2nd Report in a long-term market analysis

Climate Bonds Annual Conference 2019 will be the launch platform for the second Post-Issuance Reporting in the Green Bond Market report - an analysis of all green bonds issued up to November 2017. The report is prepared with support from HSBC, Amundi, and IDB.

Climate Bonds Annual Conference 2019 will be the launch platform for the second Post-Issuance Reporting in the Green Bond Market report - an analysis of all green bonds issued up to November 2017. The report is prepared with support from HSBC, Amundi, and IDB.

The first installment of the series was published in June 2017 reviewing green bonds issued up till April 2016.

Post-issuance reporting on UoP is a core component of Climate Bonds Standard. It is also incorporated in the Green Bond Principles (GBP) and the Green Loan Principles (GLP).

The Report

Post Issuance Reporting in the Green Bond Market sheds light on issuer practices on the level of adoption and quality of post-issuance reporting. It also covers the disclosure of both UoP and environmental impact metrics across issuer types, sectors and regions.

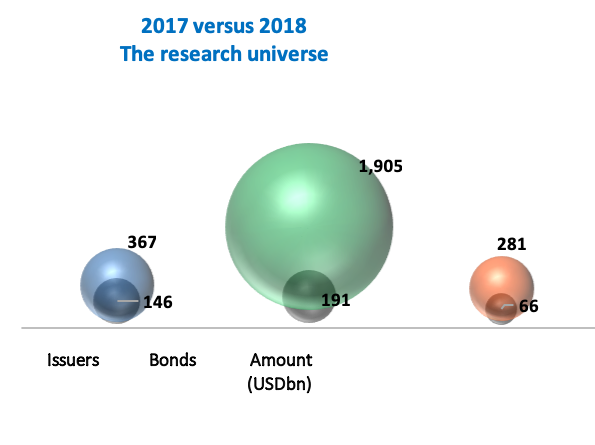

The research universe encompasses 1,905 bonds from 367 issuers with a combined value of USD281bn – issued up to Nov 2017. The volume is 76% larger than the first report.

Compared to the previous report – in which reporting was defined in the context of UoP only (not including impacts) – the share of reporting fell from 74% to 38% by bond count and from 88% to 79% by amount. However, this drop is driven by Fannie Mae, as it does not provide UoP reporting. Excluding Fannie Mae from current figures, the proportion of reporting would be 77% by bond count and 87% by amount, i.e. in line with previous findings.

The practice of green bond impact reporting is also analysed separately and in-depth for the first time.

Availability of UoP reporting

Two-thirds of issuers provide post-issuance UoP reporting and almost half of issuers report on both proceed allocations as well as impact metrics.

UoP reporting covers almost 80% of issued amount, while two-thirds of issued amount is covered by both UoP and impact reporting.

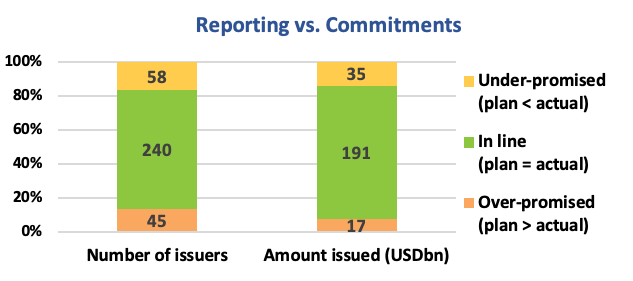

Issuers generally follow through on their reporting commitments: 93% of green bonds where issuers committed to reporting (UoP and/or impacts) at issuance, did in fact report.

A third of the bonds where there was no commitment also had reporting in place.

Larger issuers and larger deals tend to report. The reporting percentage based on amount issued is significantly higher than by number of issuers. Conversely, smaller deals, such as those issued by US Munis, generally have a lower level of post-issuance reporting.

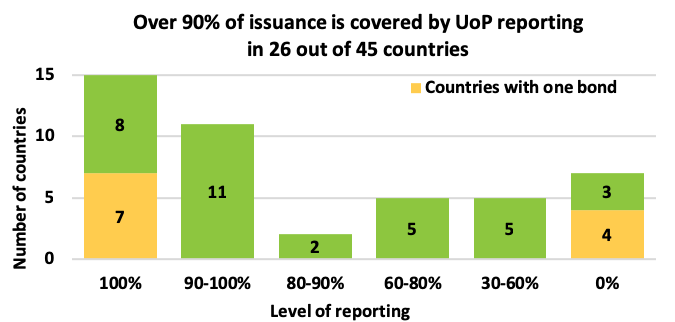

26 out of 45 countries in our research dataset have reporting levels of 90% or more. These include most of the largest green bond markets. China has the highest level of reporting, which is linked to a large number of bank issuers that are required to report on green bonds quarterly.

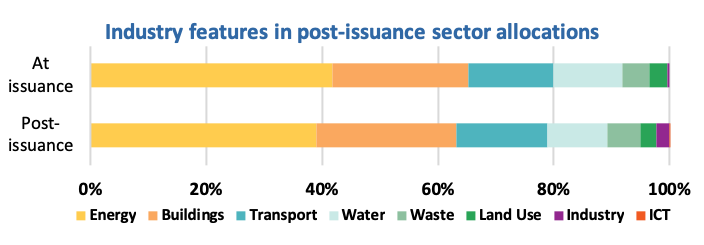

At the time of issuance, Climate Bonds screens bonds to determine alignment to eight basic categories in the Climate Bonds Taxonomy. Post-issuance disclosure generally confirms that funds were indeed allocated to assets aligned to CBI’s Taxonomy. However, actual allocations were higher for Waste and Land Use.

