Marianne Gut, Portfolio manager at the Skandinaviska Enskilda Banken (SEB) is the winner of the 2014 year-end green bonds quiz. She was the only player to score 100% at the first take of the quiz. Marianne becomes our "Climate Bonds Boffin 2014"! She wins a lifetime subscription to the Climate Bonds blog, lucky thing.

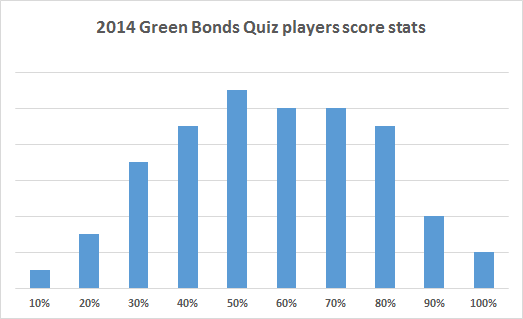

Now the rest of us just have to see how our scores compared to others - see below.