Sustainable Debt: Global State of the Market 2020

Scale and Depth of $1.7tn Green, Social and Sustainability Debt Market

LONDON: 23/04/2021 2:00 PM: Climate Bonds has released the Sustainable Debt-Global State of the Market report, which assesses the scale and depth of the green, social, and sustainability (GSS) debt markets as of the end of 2020. This report is the tenth iteration in our flagship State of the Market series, encompassing established green markets and the expanding social and sustainability labels.

The market analysis examines the changes in the GSS debt markets during 2020, while the forward-looking spotlight section explores the development of transition, green recovery finance and EU green market leadership, three themes that will continue to influence market growth into the 2020s.

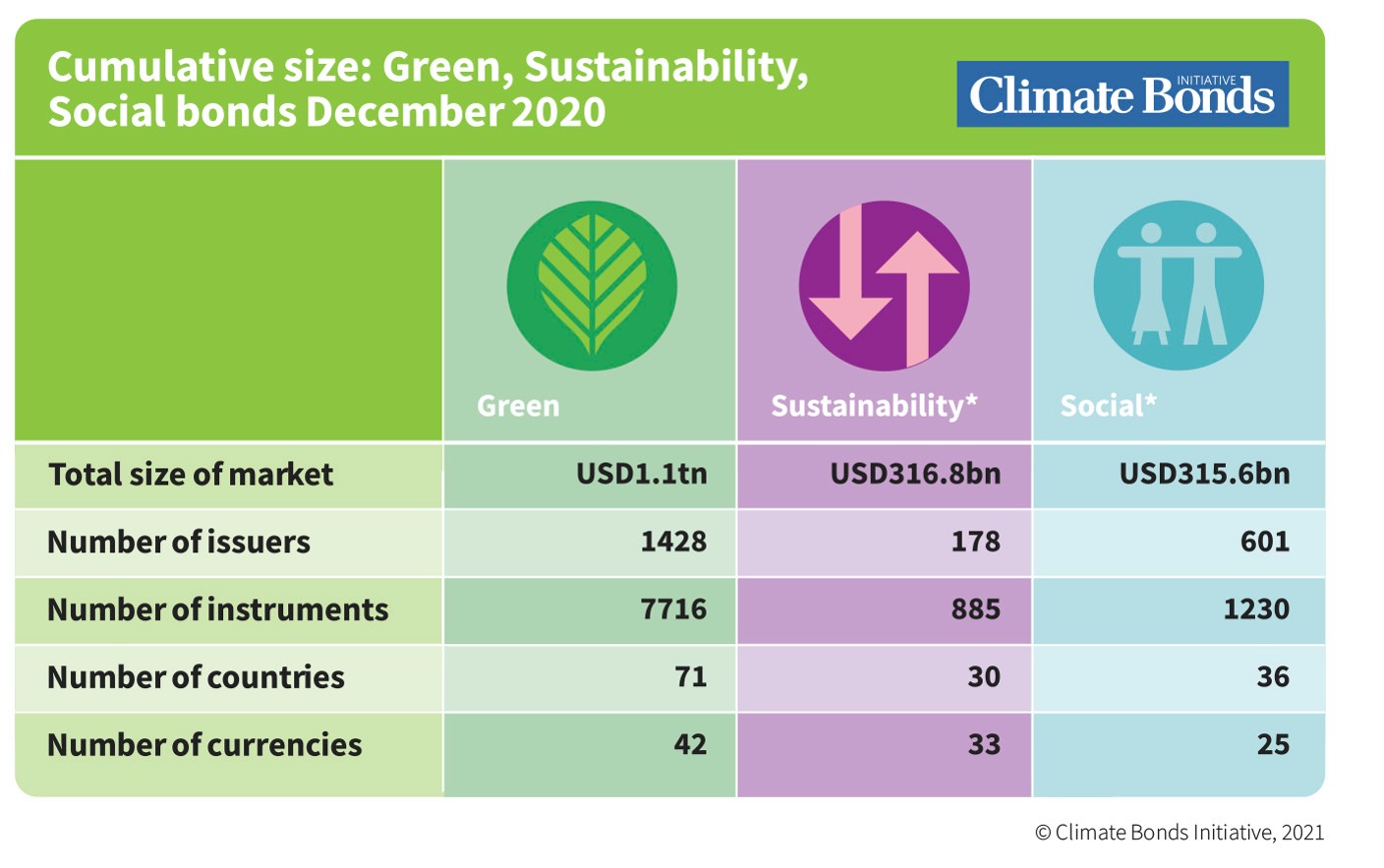

The sustainable debt market had reached a cumulative USD1.7tn at the end of 2020, with almost 10,000 instruments issued under GSS labels since 2006. Cumulative green stood at USD1.1tn, (having reached the USD1tn milestone in early Dec 2020) with sustainability bonds a cumulative USD316.8bn, followed very closely by social bonds at USD315.6bn. (See Figure 1)

