Highlights:

- USD9bn green bond issued in February so far

- Telefónica issues first green bond from the telecommunications sector. Verizon also enters GB market

- Nobina becomes first public transport company from Sweden to enter the market

- Fannie Mae publishes Green MBS deals for January: USD883m

- Japanese rail network operator JRTT returns to the market, set to adopt CBI Programmatic Certification for multiple green issuance

Don’t miss:

- Only a week to go to the Climate Bonds Annual Conference! London, March 5-7. Registrations closing this Friday, register now. Green Bond Pioneer Awards announced Tuesday 5th March. A big thank you to Global Principal Partner HSBC and to Natixis and all our other valued Conference Sponsors (full list here)

- Hong Kong green bond market briefing

- China annual green bond market report

- Canada green finance market update – coming out this week

- Japan green finance market report – coming out this week

Go here to see the full list of new and repeat issuers in February.

At a glance

As of 22nd February, monthly green bond issuance totalled USD9bn. 46% came from non-financial corporates, and almost half is attributable to ICT companies: Telefónica (Spain) and Verizon (USA).

Spanish telco debut issuer Telefónica, along with repeat issuer Iberdrola, propelled Spain to the first spot for monthly issuance to date in February, taking 23% of market share. The US and Canada are close runners up. We’ll see how rankings change at the end of the month.

Developed markets (DM) issuance represented the vast majority of volume (82%). On the emerging markets (EM) side, the Republic of Indonesia closed its second green sovereign sukuk of USD750m – accounting for 57% of EM issuance. The Philippines (36%), China (5%) and Iceland (2%) made up the remaining share of EM volumes.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

New issuers

Concordia University (CAD35m/USD19m), Canada, issued a 20-year green debenture, becoming the first Canadian university to enter the green bond market. Proceeds will be earmarked to finance the new Science Hub on the Loyola Campus. The building is expected to be 35% more efficient compared to an average non-certified research facility and to receive a LEED Gold certification after construction.

Climate Bonds view: The issuer is a welcome addition to Canada’s pool of issuers, which has already seen two debuts and two repeat issuers closing green deals in 2019. As green bond markets develop investors are increasingly looking for higher levels of transparency and standards. We encourage issuers to develop and publish green bond frameworks and to seek an external review.

JA Solar Japan (JPY 5.3bn/USD48m), Japan, issued a 21-year project bond, which obtained a 'Green 1' Green Bond Evaluation from Japan Credit Rating Agency (JCR). Proceeds will be used for new investments related to the construction of a solar power generation facility in Fukushima.

Climate Bonds view: As of the end of 2018, Japan’s green bond market reached a cumulative total of USD9.65bn with 2018’s issuance volume representing 22% growth year-on-year. This long tenor bond is one of the first out of Japan in 2019.

Look out for a trio of Climate Bonds Japan reports and briefings launching in Tokyo later this week.

Kenedix Office Investment Corporation (JPY2bn/USD18m), Japan, issued a 5-year senior unsecured green bond, becoming the first Japanese REIT to enter the market in 2019. The deal obtained a Sustainalytics Second Party Opinion, as well as a Green 1 Green Bond Evaluation from JCR. The debut deal will refinance the acquisition of two office buildings:

- KDX Kobayashi-Doshomachi Building located in Osaka, which obtained a 3-star DBJ Green Building certification and a Rank S CASBEE certification;

- KDX Toranomon 1 chome Building located in Tokyo, which achieved a 5-star DBJ Green Building certification and a Rank S CASBEE certification.

According to the Green Bond Framework, eligible properties must have obtained one of the following certification levels: 3 stars or above in DBJ Green Building certification, B+ or higher rank in CASBEE for Real Estate and 3-stars or above in BELS Certification. Buildings achieving at least 10% energy or water efficiency improvements or other environmentally beneficial refurbishments generating at least 10% improvements are also eligible.

