Climate Bonds releases Post-Issuance Reporting in the Green Bond Market 2021 report

Comprehensive review of green bond post-issuance reporting practices, supported by critical reflections on past and future market trends, within and beyond UoP instruments

London: 26/05/2021: 10:00 BST: Climate bonds Initiative releases Post-Issuance Reporting in the Green Bond Market 2021, looking into the availability and attributes of use-of-proceeds (UoP) and impact disclosure among green bonds. This publication is released biennially, and this is the third iteration of the report. Support was provided by the Inter-American Development Bank (IDB), UniCredit and Lyxor ETF.

The report provides an in-depth review of green bond reporting, shedding light on post-issuance reporting practices and identifying avenues for further improvement in this space. The analysis is based on a review of green bonds included in the Climate Bonds Green Bond Database issued between Q4’17 and Q1’19, with the bulk of the research conducted in mid-2020.

The overarching goal of this research report is to facilitate the continued evolution of sustainable finance – many topics are therefore covered, some of which are quite complex, especially related to impact reporting. Aimed at investors, issuers, regulators and other finance professionals, the report provides an understanding of the status quo and future of sustainability reporting.

Key findings:

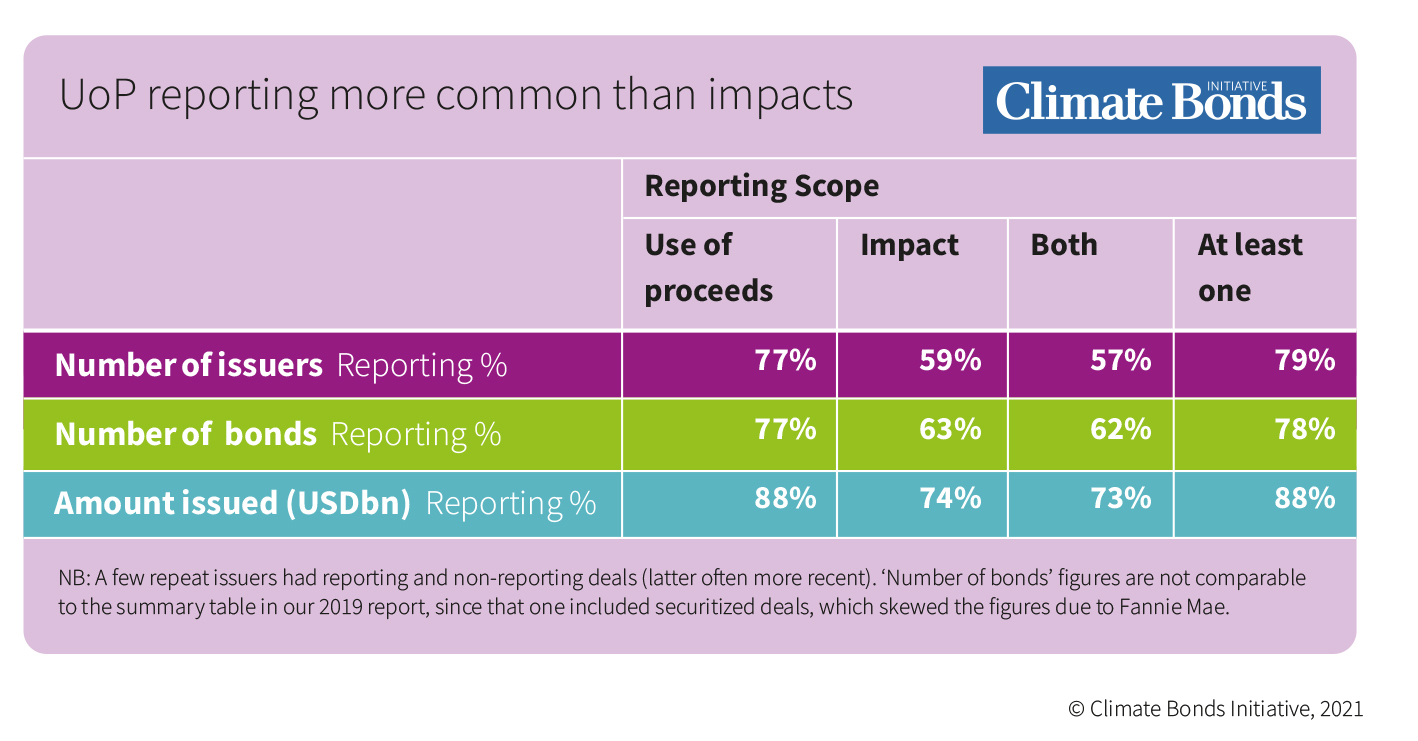

Availability of post-issuance reporting is widespread, but UoP still more commonly reported than impacts (Table 1.):

