Highlights:

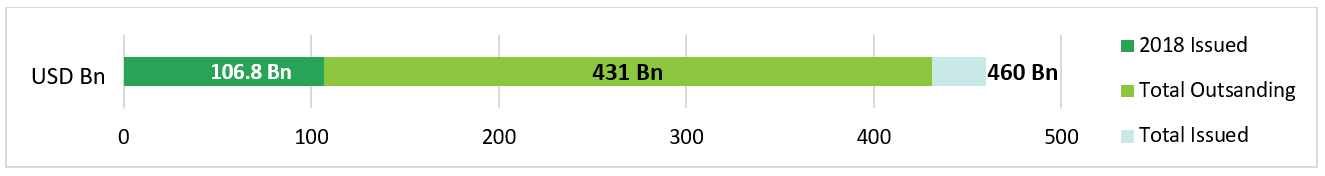

- USD8.8bn green bonds monthly volume

- State Bank of India (SBI) issues largest Certified Climate Bond from an Indian issuer

- Sumitomo Forestry Co. first convertible green bond and BBVA Bancomer first green bond from Mexican bank

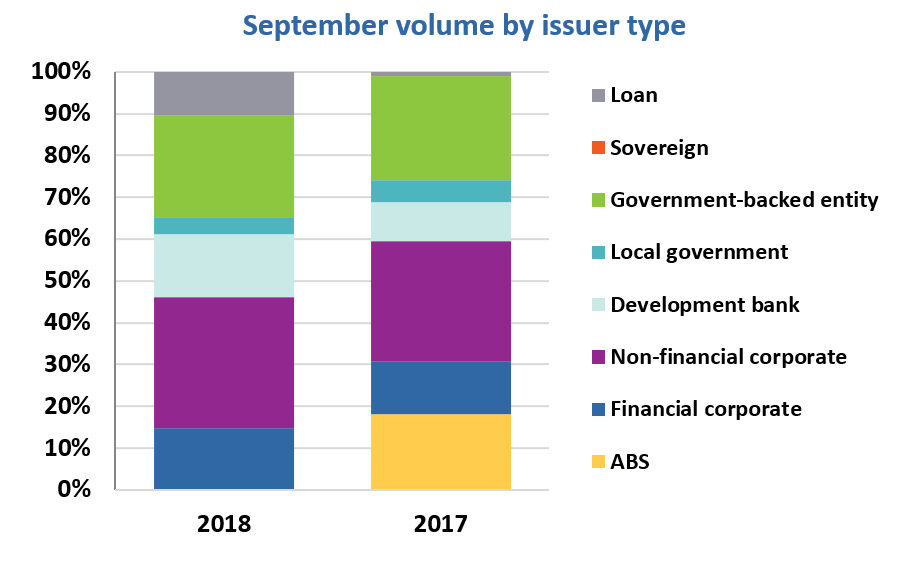

- Corporates drive monthly issuance at 31%

Don’t miss:

- Bonds and Climate Change: the State of the Market 2018

- Revised Climate Bonds Taxonomy

- Updated CBI Green Bond Database Methodology

Go here to see the full list of new and repeat issuers in September.

