Lowering the carbon footprint in Europe’s built environment

Expansion of Low Carbon Building Criteria to drive investment in emissions reductions

Low Carbon Buildings - Blog Series

Climate Bonds has developed new thresholds/baselines and proxies for a range of cities in Europe to stimulate investment in low carbon buildings and open new opportunities for green issuers and investors.

70% of today's greenhouse gas (GHG) emissions in cities come from buildings, making the transition to low carbon in Commercial and Residential buildings one of the biggest mitigation opportunities, having the ability to develop climate-aligned urban areas.

Integral to the Low Carbon Buildings (LCB) Criteria are lowering total emissions from the built environment with the objective of reaching zero carbon by 2050.

Multiple European Countries, Multiple European Certification Opportunities

Climate Bonds Certification is now available for green building investments in multiple locations.

In this the first of a 3-part Blog Series we look at Germany where LBBW and Volkswagen Immobilien have already issued LCB Certified Bonds.

In our next Blog, we’ll be looking more widely at Europe, providing details on baselines and thresholds for LCB investments in France, Netherlands Poland, Czech Republic, Belgium, England & Wales, and Norway.

In early May, we’ll follow up with a 3rd Blog on LCB Certification opportunities in other continents.

Regional Variations

Regional variations in energy use and emissions reporting practice for buildings led the Climate Bonds LCB Technical Working Group (TWG) follow country-specific analysis to establish regional trajectories and best available market proxies.

This means an issuer can now stand by their green label with certainty, knowing that the assets included in their bond meet Climate Bonds Certification requirements, achieved in one of three ways; a trajectory, a best available proxy, or a significant upgrade, relevant to the circumstances of their specific region or market.

