europe including:

- Germany

- France

- Netherlands

- Poland

- Czech Republic

Find the details in the table below:

|

Country |

Trajectory Threshold commercial buildings (baseline in annual KgCO2/sqm) |

Commercial Proxy (based on emissions-related data analysis) |

|||||||||||||||

|

Germany |

|

Valid EPC, built after 2008, and already part of a refinancing pool

|

|||||||||||||||

|

France |

|

|

|||||||||||||||

|

Netherlands |

|

EPC of A and Energy Index of 0.99 or lower.

|

|||||||||||||||

|

Poland |

|

|

|||||||||||||||

|

Czech Republic |

|

|

|||||||||||||||

Residential Buildings

The Criteria developed so far for Residential buildings in Europe use local building codes and energy ratings/labels as a proxy for performance. Like Commercial Buildings, for Residentials, top 15% of buildings establish the threshold.

Examples of the proxies are building codes such as Flemish building code or Energy Performance Certificate (EPC) rating in Belgium or the TEK Building Code 2007 & 2010 or EPC rating in Norway.

You can find more details on Trajectory and Proxy methodology in our previous blog on Germany, released yesterday and in the LCB section of our website.

Building Upgrades

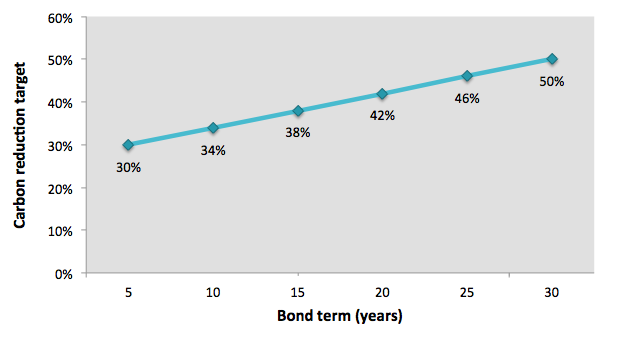

For a Building Upgrade project to qualify for Climate Bonds Certification, it has to achieve a carbon reduction target determined by the term of the bond. For a 5-year bond, the carbon reduction target is 30%. For a 30-year bond, carbon reduction target needs to be at least 50%.

The chart below indicates the carbon reduction targets for different bond terms from 5 years to 30 years.

Residential Buildings Proxies across Europe

Green investment in new residential projects and Upgrades are of increasing importance in emissions reduction.

Proxies available for Residential buildings Certification under the Climate Bonds Standard in the following countries:

- Germany

- Netherlands

- Belgium

- England & Wales

- Ireland

- Norway

Details can be found in the table below:

|

Country |

Residential proxy (based on emissions-related data analysis) |

|

Germany |

EPC of A or B |

|

Netherlands |

EPC of A (applies for prior to 2012) Dutch Building Decree 2012 and Netherland Normalisation Institute (NEN) 7120 standard (Post 2012) |

|

Belgium |

EPC of A Or Flemish building code after 2014 |

|

England and Wales |

Environmental Impact of A or B

|

|

Norway |

EPC of A, B, or C |

|

Ireland |

Building Energy Rating Certificate (BERS) rating of A |

The Last Word

Since the introduction of the LCB Criteria in 2015 we’ve seen high profile issuance in Asia, multiple issuance from Australia and the latterly new US issuers joining the market.

In Europe, we expect to see the pace of green buildings investment accelerate. More issuers turning towards Certification opportunities for green bonds, green loans and green securitisations across these new locations.

We’ll be adding more jurisdictions into 2020, to support the issuers and investors who have lowered overall building emissions in their investment considerations.

Net Zero Carbon in buildings by 2050 isn’t going to happen on its own.

There's room for everyone.

‘Till next time,

Climate Bonds