The figure below reflects information available at issuance and actual allocations as reported post-issuance.

There are also 338 bonds with unallocated proceeds of USD50bn in total. 57% of these, accounting for USD27bn, was more than two years old as of October 2018. This suggests some issuers are slow to deploy funds and do not conform with the GBP on this point.

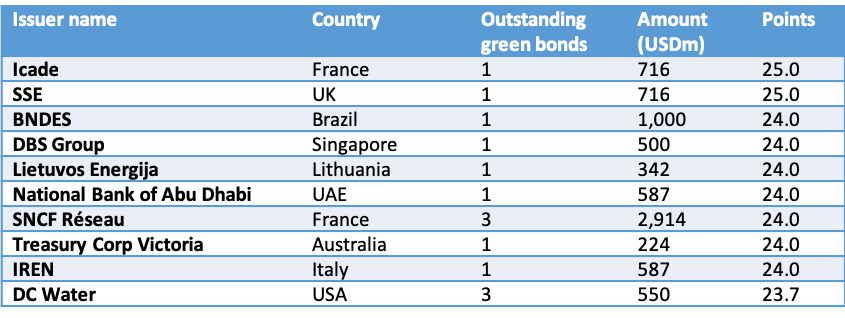

Top 10 UoP Reporting quality score

To assess the quality of reporting, Climate Bonds developed a scoring methodology based on variables related to information access and clarity, granularity, and reliability.

The scale ranges from 0 to 25 points, with issuers scoring between 5 and 25 and a third scoring above 20 points.

The top 10 reporters based on this assessment are ranked below and reflect good quality reporting spans, both regions, and issuer types.

Table 1. Top 10 Issuers UoP Quality

Impact reporting

More than three-quarters of issuers provide some form of impact reporting – that is, reporting which aims to provide quantifiable insights into the environmental effects of green bond financing.

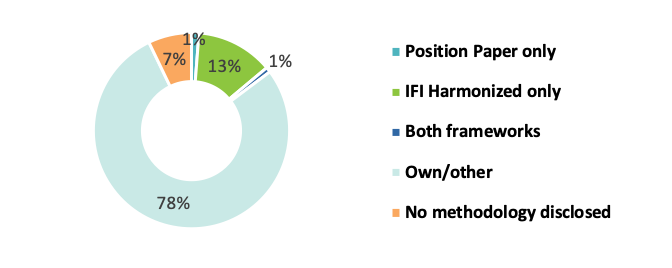

However, only 15% of reporting is produced in accordance with an established impact reporting framework: we considered the IFI Harmonized Framework or the Nordic Public Sector Issuers Position Paper. Several issuers have developed their own methodologies. Others have used the UNFCCC’s Clean Development Mechanism or the Natural Capital Protocol.

Table 2 Impact Reporting

Diversity of Metrics

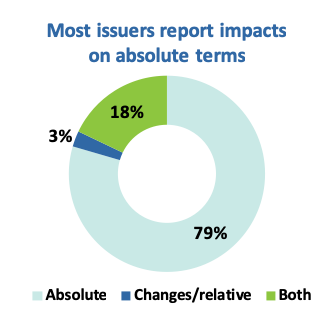

There is also little uniformity: more than 200 metrics are being reported by issuers. The most common ones relate to greenhouse gas (GHG) emissions, energy savings, energy generation capacity, water or waste treatment capacity and air pollutant reductions.

The buildings sector is the only one in which measuring intensities is more common than measuring absolute / relative reductions, for example, of GHGs, energy, water and waste.

Most of the data is actual or measured. Most impact is disclosed on an absolute basis, with only a fifth of reporting including changes relative to a baseline. Most issuers report at programme level rather than at bond or project-level.

10 best practice reporting recommendations

To improve reporting availability and quality, we have gathered a set of best practice recommendations:

- Make information easy to find.

- Provide comprehensive reporting.

- Report regularly and consistently.

- Display information clearly with graphics, benchmarks, comments.

- Obtain post-issuance external reviews to confirm allocations and verify impact disclosure.

- UoP: Disclose the funded projects, both at- and post-issuance.

- Impacts: Disclose methodologies and specify if metrics are estimated or measured.

- Impacts: Report absolute emissions reductions and relative to a specified benchmark level.

- Impacts: Provide project-level reporting with bond and programme-level summaries.

- Deliver on reporting commitment.

The last word

Post-issuance reporting has a pivotal role in ensuring the integrity of the green bonds market. Both UoP and impact reporting for green bonds are widely regarded as fundamental.

The market is moving quickly and tracking UoP is a method to ensure projects and assets are following green guidelines.

UoP forms the basis of any green instrument. As long as UoP are allocated to green assets and projects (assets & projects following set 2-degree compliant scientific criteria) any type of instrument can be green. Climate Bonds Standard Certification places UoP at the centre of our Certification framework.

We’ll be providing more insights as the market grows and once again thank our sponsors HSBC, Amundi, and IDB for providing their support for the report.

‘Till next time,

Climate Bonds