Our 2nd Nordic Regional Report: Expanded from Green to now include analysis of Social & Sustainable debt investment

Nordics At a Glance – 5% of global GSS markets

The Nordic sustainable bond market has more than quintupled from USD16.5bn since the inaugural Climate Bonds Nordic report of 2018, and including sovereign, NIB and national issuance reached a cumulative USD 88.2bn at the end of 2020.

At end 2020 the Nordic market now comprises 5% of global Green Social & Sustainability (GSS) volume – an impressive feat for a region representing approximately 0.2 – 0.3% of the world’s population and economy.

Market Highlights

- With USD88.2bn cumulative issuance, the Nordic region makes up 5% of global GSS bond volume.

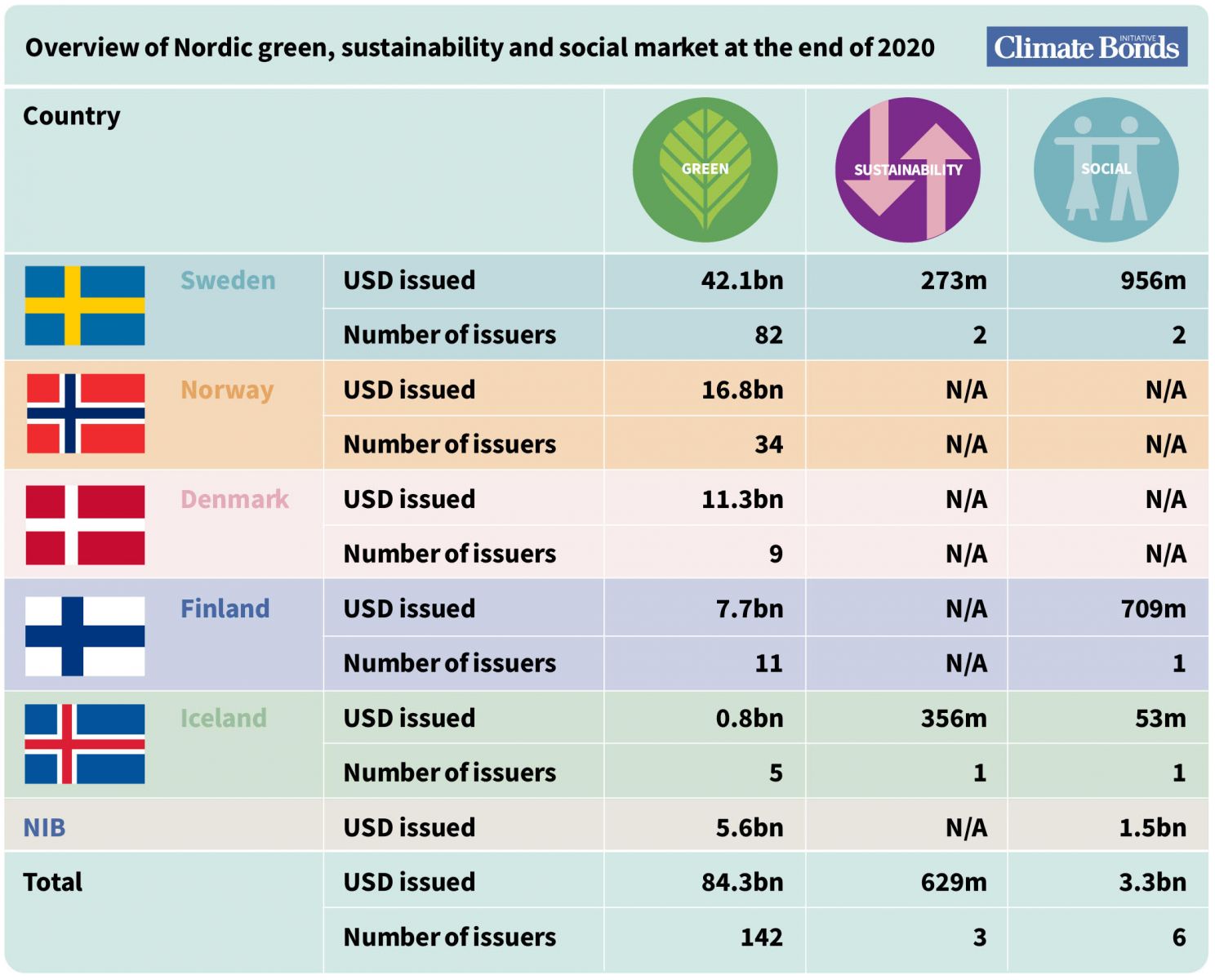

- Green bonds represent 96% of the overall Nordic GSS market reaching a cumulative USD84.3bn at end 2020, Social and sustainability-labelled bonds USD4bn.