September at a glance

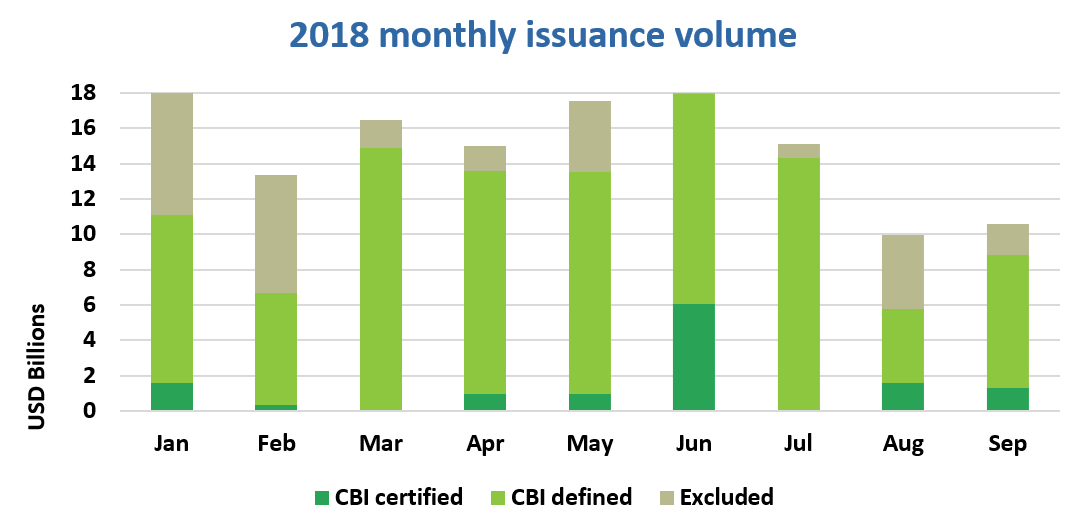

Green bond issuance in September started to pick up from August, totalling USD8.8bn. The figures are 56% lower than 2017’s monthly issuance, which was spurred by Mexico City’s landmark USD4bn deal which accounted for a fifth of volumes. Fannie Mae’s September deals have yet to be published.

Corporates dominated monthly issuance at 31%, with EUR500m and USD500m benchmark deals coming from CGNPC International and Interstate Power and Light Company respectively.

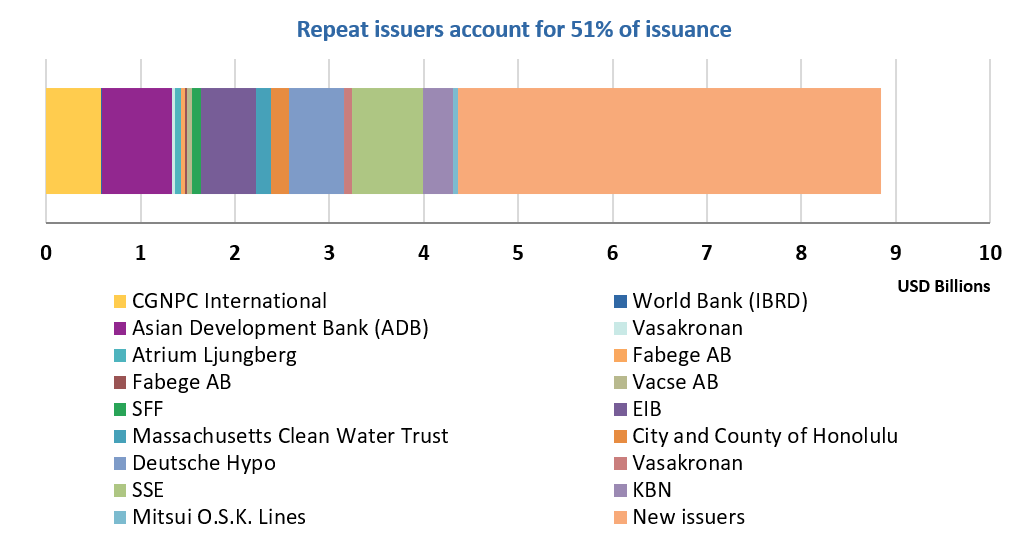

Debut deals accounted for over half of monthly volumes, including Fraser Property Limited’s green loan, Cassa Depositi e Prestiti SpA’s Sustainable “Hydro” Bond and Sumitomo Forestry Co., Ltd’s convertible green bond.

Certified Climate Bond deals from China Construction Bank Corporation, Encavis AG and State Bank of India accounted for 14% of issuance.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

China Construction Bank Corporation (EUR500m/USD589m) issued a 3-year senior unsecured Certified Climate Bond. It is Certified under the Marine Renewable Energy, Wind, Low Carbon Transport and Water Criteria of the Climate Bonds Standard. Eligible projects include:

- A railway project in South China,

- Two onshore wind projects in Northwest and Southwest China,

- An offshore wind project in East China and

- A sewage treatment facility in Central China

EY provided the Pre-Issuance Verification Report.

State Bank of India (USD650m) issued a 5-year senior unsecured Certified Climate Bond, the first deal under a wider USD3bn green finance program. The inaugural green bond from SBI is Certified under the Solar and Wind Criteria of the Climate Bonds Standard. It is the largest Certified Climate Bond from India to date.

KPMG provided the Pre-Issuance Verification Report.

Stay tuned for our special SBI Blog due out this week.

New issuers

BBVA Bancomer SA (MXN3.5bn/USD185.9m), Mexico, issued a 3-year senior unsecured green bond, becoming the first Mexican financial corporate to enter the green bond market. The deal benefits from a Sustainalytics Second Party Opinion. A list of potential eligible projects that may be financed by the debut deal is included in the SPO Appendix and shows a use of proceeds split of 54% to green buildings which have obtained or are expected to obtain a LEED certification and 46% to solar and wind projects.

