Special Webinar Event! Green Bond Pledge – A briefing for Cities.

Thursday 26th July 12:00 PM EDT/09:00 AM PDT/17:00 PM BST co-hosted by CDP and Climate Bonds Initiative

Info and Registration here.

Highlights:

- Atlas Renewable Energy issues first Uruguayan green bond

- USD8.9bn green bonds in July so far

- New issuers from Austria, Indonesia, Uruguay and the US

Go here to see the full list of new and repeat issuers in July.

At a glance

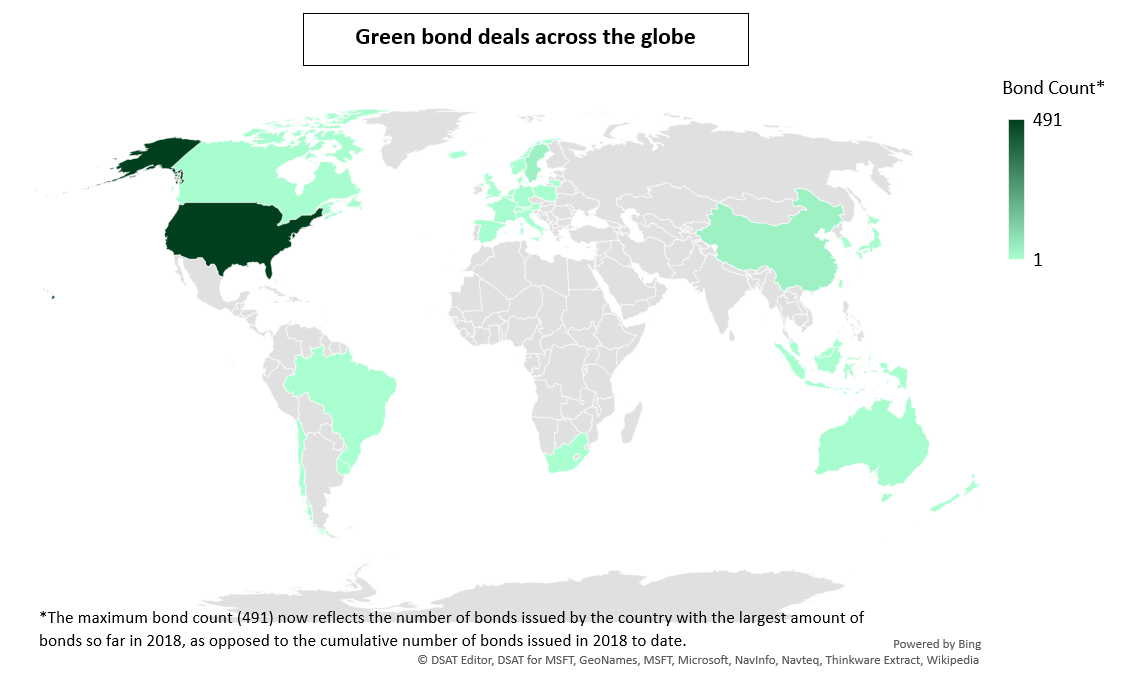

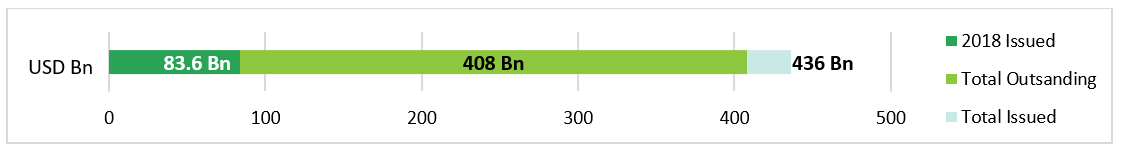

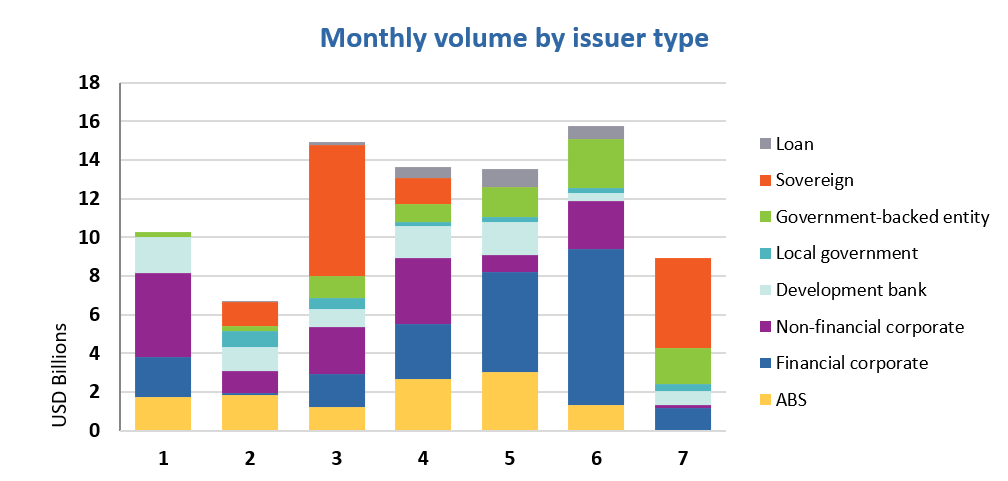

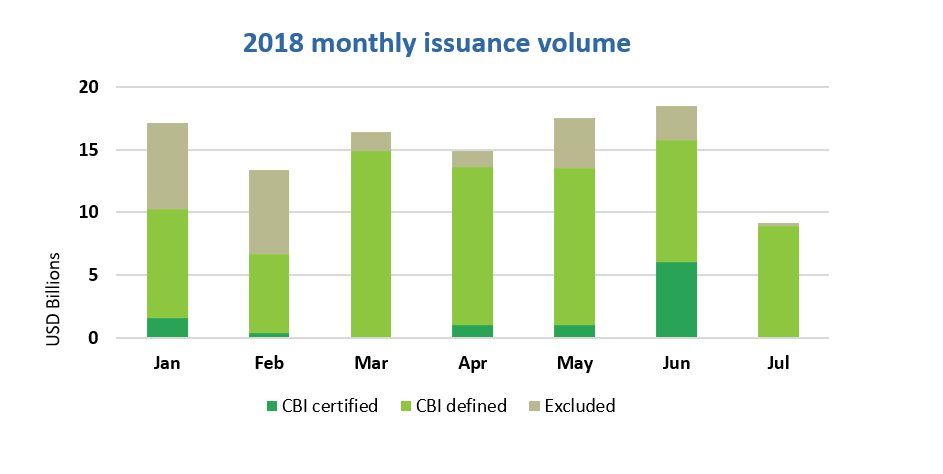

As of mid-July 2018, monthly green bond issuance totalled USD8.9bn. 27% of deals by count came from emerging markets, including the first green bond from a Uruguayan issuer.

After a two-month absence, sovereign issuance made its comeback with France’s Green OAT fourth re-opening of EUR4bn, accounting for over half of monthly issuance to date.

Government-backed issuance also kept a high pace at 22%, with deals coming from repeat issuers KommuneKredit (Denmark), Lietuvos Energija (Latvia) and NRW.BANK (Germany) and new issuer PT Sarana Multi Infrastruktur (Indonesia).

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issuer deal sheet in the online bond library.

New issuers

Atlas Renewable Energy (USD108.4m) issued a two-tranche green private placement (longest dated bond: 24 years). The deal achieved GB1 Green Bond Assessment from Moody’s. Proceeds will be allocated to refinancing two solar projects, El Naranjal (50MW) and Del Litoral (16MW), in Uruguay with an off-take arrangement with Administración Nacional de Usinas y Trasmisiones Eléctricas, the state-owned Uruguayan electricity company.