Climate Bonds view: The refinanced properties achieve a good level of green building certifications, with both certified under the highest categories of DBJ Green Building and CASBEE. However, we encourage issuers to finance projects with at least 20% (preferably 25%) of energy / water efficiency improvements.

Nobina (SEK500m/USD54m), Sweden, issued a 5-year senior unsecured green bond, becoming the first Swedish green bond issuer from the public transport sector to enter the market. CICERO provided the Second Party Opinion. The deal is expected to finance electric buses and vehicles powered by biofuels – such as rapeseed oil methyl esters or hydrotreated vegetable oil – as well as charging infrastructure.

Climate Bonds view: Green bond issuance in Sweden kept a strong pace in the first two months of 2019, totalling USD1.2bn.

NorgesGruppen (NOK400m/USD46m), Norway, issued a 5-year senior unsecured green bond – the first Norwegian issuance of 2019. CICERO provided a Second Party Opinion on the issuer’s Green Bond Framework. The net proceeds will be used exclusively to finance and refinance projects and assets in Norway. The framework specifies clean transportation, green buildings and renewable energy as eligible categories. It also allows for up to 15% of the net proceeds to support environmental investments with a positive environmental impact other than direct mitigation of climate change.

Climate Bonds view: The Nordic green bond market continues to expand, with another non-financial corporate issuer. Interestingly, NorgesGruppen is a large food retailer. This deal demonstrates that issuing green bonds is not only possible but important for corporates from different sectors, and certainly so within food retail. Investors are also keen for more issuance from the consumer/retail companies.

RCBC (Rizal Commercial Banking Corporation) (PHP15bn/USD287m), Philippines, issued a 1-year senior unsecured green bond – the largest debut deal from a Philippine green bond issuer. Sustainalytics provided the Second Party Opinion (not publicly available). Proceeds are expected to be allocated to renewable energy, buildings, transport and waste related project. To be eligible, green buildings must either meet recognised standards, such as a minimum of 4 stars in the Philippines BERDE Green Building Rating System, LEED Gold or above or belong to the top 15% of local low carbon buildings. Under the transport category, freight rail infrastructure is eligible only if not dedicated to the transport of fossil fuels.

Climate Bonds view: We welcome yet another green issuance from an ASEAN-based bank, confirming the growth trend from the region.

The BERDE Green Building Rating System is new to us, so let’s put it into context. The scheme is based on a 1 to 5-star rating scheme (5 is the highest) which is calculated from 8 core areas, including energy efficiency & conversion, water efficiency and conversion, green materials and emissions. Sustainalytics notes that the scheme puts more emphasis on water savings compared to LEED, but has less stringent energy requirements than BREEAM. Achieving best-in-class certification levels would provide higher assurance of the buildings’ green credentials.

Reykjavik Energy (ISK3.5bn/USD29m), Iceland, issued a 36-year green bond, benefiting from a CICERO Second Party Opinion. This is the third Icelandic green bond issuer to debut in the market. Proceeds will be used to fund anticipated projects in eight eligible categories: renewable energy (25%), energy distribution and management (25%), carbon capture and storage at its geothermal power plant (5%), sustainable land use and environmental management (5%), clean transportation (5%), sustainable water and wastewater management (20%), circular economy activities that lead to lower lifecycle energy and GHG use (5%), and products and technologies that support smart grid applications (10%).

Climate Bonds view: We are happy to see the Icelandic green bond market expanding to include the second government-backed entity green bond issuer. Reykjavik Energy is an example of a group with quite ambitious environmental targets, with green bond issuance fitting well within these. Despite the focus on energy (especially geothermal), it’s a positive that proceeds are expected to be spent in several different areas, including wider initiatives such as circular economy activities. This suggests the issuer is thinking about its business model holistically and plans to adjust its strategy accordingly.

Rolling Creek Utility District (USD7m), USA, issued a multi-tranche US Muni bond labelled as “Unlimited Tax Bonds, Series 2019”, which obtained a Build America Mutual (BAM) GreenStar designation. Proceeds are expected to be allocated to financing water and wastewater treatment projects and drainage facilities.

