Media Release

(Launch Webinar Friday 24th April 2020, 15:00 CEST/14:00 GMT)

LONDON 21/04/2020 07:00 BST 08:00 CEST: A broader investor base, enhanced visibility, strengthened stakeholder relationships and catalysing new business lines are amongst the benefits of green bond issuance according to a global Green Bond Treasurer Survey carried by Climate Bonds Initiative.

Sponsored by Danske Bank and Luxembourg Stock Exchange with supporting analysis from Henley Business School from the University of Reading, the Green Bond Treasurer Survey 2020 is a first of its kind, unique interrogation of market experience to identify core benefits and challenges of issuing green bonds and provides guidance to potential newcomers into green financial markets.

Eighty-six treasurers from thirty-four countries were interviewed. Respondent organisations represented around 44% of the identified green bond universe accounting for a total of USD7.4tn in bonds outstanding, including USD222bn of green bonds and which collectively had issued six hundred & eighty-six (686) green bonds at the time of data collection.

The questionnaire explored the end-to-end process of issuing a green bond and solicited views on integrating sustainability and the potential to enhance growth and scale of the market.

Headline Findings

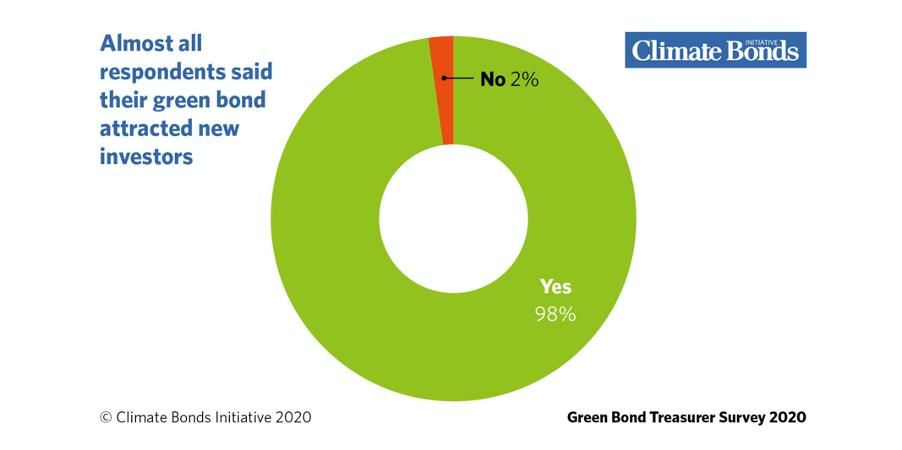

98% of respondents said that their green bond attracted new investors. The most frequently stated benefits of this were: i) a more diverse pool of investors, offering greater flexibility to reopen or issue new bonds, ii) a stickier investor base, and iii) greater visibility. (See Charts 1,2)

91% of respondents said a green bond facilitated more engagement with investors compared to a vanilla one. Investors interrogated issuers on topics including the use of proceeds, the framework, and post issuance reporting. This dialogue resulted in investors having a more intimate knowledge of the organisation.

88% of respondents said they planned to issue more green bonds, while a further 15% said they would reopen their current bond. This underscores the positive experience of issuing green bonds. An established investor base and greater visibility in the market were the most frequently cited advantages of repeated green bond issuance.

84% of the green bonds in the sample, are listed on at least one stock exchange. Visibility was the most frequently selected reason for this, followed by perception and integrity.

