Market Development Moves Forward - $3.6bn in Brazilian Green Bonds - More to Come!

Edição Brasil: Títulos de Dívida & Mudanças Climáticas - Análise de Mercado 2017

Download in English or Baixe aqui em Português

What’s it all about?

What’s it all about?

Climate Bonds Initiative has just launched the Bonds & Climate Change: The State of the Market 2017 Brazil Edition report.

Available in both English & Portuguese, this is our second annual Brazil based report.

The 2017 Brazil Edition was sponsored by the Inter-American Development Bank (IDB) in partnership with the Brazil’s sustainable finance expert SITAWI and was launched on Wednesday at the São Paulo headquarters of Mattos Filho Advogados, accompanied by a live webcast.

The Headline Numbers

The Brazilian labelled green bonds market has now reached $3.67bn, led by national companies.

Brazilian bond issuance in Q1 and Q2 2017 reached a total of $288.4bn, with green bonds accounting for 0.2% (in comparison to the global bond market, green bonds made up 4% of issuance in the same period).

Since the inaugural June 2015 issuance by BRF to September 2017, nine labelled Brazilian green bonds have been issued, five of them in the international market.

Green Bonds Use of Proceeds

Green Bonds Use of Proceeds

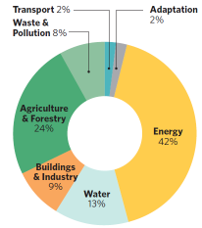

Brazil Edtion 2017 finds domestic green bonds are financing a diverse range of sectors:

- Renewable energy projects accounting for the highest proportion at 42%

- Agriculture and Forestry at 24%

- Water at 13%

- Buildings & Industry at 9%

- Waste & Pollution at 8%

- Transport & Climate Adaptation make up just 2% each, an indicator of the significant headroom for investment in these areas.

Of the nine green bonds issued to date, five have an agriculture or forestry component to them. Internationally this is a very high ratio.

Why the focus on sustainable Agriculture & Forestry?

- Brazil is the world’s largest exporter of sugar and soybeans,

- 2nd largest producer of Ethanol,

- 2nd largest eucalyptus pulp producer,

- 3rd largest exporter of corn,

- 4th largest producer of fibre furnish,

- Largest producer of sustainable FSC certified packaging,

- Amongst the top 5 producers and exporters in range of other agricultural product categories.

This December 2016 presentation from the Agriculture Ministry at our Brazil Investor Forum gives a concise snapshot. A UN FAO study forecasts that Brazil will have to increase its food production significantly to help meet demand from global population growth of the next decades.

Brazil has the world’s largest area of arable land in a single country, so developing best practice in the financing of low carbon and sustainable agricultural and forestry practices has an impact far wider than Brazil.

Why is Brazil so important?

Brazil is big. In lots of ways. It's the biggest economy in Latin America and 9th largest internationally.

It's also the 5th in population and a member of the G20.

Its largest city, São Paulo, is amongst the top 20 global megacities in 2016 and is set to remain at the top in 2030 with an estimated population of almost 25 million.

Who’s saying what?

Justine Leigh-Bell, Director of Market Development, Climate Bonds Initiative

Justine Leigh-Bell, Director of Market Development, Climate Bonds Initiative

"Brazil has an extraordinary opportunity to be the global engine of low carbon agriculture and sustainable growth. To meet this goal, banks, corporations and governments must work in partnership, on policy and market directions, in developing green finance opportunities and exploring new sources of investment.”

Gustavo Pimentel, Sustainable Finance Director, SITAWI

Gustavo Pimentel, Sustainable Finance Director, SITAWI

"The Brazilian green finance market should now grow and diversify into sectors. Wind power and sustainable forest management were the low-hanging fruit. We look forward to see issuance for infrastructure, banks and agribusiness.”

Juan Ketterer, Chief, Connectivity, Finance & Markets, Inter-American Development Bank

Juan Ketterer, Chief, Connectivity, Finance & Markets, Inter-American Development Bank

“To leverage private investments needed to bridge infrastructure and productivity gaps in Brazil it is key to further support the development of financial and capital markets. There is a need to attract national and international institutional and impact investors in low carbon investments and investments with high positive social impacts.”

The Last Word

There is a significant opportunity to finance the expansion of low carbon agriculture at scale, to increase the diversification of renewable energy sources and to develop resilient infrastructure to meet a new economic standard in the country.

From our 2016 report to now, the market has started to move.

With the support of the Brazil Green Finance Council and signatories to the Brazil Green Bonds Statement we're feeling positive about growth in the next 12 months.

Download English.

Baixe aqui em Português.

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.