Highlights:

- USD11.6bn bonds from 24 issuers in July

- First Certified Climate Bond from a Colombian issuer

- Second C-PACE securitisation worldwide

- Fannie Mae publishes Green MBS deals for June: USD2bn

- Updated H1 2018 figures: USD76.9bn

> Climate Bonds will release updated versions of the Climate Bonds Taxonomy and Green Bond Database Methodology in August – more details to come, so watch this space!

Go here to see the full list of new and repeat issuers in July.

July at a glance

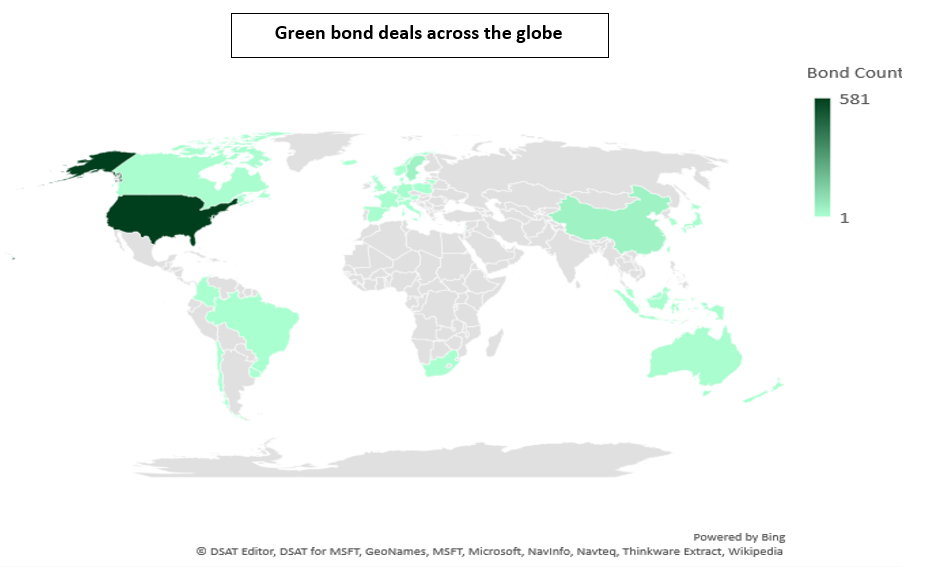

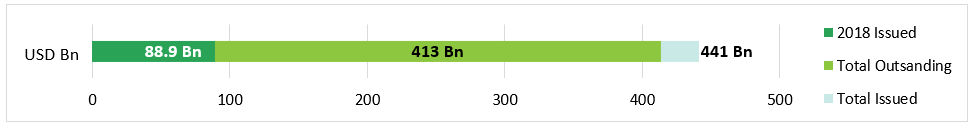

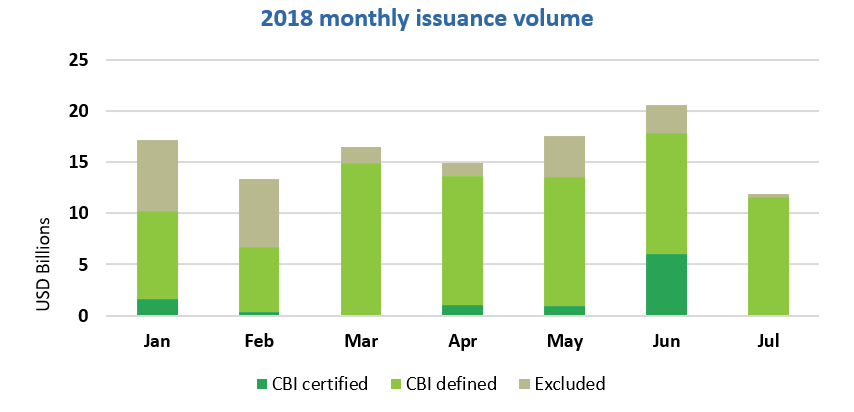

Fannie Mae’s USD2bn Green MBS deals for June have taken our H1 2018 figures to USD76.9bn, 9% up on H1 2017. The US leads country issuance accounting for around a quarter of volumes, followed by China (12%). Supranationals and Belgium each represent 8% of H1 volumes. Use of proceeds distribution remains largely similar for H1 2018 compared to H1 2017: Energy (35%), Buildings (30%) and Transport (16%) still occupy the top three spots for sector allocations.

