Credibility and Ambition at the heart of the new Corporate Entity and SLB Certification Expansion

The Climate Bonds Standard and Certification Scheme is expanding to certify non-financial corporates and Sustainability-Linked Bonds (SLBs) issued by non-financial corporates. The move represents a major development of the Climate Bonds Standard, a framework that has driven credible climate financing for over a decade.

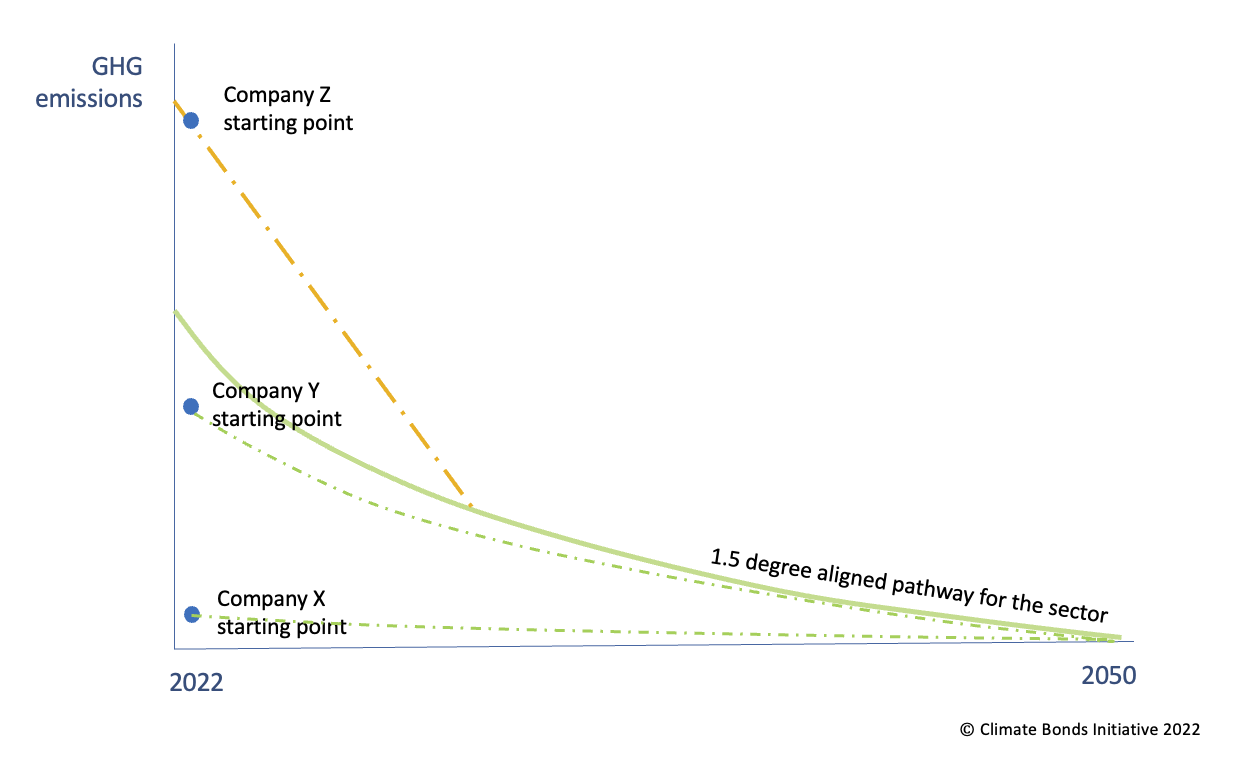

Fundamentally, the new Standard enables corporates aligned with 1.5-degree pathways, or those that will be by 2030, to be Certified under the Standard. Likewise, SLBs from non-financial corporates can also be assessed for Certification.

Proposals for this expansion are open for public consultation, feedback on which can be provided from now until 4th November 2022 by clicking here.

Standard Expands to Entity & SLB Certification

Climate Bonds’ history of developing detailed Sector criteria for assets, activities, and investments under our reputable Standard and Certification Scheme endows us with the experience to establish respected criteria for corporate and SLB certification.

This work goes beyond simple sectoral transition pathways and encompasses key governance elements that comprise important indicators of a company's willingness and ability to transition to Net Zero.

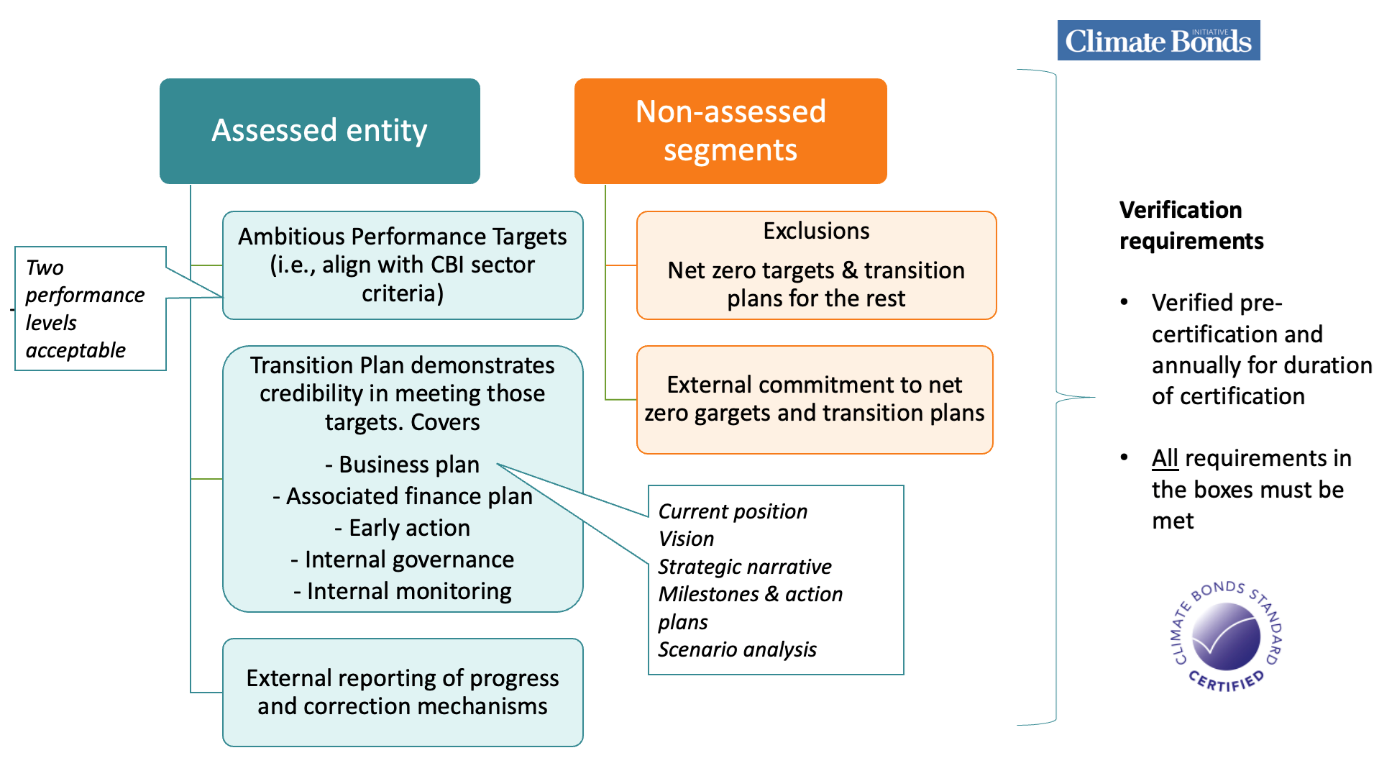

Certification will be available for corporates with emissions already ‘near zero’ and those that are not, so long as the corporate has suitably Ambitious Performance Targets and Credible Transition Plans.