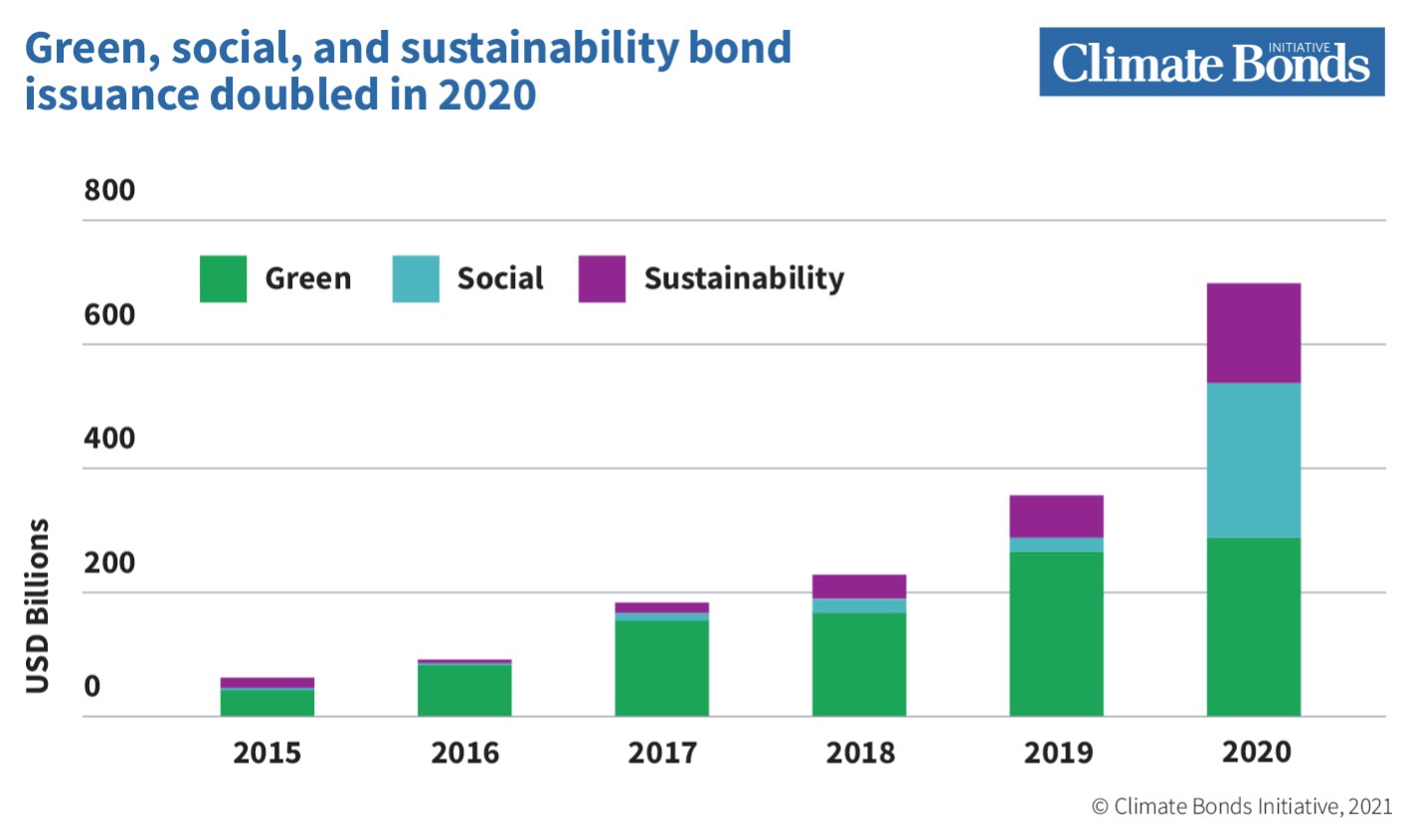

USD700bn worth of GSS instruments were issued in the calendar year 2020, almost double the 2019 total of USD358bn total, indicating the sharp growth in sustainable debt despite the impact of Covid. (See Figure 2)

