Further Expansion of Market Intelligence as Labelled Markets Diversify

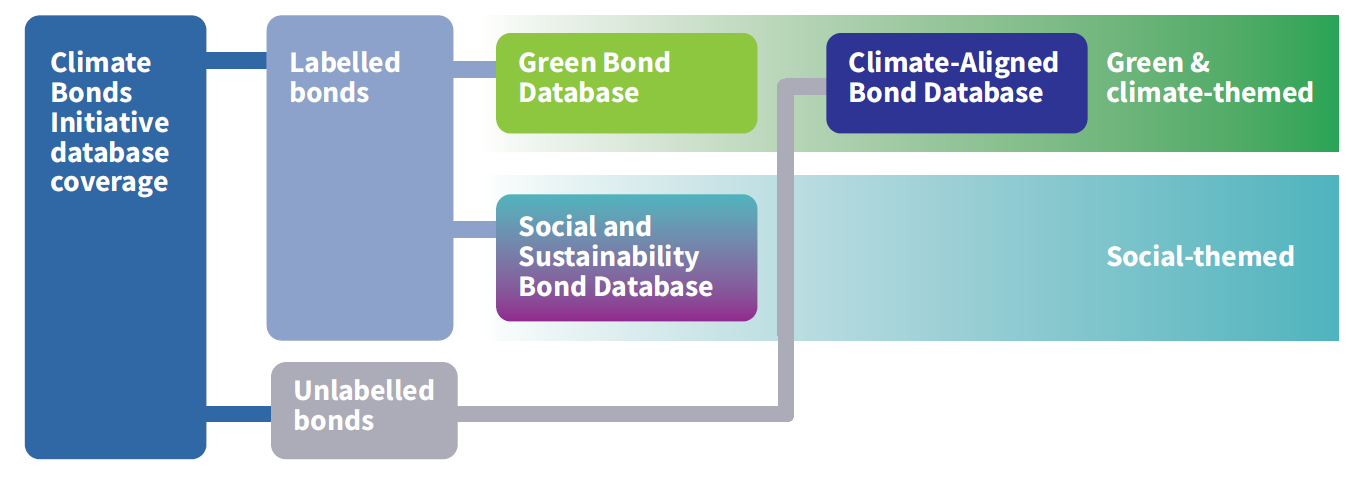

Climate Bonds is expanding its data analysis capabilities with the launch of a Social and Sustainability Bond Database (SnS DB), in keeping with the diversifying labelled bond market. The new database will complement the existing Climate Bonds Green Bonds Database, an internationally authoritative source of best practice green debt product data.

In addition to the green and climate-aligned bond databases that Climate Bonds currently maintains, the dedicated SnS DB will provide investors and policymakers with access to timely and credible analysis of the booming labelled sustainability and social-themed bond issuance.

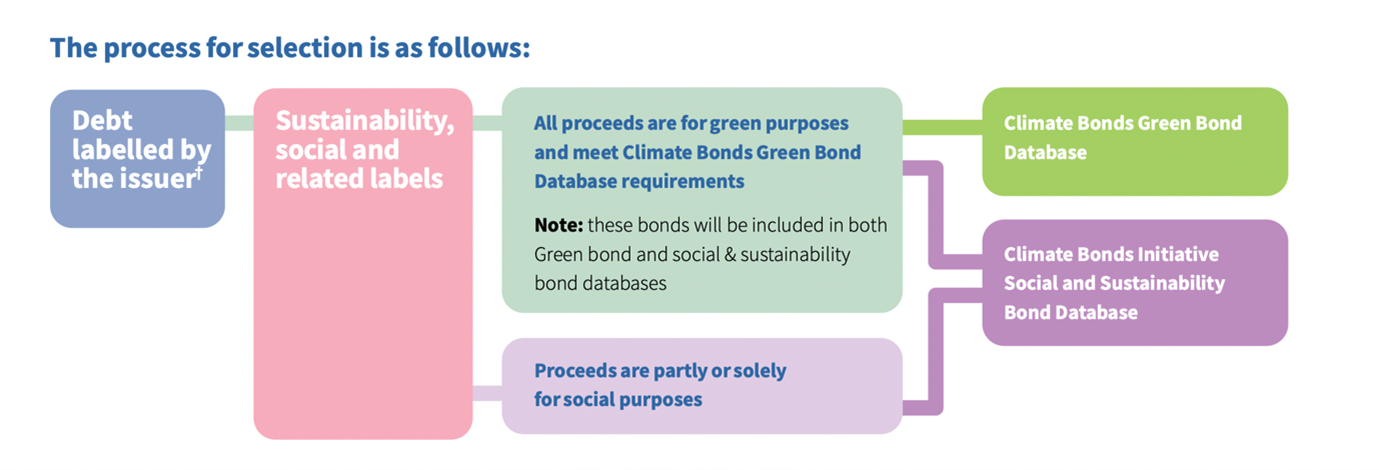

The new Social and Sustainability Bond Methodology and Database aims to identify and document credible issuance.

Social and Sustainability Bonds: Already a $1trillion Market

Social and sustainable debt markets emerged with real momentum in 2020 during the pandemic, as governments scrambled to raise finance to fight the immediate socioeconomic impacts of Covid-19.

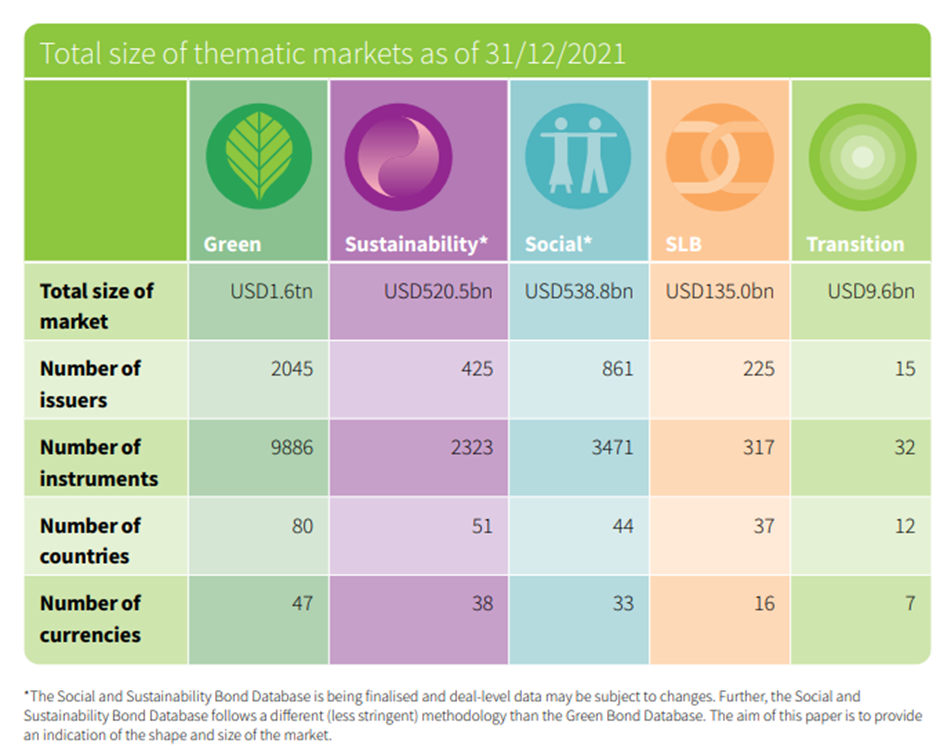

By the end of 2021, our Sustainable Debt Global State of the Market 2021 reported a cumulative total of issuance of USD520.5bn sustainability bonds and of USD538.8bn in social bonds, giving a combined total not far behind the USD 1.6tn green market.

At a Glance -Definitions

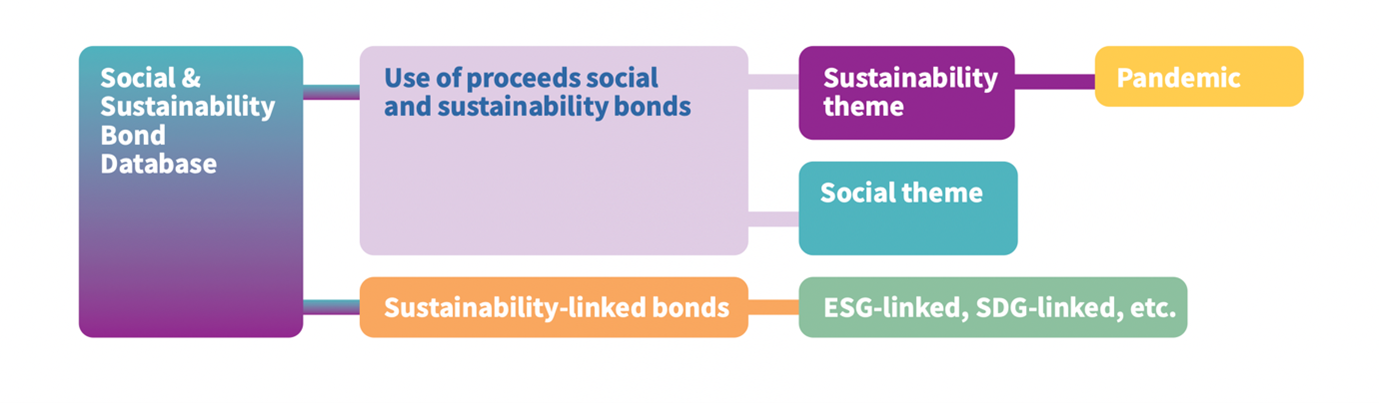

The Database covers two overarching debt themes based on the projects/ activities financed:

- Use of Proceeds (UoP) social and sustainability bonds, and

- Performance-linked bonds, mainly sustainability-linked bonds (SLBs).

The Sustainability bonds label describes use of proceeds instruments with a combination of green and social projects, activities, or expenditures.

The social debt label is exclusively related to projects with social benefits, and proceeds can go towards financing a range of positive social outcomes such as housing, gender equality, livelihoods and income equality, healthcare, and education.

Performance- or KPI-linked debt instruments, specifically Sustainability- linked bonds (SLBs) and loans (SLLs) are instruments that raise general purpose finance for the issuer.

SnS Database Methodology

The approach taken in this methodology seeks demonstration of ambition from social and sustainability bond issuers. The requirements for inclusion will be tightened over time.

Step 1: Identification of labelled social and sustainability debt

Step 2: Use of Proceeds analysis

Step 3: Key information and SDG mapping

Climate Bonds will review the methodology at least semi-annually, and updates will be made accordingly.

The Last Word

The Social and Sustainability Methodology and Database promotes market integrity and transparency as we see the continued growth of capital invested under social and sustainability labels.

It’s another step in the expansion of Climate Bonds’ capabilities in setting best practice standards and certification, defining credible transition pathways, and providing market-leading data and analysis.

Mobilising capital towards climate solutions in mitigation, adaptation and resilience at scale remains core to Climate Bonds’ objectives. Reaching an annual USD5trillion in green investment coupled with USD5trillion in social and sustainability investment by 2025 will reflect that policymakers, financial markets and investors are addressing the climate emergency with the urgency it deserves.

Til’ next time

Climate Bonds

Market intelligence and Climate Bonds Partners The Social and Sustainability database is available as an add-on to existing Climate Bonds Partners service agreements.