Thus far, corporate-wide and SLB financing is in its early years and lack of direction has threatened its integrity. Given the growing demands on non-financial corporates to develop net-zero plans, investors need assuraning such plans are credible and ambitious. Climate Bonds new Standard addresses these concerns.

Our wide network of Approved Verifiers will facilitate necessary assessments through consistent, well-informed assurance and verification services. This network will be critical in assessing the credibility of transition pathways.

In a similar vein, Climate Bonds has already begun screening all SLBs issued in the market. In the following months, we will launch a new SLB Database to capture those deemed to reflect an ambitious, 1.5 degree aligned transition.

Key features

These proposals are built upon the foundations of Climate Bonds’ Transition Principles, Transition Categories, and Credible Transition Hallmarks detailed in our two papers:

They have also been informed by a review of all similar frameworks and initiatives tackling the requirements in a credible Transition Targets and Transition Plan, including but not limited to, GFANZ, TCFD, ACT, SBTI, UK one, EU Platform for Sustainable Finance, ICMA’s SLB Principles and Climate Finance Transition Handbook.

Key features of the Corporate and Corporate SLB certification:

- Ambition: The goal of transition is to deliver no more than 1.5-degree global warming. This is a key test for eligibility for certification.

- Inclusivity: The collective goal of global net zero emissions will not be met without decarbonising the highest emitters as well as building up low or zero carbon alternatives. Certification is designed to support all transition, provided the goals, the path and the pace are suitably ambitious.

For this reason:

- Corporates and SLBs from all sectors will be eligible for certification (once relevant sector-specific criteria are available).

- Corporates and SLBs from those already on 1.5-degree pathways are eligible for certification as are those who will align with those pathways by 2030 at the latest (so long as they can demonstrate the ambition of their future Performance Targets and the credibility of their Transition Plan to deliver on those Targets).

- Granular simplicity: Bridges the gap between existing market guidance tailored specifically to SLBs which have good uptake but are lighter touch in detail[1], and the deeper company-level assessment frameworks available that are more comprehensive but perhaps too complex for wide market uptake.

Value to the Market

The Climate Bonds Standard and Certification Scheme is an easy-to-use tool that provides issuers, investors and other stakeholders guidance on issuing green bonds with climate integrity to best practice global standards.

In other words, funds can be counted upon to deliver climate change solutions, addressing concerns relating to the burden of information and reporting requirements, while maintaining the robustness and reliability of net zero targets and associated transition plans.

1. It provides issuers with guidance on the key components involved in launching a credible and ambitious SLB;

2. Aids investors by promoting accountability of issuers in their sustainability strategy and availability of information necessary to evaluate their SLB investments; and,

3. Assists underwriters by moving the market towards expected approaches to structuring and disclosures that will facilitate credible transactions.

We have seen major green washing concerns in the burgeoning but still nascent SLB market, especially when it comes to the ambition levels of the Key Performance Indicators (KPIs) being set. Our Standards & Certification of these instruments will help overcome this hurdle by improving confidence and transparency and in turn, enable further market growth.

The Last Word

Certification of corporates and SLB’s marks a huge milestone for the mission that sustainable finance has been on for over a decade. While the fight thus far has been brought chiefly by green bonds, capital also needs to be directed to heavy-emitters looking transition into the clean corporates of the future.

Corporate, SLB and Transition UoP certification products support this.

SLBs have amassed a volume nearing USD200bn over the last 2 years. However, question marks over greenwashing have always loomed as issuers and investors operate without standards or guidance.

By addressing corporate and SLB certification in Standard 4.0, Climate Bonds has provided much-needed guidance on best practice issuance of these instruments, guided by international targets on climate change.

Be sure to visit our website to submit feedback on these proposals. Click here to get started!

‘Til next time,

Climate Bonds.

[1] In particular, ICMA’s Sustainability Linked Bond Principles released in June 2020