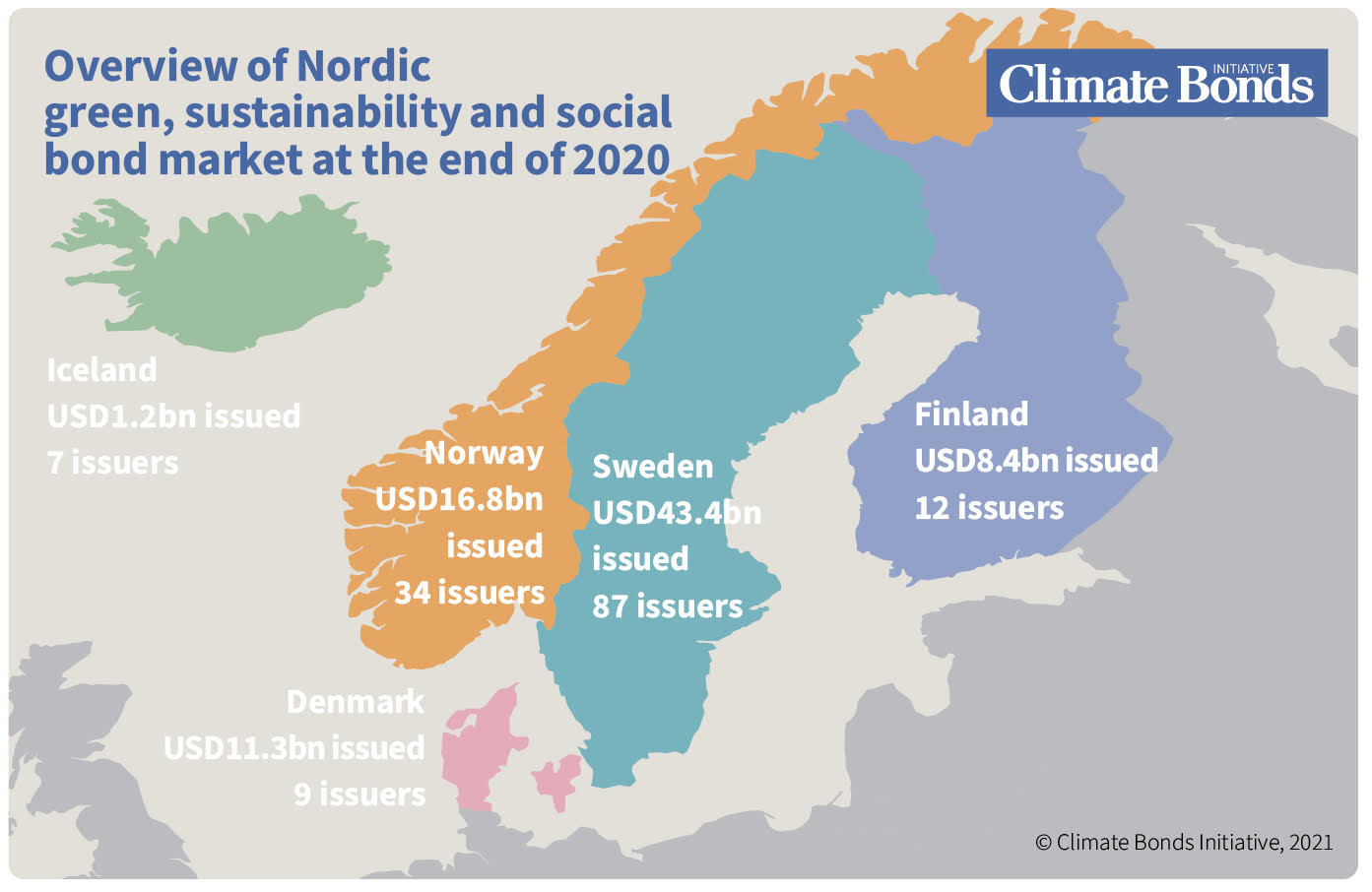

- Sweden has issued cumulative USD43.4bn of GSS, followed by Norway with USD16.8bn and Denmark at USD11.3bn. Finland as (USD8.4bn) and Iceland (USD1.2bn) comprise the remainder.

- Sweden issued its first sovereign green bond in 2020. Denmark is expected to follow later in 2021.

- Sweden (Sovereign) is the top 2020 issuer (USD 2.3bn).

- Sweden, Norway and Denmark are amongst the Top 20 nations for global cumulative green bond issuance at end 2020, occupying 7th, 12th and 16th places respectively. Finland ranks at 21st and Iceland 45th.

- Kommuninvest is the region’s top green issuer cumulatively at USD6.2bn.

- Social and sustainability labels are poised for adoption by other public sector entities after MuniFin’s social debut in Q3 2020

- Nordic unlabelled climate-aligned outstanding debt amounts to USD21.6bn.

- Avenues for expansion lie in green issuance from climate-aligned sectors and performance-linked instruments.