The issuer is committed to reporting annually on the actual generation of the solar plants and CO2 emissions avoided compared to a baseline emissions factor that adjusts over time as the country's grid composition changes.

Climate Bonds view: We welcome the first green bond from a Uruguayan issuer! It’s good to see impact reporting practices adhering to market standards.

Public Service Company of Colorado (USD700m), a US utility company, issued a senior secured bond in two tranches (longest dated bond: 30 years), labelled as “First Mortgage Bonds” and identified as a green bond in the prospectus. The deal is secured by a first mortgage lien on the issuer’s electric utility properties. The prospectus sets out a framework defining eligible green expenditures, management of proceeds and reporting of both proceed allocation and key environmental features of the financed green expenditures. The deal will fund the development, construction and operation of a 600 MW wind generation facility in Colorado at Rush Creek, as well as the related transmission infrastructure.

Climate Bonds view: As the proceeds of the bond are used exclusively to finance eligible green assets, labelling it more prominently as green would have enhanced its visibility. An external review would provide another layer of assurance on the green credentials of the financed projects.

PT Sarana Multi Infrastruktur (IDR355bn/USD25m), State backed Indonesian infrastructure financier SMI, issued a two-tranche green bond (longest dated bond: 5 years). The deal benefits from a CICERO Second Party Opinion. Proceeds will be allocated to refinancing three light rail transit projects, two mini hydro power plants, a water treatment plant and irrigation systems. A new co-power generation power plant has also been proposed for financing under this debut issuance.