While green remains the dominant label and was the largest source of outright capital, the social and sustainability labels grew dramatically and achieved higher volumes than all previous years combined. As a result, total issuance in 2020 was more evenly spread across the three major themes compared to prior periods. (See Figure 3)

An increase in the number of external reviews highlighted the emphasis investors are placing on the integrity of the green label. Most of the increase occurred in the Second Party Opinion (SPO) category. The number of Certified Climate Bonds accelerated with USD51.5bn of Certifications in 2020 and reached a cumulative total of USD154.7bn by the end of the year.

At the end of 2020, USD97.7bn worth of Sovereign GSS bond had been issued from 22 sources. Green remains the dominant theme, but sovereign social bonds were issued for the first time in 2020 by Chile, Ecuador and Guatemala and three sovereigns, Luxembourg, Mexico and Thailand, introduced sustainability bonds.

Green Bonds

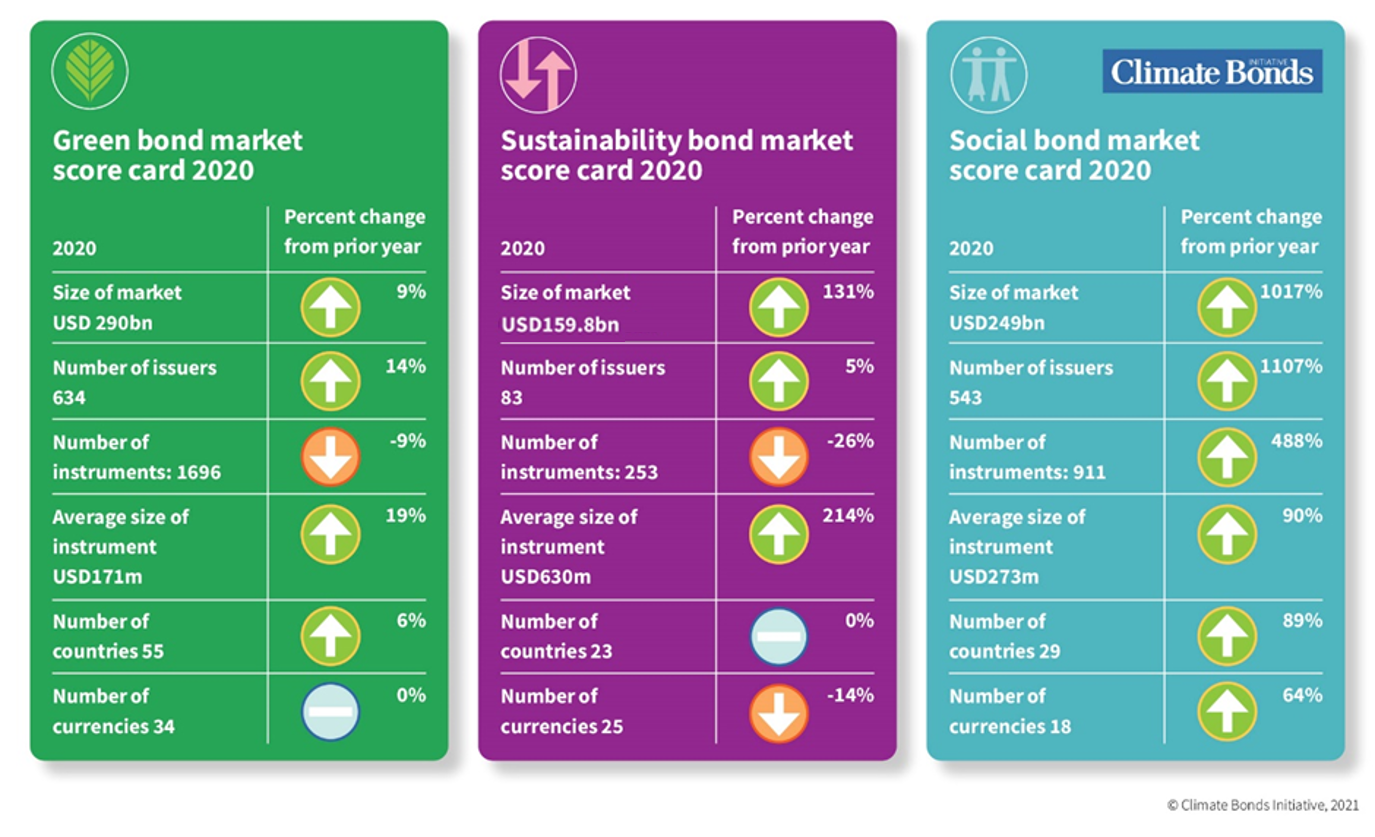

The green debt market for 2020 stood at USD290bn*, recording a 9% increase compared to 2019 thanks to a strong third quarter. While the number of issuers increased, the number of instruments declined. The average size of the individual instruments issued under the green label is the smallest of the three themes, suggesting that the green debt market has broad appeal among a range of issuer types. Multiple small instruments issued by US Municipals and Fannie Mae under the green label are key contributors to this growth in the issuer base.

At a Glance

- Four-fifths of the overall green volume originated from developed markets (DM) in 2020, compared to 73% in 2019. Emerging markets (EM) accounted for 16% versus 22% the prior year, while the contribution of supranational entities (SNAT) was 4% against 5% in 2019.

- Europe was the largest source of green debt in 2020 responsible for USD165bn or 48% of the total.

- North America remained broadly static on the prior year with USD61.5bn of green bonds compared to USD60bn in 2019.

- The green bond market in China suffered from the ramifications of the COVID-19 pandemic. Overall, bonds from Chinese entities reached just USD22.4bn, or 70% of the 2019 total of USD31.4bn.