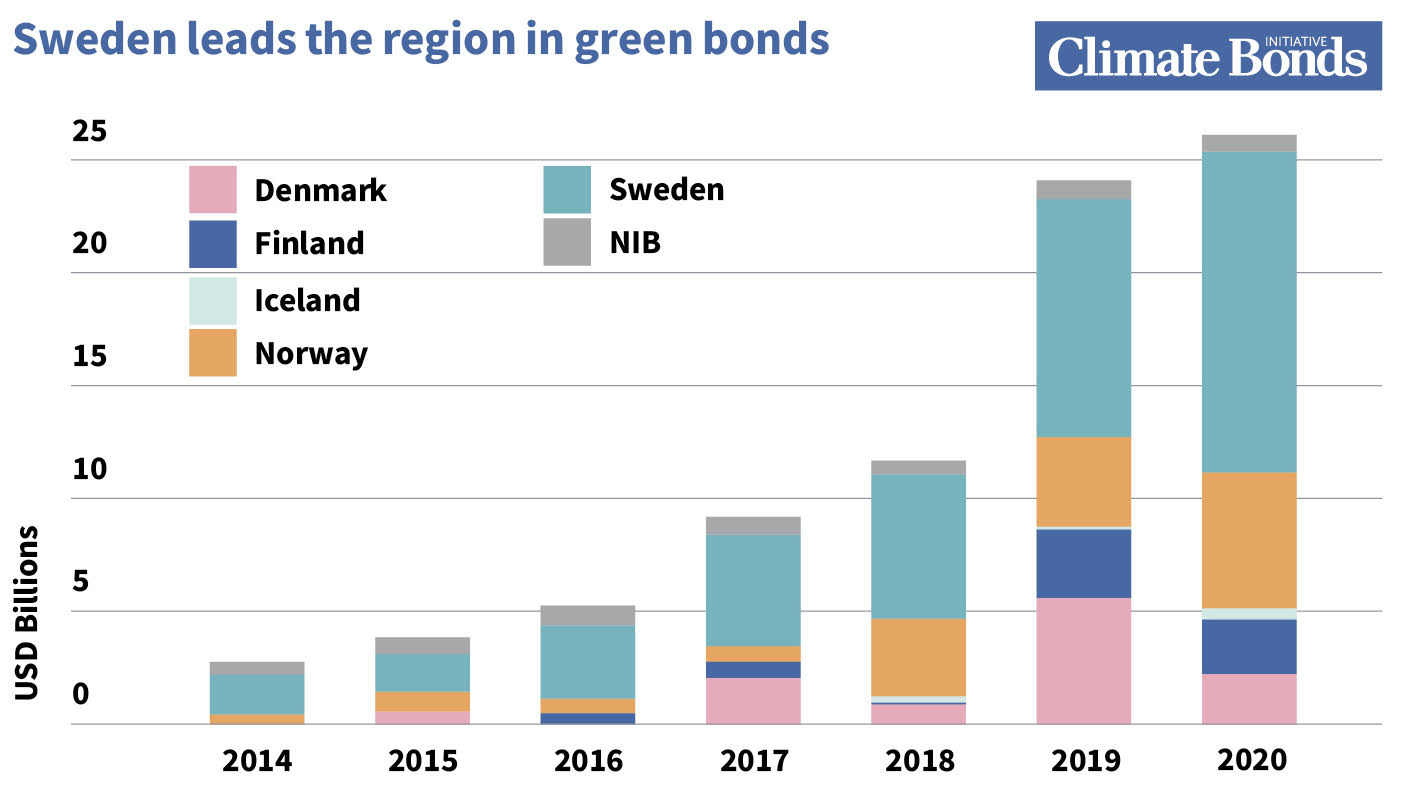

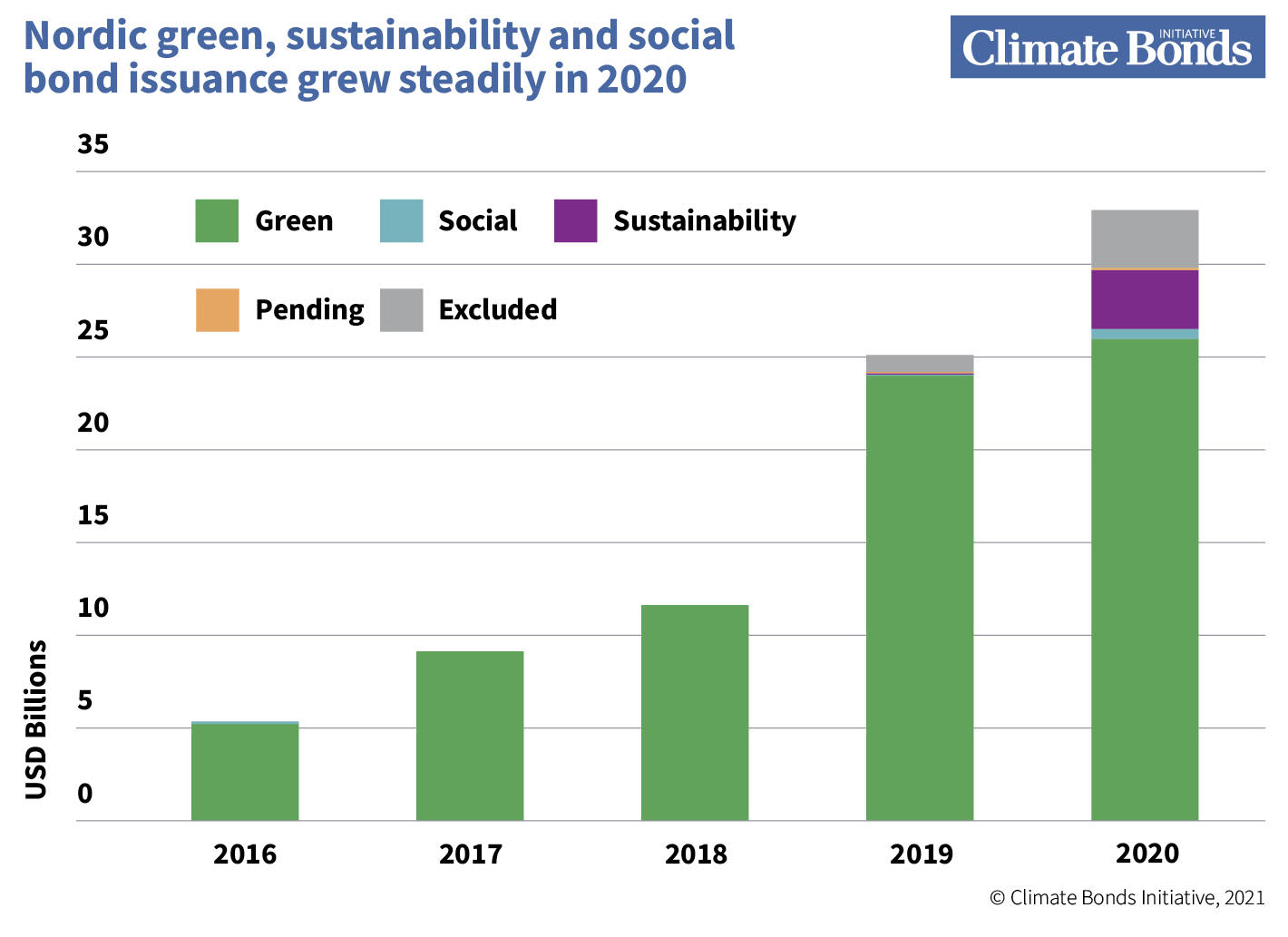

Green bonds growing fast

Green bonds comprise 96% of the overall Nordic GSS market reaching a cumulative USD84.3bn at the end of 2020. Market inception was in 2010 via NIB with annual issuance growing in the latter part of the decade to USD11.6bn in 2018, USD 24.0bn in 2019 and USD26.0bn for the 2020 year.

Swedish green bonds prevail – but others are beginning to catch up

Sweden continues its leadership, comprising half of the region’s green volume and claim both the top issuer (Kommuninvest, USD6.2bn) and the largest individual green bond issued in the region to date, after the inaugural sovereign green bond totalling USD2.3bn in September 2020.

Norway’s 2020 issuance saw a 53% jump from 2019 and now represents a fifth (USD16.8bn) of the regional cumulative issuance at the end of 2020. Denmark is third with USD11.3bn.