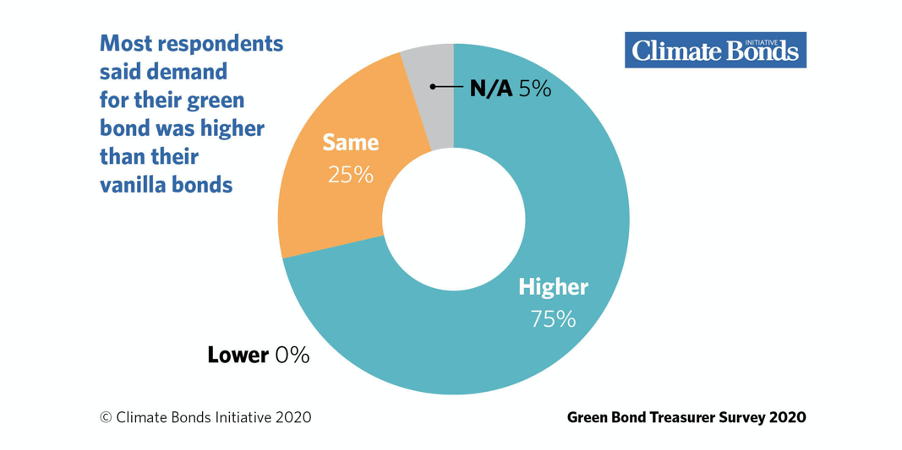

70% of respondents said the demand for their green bond was higher than for vanilla equivalents while 25% said the same and 5% were N/A. (See Chart 3)

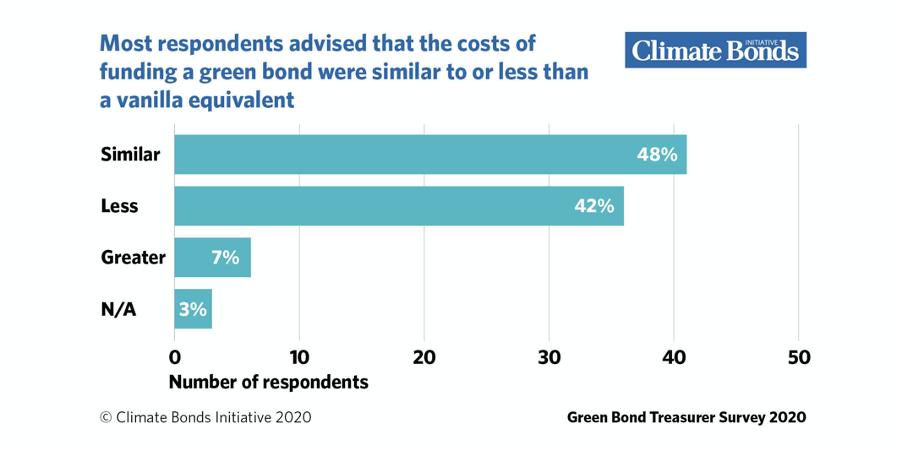

48% responded that the cost of funding green bonds was similar to that of vanilla equivalents, while 42% considered the costs to be lower. For larger issuers and those with more years of experience in the green bond market, the costs of funding for green bonds were lower than for vanilla bonds.

Additional Findings

Multiple reasons to enter the green bond market: Reasons to enter the green bond market were varied. Many respondents mentioned a strategic objective to incorporate and reinforce their sustainability commitment, while other respondents described how issuing a green bond had initiated a business transition.

Intangibles constitute main motivation for issuance: Respondents highlighted a broader investor base, which included investors with green mandates and enhanced visibility and reputation as examples of intangible benefits.

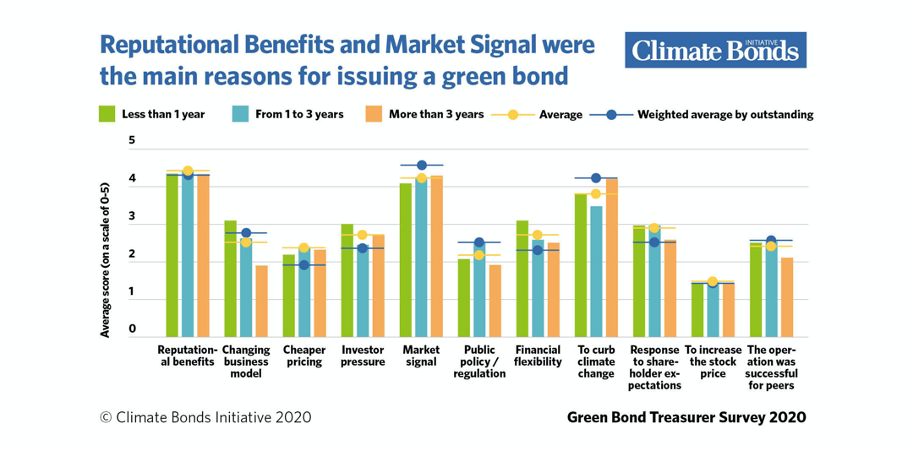

Intangibles were identified as both a motivation and a benefit resulting from issuing a green bond. Cheaper pricing was identified as an ancillary benefit and other impacts of issuing green bonds exhibit greater value to issuers at present. (See Chart 4)

Green bonds can be a catalyst for new green business lines: In some cases, issuing a green bond led to new business lines and commercial opportunities.