Eligible categories under the Green Bond Framework include renewable energy, transport, land use, water, waste and energy efficiency infrastructure improvements targeting at least 10% energy consumption reduction compared to the national average. Energy generation from fossil fuels is explicitly excluded from the framework. The land use category does not set out any eligibility requirements for irrigation systems, and in its SPO, CICERO raises concerns over how irrigation systems may “overdraw water fresh supplies, thereby threatening drinking water sources and fragile ecosystems” and assigns this category a “medium green” score.

Climate Bonds view: We agree with CICERO on the concerns related to irrigation systems and would like to see more details on the types of financed irrigation systems, as well as on the use of the irrigated land. We will keep monitoring this deal’s proceed allocation to ensure that all financed projects are aligned with the Climate Bonds Taxonomy. In particular, if the co-generation facility turns out to be fossil fuel powered the bond may be excluded from our database.

This is the third green issuance in short order from Indonesia following their world first Sovereign Green Sukuk in February. You can find out more in our recent Green Infrastructure Investment Opportunities Indonesia Report.

Raiffeisen Bank International AG (EUR500m/USD584m), Austria, issued a 3-year green bond, which benefits from a Sustainalytics Second Party Opinion. The bond will finance/refinance existing and future loans in Central and Eastern Europe that fund renewable energy, green buildings, clean transport, water management and related energy efficiency projects/assets. Geothermal projects must have direct emissions below 100gCO2/kWh, while only sustainable biomass sources that do not deplete carbon pools, biodiversity, nor compete with food sources are eligible. Hydropower assets of up to 20MW are also eligible.

Green buildings are required to either have obtained a LEED Gold, BREEAM very good or DGBN/ÖGNI Gold certification, or belong to the country’s top 15% most efficient buildings according to local building codes, building years and EPC certificates. Refurbished buildings must either lead to a twostep improvement in the energy label or a 30% increase in energy efficiency (kWh/m2). Energy efficiency improvements of fossil fuel technologies are explicitly excluded.

Climate Bonds view: The framework defines detailed eligibility criteria for each category, setting a high standard for the green credentials of the financed projects. We would like to see green bond frameworks aiming for a similar level of specific requirements going forward. For hydropower, it would be good to see issuers reporting on power density ratio or annual emissions (gCO2/kWh) of the asset.

New issuers - deals issued prior to 2018

China Power Clean Energy Development Co (CNY800bm/USD116m) issued a 3-year green panda bond in May 2017. CCXI provided the Second Party Opinion (not publicly available). The funds raised were earmarked for the construction and operation of energy-saving and clean-up projects aimed at improving energy conservation and emissions reduction, as well as energy supply infrastructure. The projects will support solar energy development and agroforestry.

Compared with traditional coal-fired stations, the proposed projects are expected to save around 0.5 million tons of standard coal per year and reduce 0.86 million tons of CO2, as well as reducing nitrogen oxides and sulphur dioxide emissions by 1357.6 tons and 2560.3 tons respectively.

Climate Bonds view: The issuer has the expertise in clean energy generation and we are pleased to see detailed expected environmental impacts of the projects. We encourage issuance that promote clean energy and reduce carbon emissions. However, we would like to see more information on the proposed projects. We also hope that the issuer will keep a close eye on the use of proceeds and put in place a comprehensive reporting regime.

Repeat issuers

- Asian Development Bank (ADB): SEK1.5bn/USD169m (June); EUR600m/USD701m (July)

