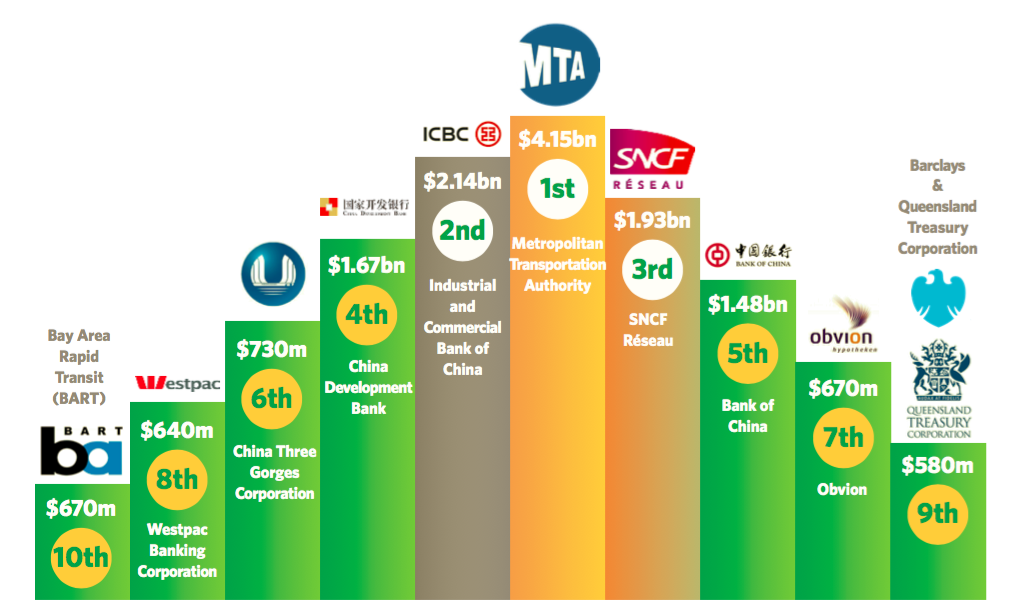

Programmatic issuers lead 2017 Top 10 Certifiers, market share grows in a year of record GB issuance

New Standards V3.0 to launch in Q2, Buildings Criteria rollout expands

Ambitious development program through 2018, new sectors opening up for Certification

We know you have all been champing at the bit to get hold of the 2017 year-end Climate Bonds Standard & Certification newsletter and now the wait is over.

Find it here. It’s a bumper issue, let's take a look!

The Rise of Certifications

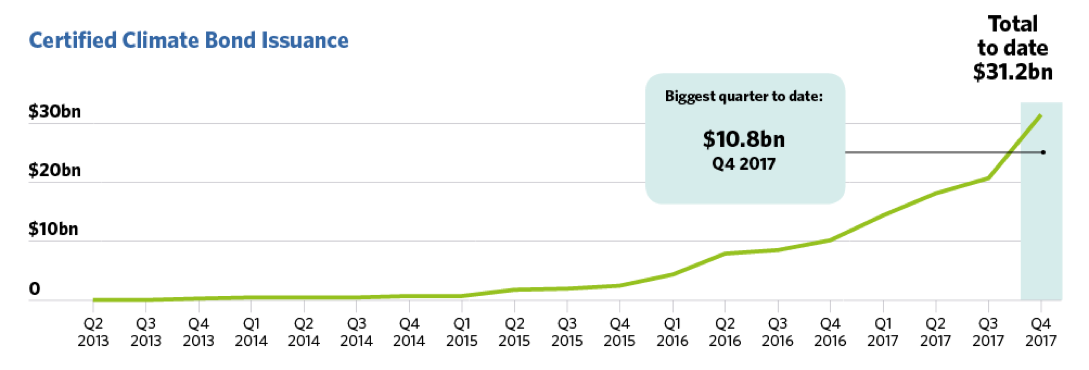

2017 ended with a surge of Certified issuance, contributing to Climate Bonds Certifications taking a record 14% of the green bond market last year, up from 9% in 2016.

$21.3bn of Certified bonds were issued in the year from a diverse group ranging from the world's biggest bank and largest transport authorities to smaller green building financiers and ABS providers.

Increased adoption of our streamlined Programmatic Certification process (designed for repeat issuers) is reflected amongst many in the 2017 Top 10 charted below.

Climate Bonds initial forecasting is for green bond issuance to reach $250-$300bn in 2018.

Our goal is for Certified Climate Bonds to make up 20%-25% of this year's market, as more issuers adopt best practice and investors focus on improving the climate impacts of their portfolios.

We want to see the trend line from later in 2017 keep its upward trajectory.

Standard V3.0 is coming and Criteria rollouts continue

The new V3.0 of the overarching Climate Bonds Standard is set for launch, updating Standard V2.1 released in January 2017.

Details of V3.0 are inside the newsletter and we'll be announcing the release soon.

Don't miss the various updates on Criteria development, in particular Low Carbon Buildings, where we are expanding the reach into new cities and regions.

On the horizon

TWGs and Criteria development will soon begin for Agriculture, Shipping, Energy Distribution Grids & Networks and Information Communication Technology (ICT) over the course of 2018 as we expand the industry sectors availble for certification.

The full story on our 2018 expansion is in the newsletter here.

![]()

The Last Word - Come and see us at at our March Annual Conference

Our next Newsletter is due in late April, but we hope to see you at the the Climate Bonds Annual Conference in London March 20th/21st.

All the Standards and Certification staff will be availble to answer any of your questions and talk you through our 2018 program.

Let's have a chat!

'Till next time,

Climate Bonds.