Positive impact on internal processes: Issuing green bonds can enhance risk management and strengthen internal relationships and commitment to sustainability. It was viewed as a positive exercise despite the additional costs and time required, which were mainly regarded as negligible or valid.

Primary obstacle is lack of eligible assets: The results of the survey highlighted a lack of eligible assets as an obstacle to growth of the green bond market.

This point echoed the results of the Climate Bonds Green Bond European Investor Survey 2019 in which respondents repeatedly raised limited green bond supply as an obstacle to market expansion.

Recommendation by most issuers: The overwhelming majority of respondents recommend that others should simply 'do it'.

Lars Mac Key, Head of DCM Sustainable Bonds, Danske Bank

“This survey shows the reason why we partner with Climate Bonds Initiative and have for many years. It provides valuable insight gathered from decision makers within green bond issuers, data and unique responses never previously available in the green finance market.”

“Based on our own experiences we all have our thoughts and hunches of how the market works. A survey like this - for which I see limitations in whom could carry it out if not the Climate Bonds Initiative - straightens those question marks and put facts rather than hunches on the table.”

Julie Becker, Deputy CEO of Luxembourg Stock Exchange and Founder of the Luxembourg Green Exchange

“The survey clearly reflects the respondents’ desire to reap the benefits of the green bond market and shows that the additional visibility, credibility and liquidity linked to the listing of a green bond on an exchange are highly appreciated by treasurers. In the current context, we see an increase in social bonds in response to the COVID-19 pandemic and we expect more and more organisations to broaden their scope of thematic bonds in the coming months.”

Dr Ivan Sangiorgi & Dr Lisa Schopohl, ICMA Centre, Henley Business School, University of Reading

“Collaborating with the Climate Bonds Initiative on this latest Green Bond Treasurer Survey and contributing with our research expertise to the analysis of the survey was a great opportunity. There is still a long way to go on the journey to combat climate change, but we believe that the insights from the survey are a vital step in the right direction and will help to grow the green bond market and facilitate the transition from a high- to low-carbon economy.”

Sean Kidney, CEO, Climate Bonds Initiative

“The survey advice from multiple treasurers to simply ‘do it’ on green issuance is a message to be taken up by sovereigns in their recovery capital raising programmes, the banking sector and corporates considering their transition pathways. The investor appetite is there. It will only increase as asset owners and institutional investor calls grow for climate, resilience measures and sustainability considerations be at the core of stimulus and economic response programs.”

Survey results in depth - Webinar Briefing

A Launch Webinar will be held on Friday 24th April 2020, 15:00 CEST (14:00 GMT) to discuss survey results in detail. Guest Speakers, Carlo Houblie, Luxembourg Stock Exchange and Lars Mac Key, Danske Bank in conversation with report Co-Authors from Climate Bonds Initiative.

Webinar Registration, via Zoom can be found here.

Green Bond Treasurer Survey 2020 is available here.

<Ends/More>

For more information:

|

Notes for Journalists

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Survey Background: Climate Bonds surveyed 86 green bond treasurers and equivalents to gain a comprehensive understanding of the experience of issuing a green bond including benefits and challenges.

The survey captures issuers from a variety of sectors, regions and markets. They range from new, single green bond issuers to experienced issuers who joined the green bond market in its early stages.

Climate Bonds partnered with Henley Business School on the statistical analysis of the results.

Respondents were divided into terciles to denote small, medium, and large issuers based on total bonds outstanding as of December 2019. These categories are used to describe respondents throughout this paper.

The cut-off date for green bond data is beginning of December 2019.

Acknowledgements: Climate Bonds Initiative thanks Danske Bank and Luxembourg Green Exchange for their sponsorship and support in the production of this report and Henley Business School, University of Reading for data support.

Suggested citation: Harrison C., Muething L., Tukiainen K. Green Bond Treasurer Survey, Climate Bonds Initiative, April 2020.

<Ends/More>

Charts and Tables

Chart 1 – Investor Response

Chart 2 – Investor Demand

Chart 3 – Cost of Funding

Chart 4 – Reasons for Issuing