Climate Bonds view: The bond has not explicitly been labelled as green by the issuer, but we have accepted the BAM GreenStar designation as a sufficient label, as well as an assurance that the use of proceeds aligns with the Green Bond Principles. The GreenStar designation provides a high-level assurance, without disclosing the details of the selection process of eligible projects, management of proceeds and reporting practices. We strongly encourage issuers to make this information publicly available to comply with best practice transparency standards.

Samhällsbyggnadsbolaget i Norden AB (SBB) (SEK500m/USD54m), Sweden, issued a 5-year senior unsecured green bond, benefiting from a CICERO Second Party Opinion and an E2/64 Green Evaluation from S&P Global. Proceeds will be used to refinance a property portfolio consisting of rent-regulated residential apartment houses in Nordic countries, predominantly Sweden, built between 1900 and 1991, and related investments.

The buildings in this ‘Green Project Portfolio’ are predominately built between the 1950s and 1980s. SBB will make various investments in energy efficiency, with the commitment to reduce the purchased amount of energy (kWh) per heated square meter and year by at least 30% across the portfolio. Other relevant investments may support climate resilience or increase tenant functionalities. SBB might use other measures applicable, such as the installation of rooftop solar units.

Climate Bonds view: Nordic and in particular Swedish issuance continues to grow. A significant portion of this has been in real estate, and this bond provides another example of retrofits on existing building stock.

Shandong Water Affairs Development Co. (CNY400m/USD59.5m), China, issued a 5-year green bond, benefiting from a Second Party Opinion (not publicly available) from Golden Credit Services. The proceeds will be allocated to five projects: the development of a wastewater treatment plant and four integrated water projects, which include the construction and operation of urban and rural water supply and drainage, ecological wetland construction, river treatment, sewage treatment, sludge treatment and disposal, water reuse, brackish water desalination, inter-regional water transfer, urban industrial water supply and drainage, drinking water (centralized water supply), etc.

Climate Bonds view: We consider the intended use of proceeds for this issuance to be aligned with our Taxonomy. Investments in sustainable water management and tackling water pollution are a priority area for the Chinese government.

Stora Enso (SEK6bn/USD604m), Finland, issued a 3-tranche senior unsecured green bond (longest-dated bond: 5 years), benefiting from a Sustainalytics Second Party Opinion. Proceeds will be earmarked to finance projects under sustainable forestry, renewable energy, water, waste, energy efficiency and renewable / low carbon / eco-efficient product technologies and processes.

Eligible renewable energy projects include power generation from biomass and waste products, as well as related renewable energy infrastructure. Energy efficiency projects are expected to meet a 20% improvement threshold and cannot be related to operations running primarily on fossil fuels. In its Green Bond Framework, Stora Enso states that “where appropriate, the use of proceeds may be used to finance operating expenditures related to the projects (e.g. forest management, R&D) and will be tracked on a project or portfolio basis.”

Climate Bonds view: The debut of the first Finnish forest products company in the green bond market is a promising development, given the country’s potential for financing green assets in the land use sector. Bioenergy sources from by-products are aligned to the Climate Bonds Taxonomy.

Operating expenditures and R&D raise a red flag as they are not aligned to the Climate Bonds Taxonomy and therefore should make up no more than 5% of the proceeds allocations to be eligible for inclusion in the CBI Green Bond Database. As the issuer has committed to tracking funding going to these project types, we will keep monitoring reporting to ensure the share doesn’t exceed the 5% threshold.

Telefónica (EUR1bn/USD1.14bn), Spain, issued a 5-year senior unsecured green bond – the first green deal from a telco. Telefónica is expected to use the proceeds to finance and refinance, in whole or in part, existing and future projects that promote energy efficiency and the reduction of GHG emissions within its own operations and those of its clients.