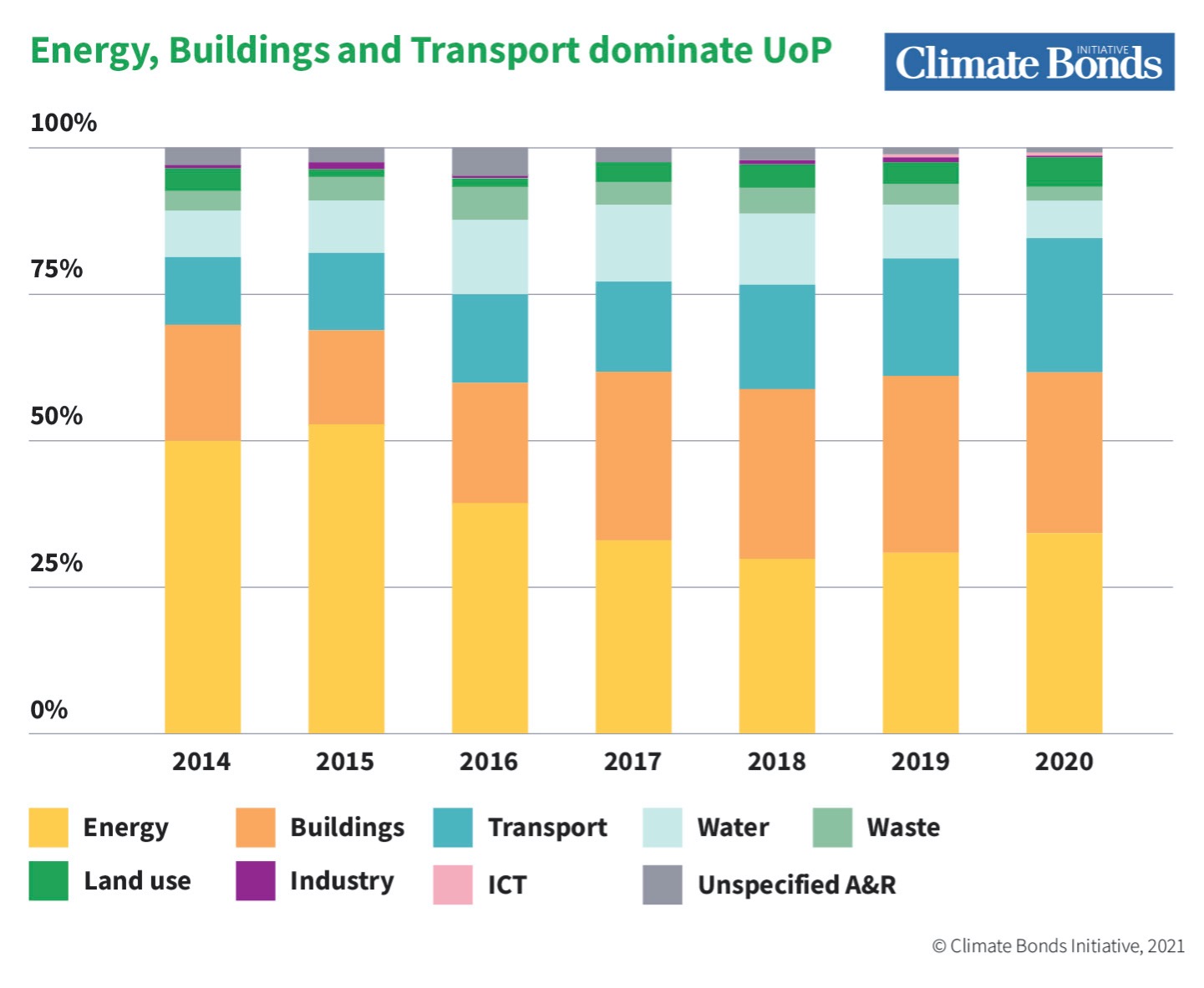

- Together, Energy, Buildings, and Transport were respectively the three largest Use of Proceeds (UoP) categories, contributing 85% to the total in 2020. Energy and Transport, along with Land Use, were the only categories to expand in 2020. (See Figure 4)

Sustainability Bonds

In 2020 the amount of debt issued under the sustainability theme reached USD159.8bn, 2.3 times that of 2019. More issuers entered the market, and the size of the individual instruments was, on average, three times larger than the prior year. Individual instruments increased in size and were larger (on average) than those issued under the green or social labels.

At a Glance

- In 2020, sustainability bond issuance increased by 131% compared to 2019. Overall, supranational entities (SNAT) accounted for 63% of the volume, DM for 32%, and EM for 5%. This translates into growth for both supranationals (SNAT), and DM compared to 2019, while EM volume dropped by 9% compared to the previous year.

- Most of the 260% growth from SNAT issuers originated from development banks, especially multilateral (MDBs). The main driver was the World Bank, but other players such as the Asian Infrastructure Investment Bank (AIIB) debuted sustainability bonds in 2020.

- Europe enjoyed solid growth of 43% (USD31.6bn versus USD22.2bn in 2019), making up 20% of total 2020 issuance and ranking second after SNAT.

- North America was among the regions showing the most impressive development. Issuance grew by 164% year-on-year from USD3.9bn to USD10.4bn.

Social Bonds

