COP21: 09/122015: Paris: Today we are launching a Green Bond Guide for the public sector, offering detailed action plans & best-practice examples from around the world for how to grow green bond markets.

The Guide is the result of a partnership between the Climate Bonds Initiative and the UNEP Inquiry into the Design of a Sustainable Financial System.

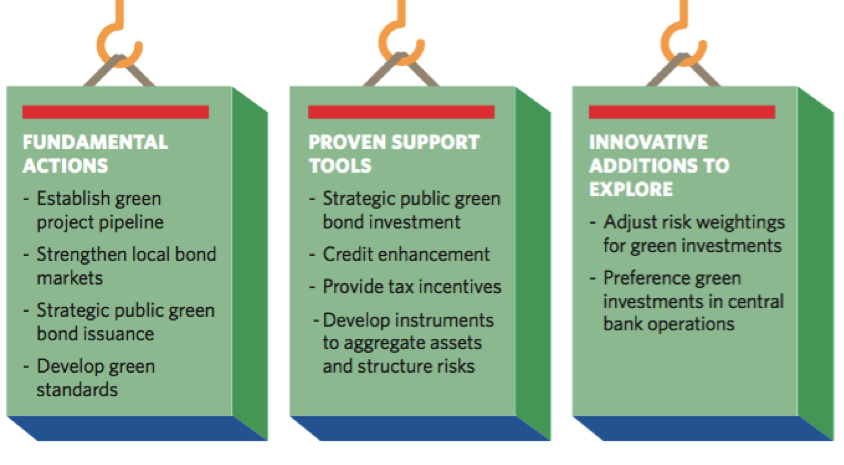

Three Major Categories of Green Bond Recommendations for the Public Sector

The Guide offers detailed action plans within each of these categories and a wide range of best-practice examples. The application and mix for each country will depend on the specific macroeconomic context and policy priorities.

The findings of this report will also feed into an OECD report on green bonds, to be launched in 2016, and country-specific policy reports under development by the Climate Bonds Initiative.

The World Bank View – Annex to the Report

The Guide includes an annex from the World Bank Group as an additional resource for policymakers in emerging economies to assist them in foundational bond market development.

Key findings of the report in the context of COP21 and the new INDCs

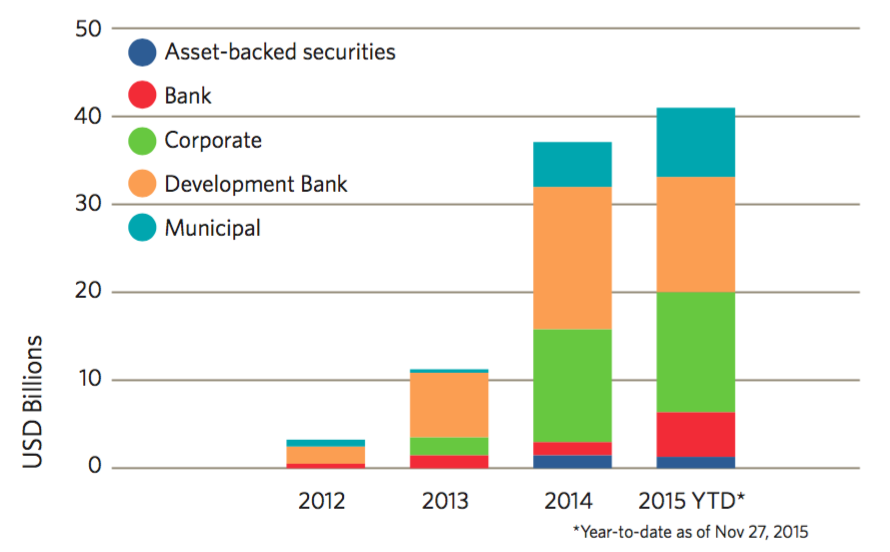

The green bond market - bonds whose proceeds are used for green projects, most commonly climate mitigation and adaptation projects - is growing rapidly. So far, US$40bn of green bonds has been issued in 2015, making it the largest year of issuance to date.

Green bonds have featured heavily in climate finance events here in Paris, as a tool to scale up climate investments by tapping into institutional investors – who hold US$93 trillion in OECD countries alone.

However, the market growth needs to be accelerated for green bonds to help meet the climate goals set out in the Intended Nationally Determined Contributions (INDCs - country plans for climate mitigation and adaptation) being discussed at COP21. The report identifies $1trillion in green bonds by 2020 as an interim goal.

To give you an idea of the scale of investments needed, India’s INDC alone requires USD2.5 trillion of investment from now until 2030.

Bonds are an attractive financing tool for low carbon and climate resilient infrastructure projects, providing a potentially low cost and long-term source of capital.

In emerging economies with nascent bond markets, actions to develop green bond markets can be done as part of the general bond market development process. This allows countries to simultaneously address both INDC country climate plans and capital market development aims.

What the Report Authors Say:

Sean Kidney, CEO of the Climate Bonds Initiative:

“This guide can help the public sector in translating aspects of their national INDC objectives into climate finance outcomes. Adding green bonds into the climate finance mix can help the shift of capital to low carbon projects, infrastructure and climate resilient development.”

Credible, robust and liquid green bond markets can only accelerate the investment directions that INDCs in part, require, to meet individual country targets.”

“There is clear interest amongst policy makers to scale green bond markets. Here at COP21 green bonds are being identified as a potential new source of climate finance for cities, regions and low carbon infrastructure and projects across many sectors.”

Nick Robins, co-director of the UNEP Inquiry:

“The potential opportunity of the green bond market has caught policy makers’ attention. There are increasingly examples of governments moving from interest to action. China’s central bank has published a range of ambitious policy proposals for green bonds, with official green bond guidelines launching soon. India’s capital markets regulator SEBI just announced green bond guidelines. In the EU, supporting green bond standards is included in Capital Markets Action Plan.”

“At COP21 many discussions have centered around climate finance and the level of investment needed to bring about low carbon outcomes. Green bond market development is seen as a real option.”

“This report can only assist governments, policy makers and ultimately institutional investors in developing sustainable climate finance outcomes.”

---

This is a first iteration of the policy guide - so we're looking for feedback. Please email Beate Sonerud. We’d love your input.

About UNEP: The United Nations Environment Programme (UNEP) is the leading global environmental authority that sets the global environmental agenda, promotes the coherent implementation of the environmental dimension of sustainable development within the United Nations system and serves as an authoritative advocate for the global environment. More information here.

For more information, please contact:

Andrew Whiley, Communications Manager, Climate Bonds Initiative +44 (0) 7506 270 943

Olivier Lavagne d'Ortigue, UNEP Communications +1-929-499-7080