More broadly, eligible green areas under BBVA’s recently announced SDG Bond Framework include green buildings that have received environmental certifications, renewable energy, sustainable transport, waste management and water management.

Climate Bonds view: This is the fourth Mexican issuer to enter the green bond market, taking the country’s cumulative volume to USD6.8bn. We believe that green bonds can be a bridge to achieving the SDGs, particularly contributing to SDGs 6, 7, 9, 11 and 13. Read more in our post from June.

Canton of Basel Stadt (CHF0.23m/USD0.24m), Switzerland, issued a 7-year senior unsecured green bond, becoming the second Swiss canton to enter the green bond market after Canton of Geneva in November 2017. ISS-Oekom provided the Second Party Opinion. Proceeds are earmarked for energy efficient use of green buildings in Basel: measures include both efficient use of space and property optimisation.

The Green Bond Framework sets out requirements for new constructions and refurbishments for each asset type, including green building certifications, energy measures (e.g. thermal insulation and climate-friendly heat generation) and ecological measures (e.g. resource saving construction methods and recycled material). According to Sustainalytics’ SPO, all buildings have used resource-savings construction methods or recycled material. 89% of the buildings in the asset pool by number provide water efficiency measures and 37% by number achieved a SNBS Gold and Minergie A ECO certification.

Climate Bonds view: This is the fourth Swiss green bond issuer to enter the green bond market, taking the country’s cumulative volume to USD1.1bn.

Cassa Depositi e Prestiti SpA (EUR500m/USD585m), Italy, issued a 5-year senior unsecured Sustainability “Hydro” Bond, becoming the first Italian issuer to come to market with a Sustainability bond. The deal benefits from a Vigeo Eiris Second Party Opinion. The deal was issued under Cassa Depositi e Prestiti’s Green, Social and Sustainability Bond Framework, which distinguishes between green and social eligibility criteria and allows the issuer to classify a bond as “green”, “social” or “sustainability” depending on the use of proceeds.

The debut bond will finance projects related to the development and modernisation of Italy’s water and wastewater infrastructure, such as water treatment facilities, water storage, sewage networks and wastewater treatment plants. The issuer stated that there is a significant infrastructure gap in the country’s water and wastewater sector, with average annual investments per capita well below other European countries.

Climate Bonds view: We are pleased to see the deal’s proceeds contributing to increasing investments in critical water and wastewater assets. This is the issuer’s second bond in the ESG sector, following a EUR500m social bond in November 2017. The creation of a joint framework for green, social and sustainability bonds is a creative way to keep deal costs down and have the flexibility to raise funding for different asset pools as a repeat issuer.

China Everbright Bank (USD300m), China, issued a 5-year green bond, benefiting from a Sustainalytics Second Party Opinion. Proceeds will be allocated to a broad range of eligible assets, including renewable energy, clean transportation, solid waste treatment, waste water treatment, climate change adaptation, and energy efficiency. Clean coal, fossil fuels, nuclear energy and related assets are excluded from the framework. Hydropower projects with capacity over 25MW are also excluded.

Climate Bonds view: We are glad to see this bond’s framework is closely aligned with international green bond definitions, but more detailed disclosure on project type and expected climate impact are encouraged.

China Gezhouba Group Lvyuan Technology (CNY1.2bn/USD175m), China, issued a 5-year green bond, benefiting from a Lianhe Equator Second Party Opinion (not publicly available). Proceeds will be fully allocated to three projects falling into waste management sector: CNY200m for copper and aluminium recycling and remanufacturing, CNY650m to build a waste recycling and processing centre, and the rest will finance plastic and steel waste production lines, which are expected to recycle 2.12m tons of plastic and 0.5m tons of steel per year.

Climate Bonds view: We welcome the clear disclosure on the actual amount to be allocated to eligible projects and the quantitative expected environmental impact the issuer has disclosed.

Everbright Water (CNY400m/USD59m), China, issued a 5-year green bond. Shanghai Brilliance provided both the Second Party Opinion (not publicly available) and GB-1 rating. Proceeds will be allocated to four water projects in China: a river dredging project (30%), two wastewater treatment projects (60%) and a water distribution project (10%). Expected Biochemical Oxygen Demand (BOD) reduction, Chemical Oxygen Demand (COD) reduction and other environmental impacts are also disclosed in the prospectus.

Climate Bonds view: We are expecting to see a further CNY400m worth in green bond issuance under the same framework as the issuer has confirmed a CNY800m programme.