The social bond market exploded in 2020, with USD249bn representing a more than 10-fold increase (1022%) year-on-year, the sharpest annual growth in any theme since the inception of the GSS debt market. The number of issuers using social labels grew by 1107% from 45 in 2019, reaching 543 in 2020 and encompassed a broader range of countries and currencies than ever before.

The dramatic growth can be largely attributed to the effects of the COVID-19 pandemic and the increasing desire of bond issuers to address health and other social concerns in a more strategic way.

At a Glance

- Issuance skyrocketed in nearly all regions in 2020. Overall, with the pandemic label as a sub-label of social bonds, all regions saw an increase in issuance apart from Africa.

- Pandemic bonds contributed substantially to the growth and accounted for 34% of 2020 social bond issuance.

- China with USD68bn of issuance and SNAT with USD77.7bn made the largest contributions to the 2020 issuance volume. France ranked third, with USD52.5bn and Japan fourth with a total of USD8.8bn.

Looking Forward

The paper includes forward-looking spotlight analyses of the following three themes which will continue to influence the development of the GSS debt market.

The development of transition instruments

No industry or entity can be left behind in the transition to a net-zero carbon economy and a more resilient and equal society. The development of instruments to accommodate a broader range of issuers and activities is essential in extending the thematic bond market and can help investors to build diversified portfolios.

Green recovery finance

We examine how four governments have implemented measures to ensure a sustainable recovery. Post-pandemic recovery spending linked to GSS expenditures encourages crowding in of investment by introducing more projects into the real economy.

