Guest Post by Michael Paparian, former California Deputy State Treasurer and long term environmental policy and environmental finance advocate. Mike is Climate Bonds representative in California.

As I write this, I’m breathing the smoke from yet another intense California fire. Although I’m over 50 miles away, we’ve been warned to stay indoors to avoid health problems. This fire is approaching 100,000 acres burned; a milestone that has been met all too often in recent years.

Our California fire season used to be mainly in the late summer and fall, after a dry spell. It’s now approaching year-round, as California becomes hotter and drier due to climate change.

It’s no coincidence that 2017 was the second warmest year in California’s record. 43 people lost their lives in California in 2017 due to fires which consumed over 1.3 million acres and resulted in $180 billion in suppression, insurance and recovery costs. Very large fires used to happen rarely, but now happen with regularity. Fifteen of the twenty largest California fires since 1930 have happened after 1999.

As California builds and finances the infrastructure for the future, new fire stations are clearly an essential part of the mix and with the state embracing green finance principles; it’s no surprise that the latest local financing for fire stations was accomplished with green bonds.

This is a small, real economy example of green bonds financing the infrastructure needed in a climate challenged world.

Subnational Action on the Global Agenda

Subnational government use of green bonds is increasing dramatically and so is their recognition of the link between infrastructure finance, climate resilience and adaptation.

The Green Bond Pledge launched in March by ex-UN climate chief, Christiana Figures, is a way to demonstrate local commitment to discussing and addressing climate impacts on infrastructure while assuring that project financing uses green bonds where applicable.

It’s another step for cities and municipalities in connecting their climate action conversations with their capital raising strategies and balance sheets.

This is already happening in California where state and local government agencies issued more than $4.15 billion in green bonds last year; surpassing all previous years. The bonds are helping finance everything from sustainable water, fire stations and mass transit projects to energy efficient hospitals, green schools and climate-resilient infrastructure.

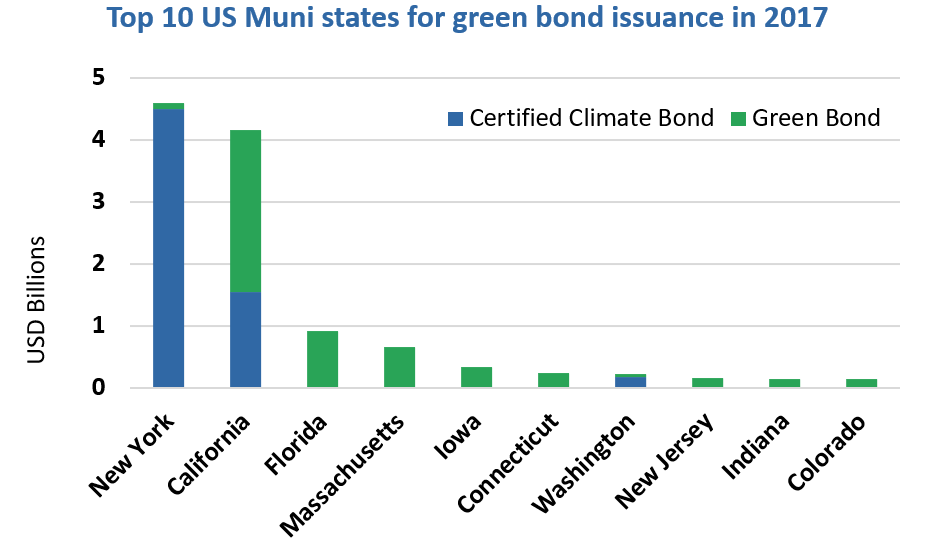

Overall a record USD12bn of green municipal bonds were issued across U.S. in 2017 with New York State finishing the year ahead of California in the Top 10 list out of the 20 states who issued green. They stand out among the lower 48 states.

Yet, green bond leadership at the local level, particularly in U.S. with its huge muni bond market, isn’t woven more broadly into local climate action agendas.

The Global Green Bond Surge

2017 saw a wider global surge in green bonds. For the first time, close to $160 billion in green bonds were issued globally.

