By Justine Leigh-Bell, Manager of Standards and Certification Scheme

Climate Bonds Blog

如有兴趣订阅中文版电子通讯,请发送电邮至 info@

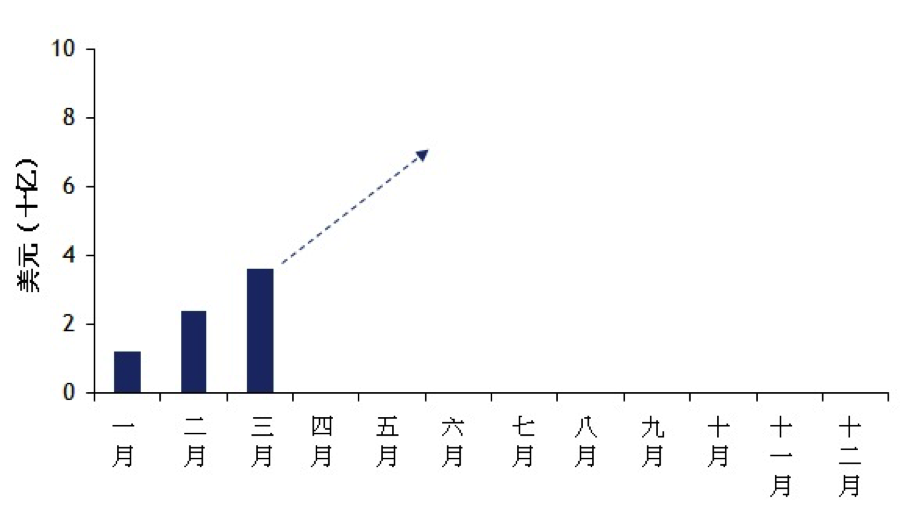

2015年第一季度内,市场上合共发行44宗绿色债券(总计72 亿美元)。虽然1月份发行数量较少,但随后市场逐步增长,单计3月份市场共发行了三倍于1月份的绿色债劵。按照目前市场上正准备发行的绿色债劵数量,以及预期市场于第三及第四季度将会因联合国气候变化公约缔约方会议(UN COP)变得更加炽热,我们预测2015年将是有史以来绿色债劵发行量最高的一年。

绿色债劵市场将从缓慢的第一季度快速增长

London, Monday 8 June: Climate Bonds Roundtable on Green Securitisation

Green securitisation can address the low-carbon financing gap by allowing smaller scale assets to be aggregated to access the bond markets. This can provide access to capital at scale, and lower the cost of capital. To tap into the potential of green securitisation, policymakers can play a role in addressing barriers that currently exist in the market, mainly around getting financially attractive green ABS deals to investors. The role of policymakers can include supporting standardised loan contracts for relevant green assets; warehousing and credit enhancement.

Today, Australia and New Zealand Bank (ANZ), Australia’s third largest bank, closed their A$600m ($464m) inaugural green bond deal – and the largest Certified Climate Bond to date. The 5-year bond has a semi-annual coupon of 3.25% and is rated Aa2e/AA-. ANZ was underwriter of the bond.

This week we have a lot of exciting green bond gossip about a strong pipeline of really diverse issuance coming through.

Municipal bonds

Second green issuance from Stockholms Lans with SEK 1.8bn ($215) green bond in two tranches (SEK1.5bn, 6yr, 1%, AA+ and SEK300m, 6yr, £MS+32BPS, AA+)

Green Bonds in April have seen new currencies, new issuers and the first ever green covered bond.

This week we’ve seen two sizeable corporate green bonds come to market: a US$600m bond from repeat issuer Bank of America and a first issuance of SEK2.5bn ($300m) from Swedish energy provider Fortum Varme. There has also been a smaller green municipal bond issuance ($32.9m) from San Francisco Public Utilities Commission.

There were quite a few market developments too: State Street launched a green bond index fund that tracks the Barclays/MSCI green bond index; the World Bank finally made the second opinion on their green bond framework public; SRI membership organisation Eurosif put green bonds on the agenda for EU policymakers as part of the Capital Markets Union. And, as always, we have some green bond gossip for you.

如有兴趣订阅中文版电子通讯,请联络黒田一贤 (info@climatebonds.net) 。

自上月中国人民银行发布《构建中国绿色金融体系》以来,此报告及其政策方向获得媒体高度关注。

此报告订立非常积极进取的议程,探讨如何透过政策及市场创新,加速发展中国绿色金融及资本市场。

报告亦详细讨论了绿色债券的发展路径! (而我们气候债券组织也有作为外国专家参与其中)

该报告是绿色金融工作小组的工作成果 – 超过40名专家所组成的小组由人民银行及联合国环境规划署Inquiry into the Design of a Sustainable Financial System共同召开,成员来自政府部门的政策制定者、金融行业代表和绿色金融国内外专家 (Sean 为其中一员)。

Since it was released late last month, a ground-breaking report, “Establishing China’s Green Financial System”, from China’s central bank, the People’s Bank of China (PBoC), released, has been getting a lot of media attention.

The report sets out an ambitious agenda for how China can green its rapidly developing financial and capital markets, using policy, regulatory and market-innovations.

It also details an impressive push for green bonds! (And yes, the Climate Bonds Initiative did have something to do with that.

The first EVER green Pfandbrief is a hit with 4x oversubscription AND 15 brand new investors for BerlinHyp! Plus it’s greening the cover pool – which is seriously cool! EUR 500m ($545m), 7 yr, 0.125%, Aaa/AA+