COP21: 09/122015: Paris: Today we are launching a Green Bond Guide for the public sector, offering detailed action plans & best-practice examples from around the world for how to grow green bond markets.

Climate Bonds Blog

Support for Green Bonds in Climate Finance Policy & Market Mix

Corporate

HSBC inaugural €500m ($547m) green bond is BIG success with 4x oversubscribed (0.625%, AAA, 10 yrs)

Register here

Joint Focus on Standards and Categorisation for Green Investments

Register now!

COP21: Paris: 6/12/2015: 1500 CET: Justine Leigh-Bell, Head of Standards at Climate Bonds has issued a call to action for global transport stakeholders to participate in the development of the world’s first Low Carbon Transport Climate Bonds Standard for green and climate bonds.

Bonjour! from Paris, which is currently buzzing with climate change enthusiasts and hopeful negotiators as the COP21 ends its first week.

And what a week at Le Bourget it’s been. From some of the discussions it looks like green bonds are firmly on the climate finance agenda.

The FOUR 2015 headlines everyone should take away:

1) Green bonds are financing a range of green projects – from renewable energy to sustainable water.

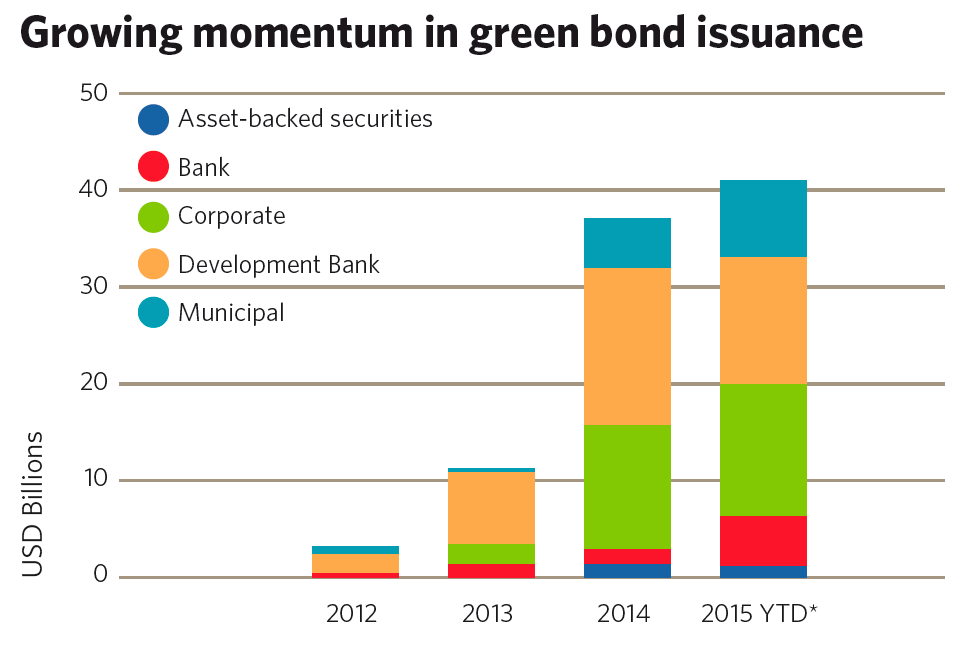

At the last month of 2015, green bond issuance passed last year record of $36.59bn to reach $40.05bn.

A total of $7.92bn new issuance in November makes it the biggest month EVER for green bond issuance in the history!

Expect more updates on new issuances in our next blog.