EU GSS leadership

Europe is home to the world’s largest green bond market, which has developed with the strong leadership of the EU. Multiple European nations have issued Sovereign GSS bonds. The EU has stated its ambition to be the first climate neutral bloc by 2050, and this objective is being pursued by connecting policy and budget, regulation, and the support of institutions including the ECB.

The EU is the largest issuer of GSS bonds, having entered the thematic bond market in 2020 with EU SURE bonds. The presence of such a large-scale issuer of high credit quality is contributing to the creation of a transparent, liquid source of funding for entities wishing to support the transition to net zero through debt markets.

(See Figure 5)

2021/2022 and beyond

The growth in the market demonstrates the role that green and sustainable finance can play in the transition to a low carbon economy and a more equal society. We expect social and sustainability matters to continue growing and labelled instruments to become mainstream means of raising capital.

Multiple influences that will likely continue to develop through the 2020s and shape the expansion of the labelled bond market include the harmonisation of green taxonomies, the rise of the sovereign GSS bond club and the establishment of transition finance.

Rupert Cadbury, Fixed Income Portfolio Strategist at State Street Global Advisors:

“As we begin to recover from the impact of the COVID-19 pandemic, a backdrop of ever-growing interest in and actions on the climate emergency is being established. The potential of a green revolution that can drive and sustain this recovery will certainly be on top of the agenda in every country and business. From the UK government’s pledge to issue its inaugural green bond this summer, to the many discussions ahead of COP26 this November, all things point to the fact that a sustained global recovery will depend on more than just short-term stimulus packages, but rather on a comprehensive global effort to support the global transition to a net-zero economy.”

“With USD1.71bnof green bond investments, State Street Global Advisors has been an active investor in green bond issues globally since 2012. The Sustainable Debt-Global State of the Market report helps investors to understand and navigate the latest developments and trends in the GSS bond space and provides an important reference tool to formulate discussions with clients, as well as climate related initiatives and partnerships. Importantly it can also help drive our innovation, as we continue to develop climate related investment products and strategies for investors.”

Ingo Speich, Head of Sustainability & Corporate Governance, Deka Investment:

“Sustainable finance continues its drive despite the impact of the pandemic. This State of the Market report demonstrates the shift towards green and sustainable investment is underway and beginning to accelerate.”

“The finance sector has a vital role in ensuring this acceleration continues and Deka is committed to playing its part. Sustainability is a core element of our business model and the report signals the pathways that all stakeholders, banks, investors, issuers and corporations can follow in the transition towards net zero.”

Sean Kidney, CEO, Climate Bonds Initiative:

“The green, social and sustainability markets have been at the foundation of climate-conscious recovery from the pandemic. A key feature of the 2020 labelled bond market is the broadening and deepening of thematic issuance. The emergence of a transition label points towards the pathways investors and corporates in basic industries must take towards net zero. The rise of social and sustainability issuance indicates welcome market developments towards building resilience and adaptation measures as part of sustainable development.”

“2020 was a demonstration that business-as-usual economic policy is not sufficient to address multiple and sustained shocks of the sort that climate impacts will increasingly drive. The gap between current investment levels and the sustained flow of global capital in trillions towards climate and green solutions is yet to be bridged.”

Ends

Sustainable Debt: Global State of the Market 2020 can be downloaded here.

For more information:

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Acknowledgements: Climate Bonds Initiative thanks DekaBank and State Street Global Advisors for their sponsorship and support in the production of this report.

Methodology: Full methodology can be found in Section 2 of the Report.

Annual Issuance: *Climate Bonds initial estimate for 2020 green bond issuance published on January 24th 2021 was USD269.5bn. As noted at the time this figure was subject to upwards adjustment as final data became available from pending and late December deals.

Pandemic Bonds: Climate Bonds definition of a pandemic bond is a UoP instrument financing COVID-19 response measures under a label specifically related to this.

Sovereign Green Social and Sustainability Bonds: Further information can be found in Climate Bonds SGSS Survey report released in January 2021.