Finland, similar to Norway, has grown rapidly to reach USD7.7bn cumulative issuance or 9% of the market. Latest entrant Iceland has five green issuers with more in the pipeline. Regional development agency NIB has issued USD5.6bn of green bonds to date.

Sweden joins the Sovereign Green Bonds Club - Denmark Seeks Membership

Green-mandated investors – many of whom are already highly active in the region – enthusiastically welcomed both the Swedish sovereign as well as the Danish announcement. These demonstration issuances will help encourage others to join the market and time help to build significant added volume.

Climate Bonds is calling for a doubling of Sovereign GSS issuers with a target of 40 by 2022. The addition of Denmark is anticipated.

Corporate Growth

Corporates constitute the most prevalent issuer type in the Nordics. Their share reaches half (USD41.8bn) of the cumulative total, split between financial and non-financial corporates at 23% and 27%, respectively.

Corporate issuers also helped to keep the market afloat in 2020, especially from a real economy perspective – the proportion of non-financial institution issuance grew to 35%.

Swedish property company Vasakronan is the largest such issuer (USD4.9bn cumulative). On the financial side, Norway’s mortgage lending institution SpareBank 1 Boligkreditt leads with USD3.3bn issued in four deals.

Public sector entities are also strong, with government-backed entities (including regional top issuer Kommuninvest) contributing nearly a third (32%) and local governments particularly from Sweden a further 7% of cumulative green volume.

