Sustainable Finance Soars in North America: Report

Average Annual Growth at 76%, Q1 2021 at 10%

Green Label Fronts Sustainable Market and Offers Pricing Benefits

LONDON: 12/07/2021 09:00 BST: Climate Bonds has released the North America State of the Market report, which assesses the scale and depth of the US and Canadian Green, Social and Sustainability (GSS) debt markets to the end of March (Q1) 2021.

This report is Climate Bonds’ first stand-alone State of the Market report for the North America market encompassing established green markets and a first of its kind analysis of the expanding social and sustainability bond labels, support was provided by Moody’s ESG Solutions and Amundi Asset Management.

Major findings

The North American sustainable debt market reached a cumulative USD311bn at the end of Q1 2021, with almost 6,000 instruments issued under GSS labels since 2011. Cumulative green issuance dominated atUSD271.4bn, with sustainability bonds following at USD24.3bn and social bonds at USD15.5bn.

In the 5-years (2016-2020), the North American GSS market grew by an average of 76% year-on-year and for the first 3 months of 2021 by 10%.

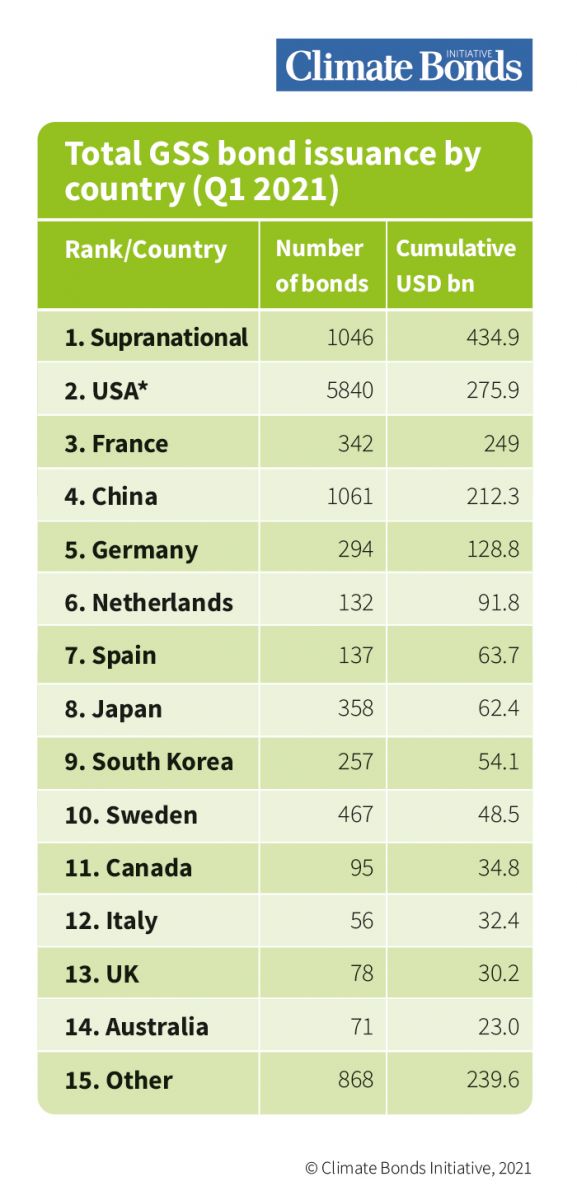

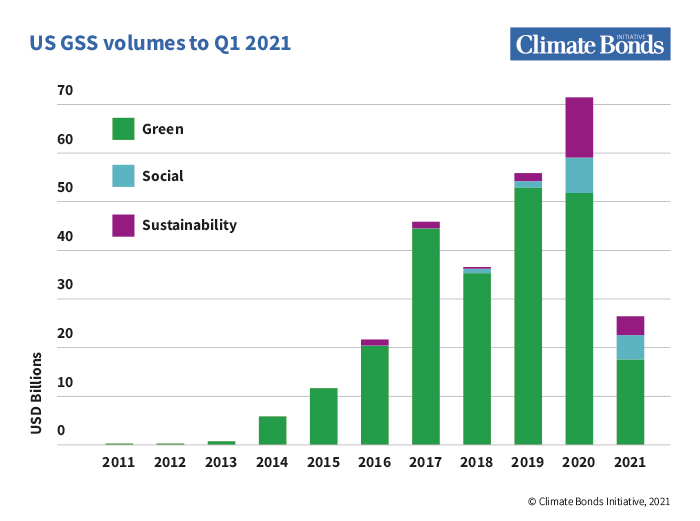

The US is the second largest source of cumulative GSS debt globally (behind supranational issuance) and the largest single country, while Canada ranks eleventh overall, and is the tenth largest country (see Figure 1). Green is the dominant theme, with 87% of the volume, followed by minor but growing shares of sustainability and social-themed bonds. (See Figure 4)

In an analysis of 56 qualifying bonds in the region, three quarters of green bonds achieved a Greenium in the primary market.