- Atrium Ljungberg: SEK500m/USD57m

- Guangdong Huaxing Bank: CNY2bn/USD300m

- KommuneKredit: EUR750m/USD877m

- Lietuvos Energija: EUR300m/USD352m

- Province of Québec: CAD500m/USD381m

- Tus-Sound Environmental Resources: CNY455m/USD69m

Trends

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

City of Los Angeles |

USD276.2m |

12/07/2018 |

Sustainability/Social bond |

|

Shanxi Jincheng Anthracite Mining Group |

CNY1bn/USD157.7m |

08/03/2018 |

Not aligned |

|

Guangzhou Yuexiu Holding LTD |

CNY2bn/USD316.7m |

27/02/2018 |

Working capital |

|

Olam |

USD500m |

26/03/2018 |

Sustainability-linked credit facility |

|

Wilmar |

USD200m |

27/11/2017 |

ESG linked credit facility |

|

AccorHotels |

EUR1.2bn/USD1.4bn |

29/06/2018 |

ESG linked credit facility |

|

MAPFRE |

EUR1bn/USD1.2bn |

26/02/2018 |

ESG linked credit facility |

|

Danone |

EUR2bn/USD2.5bn |

12/02/2018 |

ESG linked credit facility |

|

Philips |

EUR1bn/USD1.2bn |

12/04/2017 |

ESG linked credit facility |

|

Red Eléctrica España |

EUR800m/USD949.3m |

21/12/2017 |

ESG linked credit facility |

|

Fromageries Bel |

EUR520m/USD949.3m |

21/12/2017 |

ESG linked credit facility |

|

Agricultural Development Bank of China |

CNY4bn/USD452m |

02/05/2018 |

Not aligned |

|

Grupo Siro |

EUR240m/USD280.6m |

12/07/2018

|

Impact loan/ESG linked credit facility |

|

Credit Agricole CIB |

USD1m |

29/06/2018 |

Pending |

|

World Bank (IBRD) |

SEK3bn/USD339m |

17/07/2018 |

Pending |

|

IFC |

GBP350m/USD463m |

12/07/2018 |

Pending |

Green bonds in the market

- ADB: closing on 16 July

- Terna: closing on 23 July

- North American Development Bank: closing on 24 July

- Faro Energy: Certified Climate Bond

- State Bank of India: Certified Climate Bond

- Empresa de Energía del Pacífico (EPSA): Certified green bond program, up to COP420bn

- San Francisco Public Utilities Commission: Certified Climate Bond

Investing News

The IFC and Moroccan capital markets authority (AMMC) published guidelines for new financial instruments aimed at addressing climate change and promote positive social outcomes. These include updated guidelines for Morocco’s green bond market and a new framework for the social and sustainability bond market.

Six of the largest sovereign wealth funds with a combined USD3tn in assets launched a framework on how to integrate climate change into their investment decisions.

Dutch banks ABN Amro, ING and Rabobank developed Circular Economy Finance Guidelines, which are designed to become a common framework for financing circular economy-related projects/assets.

Nasdaq Nordics launched an ESG version of its benchmark OMX Stockholm 30 index.

Nigeria’s DMO to list the country’s ground-breaking sovereign green bond on the Nigerian Stock Exchange tomorrow Friday 20th June.

Results from a recent financial sector survey reveal pathways to achieving USD1tn in cumulative US private investment in renewable energy by 2030.

Green Bond Gossip

The Qatar Central Bank (QBC) is seeking to issue green bonds to promote sustainable development, according to a Doha Bank top official.

Mytrah Energy is planning to issue around 26bn rupees worth of green bonds in the next two years.

Green investment firm Business Venture Partners (BVP) eyes EUR7.5bn green bond issuance to fund renewable energy projects.

In a break from the past major US utility SFPUC is actively seeking international investor interest for its latest (Climate Bonds Certified) green municipal water bonds. Environmental Finance has the story.

Reading and Reports

Former California Deputy Treasurer Mike Paparian has penned a guest post for the Climate Bonds. Green Bond Pledge: A Climate Finance Framework for Cities & Subnationals. Don’t miss it!

Moody’s latest report “Green Bonds – Sovereign - Sovereign green bond market on course for critical mass, but challenges remain” provides an outlook on the sovereign green bond market.

Versik Maplecroft’s latest report on “How can I tap sovereign green bond opportunities?”

The Blockchain Climate Institute released their book on “Transforming Climate Finance and Green Investment with Blockchains”.

Top renewable financiers reveal pathway to USD1tn in US investment by 2030, according to a recent Forbes article.

The first episode of “The Drawdown Agenda” podcast explores in detail the key carbon-reduction solutions across the seven sectors at the heart of Drawdown— energy, food, women and girls, transport, materials, building and cities, and land use- as well as emerging solutions.

Episode 8 of the ESG Podcast: Guidance needed to nurture the green bond market (part one) explores how green bond financing is progressing in Asia.

Climate Bonds Reports:

Can US municipals scale up green bond issuance? Likely, “yes” identifies potential US Muni green bond issuers by considering the upcoming bond maturities of climate-aligned municipal entities in the water, waste, transport, renewable energy and land use sectors.

Moving Pictures

Watch Femi Onifade, Head, Secondary Markets at the Nigerian Stock Exchange discuss tomorrows Sovereign Green Bond listing with CNBCAfrica. 5:18mins

This Ted Talk presents a new way to remove CO2 from the atmosphere.

Watch how this company turns shipping containers into an energy efficient floating student housing.

Take 0:55 mins to learn how this Brazilian city has almost reached zero waste in 2018.

‘Till next time,

Climate Bonds