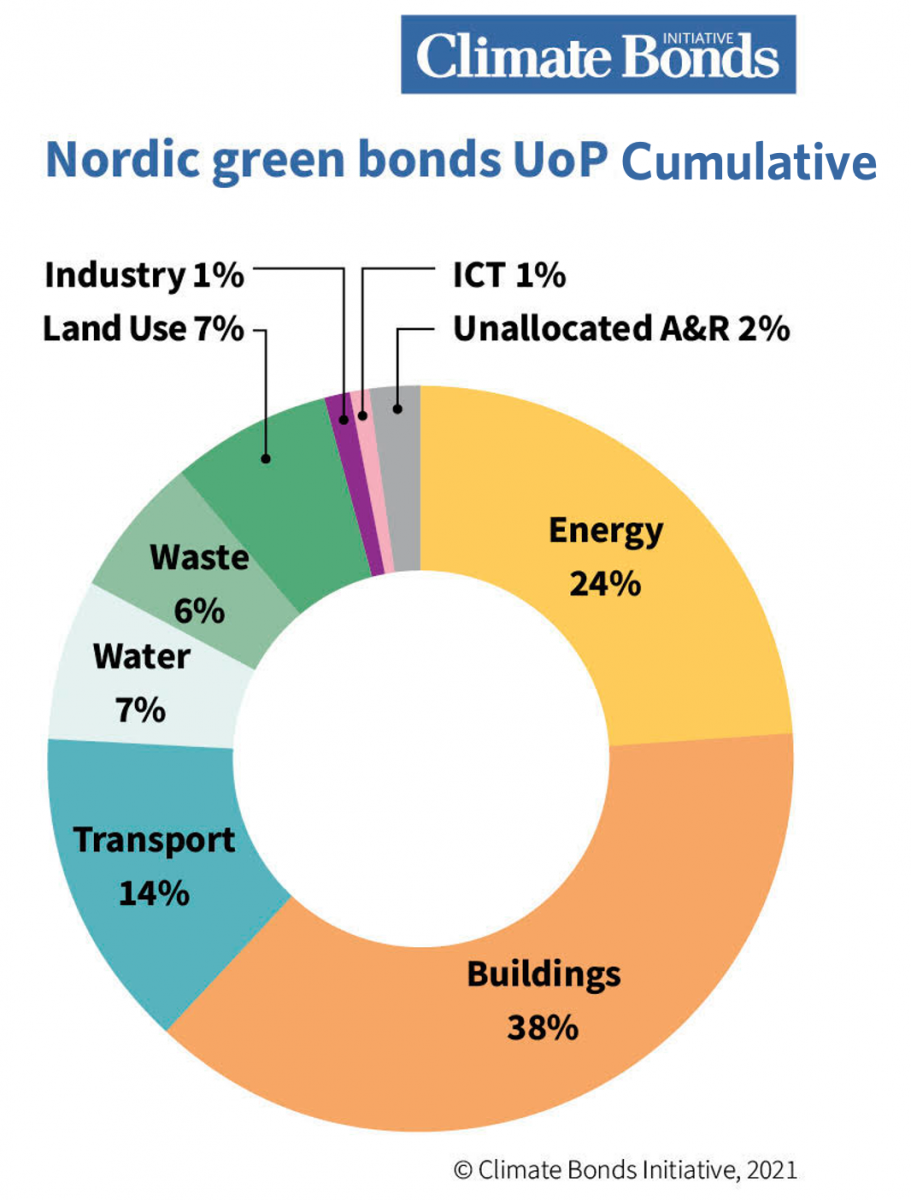

Diversity in Use of Proceeds (UoP) - Buildings Lead

Allocations to Buildings are high in the Nordics (34%), reflecting the prevalence of real estate and construction issuers like Vasakronan, DNB Boligkreditt (with a Certified Climate Bond) and 2020 new entrant Sato Oyj (FI).

Energy and Transport have major shares (24% and 14%) with renewable energy (heat and power) issuers like Vattenfall (SE) and Reykjavik Energy (IS) being active.

Land use, Water and Waste represent a relatively high share compared to the global market. The first is a result of the prevalence of the forestry industry in the Nordics and the many dedicated companies who have issued green bonds – UPM being the latest example (EUR750m/USD882m, September 2020).

Water and Waste projects are often funded by Nordic public sector issuers. Nordic commercial banks also contribute to UoP diversity by routinely allocating proceeds across a high number of categories.

There are considerable differences by country: Sweden and Norway are characterised by Buildings, whereas Energy tops the charts in Denmark and Iceland. Finland’s mix is the most balanced and it also has the largest share of Land use (21% cumulatively, 37% in 2020).