- 77% of issuers representing 88% of the amount issued provided use-of-proceeds (UoP) reporting

- Drops to 59% of issuers and 74% of the amount for impacts

- 57% of issuers and 73% of the amount have both UoP and impact reporting

- Amount issued share is higher as larger issuers are more likely to report

- Reporting share has increased versus early stages of the market (especially on impacts) and also in recent years, albeit by a smaller margin

Detailed Findings:

Greenwashing is very rare: from our estimates, almost all non-reporting issuers at the time of research have now reported at least UoP. In addition, no bonds were excluded from our database following the post-issuance research, reflecting our robust database methodology and the fact that issuers genuinely finance green projects/assets.

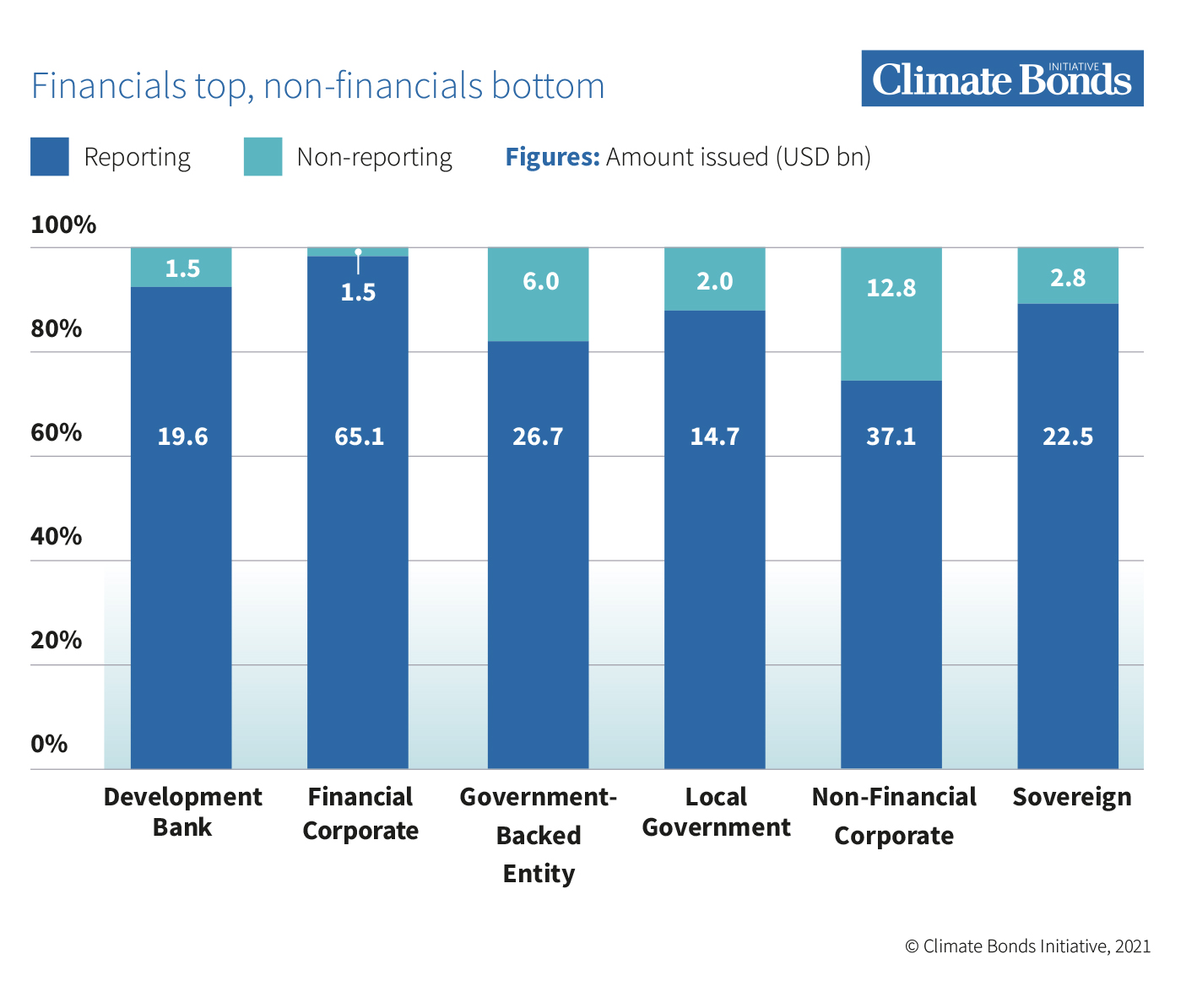

It is rare to find any segment of the market with more non-reporting than reporting issuers, but there are variations in availability of reporting depending on deal size, external reviews, issuer type and geography, for example:

- Reporting share higher among larger deals and larger issuers, as well as in deals with external review (especially post-issuance)

- Private sector issuers most polarised in terms of reporting availability, with financial corporates ranking first and non-financials last – in broad terms, public sector issuers exhibit more consistency. (Chart 1)

- Developed Markets (DM) tend to have a higher share (and quality) of reporting, but relationship is not perfect and there are several exceptions (especially small markets due to added variance)

The quality and consistency of reporting vary more significantly: key aspects include providing clear, easily accessible and granular information, as well as reporting in line with commitments at issuance and obtaining external reviews.

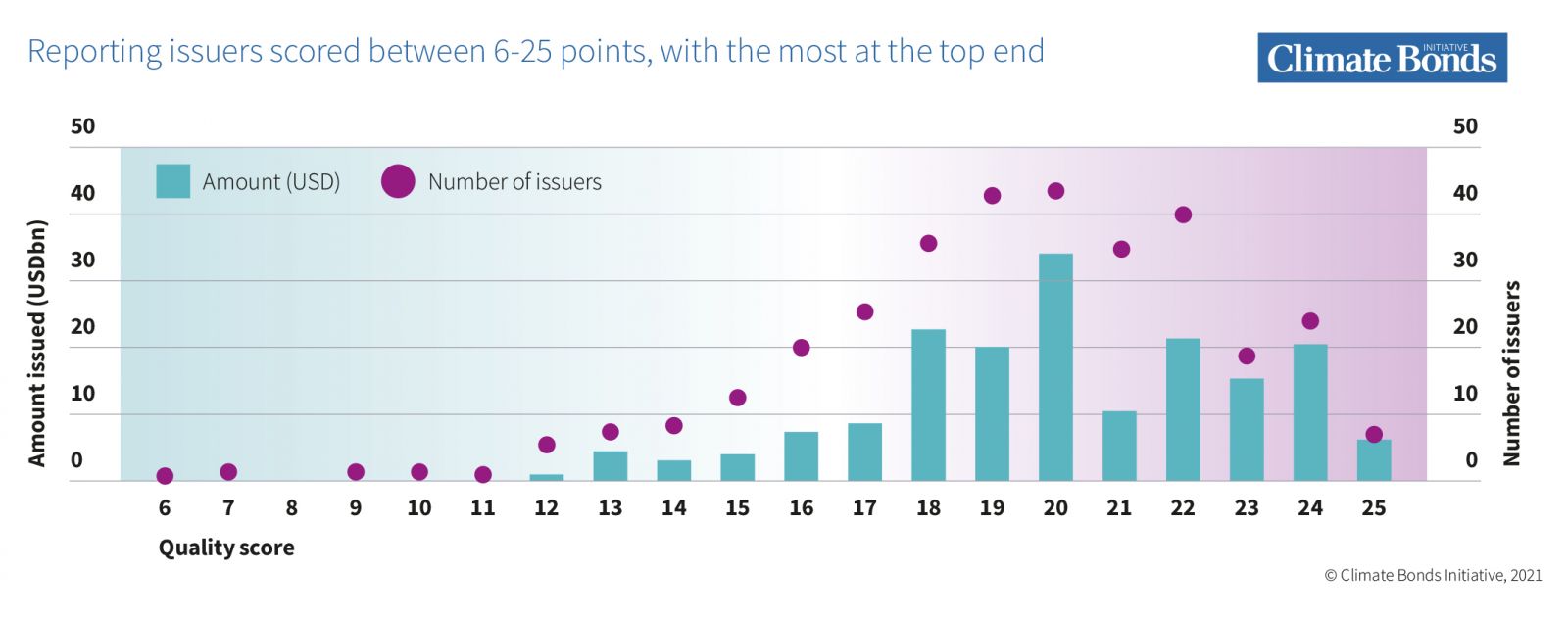

In our methodology we scored issuers out of a total of 25 points, and found that (Chart 2):