Climate Bonds view: There has been very limited green bond issuance from the ICT sector, so it’s definitely a step forward to see a large green bond come to market. Vodafone was the first telecoms provider to release a green bond framework, and CBI expects issuance in the sector to increase in 2019 which will also benefit investors looking to diversify their green and ESG based portfolios.

Verizon Communications Inc (USD1bn), USA, issued a 10-year senior unsecured green bond, benefiting from a Sustainalytics Second Party Opinion. The proceeds will fund investments in renewable energy, energy efficiency, green buildings, sustainable water management and biodiversity and conservation.

Climate Bonds view: The breadth of project categories that Verizon has listed suggests it is viewing its activities holistically, which we see as positive. The US corporate market continues to lag in green issuance compared to its size and significance. High profile issuance like this should be seen as a signal by others.

New issuers issued prior to February 2019

Japan Housing Finance Agency (JHF) (JPY10bn/USD91m), Japan, issued a 20-year green bond in January 2019. Its bond scheme was selected as a pilot project by the Ministry of the Environment of Japan (MoEJ) under its Pilot Project for Green Bond Issuance. The alignment of pilot projects to Japan’s Green Bond Guidelines 2017 is checked by MoEJ and its contractors – in this case, E&E Solutions and JCR.

Eligible assets are limited to mortgages on newly constructed Flat 35S housing, which covers low-carbon houses with primary energy consumption level 4 or higher or thermal insulation performance level 4, as well as houses with an approved energy efficiency improvement plan, and each asset is verified by an inspection agent, certified by JHF. The pool of mortgages their debut green bond refinances were originated in autumn 2018.

Climate Bonds view: JHF is a government-backed agency, which acquires mortgages from originating banks and refinances itself in the bond market by issuing RMBS securitisations or bonds. Similar to Fannie Mae in the US, it plays a key role in financing residential properties in Japan and can leverage its position to promote investment in energy efficient buildings.

Its Flat 35S is a fixed-rate mortgage product, which provides financial incentives for high-quality, energy-saving and earthquake-resilient housing. In addition to the green bond, JHF’s two recent RMBS deals (Series 140 and Series 141) include Flat 35S collateral, so we would hope to see more green issuance from JHF going forward.

The energy consumption level and insulation performance level are graded from 1 to 5, where Level 5 is the best in terms of energy-efficient performance and Level 1 is the worst. Level 4 corresponds to the current national energy efficiency standards, and Level 5 is 10% better. Consequently, the housing financed with the green bond is among the most energy efficient in Japan, which is aligned with the Climate Bonds Taxonomy. However, we encourage all issuers to make information on the assets financed by a green bond publicly available for market transparency.

Jiangsu Guoxin Investment Group Limited (CNY1bn/USD149m), China, issued a 3-year green bond in January 2019, benefiting from a Lvrong Green Finance Second Party Opinion (not publicly available). The bond finances the construction of a pumped storage power station equipped with six 250,000 kW mixed-flow reversible water pump turbine generator sets, with a total capacity of 1.5m kW. The annual power generation capacity of the power station is 2.007bn kWh, and the annual pumping capacity is 2.676bn kWh.

Climate Bonds view: Pumped-storage hydroelectricity allows energy from intermittent sources (such as solar and wind) and excess electricity from continuous base-load sources to be saved for periods of higher demand. The Ministry of Land and Resources approved a total of 1.96km2 of construction land for the project, which gives a power density of at least 756.98w/m2. The facility is contributing to a grid which has at least 20.3% share of intermittent renewables and since they’ve used Lvrong Green Finance conduct assessment on social and environmental risks we consider the intended use of proceeds to be aligned with our definition of green.