The Trajectory Methodology explained

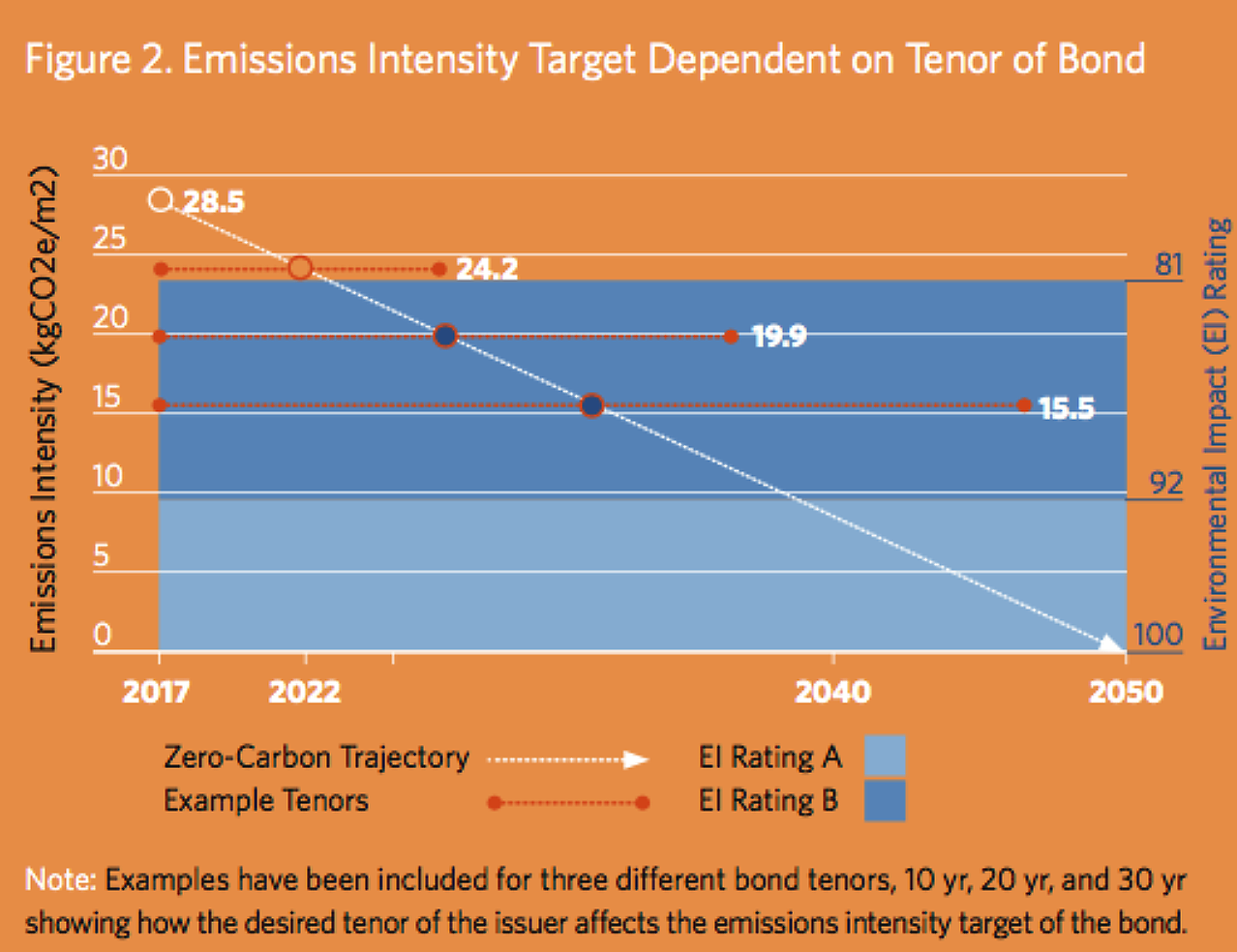

The Trajectory Methodology of the LCB Criteria are hurdle rates that comply with the decarbonisation required by 2-degree scenarios of the Paris Accord.

The trajectory (expressed in a kgCO2e/m2calculation) is established by taking the emissions performance of the top 15% of buildings in the selected locations (the baseline) and drawing a straight line to hit net-zero carbon by 2050.

Regional variations in emissions intensity, and hence in the baseline, make these trajectories location or city specific.

A building or portfolio of buildings can demonstrate eligibility for Certification if their emissions intensity is at or below an emissions intensity target calculated using the trajectory and the term of the relevant bond. Specifically, the target is equal to the value of the trajectory in the year that corresponds to the mid-point of the bond’s tenor.

Germany in focus – Commercial Buildings

For Germany two pathways are available for Commercial property, the baseline/trajectory path and the proxy path.

Climate Bonds has worked to establish multiple city level decarbonisation trajectories within Germany.

The table below gives the kgCO2e/m2/y starting point for trajectories towards zero carbon.

| Commercial Building Baselines (kgCO2e/m2/y) | |

| Berlin | 68.72 |

| Cologne | 65.00 |

| Dusseldorf | 64.06 |

| Frankfurt | 68.91 |

| Hamburg | 67.74 |

| Munich | 75.68 |

| Stuttgart | 69.71 |

There is also a Commercial Proxy available for Germany, based on emissions-related data analysis. It requires a Valid EPC, built after 2008, and already part of a refinancing pool. Our Fact Sheet explains more.

Proxies explained

Where data availability is limited and a low carbon trajectory cannot be established with confidence, Climate Bonds has reviewed a range of market-based mechanisms such as building codes, rating schemes and post occupancy performance evaluations to determine best available proxy in the market. These act as place holders until enough data to establish a trajectory, can be gathered.

Germany in Focus – Residential Proxy

For residential assets in Germany, Climate Bonds has run into a similar challenge as Commercial Buildings. Energy and emissions performance data is not widely available. In order to begin to develop financial carbon performance standards for the German market, Climate Bonds has leveraged the work of the European Commission and the Energy Performance Building Declaration (EPBD).

Through this programme, German Residential Buildings are required to benchmark building performance through a similar programme as the UK’s Energy Performance Certificate (EPC) known as Energieeinsparverordnung (EnEV) or Energy Saving Ordinance.

Through this programme, a building is given an Energieausweis consisting of an A-G rating.

It has been determined that a residential building with an Energieausweis (EPC) B rating and higher qualifies for Climate Bonds Certification under the proxy route.

This proxy is reviewed on a regular basis to ensure it remains aligned with the performance of the top 15% of the market.

|

Residential proxy for Germany (based on emissions-related data analysis) |

|---|

| EPC of A or B |

As emissions data becomes available for residential assets, Climate Bonds intends to scope development of a low-carbon trajectory that supersedes the Residential market proxy. Our Fact Sheet is here.

Building Opportunities, Building Green Investment – What can you do?

Climate Bonds develops new baselines in different markets to reflect investors need, data availability and trends in green bonds demand.

We are always looking for industry sector and civil society participants to support the development of new baselines in cities and regions. Please contact Anna Creed, Head of Standards for more information.

We also look at incorporating suitable proxies where emissions performance data is not yet available or detailed to meet the Criteria. Please see our Guidelines for more details.

The Last Word

Climate Bonds believes that reducing overall emissions intensity in the built environment, with an ultimate objective of a net zero carbon buildings is a vital contributor to our climate challenge.

We are not alone in that view, amongst many, the World Green Building Council (WorldGBC) also emphasises a net zero carbon trajectory.

Our Low Carbon Buildings Criteria is designed to encourage more investment in both new builds and refurbishments that move building stock towards that zero emissions goal.

The increasing LCB Certifications in US, Australia and Scandinavia demonstrate that the LCB Criteria is gaining acceptance amongst investors and issuers pursuing best practice in green building.

More to come on Europe and elsewhere. Stay tuned!

'Till next time,

Climate Bonds