Climate Bonds Launches Version 3.0 of the international Climate Bonds Standard

Universal compatibility for global green investment - Certification a label of trust in debt markets

London 11/12/19: 14:00 GMT: The Climate Bonds Initiative has released Version 3.0 of the international Climate Bonds Standard, a significant development for global green bond and loan markets.

Sean Kidney, CEO of Climate Bonds Initiative said, “The Climate Bonds Standard now underpins certification of over USD100 billion worth of green bonds and debt products around the world and is growing. Climate Bonds Certification has emerged as a universal adaptor for issuers and investors in both developed and emerging economies.”

“It’s a simple pathway to best practice that provides recognition and compatibility in multiple jurisdictions. Climate Bonds Standard Version 3.0 (Standard V3.0) strengthens disclosure and green definitions and is another step in the maturation of the green finance market that’s growing towards a trillion dollars in annual issuance.”

Climate Bonds Standard V3.0 is a major upgrade to the Climate Bonds Standard, designed to ensure compatibility with the new EU Green Bond Standard (GBS),the latest version of the Green Bond Principles (GBP), Green Loan Principles and recent market developments including guidelines adopted by India, ASEAN and Japan.

The new Standard V3.0 provides guidance for:

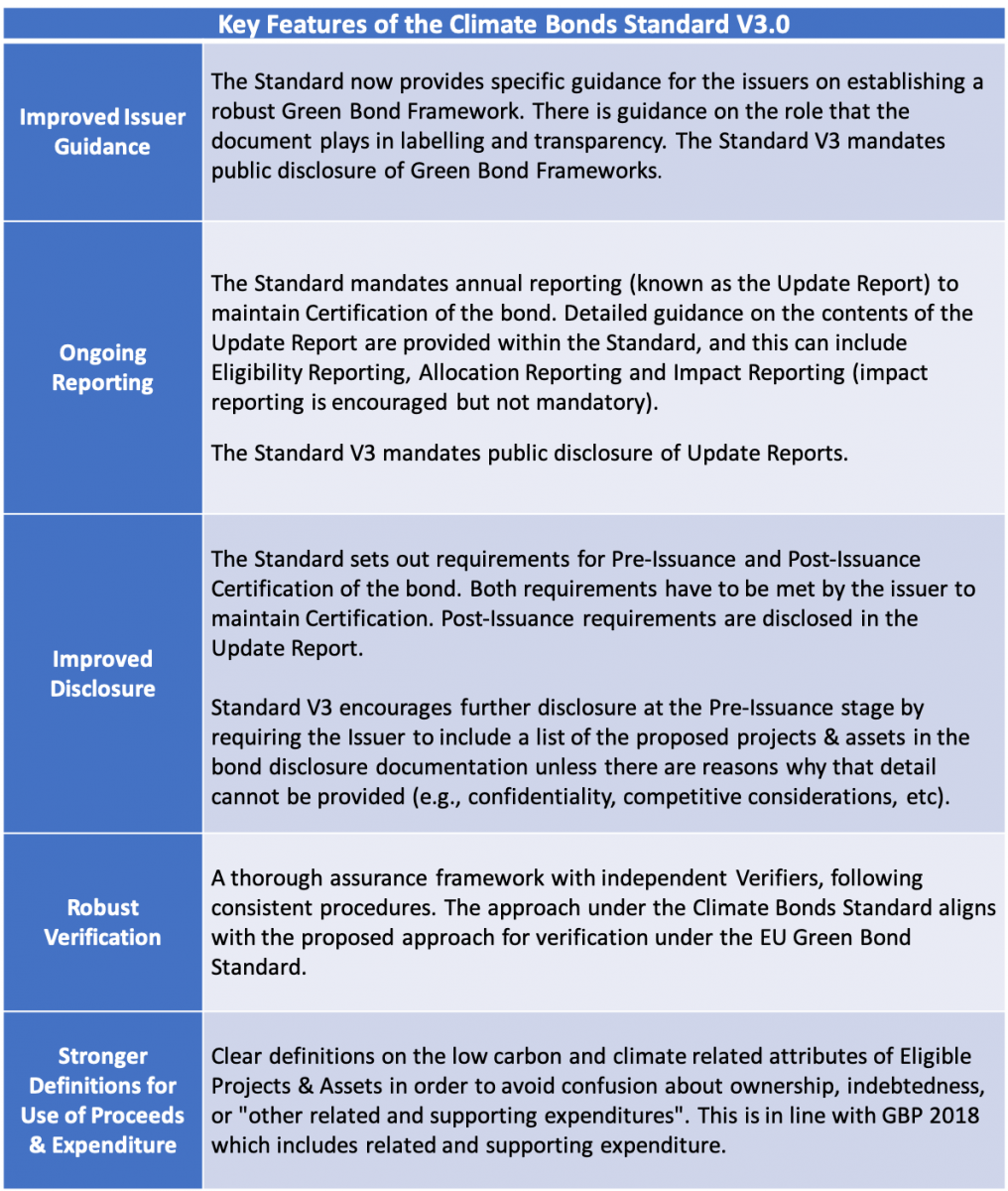

- Robust Green Bond Frameworks: Standard V3.0 provides issuers with detailed requirements for what their Green Bond Framework document must contain.

- Ongoing Reporting: Standard V3.0 reporting requirements are more clearly defined via a formal annual Update Report which covers Allocation, Eligibility and Impact Reporting.

- Expenditures & Debt Instruments Definitions: Standard V3.0 provides detailed definitions on which type of expenditures are eligible and an expansion in the list of debt instruments which can be Certified, including loans, sukuk, deposit products and other investments.

Climate Bonds Certification provides assurance for issuers and investors that a green debt product meets labelling requirements for major global jurisdictions, is science based and is aligned with the goals of the Paris Climate Agreement to limit warming to under 2 degrees. To date over $100bn of green investment has been certified under the Standard.

Recent certified issuance includes sovereign green bonds issued by the governments of Chile and the Netherlands, corporate debt from Porsche, and a 100-year green bond from SNCF.

Standard V3.0 aims to support the expansion of the green investment market – forecast to reach up to USD250bn of green debt issuance in 2019 and accelerate the mainstreaming of green bonds, green loans and other products via a simple label which investors can trust.