Launch Webinar:

A Report Launch Webinar will be held on

Tuesday 27th April 2021

06:00 New York / 11.00 London / 12.00 Paris / 17.00 Bangkok / 18:00 HK / 20:00 Sydney

Images:

Figure 1: Cumulative size: green, sustainability and sustainability markets at December 2020

Figure 2: Scorecard, green, sustainability and social bonds markets, annual 2020

Figure 3: Green, social and sustainability market growth 2015-2020

Figure 4: Use of Proceeds, green bonds 2014-2020

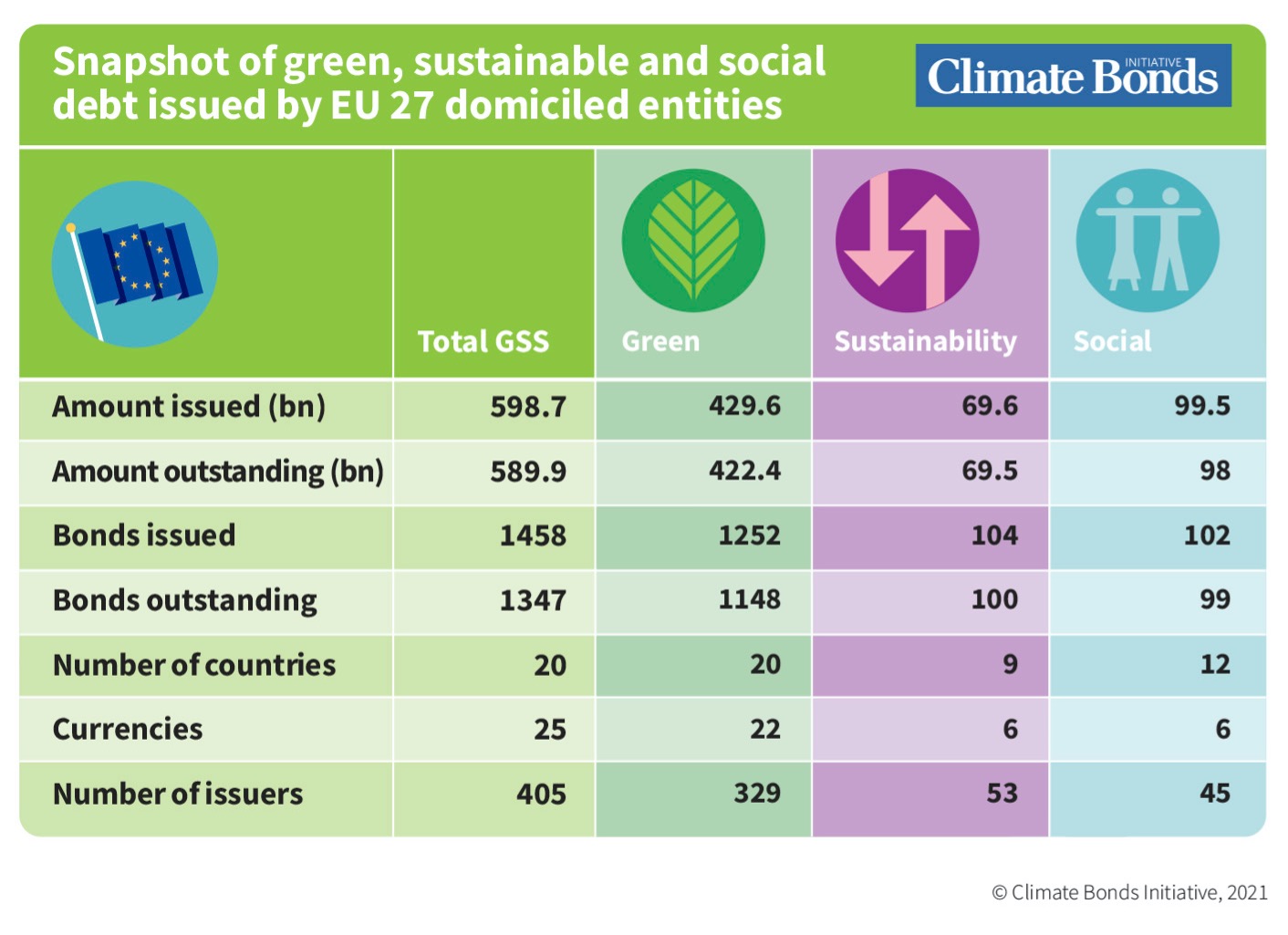

Figure 5: Green, sustainability and social debt, EU domiciled entities

ENDS