A screening tool for investors and issuers

The Climate Bonds Initiative has launched a Hydropower Technical Working Group (TWG) to assess and develop Criteria for climate-friendly investment in the sector.

The aim is to develop Criteria that can identify and monitor hydropower investments which deliver climate mitigation benefits and/or incorporate adaptation and resilience impacts, whilst screening out those that don’t meet these objectives.

The Criteria are intended to provide a screening tool for both investors and issuers to determine whether bonds linked to hydropower assets can be considered consistent with limiting warming to a global average of 2°C. They will provide a potential path for certifying green bonds in the sector, under the Climate Bonds Standard and Certification Scheme.

The TWG will be taking a robust science-based approach, one that looks at verifiable targets and metrics and takes into account in its analysis and assessment processes the environmental and social challenges that face some hydro developments.

Richard Taylor, Chief Executive Officer, International Hydropower Association:

Richard Taylor, Chief Executive Officer, International Hydropower Association:

“Climate change can only be managed once we have developed tools for increasing investment in climate-aligned infrastructure. Building on existing guidance and protocols, the Climate Bond Standard is a crucial step forward in this process. Specific criteria for the screening of climate-compatible hydropower will be essential for bond issuers and investors to move forward with confidence."

New Group Part of Wider Standards push by CBI

This launch marks a further stage in developing specific Sector Based Criteria, which operate under the overarching Climate Bonds Standard.

Sector Criteria are currently available for Solar, Wind, Geothermal, Low Carbon Buildings and Low Carbon Transport. Soon to be available are Criteria for Water, Bioenergy, Land Use and Marine.

Later in 2016, Climate Bonds will begin development on Criteria for bonds focussed on Industrial Energy Efficiency, Waste Management and Information Communication & Technology.

What types of hydropower projects are there?

The IPCC classifies hydropower into three main categories: run-of-river, storage (reservoir) and pumped storage hydropower. In addition, in-stream technologies (new and less developed) can be added as a fourth category.

The Hydropower TWG – What’s involved?

The TWG brings together a host of industry, environmental, technical and water experts drawn from international NGOs, government and academia. TWG processes will be conducted through regular meetings and bilateral consultations, organised around evolving draft documents. Once developed, Draft Criteria will then be opened for public and industry stakeholder consultation. Feedback will be reviewed before being submitted to the Climate Bonds Standard Advisory Board* for consideration.

The Hydropower TWG commenced with its initial meeting on June 21st.

Who is on the Hydropower TWG?

|

|

|

|

|

WWF |

International Hydropower Association |

Alliance for Global Water Adaptation |

International Institute for Environment and Development |

|

|

|

|

|

Water and Power Law Group PC |

Norwegian Ministry of Petroleum and Energy |

State Secretariat for Economic Affairs |

National Planning Commission, South Africa |

|

|

|

|

|

IUCN Global Water Programme |

Great Rivers Partnership, TNC |

REN21 |

International Hydropower Association (IHA) |

|

|

|

|

|

Independent Consultant |

TNC |

||

| TWG Observers | Technical Consultant | ||

|

|

|

|

|

World Bank Group |

World Bank Group |

Climate Bonds Initiative |

|

Why develop eligibility criteria for hydropower related green bonds?

David Harrison, Senior Advisor and Consultant, Great Rivers Partnership, TNC:

David Harrison, Senior Advisor and Consultant, Great Rivers Partnership, TNC:

"From an environmental perspective, it is right to be cautious about hydropower. However, the reality is that hydropower will play an important role in the transition to a low carbon economy; it's the most established renewable source and has significant energy storage potential, enabling much greater development of wind and solar. Given this, and the prospect of further large-scale hydro development particularly in developing countries, the TWG's task of science-based eligibility criteria for the inclusion of hydropower in green bonds is critical."

Developing the Sector Criteria

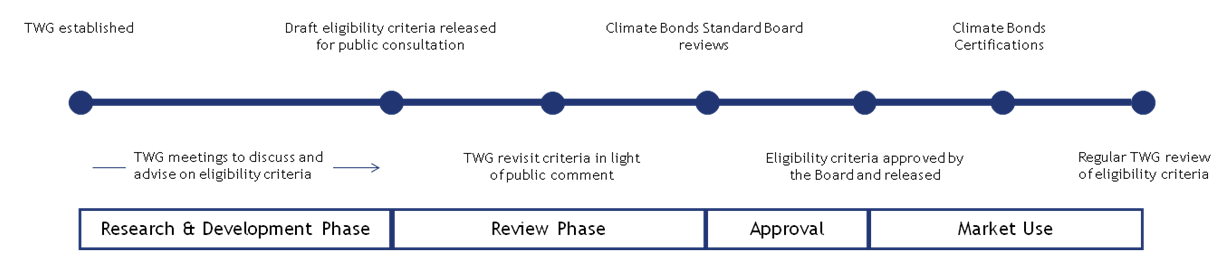

The TWG undertakes the following process when developing sector-specific criteria:

About the Climate Bonds Standard

The Climate Bonds Standard is not a financial standard, rather it provides a science backed screening tool that investors, issuers and intermediaries can use to evaluate the environmental integrity of green and climate bonds.

The Climate Bonds Standard allows easy prioritisation of climate and green bonds with confidence that the funds are being used to deliver climate change solutions.

Bonds are certified under the umbrella Climate Bonds Standard; specific assets funded must also meet the requirements of the relevant Criteria. The Climate Bonds Standards Advisory Board* reviews all criteria and documentation prior to final release.

Members of the Climate Bond Standards Advisory Board* include:

- California State Teachers Retirement Service (CalSTRS)

- California State Treasurer

- CDP (formerly the Carbon Disclosure Project)

- Institutional Investors Group on Climate Change (IIGCC)

- The International Cooperative and Mutual Insurance Federation (ICMIF)

- Investor Group on Climate Change

- Investor Network on Climate Risk

- The Natural Resources Defense Council

The Last Word

Anna Creed – Standards Manager, Climate Bonds Initiative

Anna Creed – Standards Manager, Climate Bonds Initiative

“We have seen a recent surge of inquiries regarding potential development of Hydropower Criteria under the Climate Bonds Standard, it’s a positive that the technical working group process is now underway.”

“The work of the Hydropower TWG will build on both existing hydropower protocols and the previous work of the Climate Bonds Initiative Water expert group. The Water group has previously developed criteria to identify grey water investments that deliver climate mitigation benefits and/ or incorporate adaptation & resilience impacts.”

“Hydropower was initially a sub-sector under consideration by the Water group, but given both the complexities and sensitivities of hydropower investments, it was decided to address it under a separate expert group.

“A distinct Working Group will help ensure the many issues around hydropower are closely examined, relevant science is considered and draft standards draw out specific climate-focused reporting and monitoring requirements for hydropower bonds and fully leverage existing guidance.”

*Disclosure: The CBSAB is an Advisory Committee to the Climate Bonds Board.

Disclaimer: The information contained in this communication does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments that any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.