Market & policy makers must rally, not rest on driving investment as we face ‘unprecedented’ climate challenges

2021 up 57% on 2020

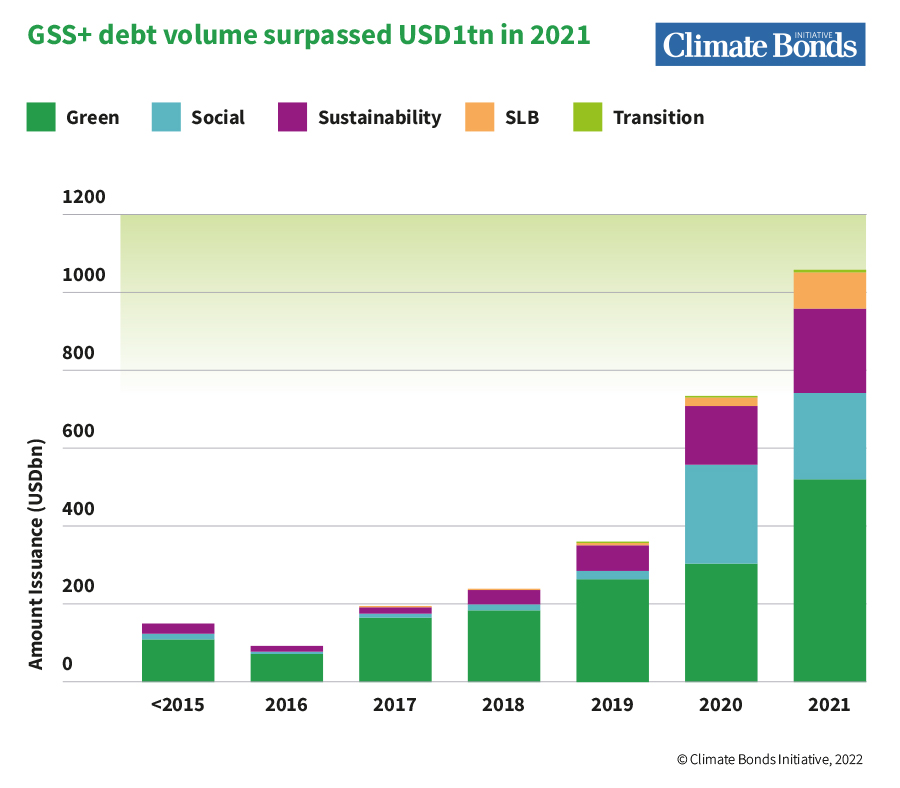

Climate Bonds Market Intelligence latest analysis has revealed GSS+ (Green, Social, Sustainability, Sustainability-Linked and Transition) themed debt rose to almost USD1.1tn in 2021, marking a 57% increase upon 2020 volumes.

A complete breakdown of soaring sustainable markets is now available in our 2021 Sustainable Debt State of the Market Report. The flagship annual report is the most comprehensive of its kind, providing detailed analysis across the sustainable debt themed market, sectors and geographies, as well as insights on taxonomies and sovereign green bonds.

A $2.8tn market

By the end of 2021, Climate Bonds had recorded 16,697 GSS+ debt instruments with a cumulative volume of USD2.8tn since market inception in 2007. Last year’s record volume of USD1.1tn was accumulated over 5999 instruments and makes up 35% of the lifetime market volume of 2.8tn.

Green leads with a 75% jump in 2021

Annual green bond issuance broke the half-trillion mark for the first time, ending 2021 at USD522.7bn, a 75% increase on prior year volumes. The green theme attracted 839 issuers during the year and the average size of individual green bonds increased by more than 50% to reach USD250m.

Europe was the most prolific region, with cumulative issuance reaching USD758bn by year-end, though at the national level, the U.S. stood at the top place as volumes increased by 63% to USD81.9bn in 2021 from USD50.3bn in 2020.

The Sovereign GSS Bond Club continued to expand its membership. Eleven countries contributed to USD72.8bn in new bonds or taps. Italy, the UK, Serbia, Spain, and South Korean issued debut sovereign green bonds. We’ll have some more to say on sovereign issuance later in Q2.

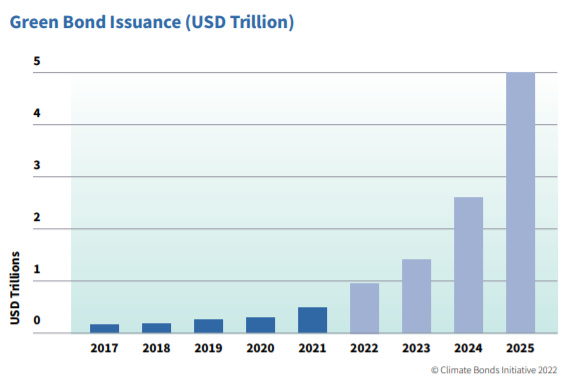

Annual Green $5 Trillion by 2025

The sharp rise in green issuance has led to anticipation that the first annual green trillion could arrive in 2022. A Climate Bonds survey that had input from a range of market actors including issuers, investors and asset managers, affirmed that 2022 will now see the realisation of this long-held market milestone.

The next milestone for the green finance is set to an annual $5 trillion by 2025 to address the climate crisis.

At a Glance 2021: Social Bonds

Social bond issuance rose steeply as the COVID-19 pandemic struck in early 2020. The proceeds went into financing a range of positive social outcomes such as housing; gender equality; livelihoods and income equality; healthcare; and education.

Issuance in 2021 was slightly more subdued, with volumes reaching USD223.2bn, a decline of 13% year-on-year. While the number of new instruments more than doubled (2555 in 2021, a 102% rise from the 1265 instruments issued in 2020) the average size of each bond more than halved (USD87m average in 2021 down from USD201.7m).

At a Glance 2021: Sustainability Bonds

The proceeds of sustainability bonds are earmarked for projects with a mixture of green and social outcomes. Sustainability volumes reached a record USD200.2bn in 2021, a 23% increase on the USD162.5bn witnessed in 2020.

In 2021, Climate Bonds captured 287 issuer names, a 184% increase when compared to 2020. The average size of each instrument declined to USD188m from USD310m in 2020. The number of countries issuing in 2021 grew 84% YOY to reach 46.

SLBs Boom, Transition Bonds still Budding

Sustainability-Linked Bonds (SLBs) truly arrived on the labelled finance scene in 2021, totalling USD188.8bn in volume with 277 issuances. This steep rise represents an expansion of 941% on last year’s total of USD11.4bn. The average size of each instrument was relatively large at USD428.8m.

Unlike typical green and social bonds, SLBs come with no restrictions on the use of proceeds. Instead, issuers commit to improving their environmental performance against KPIs and link the achievement of these pledges directly to the coupon paid to investors.

The transition bond market is still new and continued to grow, with 12 bonds coming from nine issuers in 2021, amounting to a volume of USD4.4bn.

The transition bond market grew more than 33% year-on-year to a cumulative USD9.6bn.

The Last Word: ‘Unprecedented times’

The world is staring a climate catastrophe in the face. Science has decisively demonstrated the risks to life on earth and so far, the reaction has been painfully laxed.

Labelled debt markets provide a framework for scaling up investment to unprecedented levels.

Acceleration of capital towards climate solutions is both a hedge against risk and an enormous opportunity. Climate forecasting consortium the Inevitable Policy Response forecasts an acceleration in government and policy action that institutional investors need to be in front of.

In 2015, when the green market reached a cumulative USD100m it was a cause for celebration. Shortly after, November 2017 during COP 23 green bonds topped the annual USD100m mark for the first time.

Globally the cumulative USD 1 trillion milestone was reached in December 2020, a green investment total that was more than a decade in the making since the first green bond of 2007.

While the first trillion or two in sustainable debt is undoubtedly a good starting point, the level of response needs to go much further each year in this decade if the international targets of 50% emissions reduction by 2030 is to be achieved.

Sean Kidney has called for green issuance to rise to USD5tn annually by 2025. There’s also plenty of headroom for expansion into trillions of social and sustainability themed investment.

“The unprecedented times in which we live call for unprecedented levels of action.”

Sean also asserts that as the climate crisis begins to take hold, the finance sector cannot shirk responsibility any longer:

“Failure to affect immediate redress in the environmental merits of global finance implicates market actors as accessories to irreversible climate catastrophe.”

Expansion in 2022

For now, we at Climate Bonds look to match the expanding market with an expansion of our own work this year. This year we are set to expand the Climate Bonds Standard, taxonomy work, policy toolkits and market data reporting in 2022

Beginning with the Q1 Market report due in the coming weeks, the launch of our new Social and Sustainability Database and rollout of new heavy industry Criteria for Certification; Cement, Basic Chemicals and Steel.

‘Til Next time,

Climate Bonds