Alongside the Standard, the Climate Bonds Initiative works to expand green definitions for investments across the global economy that are in line with the goals of the Paris Agreement.

<Ends>

For more information, please contact:

|

Head of Communications & Media, Climate Bonds Initiative +44 (0) 7914 159 838 |

Communications & Media Officer, Climate Bonds Initiative +44 (0) 7593 320 198 |

Notes for journalists:

About the Climate Bonds Initiative: Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low carbon economy. Climate Bonds undertakes advocacy and outreach to inform and stimulate the market, provides policy models and government advice, market data and analysis, and administers an international Standard & Certification Scheme for best practice in green bonds issuance. For more information, please visit www.climatebonds.net.

About Climate Bonds Standard: It is an overarching science-based, multi-sector standard overseen by the Climate Bonds Standards Board that allows investors and intermediaries to easily assess the climate credentials and environmental integrity of bonds and other green debt products.

Launched in 2011, with periodic updates, the Climate Bonds Standard is the most detailed climate aligned investment criteria available in the market and provides guidance to issuers, investors, governments and regulators.

Release of Standard V3.0 is part of Climate Bonds Initiative’s development programme to improve the Standard, extend underlying Criteria to additional industry sectors, strengthen overarching Adaptation and Resilience (A&R) factors in each Criteria and update the core Climate Bonds Taxonomy.

Standard V3.0 and supporting documentation is available here.

Transition arrangements for the new Version: The current Climate Bonds Standard V2.1 as utilised by issuers & verifiers will remain operative for new Certifications in parallel with Standard V3.0 till June 30, 2020 subject to Verifier and market readiness. Certified transactions can be continued under V2.1, or issuers can choose to adopt Standard V3.0 for their ongoing reporting.

We welcome ongoing input from stakeholders on Standard V3.0 and we look forward to developing an enhanced V3.1 in the future. Further detail is available here.

About Climate Bonds Certification: Climate Bonds Certification framework has been designed to work in parallel with the normal process for issuing bonds, loans or other debt products. It has 2 phases, Pre-Issuance or Post-Issuance. Certification of a Climate Bond at the pre-issuance phase enables the issuer and underwriters to market the bond or debt product as Certified. Further assurance activities in the post-issuance phase must be undertaken to maintain the Climate Bonds Certification.

The full Climate Bonds Database of Certified issuance can be found here.

The full Climate Bonds Directory of Approved Verifiers can be found here.

Ends