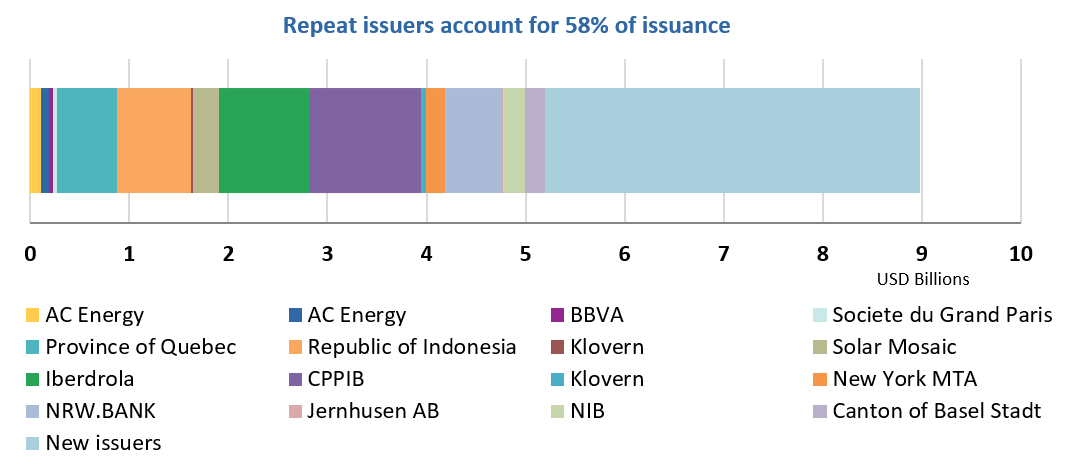

Repeat issuers

- AC Energy: USD75m (tap) – Certified Climate Bond

- AC Energy: USD110m – Certified Climate Bond

- BBVA: EUR35m/USD40m

- CGN Wind Energy: CNY1bn/USD147m - issued in January 2019

- Canton of Basel Stadt: two tranches for a total of CHF200m/USD200m

- CPPIB (Canada Pension Plan Investment Board): EUR1bn/USD1.1bn

- Fannie Mae: USD883m issued in January 2019

- Iberdrola: EUR800m/USD905m

- Jernhusen AB: SEK150m/USD16m

- Klovern: SEK200m/USD20m (tap); SEK400m/USD44m (tap)

- Los Angeles County Metropolitan Transportation Authority: USD419m – Certified Climate Bond

- New York MTA: USD191m – Certified Climate Bond (Programmatic Certification process)

- NIB (Nordic Investment Bank): SEK2bn/USD221m

- NRW.BANK: EUR500m/USD572m

- Province of Québec: CAD800m/USD606m

- Republic of Indonesia: USD750m

- Société du Grand Paris: EUR50m/USD44m – Certified Climate Bond (Programmatic Certification process)

- Solar Mosaic: two tranches for a total of USD260m

- Zhejiang Deqing Rural Commercial Bank: CNY200m/USD30m - issued in January 2019

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though, we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular, SDGs 6,7,9,11,13 and 15, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

Examples of social goals without a clear climate angle are supporting museum visits for children or financing social housing, but not necessarily energy efficient properties nor for such upgrades. Social projects with a climate angle – e.g. social housing upgrades to improve energy efficiency by 25% or more – will be treated as green bonds and analysed accordingly.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

China Banking Corporation |

USD150m |

18/10/2018 |

Pending |

|

KEB Hana Bank |

USD300m; USD300m |

30/01/2019 |

Sustainability/Social bond |

|

Shenzhen Energy Group Co., Ltd. |

CNY1.5bn/USD246m |

22/02/2019 |

Working capital |

|

Guangzhou Metro Group Co., Ltd. |

CNY3bn/USD442m; CNY1.6bn/USD236m |

24/01/2019 |

Working capital |

|

Xinxing Ductile Iron Pipes Co., Ltd. |

CNY1bn/USD147m |

22/01/2019 |

Working capital |

|

Huzhou Municipal Construction Investment Group |

CNY500m/USD74m |

18/01/2019 |

Not aligned |

|

Guangzhou Metro Group Co., Ltd. |

CNY3bn/USD443m |

18/01/2019 |

Working capital |

|

Guodian Financing Lease Co., Ltd |

CNY1.6bn/USD229m |

08/01/2019 |

Not aligned |

|

DTE Energy |

USD650m |

15/02/2019 |

Pending |

|

Dormitory Authority of the State of New York |

USD83m |

13/02/2019 |

Pending |

Green bonds in the market

- Korea Western Power: CHF200m – closing February 27

- Snam: EUR500m – closing February 28

- Contact Energy: NZD100m, Certified Climate Bond (Programmatic Certification )– closing March 1