But, is the growth fast enough to tackle our climate needs? Not yet, though there is hope.

Gothenburg, Sweden received awards as a trail-blazing early issuer of green bonds for green projects. Cape Town is using green bonds for clean water and electric buses. Mexico City issued a green bond for various sustainability projects, hence, local governmental leadership examples are emerging country by country.

At the COP23 Climate Summit in Germany last fall, mayors and city representatives from local governments came together to show world leaders their commitment to accelerating climate solutions. Several federations of local agencies have been facilitating these efforts, with not-so-catchy acronyms like: R20, ICLEI, C40, Under-2 Coalition, Compact of Mayors, UCLG and more.

These groups showcased innovative steps to reduce fossil fuel use, create sustainable cities and accelerate their national climate agendas. From the U.S. the “We are Still In” Coalition showed that actions at the local and state level can make up for the present lack of national leadership.

"We can draw from the power and enthusiasm of local and regional leaders in the mission to tackle climate change.” said Prime Minister of Fiji and COP23 President Frank Bainimarama, speaking to local leaders at the COP23 Summit. “So many of you have already demonstrated how to make decisions and implement them."

Resilience and adaptation at a local level

What’s common at many subnational levels is a growing realization of the need for resilience in both local communities and their infrastructure.

For some communities, water quality, scarcity and efficiency have come to the fore, in others, flood mitigation, storm surge and ocean rise is a growing threat. Transport, sustainable development and clean energy are common themes in almost every city.

What’s lagging in many of the local activities is a connection and commitment to green finance.

The critical link is finding the right pathways to aligning balance sheets and infrastructure investment with climate action outcomes.

Why a Green Bond Pledge?

Just as many local governments have committed to 100% renewable energy, 100% green buildings and other measures over time, local governments can increasingly link their climate ambition with investment via a commitment to issuing more of their bonds as green bonds.

This is the space that the Green Bond Pledge is designed to open up.

The Pledge helps bring the political and climate policy objectives of cities and municipalities closer to financial and investment areas.

The Pledge allows local governments to demonstrate to investors and the financial markets that they are committed to best practice related to their infrastructure projects.

This is a change that can be made fairly easily. With a staged, progressive and prudent implementation into capital raising policies, it is possible, overtime, to integrate local capital allocation and investment decisions with climate goals.

The Last Word

Local governments are well positioned to lead their peers, national governments, corporations and the finance community by committing to a broad green bond policy objective for their infrastructure.

Supporting the development of green finance is consistent with the stance global leaders are taking with regards to international finance, banking sector and big pension and sovereign wealth funds.

If the green pipeline grows wider and longer, investors will respond.

Local governments have demonstrated their influence in terms of moving the marketplace for clean energy, clean transportation, green buildings and more.

These local governments can also now urge the financial markets to shift more rapidly towards climate solutions by saying “yes” to the Green Bond Pledge.

In March Christiana Figueres from M2020 placed a challenge before all bond issuers: city, corporates and banks, to begin the green transition in their borrowing programs, by committing to the Pledge and start a new a new green finance conversation.

The Global Climate Action Summit, (GCAS) in San Francisco in September provides an ideal platform for city and municipal governments to announce their support for the Pledge before an audience of the world’s biggest investment funds.

I can’t think of a better time to respond.

Mike Paparian

Want to know more?

Webinar: 26th July, 2018

12:00 PM EDT/09:00 AM PDT/17:00 PM BST

This webinar, co-hosted by CDP and Climate Bonds Initiative, will introduce the Green Bond Pledge. Speakers will outline the Green Bond Pledge’s role to foster debate around finance for low carbon, climate resilient urban infrastructure as a part of cities’ plans to help the US to meet its Paris Accord emissions goals.

We will also share information on the upcoming GCAS and Green Bond Pledge announcements in support of maintaining climate momentum across states and cities.

The Green Bond Pledge will also be highlighted as a major commitment local governments can make to the Global Climate Action Summit Sept. 13-14 in San Francisco. For information on the Climate Action Summit, see www.globalclimateactionsummit.org