Fraser Property Limited (SGD1.2bn/USD876m), Singapore, issued a 5-year term-loan. According to the press release, proceeds of the deal will be used to refinance existing loans relating to the development of Frasers Tower, which received the Singapore Building and Construction Authority (“BCA”) Green Mark Platinum Award.

Climate Bonds view: The BCA Green Mark scheme rates a building against five main categories: energy efficiency, water efficiency, environmental protection, indoor environmental quality and other green features and innovation. The four rating levels under the scheme are (ascending order): Certified, Gold, GoldPlus and Platinum. The Fraser Tower has achieved the highest rating level, which is aligned with best practice. We would like to see Green Bond/Loan Frameworks made publicly available by issuers to increase transparency.

Hitachi Zosen Corporation (JPY5bn/USD44m), Japan, issued a 3-year senior unsecured green bond, which benefits from a DNV GL Second Party Opinion. Proceeds will be allocated to financing waste-to-energy generation facilities, with refinancing being limited to existing projects to be finalized or taken into operation within the last 24 months. The two eligible projects listed by the issuer as of September 2018 are the Kyoto South Clean Center EfW project (expected to be completed in March 2019) and the Energy-from-Waste Plant for Kikuchi Environmental Preservation Association (expected to become operational in March 2021).

Hitachi Zosen has engaged DNV GL to assess whether the financed projects are in compliance with the Green Bond Framework one year after the bond’s issuance.

Climate Bonds view: This is the first green bond issuer from Japan to fully allocate proceeds to WTE facilities. The issuer has set out a clear reporting framework and has gone a step further by engaging DNV GL to confirm that the financed projects comply with the eligibility requirements. We encourage more issuers to seek for third parties to review proceed allocations in order to align with best practice transparency standards.

Interstate Power and Light Company (USD500m), USA, issued a 10-year senior unsecured green bond. According to the prospectus, proceeds will be allocated to the construction and development of wind and solar electric generating facilities.

Climate Bonds view: The bond prospectus provides a good level of disclosure on proceed allocation, management and reporting practices. Going forward, we hope to see more issuers seeking for external reviews to best practice transparency standards.

Sumitomo Forestry Co., Ltd (JPY10bn/USD89m), Japan, issued a 5-year convertible green bond, benefiting from a Vigeo Eiris Second Party Opinion. The deal is the first green convertible bond worldwide. The full amount of proceeds will be exclusively allocated to refinance the acquisition of 30,000 hectares of FSC certified timberlands and related assets which comprise plantation forests in Nelson, New Zealand.

Climate Bonds view: Sumitomo Forestry Co., Ltd has been identified as a fully-aligned issuer under the land use sector in the Climate Bonds latest State of the Market report. It’s great to see a fully-aligned issuer entering the green bond market and capitalising on the benefits of the “green” label. As the first green bond with Stock Acquisition Rights, the deal adds structural diversity to the market.

New World Development (HKD3.6bn/USD459m), Hong Kong, issued a green loan in March 2018. Sustainalytics provided the Second Party Opinion. Proceeds will finance a green commercial re-development project at King’s Road, North Point, Hong Kong. The project is expected to be completed in 2019 and has achieved a Platinum WELL Building Standard Pre-certification, a Provisional Platinum BEAM Plus and a Platinum LEED Pre-certification.

Climate Bonds view: The commercial re-development project obtained top certification rankings across all three green building certification schemes. We note that the WELL Building Standard assesses health, wellbeing, productivity and the happiness of building occupants, rather than the building’s energy credentials. We will keep monitoring reporting to ensure that the provisional and pre-certification ratings are achieved.