- Oregon Wisconsin School District: USD12.3m – closing March 1

- FYI Properties - closing March 5

- Tokyo Tatemono - closing March 15

Investing News

The Kenya Capital Markets Authority (CMA) and Nairobi Securities Exchange (NSE) have launched new Green Bond Guidelines and Listing Rules, a further step in the Green Bond Programme established in 2017, whose partners include Central Bank of Kenya, Kenya Bankers Association, NSE, CMA, Climate Bonds Initiative, Financial Sector Deepening Africa and Dutch Development Bank, FMO. (NTV Nation TV news report is here. 1m:58secs.)

Spain’s Socialist government announced a EUR47bn public investment plan on Wednesday to tackle climate change over 10 years, which would be partly financed by issuing green bonds.

Australia’s Prime Minister, Scott Morrison, announced an AUD2bn extension to the country’s Climate Solutions Fund, aimed at ensuring Australia meets its 2030 emissions reduction target by partnering with remote Indigenous communities, small businesses and farmers.

South Africa set to introduce a carbon tax in June starting at ZAR120 per tonne of carbon dioxide, although various free allocations reduce the effective rate to ZAR6-54/t, depending on the industry.

The strategy and governance indicators of the PRI’s climate risk indicators, based on TCFD guidelines are to become mandatory for the organisations 1600+ signatories to report on from 2020.

Climate risk, or "natural disaster risk" in the wording of Japan's Financial Services Agency (FSA), is one of several strategic priorities as it seeks to ensure the stability of the financial system.

The Church Commissioners for England and other institutional investors have welcomed a position statement from commodities giant Glencore significantly strengthening its commitment to combat climate change.

Members of the European Parliament are planning to add a controversial ‘non-sustainable’ category to the EU’s Taxonomy of Sustainable Economic Activities.

European Union lawmakers struck an agreement on green public procurement rules for new buses, requiring local authorities purchase a minimum share of 24% to 45% by 2025 of clean vehicles running on gas or electricity by 2025 and 33% to 66% by 2030, depending on a country’s population and GDP.

Green Bond Gossip

The Egyptian government aims to issue between USD250m and USD500m of debut green bonds this year.

The Kenya Electricity Generating Company (KenGen) is looking into issuing raising funds through green bonds later this year.

Following approval of its bookbuild by the Securities and Exchange Commission (SEC), Access Bank Plc is set to issue the first corporate Certified Climate Bonds in Africa.

Japan Railway Construction, Transport and Technology Agency (JRTT) is returning to the market with a benchmark size offering.

Renew Power Limited is preparing the issuance of a USD denominated senior secured Certified Climate Bonds through a Restricted Group consisting of certain subsidiaries of the company.

Readings & Reports

International targets to cut emissions and limit climate change will be missed due to rises in deforestation and delays in changing how humans use land, a new study warns.

UK steelmakers and university experts are teaming together on a seven-year research programme aimed at boosting the productivity of the steel sector by championing carbon capture techniques and minimising industrial waste streams.

McKinsey & Company have recently published perspective pieces on how the energy transition will unfold and on recycling and the future of the plastics industry.

Climate Bonds reports:

Only a week to go to the Climate Bonds Annual Conference! London, March 5-7. Register here.

4th Green Bond Pioneer Awards announced Tuesday 5th March at the evening event.

A big thank you to HSBC, Natixis and all our Conference Sponsors – see the full list here.

‘Till next time,

Climate Bonds