- The average quality remained stable versus our 2019 study, and there was still some improvement, including fewer low-quality reporters

- Large deals do not necessarily have higher-quality reporting: average, median and maximum scores relatively constant for all deal sizes, although there is a clear increase in minimum scores, i.e., larger deals less likely to have poor-quality reporting

- European entities are most consistent in quality, with 110 issuers ranging between 10–25 points; Asia-Pacific has a 6–25 range, and North America’s range is also wider than Europe’s even though its issuer count is about half

- More than just having high-scorers, more mature green bond markets have consistently good-scoring issuers

- Spain is the country with most high scorers (previously France), with four scoring at least 24 points; Hong Kong follows, with three

Harmonising Disclosure

An expanding market, together with increasing guidance and developments in reporting practices, have contributed to a rich and varied reporting landscape. However, this varied landscape is difficult to navigate and could cause ambiguity for investors and analysts of the green bond market.

Harmonisation of disclosure must be the priority, in the absence of a common framework to report within, issuers must independently plan, create and publish green bond reports. A common standardised reporting framework and platform leading to greater availability, quality and consistency of disclosure globally is an important next step in the green bond market.

Beyond UoP instruments there is an urgent need for comprehensive sustainability reporting to create a purpose-driven economy with impact measurement at its core.

François Millet, Head of ETF Strategy, ESG & Innovation, Lyxor

“Beyond the attention investors initially pay to selecting the right investments in quality green bonds, they now require the traceability of projects and assets they are financing. This extra due diligence gives them a better way to understand the ESG impact of their investments by measuring to what extent they contribute to society and to their own carbon neutrality objectives. This is why assessing, and benchmarking issuer reporting is fundamental to support best practices”.

Antonio Keglevich, Head of Sustainable Finance Advisory, UniCredit

“The acceleration of capital flows into sustainable activities makes indispensable the harmonisation of disclosure with impact reporting at its core. In order to maintain the unique quality of this asset class, both asset owners and asset managers rightly demand to be regularly informed about the efficacy and meaningfulness of their investments. This report provides valuable insights into recent evolutions and current practices in reporting, stipulating the need for further harmonisation across the globe with clearly defined impact reporting in order for this asset class to be able to deliver its full transformational potential.”

Juan Antonio Ketterer, Chief, Connectivity Markets and Finance, IDB

“Latin America and the Caribbean need to attract more green investment by improving the quality and the quantity of information about green bonds in the region. Investors need to know who is investing in what and the sort of impacts that these investments are generating.”

“Green bond market offers an incredible opportunity for scaling up private investment needed for the region to achieve the Paris agreement targets. We’ll continue to design and use innovative financing tools to leverage private-sector investment and promote climate-resilient development.”

Sean Kidney, CEO, Climate Bonds Initiative

“Tackling the climate crisis necessitates a fundamental shift in how we invest capital. Ambitious frameworks driving low-carbon investment through transparent reporting mechanisms must be deployed throughout the global market”.

“Progress towards harmonising definitions on sustainable activities has begun, marking a positive display of cooperation in the market. This should now be followed by a uniform approach to reporting standards that inspires confidence in the integrity of the unrelenting green bond revolution”.

<Ends>

For more information:

Senior Communications and Digital Manager,

Climate Bonds Initiative.

+44 (0) 759 332 0198

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Post Issuance Reporting Series: The series began in June 2017 and is released every two years. The previous reports can be found here.

Methodology: Research was conducted just over one year after the end of issue cut-off period; the figures cover bonds issued between Q4’17 and Q1’19, with the bulk of the research conducted in mid-2020. This allows for more than a year since the end of the issue date cut-off, but less than the two-year maximum recommended by the Green Bond Principles (GBP).

Acknowledgements:

Support and funding for this paper were provided by Inter-American Development Bank (IDB), UniCredit and Lyxor ETF.

Tables & Charts:

Table 1.

Chart 1.

Chart 2.

Chart 2.

Ends