Repeat issuers

- Asian Development Bank (ADB): USD750m

- Brookfield Renewable Partners: CAD300m/USD219.3m

- Vasakronan: SEK200m/USD22m

- World Bank (IBRD): USD7m

September trends

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Region Occitanie |

EUR200m/USD235m |

26/09/2018 |

Sustainability bond |

|

BPCE |

EUR1.3bn/USD1.5bn |

26/09/2018 |

Social bond

|

|

NWB Bank |

EUR1bn/USD1.2bn |

25/09/2018 |

Social bond

|

|

City of Vancouver |

CAD85m/USD66m |

21/09/2018 |

Not aligned

|

|

Enterprise Community Loan Fund Inc |

USD50m |

27/09/2018 |

Social bond |

|

China Construction Bank Corporation |

USD1bn |

24/09/2018 |

Social bond

|

|

Chimei Corporation |

TWD5bn/USD163m |

26/09/2018 |

Not aligned |

|

Pingan Leasing |

CNY508m/USD74m |

17/09/2018 |

Working capital |

|

Sumitomo Mitsui Trust Bank |

EUR500m/USD584m |

17/09/2018 |

Pending |

|

Casablanca Finance City |

MAD355m/USD38m |

24/09/2018 |

Pending |

|

Credit Agricole CIB |

USD4m |

28/09/2018 |

Pending |

|

Vasakronan |

SEK610m/USD69m |

21/09/2018 |

Pending |

|

Chongqing Qianjiang |

CNY400m/USD58m |

21/09/2018 |

Pending |

Green bonds in the market

- DZ Bank: EUR250m, closing October 2

- Korea Railroad Corporation: EUR110m, closing October 2

- Deutsche Kreditbank AG: EUR500m, closing October 2

- Public Utility District No.1 of Oreille County, Washington: USD83m, closing October 3

- Getlink SE: EUR550m, closing October 3

- IFC: USD100m, closing October 4

- Mitsubishi UFG: EUR500m, closing October 9

- World Bank (IBRD): USD200m, closing October 10

- City of Saint Paul, Minnesota: closing October 10

- Development Bank of Japan: EUR700m, closing October 10

- Societe Generale: 3 tranches for a total of TWD1.6bn, closing October 18

- Encevo SA: EUR250m, closing October 23

Investing News

Hong Kong’s Securities and Futures Commission (SFC) released a new strategic framework aimed at the development of the “green finance” sector in the city.

The UK's Prudential Regulation Authority will launch a Climate Financial Risk Forum alongside the Financial Conduct Authority, helping private sector participants, technical experts and other stakeholders to consider climate-related financial risks, to share best practice and provide intellectual leadership.

US issuers state that natural disasters which have occurred in the past year have stimulated demand for PACE to help protect homes from damages.

The UK, Canada, Denmark and Spain join the Carbon Neutrality Coalition, pledging to develop net zero emissions plans.

BlackRock announced the launch of the "iShares JP Morgan ESG $ EM Bond UCITS ETF", providing exposure to sovereign and quasi-sovereign bonds from emerging market issuers that adhere to high environmental, social and governance (ESG) standards.

GRESB is holding events across the world to present the 2018 GRESB results providing insights on the ESG performance of real estate and infrastructure portfolios.

Build American Mutual launched a BAM GreenStar Assessment program to identify municipal green bonds.

Green Bond Gossip

The Canada Pension Plan Investment Board (CPPIB) is expected to start roadshowing its first EUR-denominated green bond in October, following its CAD green bond in June 2018.

Also from Canada, TransLink, Metro Vancouver’s transit authority, is considering green bond issuance.

Banco Atlántida developed a Green Bond Framework which obtained a Sustainalytics Second Party Opinion.

Japanese retail chain Marui Group’s Green Bond Framework obtained a Sustainalytics Second Party Opinion.

Transportation service provider ANA Holdings obtained an R&I Green Bond Assessment for its green bond scheduled to be issued in October.

French public development bank SFIL Group developed a Social Note Framework which obtained a Sustainalytics Second Party Opinion.

Reading and Reports

The Sustainable Banking Network (SBN) has released Creating Green Bond Markets, Insights Innovations and Tools from Emerging Markets, jointly prepared by the IFC and Climate Bonds.

BlackRock’s annual Global Insurance Report sees increased interest in green bonds as engagement in ESG issues rise.

Moody’s recently published a report on “Environmental Risks -- Global: Heat map: 11 sectors with $2.2 trillion debt have elevated environmental risk exposure”.

The Bank of England Prudential Regulation Authority released its latest report: “Transition in thinking: The impact of climate change on the UK banking sector”.

The TCFD published its 2018 Status Report.

Latest report from the World Green Building Council: “Creating an Energy Efficient Mortgage for Europe: Towards a New Market Standard”.

McKinsey & Company’s article on “No time to waste: What plastics recycling could offer”.

Readings from the Property Chronicle:

- What agriculture fits with future environmental needs?

- Property valuation: Climate change and perpetual assumptions

Readings from Edie:

- TCFD, SDGs and pop-up squads: What the future holds for sustainability reporting

- The World Benchmarking Alliance launches to rank businesses on SDGs

- The World Bank launches $1bn energy storage programme for developing nations

Moving Pictures

Watch how California’s renewable energy policies are setting an example for the world to follow.

Discover how an ancient African farming method can help fight desertification and hunger.

Take 48 seconds to learn how France plans to triple its number of cyclists.

‘Till next time,

Climate Bonds