Beyond GSS labelled bonds, Climate Bonds’ analysis found also North America was the source of 65 issuers of unlabelled climate aligned bonds. These are vanilla bonds which are not labelled as green but issued by entities whose majority business activities are climate aligned, for example, pure plays, or rail companies.

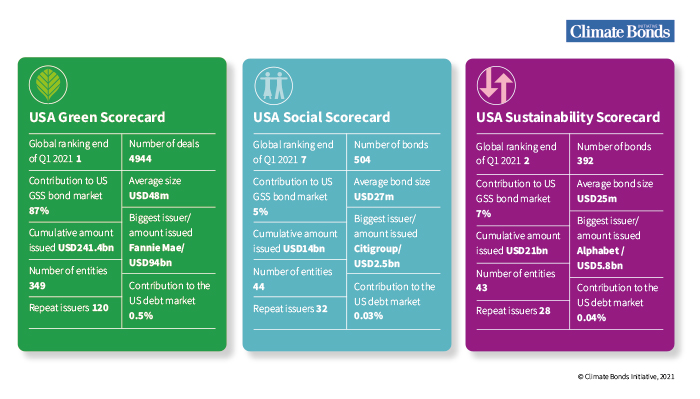

At a Glance: US

- Cumulative market totals: Green USD241.4bn, Social USD14bn, Sustainability USD21bn

- In the 5 years 2016-2020 the US green social and sustainability (GSS) grew by an average of 72% a year and for the in the first 3 months of 2021, by 11%

- The market has several unique features, including the large volume of green Mortgaged Backed Securities (MBS) from Fannie Mae, which accounts for 39% of overall issuance, without which the US would fall behind China and France in national rankings. Green US Municipal bonds issued by local government authorities and state backed government-backed entities make up 23% of total volume

- The US GSS market remains largely characterised by numerous small deals, or tranches, mainly from municipal issuers which are mostly purchased by domestic retail or institutional investors

- The US social bond market is still in its infancy and the private sector has dominated issuance to date, but there is huge potential for the state sector to contribute to the growth of this market. The Biden administration’s emphasis on addressing social inequalities is expected to result in further development of this market

- The US sustainability bond market was opened in 2016 with Starbucks issuing a pair of bonds worth USD1.25bn. In 2019 new bonds totalled USD1.9bn and later in 2020, there was a dramatic increase that led to an extra USD12bn of bonds. In a similar vein 2021 started with new bonds worth USD3.9bn having been issued by the end of Q1

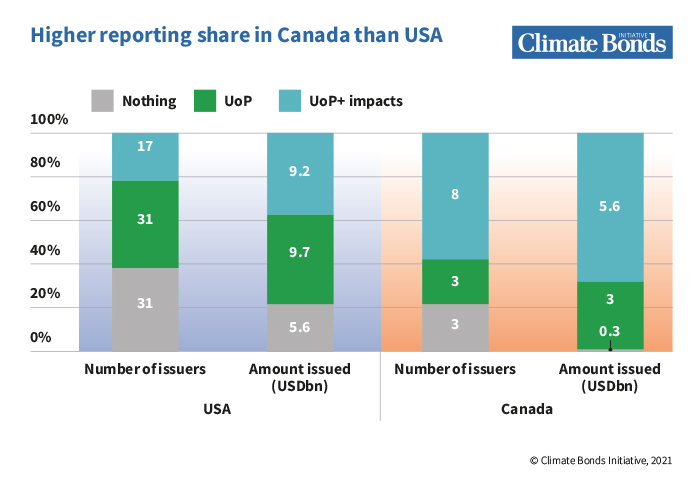

- Strengthening reporting standards will ensure greater confidence and transparency in labelled markets. The US was found to be one of only four countries with post-issuance reporting below 80% and more than USD1bn issued, in a recent Climate Bonds report.

At a Glance: Canada

-

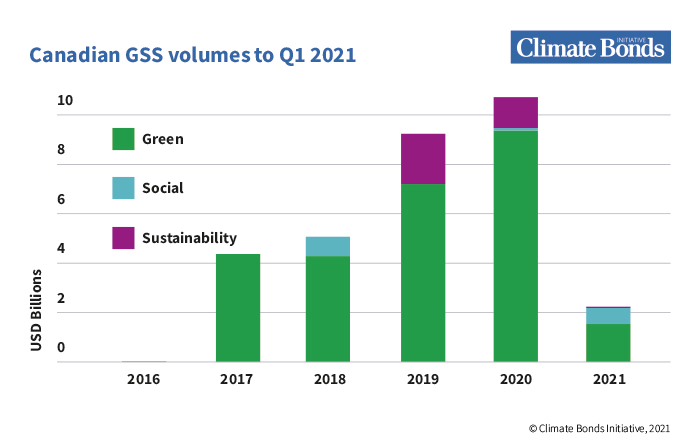

Green total: USD30bn, Social Total: USD1.5bn, Sustainability total: USD3.3bn (See figure 3)

-

In the 3-years 2018-2020 the Canadian GSS market grew by an average of 70% year on year and the first 3 months of 2021, by 8%

-

The Canadian market is populated by larger deals compared to the US, with an average size of USD366m. Larger deals help attract a broader range of international investors, which was also reflected in the fact that Canadian GSS bonds had been issued in six currencies.