Energy is the largest sector financed by unlabelled climate-aligned issuance, ahead of Land use – both of which are key to the region’s economies and contribute heavily to their GDPs.

Leadership in green bond transparency and disclosure

The Nordics set a regional best practice example on external review coverage: 99% of volume benefits from an external review. Second Party Opinions (SPO) are the format of choice, with Norway-headquartered Cicero Shades of Green being the leading provider.

Nordic green bonds also come with a high degree of post-issuance disclosure. Most deals (82% by number, 93% by volume) have both impact as well as use of proceeds reporting published.

Certified Climate Bonds representing international best practice comprise 9% of Nordic green bond issuance, which is about half of the global figure.

Social & Sustainability Bonds Emerge

Social and sustainability-labelled bonds are relatively new to the region and only amounted to USD4.4bn at the end of last year.

Swedish housing provider Hemsö was the first in 2016 with a sustainability bond and has since been joined by others including Íslandsbanki (IS) in 2020.

On the social side, MuniFin issued the region’s first labelled social bond with an accompanying position paper on defining its target population for this funding in September 2020. Medical device manufacturer Getinge, on the other hand, utilised the COVID-19 label to provide immediate pandemic relief via SEK1bn (USD106m) commercial paper to fund a temporary expansion of the production of ventilators and other life-saving equipment.

We anticipate that other issuers from the public and private sectors may follow suit and adopt variants of the social and sustainability labels, following Denmark’s pension fund ATP’s announcement of its intention to allocate DKK50bn (ca. USD8.1bn) into social and sustainability bonds by the end of 2021.

Further growth in the broader labelled space may also come from performance-linked instruments, including Sustainability-Linked Bonds, with early yet prominent examples arising from the shipping (Odfjell SE) and consumer goods (H&M) industries.

Untapped potential – Climate Aligned Bonds

We expect the Nordic GSS bond market to continue to expand considerably. With several new deals since the cut-off date for this report, 2021 is on track to surpass 2020 as another record year for this region.

Part of future issuance may come from companies that already operate in climate-aligned sectors such as renewable energy, land use, and public transport. This represents an important opportunity for issuers to support the growth of the Nordic green bond market via green or labelled issuance.

We identified 24 climate-aligned issuers with USD21.6bn of outstanding bonds from Sweden, Norway, Denmark and Finland.

Discussion with companies operating in key industries across the region has highlighted examples of issuers that could also be new entrants in the market, if their climate-aligned assets are sizeable enough to be (re)financed via a labelled green debt instrument.

Finally, the public sector as the cornerstone of the Nordic model and its constituent economies should continue to play an active part in the sustainable finance sphere.

More government-backed entities and local governments will likely opt for the green label, whilst MuniFin’s peer LGFAs in the other countries may follow in its footsteps down the social bond route.

The Last Word

The Nordic region continues to be a pioneer in the green and sustainable finance space.

Commitments to net-zero emissions – most before 2050 and as early as 2035, have set a leading level of ambition. These commitments, coordinated policy efforts and sovereign issuance, will encourage more GSS issuers to come to market.

Institutional investor support for green finance is evident and most of the major Nordic pension funds have begun to lay out net-zero roadmaps of their own, including the establishment of dedicated green bond mandates.

Both Nordea and Handelsbanken are aiming to be carbon neutral in the next few decades, representing an opportunity for smaller local issuers to take advantage of continued access to capital for any funding needs related to low-carbon, sustainable assets and/or activities.

This combination of net-zero commitments, policy action, investor and banking sector support is the platform for a model of sustained green growth paths.

From our original Nordic State of the Market report in 2018 to the end of 2020, the progress is evident.

Three Nordic nations in the global top 20 of green bond issuance speaks for itself.

Accelerating transition will deliver on the ambitious domestic targets and extend the Nordics role as international leaders on climate.

‘Til next time,

Climate Bonds

Note: All data are to the end of 2020, as of 28 February 2021. There has been subsequent issuance in 2021.

Acknowledgement: Nordic State of the Market is produced with the welcome support of Danske Bank.

Download: Nordic Sustainable Debt: State of the Market 2020