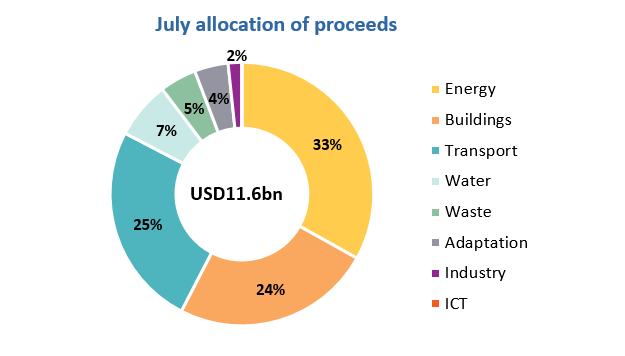

Green bond issuance in July totalled USD11.6bn, a 9% increase compared to 2017’s monthly figures. Developed markets issuance prevails at 75% when accounting for deals by volume, with France’s sovereign Green OAT tap representing over 40% of the total. Considering the number of deals reveals a different story, with 52% of green bonds coming from emerging markets. China keeps the lead for EM issuance at 17%, followed by Colombia at 9% and Indonesia, Lithuania, South Korea and Uruguay at 4% each.

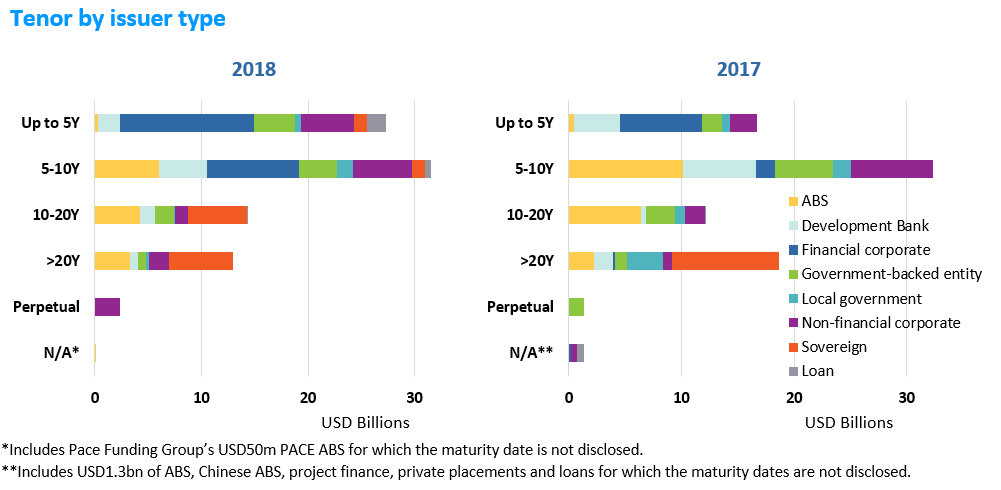

For the period January through July 2018, two thirds of green bond issues have a tenor of 10 years or less, 7% up year-on-year. Financial corporates tend to issue shorter-dated deals. However, 2018 to date shows an increased appetite for medium-term debt, with 41% of issues having tenors between 5 and 10 years compared to just 19% in 2017. Sovereigns mainly issue longer-dated deals (10 years or above), but their tenor profile is also diversifying, with almost 20% of bonds having a tenor of 10 years or less in 2018.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issuer deal sheet in the online bond library.

Certified Climate Bonds

Empresa de Energía del Pacífico (COP70bn/USD24m), Colombia, issued a privately placed 12-year Certified Climate Bond, becoming the first Colombian issuer to come to market with a Certified deal. Proceeds will finance the construction of 4 solar power plants across Colombia, located in Yumbo, Bolívar, Chicamocha and Valledupar. The total estimated capacity of the projects is around 200MW.

EY provided the Pre-Issuance Verification Report.

Faro Energy, UK, issued a Certified Climate Bond – deal size and tenor are confidential. The bond will be used to finance distributed solar power projects in Brazil located in Rio de Janeiro, Pernambuco, Minas Gerais and Tocantins Paraiba. The project’s total production is approximately 9,905 kWh/kWp/year.

Bureau Veritas provided the Pre-Issuance Verification Report.

New issuers

Advanced Soltech Sweden AB (SEK150m/USD17m), Sweden, issued a 5-year green bond. CICERO provided the Second Party Opinion (SPO). The deal will finance new solar power stations and/or upgrades and expansions of existing solar projects owned and managed by Soltech’s Chinese subsidiary Advanced SolTech Renewable Energy Hangzhou Co. Ltd. To be eligible, solar power stations must be installed on existing buildings in areas with poor air quality due to high levels of greenhouse gas emissions. In the SPO, CICERO notes that, although it goes beyond the requisites for obtaining a “dark green” shade, providing quantitative metrics of what is defined as “high” GHG emissions levels would provide additional transparency to the eligibility criteria.

Climate Bonds view: We agree.

CleanFund (USD104), USA, issued a debut C-PACE ABS, the second C-PACE securitisation deal worldwide. The PACE Assets are secured by an initial pool of 82 PACE Assessments of commercial properties in California (45), Connecticut (31), Missouri (3), Colorado (1), Ohio (1) and Texas (1). The PACE Assets have a weighted-average (WA) annual interest rate of 6.19% and a WA original term of 22.9 years. The presale report includes a description of the top 5 largest Assessments.

Climate Bonds view: Globally, this is the second C-PACE ABS after Greenworks Lending’s private placement in 2017. Going forward, we would like to see more disclosure relative to the whole pool of assets.

Hang Lung Properties Limited (CNY1bn/USD150m), China, issued a 3-year green bond, which benefits from a Lianhe Equator Second Party Opinion (not publicly available). Proceeds will be used to finance two of the firm’s construction projects, namely Heartland 66 and Spring City 66. Both buildings have obtained a LEED Gold pre-certification and a Green Building Label of two-star or above, which is in line with China’s Green Bond Support Project Catalogue (2015 edition). The issuer estimated detailed environmental impacts, such as reductions in CO2, SO2 and NOx emissions, as well as water usage savings.

Climate Bonds view: It’s good to see that both proposed construction projects have obtained green building certifications. This issuance generates multiple environmental benefits through energy efficiency and reduced water usage. We would like to see more transparency related to the monitoring of proceed allocations and reporting system.

Korean Hydro & Nuclear Power (USD600m), South Korea, issued a 5-year green bond, which benefits from a Vigeo Eiris Second Party Opinion. Proceeds are earmarked for financing and refinancing renewable energy, clean transport and green buildings located in South Korea and overseas.

Run-of-river hydropower plants and hydropower plants with a capacity up to 20MW are eligible, as well as modernisations and upgrades of existing hydro facilities to improve their energy performance and safety. For bioenergy, biomass will be sourced from low-grade wood fibre pellets, sawdust and other wood industry by-products. Properties are required to have obtained a LEED Gold, BREEAM Very Good or an equivalent national standard, such as the Green Standard for Energy and Environmental Design (G-SEED).

Climate Bonds view: This is the second debut Korean green bond issuer to enter the market in 2018 following K-Water's USD300m green bond in May, taking the country’s total cumulative issuance to USD3.6bn. For hydropower projects, we would like to see disclosure on the power density ratios and annual emissions (gCO2/kWh) of the assets.

North American Development Bank (CHF125m/USD126m), supranational (NADB), issued an 8-year green bond, which benefits from a Sustainalytics Second Party Opinion. The deal will finance wind and solar projects, water & wastewater management, waste management and energy efficiency. Examples of potential eligible energy efficiency projects are municipal and commercial buildings upgrades, industrial equipment retrofits and public lighting. Industrial emissions reduction projects are eligible under the waste category.

Climate Bonds view: The framework does not explicitly exclude projects related to fossil fuels. Industrial equipment retrofits and industrial emissions reductions raise a red flag as they could involve the funding of fossil fuel-based technologies. We will keep monitoring the bond’s impact reporting to confirm that allocation of proceeds are aligned with the Climate Bonds Taxonomy.

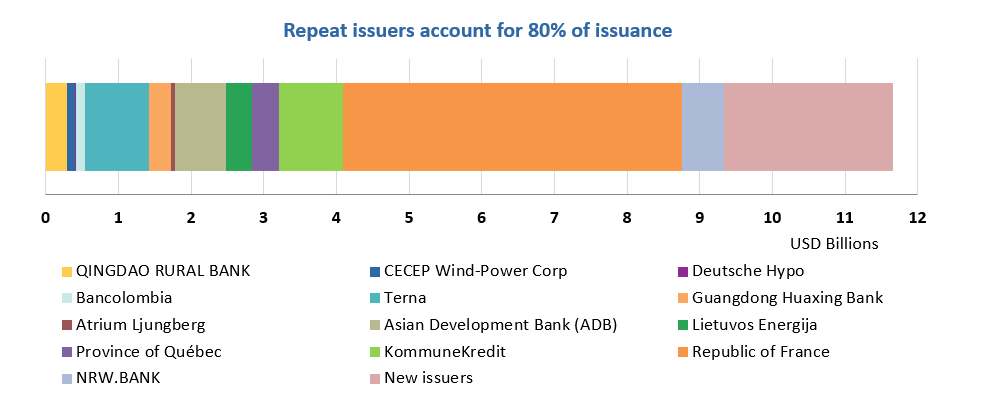

Repeat issuers

- Bancolombia: COP299bn/USD104m

- CECEP Wind Power Corp: CNY700m/USD104m

- Deutsche Hypo: EUR10m/USD12m

- Fannie Mae: USD2bn (June)

- Qingdao Rural Bank: CNY2bn/USD294m

- Terna: EUR750m/USD881m

July trends

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Taishin International Bank |

TWD20m/USD0.7m |

05/07/2018 |

Not aligned |

|

New York City Housing Development Corporation |

US25.4m |

09/08/2018 |

Sustainability/Social bond |

|

Korea East West Power |

USD500m |

19/07/2018 |

Sustainability/Social bond |

|

Industrial Development Authority of Fairfax County |

USD75m |

31/07/2018 |

Sustainability/Social bond |

|

Korea Land and Housing Corporation |

CHF100m/USD101m |

31/07/2018 |

Sustainability/Social bond |

|

Citigroup |

ZAR140m/USD11m |

12/07/2018 |

Pending |

|

Credit Agricole CIB |

EUR2.8m/USD3.2m |

11/07/2018 |

Pending |

|

Credit Agricole CIB |

EUR5m/USD6m |

20/07/2018 |

Pending |

|

Credit Agricole CIB |

SEK10m/USD1m |

20/07/2018 |

Pending |

Green bonds in the market

- City of Toronto: closing 1 August

- National Wildlife Federation: closing 1 August

- Industrial Development Authority of Fairfax County: closing 1 August

- San Francisco Public Utilities: closing 9 August

- South Carolina Jobs-Economic Development Authority

- State Bank of India: Certified Climate Bond

Investing News

Foresight completed the acquisition of a 2.5MW operational anaerobic digestion plant in the UK, on behalf of a pension fund.

Ontario Teacher’s Pension Fund invested CAD200m in Stem, a California based energy storage company.

Captor, a Swedish based asset manager, launched Captor Dahlia Green Bond Fund, an actively managed fixed income fund with a focus on green bonds, as well as sustainability and social bonds.

Lead portfolio manager at NN Investment Partners, Bram Boss, states there are the first signs of institutional investors showing interest in the green bond market.

Egypt approved a legal framework to issue green bonds to support the financing of renewable energy and clean transportation projects.

The UK announced a GBP343m Aerospace Sector Deal as part of the Government’s Industrial Strategy aiming at leading the transition to a low carbon aviation industry.

Green Bond Gossip

French state-owned company Société du Grand Paris has set up a Green Euro Medium Term Note program of up to EUR5bn. Proceeds will be allocated to infrastructure and project management of the Grand Paris Express metro system.

Nigeria plans to devise a green bond programme before the end of 2018.

The African Import-Export Bank (Afreximbank) has partnered with Aenergy to support the growth of green infrastructure projects. The two parties will have the capacity to issue at least USD850m worth of green bonds in the next five years.

Gussing Renewable Energy International is planning to issue its debut secured green bonds.

City of Vancouver’s Green Bond Framework received a Sustainalytics Second Party Opinion.

Moody’s assigned a Green Bond Assessment of GB1 to Monash University’s third Certified Climate Bond.

Reading and Reports

McKinsey’s published an article on “How industry can move towards a low-carbon future”.

INEP Finance Initiative published “Navigating a new climate”, the second report in a series presenting the outputs of a collaboration between 16 of the world’s leading banks to advance recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosure.

The Council on Foreign Relations published a report on “Applying Blockchain Technology to Electric Power Systems” in part as a solution to grid complexity as a result of connecting clean energy and EV charging.

The OECD released their publication on “Energy Efficiency and Renewable Energy Financing in Ukraine”.

Rienergia has published a series of articles exploring the current and potential future role of hydropower within the renewable energy sector, with a focus on the Italian market:

- Tecnologia: dalle mega centrali idroelettriche al mini e micro idro

- Idroelettrico, per il rilancio bisogna cambiare passo

- L’idroelecttrico ai tempi dei cambiamenti climatici

- Idroelettrico: regolazione e iter autorizzativi

Climate Bonds Reports

Don’t miss our China Green Bond Market Mid-Year Report 2018 – available in English and Chinese.

We recently released the second instalment in our SDG briefing series: “Why making infrastructure climate-adapted and resilient will help meet the SDGs”.

“India Green Bond Market: Overview & Opportunities” is our latest country briefing analysing the progress of India’s green bond market and potential avenues for future growth.

Moving Pictures

These solar panels harness energy from rain to generate power by night.

Watch how this wind turbine creates 37 litres of drinking water a day out of thin air.

Take 0:47 mins to discover which country has become the first to divest completely from fossil fuel companies.

Watch how energy efficiency improvements in buildings can cut bills as well as emissions.

Take just 1 minute to discover how Norway recycles 97% of all its plastic drinks bottles.

‘Till next time,

Climate Bonds