-

Since inception of the Canadian green bond market in 2014, the market has been dominated by financial corporates and local governments on a yearly basis, except for one year (2015)

-

The social and sustainability themes are in the early stages of development in Canada, with 15 bonds issued by the end of Q1 2021, cumulatively worth USD4.8bn

-

Canada achieved an impressive 96% post-issuance reporting record by volume of issuance. (See Figure 5)

Climate transition in the financial and real economy in North America

The USA and Canada have recently introduced economy-wide emissions reduction targets at the highest levels of government, as well as publicly reaffirming their commitment to work together on emissions reductions.

Due to a continued reliance on fossil fuels to power much of their economies, there is a need for the public as well as private sector to transition to low-carbon energy systems. Labelled bonds present an opportunity to finance transitions that require companies to drastically change their business models.

Green securitisation in the USA

The securitisation market is well developed in North America, and at the end of 2020, there was USD12.7tn of debt outstanding in commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS), and ABS. The country is the leading source of securitised green debt. Opportunities for further growth are home lending, SME pureplay lending, zero emission vehicles, solar energy and PACE (Property Assessed Clean Energy).

Green bond pricing in the primary market

Between 2016 and December 2020, there were eight qualifying bonds originating from issuers based in Canada and 48 from the USA. The analysis shows that green bonds from the USA and Canada attract larger book cover and achieve greater spread compression compared to vanilla equivalents.

Three quarters of green bonds achieved a greenium and around half of green bonds were allocated to investors describing themselves as green. In the immediate secondary market, green bonds tended to tighten by a greater magnitude than vanilla equivalents and matched indices after 28 days. This suggests that green bonds offer value to both issuers and investors.

Outlook

1. The USA must issue Sovereign GSS debt. Multiple countries have already taken the plunge, and Canada has stated its intention to come to the market in 2021.

2. A broader range of Canadian and American GSS bond issuers will create a more diverse investment pool, thereby enabling more high-profile investors to participate in this market.

3. Clear transition pathways will enable issuers from a broader range of sectors to be active in the North American GSS bond market.

4. Benchmark-sized, labelled deals create critical mass and encourage investors with dedicated mandates to drive policy change. More large bonds are needed to bring scale to the North American GSS bond market.

5. Repeat issuance introduces economies of scale for both issuers and investors. Entities who have issued GSS bonds should return to the market regularly.

6. Clear, accessible, and consistent pre-and post-issuance reporting will support investor confidence in the credibility of the GSS themes.

Patrick Mispagel, Managing Director, Sustainable Finance, Moody’s ESG Solutions:

“Bolstered by a favourable policy backdrop and ambitious corporate action on climate change, the North American labelled green, social and sustainability (GSS) debt market looks set for rapid expansion in the coming years. Clear, accessible and consistent reporting, reinforced by the wider use of external reviews, will be vital to drive investor confidence and unlock sustainable investment opportunities across the US and Canada.”

“Moody’s ESG Solutions is committed to supporting the development of this growing market through our innovative Second Party Opinions (SPOs), which bring clarity to the sustainability impact of GSS bond proceeds and frameworks, and their alignment to market standards and best practices.”

Brad Komenda, Portfolio Manager and Deputy Director of Investment Grade Corporates, Amundi Asset Management:

“We’re seeing a massive increase in green and social bond issuance, moving from niche products to being central components of broader strategies aimed at specific green and impact objectives. The tremendous growth of this market segment is creating a need for new product solutions to meet investor demand, including helping support new approaches such as Net Zero.”

Sean Kidney, CEO, Climate Bonds Initiative:

“The USA’s campaign to tackle climate change is being revived through major policy commitments which are poised to send sustainable debt skyward. We hope the US will match Canada by announcing a sovereign green bond issuance, a move that bolsters domestic sustainable debt markets and demonstrates real climate intent.”

“The USA has led national green bond rankings for several years, however, significant upside potential and unmet demand remains, in both the municipal and corporate markets. This demand will only grow as large investors continue to seek sustainable investment opportunities, align towards emissions reduction goals and reduce long term carbon exposure in their portfolios.”

<Ends>

North America State of the Market 2020 can be downloaded here.

Launch Webinar:

A Report Launch Webinar will be held on Tuesday 13th July 2021

10:00 San Francisco / 10:00 Vancouver / 12:00 Chicago / 13:00 NYC /18:00 London / 19:00 Paris

For more information:

Senior Communications & Digital Manager

Climate Bonds Initiative (London)

+44 (0) 7593 320 198

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Acknowledgements: Climate Bonds Initiative thanks Amundi and Moody’s ESG Solutions for their sponsorship and support in the production of this report.

Methodology: Full methodology can be found in Appendix A & B of the Report.

Pandemic Bonds: Climate Bonds definition of a pandemic bond is a UoP instrument financing COVID-19 response measures under a label specifically related to this.

Figure 1:

Figure 2:

Figure 3:

Figure 4:

Figure 5: