Issue 4 of our Quarterly Newsletter

If you’re already an avid follower of our Standards and Ceritification quarterly editions and need no further introduction, go straight to the newsletter here.

What's inside?

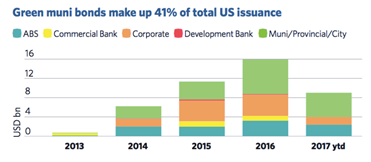

Munis dominate US green bond issuance

Municipals make up nearly 50% of total US green bond issuance.

Building this figure to 50% and beyond should be high on the agenda for the cities and states committed to the Paris Agreement and needing to fund new infrastructure.

California has already taken steps to promote green bonds to meet infrastructure and climate change needs across the US.

We look forward to Treasurer Chiang's Green Bonds Symposium in February 2018 to provide further direction for prospective issuers at city & municipal level.

"Be Climate Smart says BART" & "Invest in the Planet-Invest in the MTA"

Big public authorities on both the East and West Coast are taking the lead on green finance with innovative campaigns aimed at "mom & pop" retail investors. Both have had some success.

They are also becoming early adopters of the streamlined programmatic process for multiple Climate Bonds Certification.

The programmatic process is well suited to municipal authorities and cites with ongoing bond programs and a desire to meet best practice in climate standards.

There's more information in our previous Q1 newsletter or contact Rob Fowler direct for a one-on-one briefing.

New Criteria in the pipeline

Release or public consultation is imminent for:

• Marine Renewable Energy Criteria

• Nature Based Water Criteria

• Bioenergy Criteria

• Forestry & Land Conservation Criteria

• Fisheries Criteria

Watch our Blog or Twitter for announcements and Webinar dates.

Certified Bond Issuance on the up

Over Q1 and Q2 this year, USD 6.5bn of Certified Climate Bonds have been issued, raising the total of Certified Climate Bonds to USD 15.8bn.

In 2016, USD 7.5bn of Certified Climate Bonds were issued.

At the halfway point of 2017 we are now only USD 1bn shy of the total for all of 2016.

And there’s more coming in the pipeline for Q3.

See page 3 for full data analysis of Q2 Certified Climate Bonds.

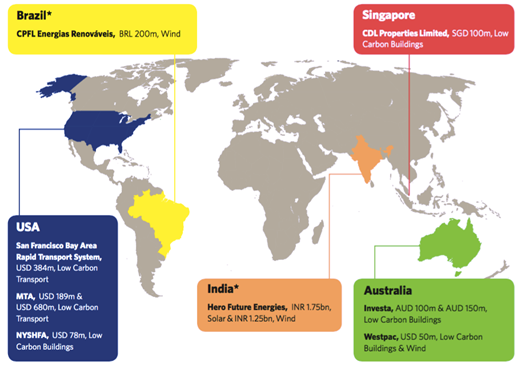

Snapshot of Certified Climate Bonds Q2: April – June 2017

Want to see the full picture? Download the Q2 Newsletter here.

The Last Word

Climate Bonds is hiring!

While we’ve got your focus on Standards and Certification we should remind you we have a new opening for Climate Science Programme Manager.

A role that sits square in the middle of our Climate Bonds Standards work.

Is this you or maybe someone you know?

Take a look at the job description for more details.

‘Till next time

Climate Bonds

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.