Green Bond European Investor Survey

Fixed Income Managers want corporate transition issuance:

See impact, issuance and policy as drivers of market growth

LONDON 13/11/19 09:00 GMT: Climate impact, green credentials and supportive policy frameworks are at the top of investor responses to Climate Bonds’ first green bond investor survey, undertaken with forty-eight (48) of the largest Europe-based fixed income managers with a combined AuM of EUR13.7tn.

With supporting analysis from Henley Business School of Reading University and sponsored by the Credit Suisse, Danske Bank, Luxembourg Stock Exchange and Lyxor Asset Management the European Investor Green Bond Survey was undertaken during 2019 to identify approaches that would accelerate EU based and global green bond issuance.

Key Findings:

Investors are looking for green transition opportunities:

Corporate issuance was nominated by 93% of respondents as one of their preferred green bond investment channels followed by development banks at 76% and sovereigns on 57%.

(See Sector Findings)

Investors want deals with high climate impact:

The survey found a positive correlation between the level of interest in industry sectors with the pollution level (measured by GHG emissions) of those sectors. Respondents highlighted Industrials, Energy and Utilities, Consumer Discretionary, and Materials as the top sectors of interest.

(See Sector Findings)

Investors highly value green credentials and transparency:

All else being equal, the most important factor for making a green bond investment decision is satisfactory green credentials at issuance. Respondents demonstrated high expectations of integrity, with 79% saying they would definitely not buy a green bond if the proceeds were not clearly allocated to green projects at issuance, and 13% would be less likely to. Fifty-five percent (55%) would definitely sell if post-issuance reporting was poor, and 30% would be more likely to.

Policy a driver to investment:

Respondents view policy as the most effective way to scale up the green bond market, with standardisation of definitions being a priority. Policies such as tax incentives and differentiated capital treatment of low- versus high-carbon assets, designed to channel investment from high- to low-carbon assets, are also regarded as having high potential.

Lack of supply:

There is strong investor appetite for green bonds, with respondents consistently expressing demand for more bonds from more issuers in more sectors. Almost two-thirds of respondents (64%) said they prefer green bonds where available and competitively priced (over vanilla equivalents); over half of these also have a specific green bond fund and/or mandate.

Sector Findings

Corporates were identified as the most demanded issuer type, with respondents expressing an interest in the following five top sectors substantially above the rest:

- Industrials (e.g. transportation, machinery, services)

- Utilities (e.g. electric, gas, water)

- Consumer Discretionary (e.g. automotive, retail, electronics)

- Energy (e.g. oil & gas, but for renewable energy projects)

- Materials (e.g. metals & mining, chemicals, construction materials, forestry products)

Marisa Drew, CEO Impact Advisory and Finance Department, Credit Suisse:

“This survey is an important benchmark and source of high-quality feedback demonstrating how far the green bond market has evolved over the past decade. The size of AUM represented by the respondents and the increasing level of sophistication and rigour they are applying to the analysis of these instruments is a strong indicator of the support for, and adoption of, this market. It also reinforces the critical role the capital markets can play in helping the world allocate capital towards addressing climate change.”

“Investors also remind us in this survey, that improved transparency, standardisation, clear linkages of proceeds to green outcomes, and the inclusion of a wider issuer universe are all key to unleashing the full potential of green finance markets. This will require a concerted effort from issuers, underwriters, ratings agencies, regulators and policy makers.”

Bo Søndergaard, Head of SRI Bond Marketing, Danske Bank:

“The investor survey from Climate Bonds Initiative again provides us with some very useful information and offers some good insight to investor thinking, which in turn can help drive the green bond market even further. As an example, investors have been calling for increased transparency via allocation reporting and impact reporting, especially regarding greenhouse gasses, long identified as of high importance. This survey gives proof of those thoughts in a compiled format, strengthening our arguments in issuer advising discussions.”

“It is also encouraging to see investors expressing a strong interest for green corporate issuance, identified as the most in-demand issuer type."

Julie Becker, Member of the Executive Committee of Luxembourg Stock Exchange and Founder of the Luxembourg Green Exchange:

“The survey highlights the unmet demand for green bonds, and clearly suggests that there is a lack of adequate supply, especially from corporate issuers. Respondents call for more diversification in green bond issuers, and we hope that such feedback from the investor community will lead to an uptick in green bond issuance from corporate players. If we are to reach the UN Sustainable Development Goals, the private sector needs to mobilise and help drive the transition into a low-carbon economy.”

François Millet, Head of ETF Strategy, ESG & Innovation at Lyxor AM:

“Lyxor has pioneered the green bond ETFs market, launching the world’s first ETF on green bonds and is committed to providing investment solutions to aid climate transition. After partnering with CBI last year to conduct the first-ever survey on the French green bond market, we are happy to be a part of this new survey which sheds light on how investors’ expectations are shaping up this fast-growing market in Europe.”

Sean Kidney, CEO, Climate Bonds Initiative:

“The survey tells us that investor demand for green is strong and continues to build. There's a particular interest in companies and industries transitioning to green.”

“Robust offerings from heavy emitting industry sectors and their underlying corporates that demonstrate a credible brown to green commitment, corporate transition and capex plans that align with Paris goals and a zero-carbon direction will attract continuing institutional investor support.”

"The opportunity for policy-makers and governments is to build on this momentum to achieve the rapid capital shift towards low carbon investment is needed. Regulatory support and fiscally efficient incentives and policy measures can be instrumental in accelerating the market.”

European Investor Green Bond Survey 2019 can be downloaded here.

A Webinar will be held on Wed, 27 November 2019, 11:30 – 12:30 GMT to discuss survey results in detail. Registration can be found here.

<Ends>

For more information:

Head of Communications and Media,

Climate Bonds Initiative

+44 (0) 7914 159 838

andrew.whiley@climatebonds.net

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Survey Background: Climate Bonds surveyed 48 of the largest Europe-based investment managers to gain a comprehensive understanding of how the fixed income investment community is addressing or intending to address climate change through investment decisions.

The total assets under management (AUM) of respondents is EUR13.7tn, and their total fixed income AUM is EUR4.3tn, with an average of EUR90bn and median of EUR34bn.

Climate Bonds partnered with Henley Business School on the statistical analysis of the results.

Some of the results were analysed using weighted averages based on the fixed income AUM of respondents where known.

Respondents were divided into terciles to denote small, medium, and large investors based on fixed income AUM. These categories are used to describe respondents throughout this paper.

The cut-off date for green bond data is end of April 2019. However, where appropriate, subsequent deals are mentioned. This is particularly relevant for sovereign green bond issuance.

Acknowledgements:

Climate Bonds Initiative thanks Credit Suisse, Danske Bank, Lyxor Asset Management and Luxembourg Stock Exchange for their sponsorship and support in the production of this report.

Further developments:

Climate Bonds Initiative, supported by Credit Suisse is working to address aspects of investor asks highlighted in this survey with the announcement of the Sustainable Transition Bond Initiative to assist the corporate brown to green transition.

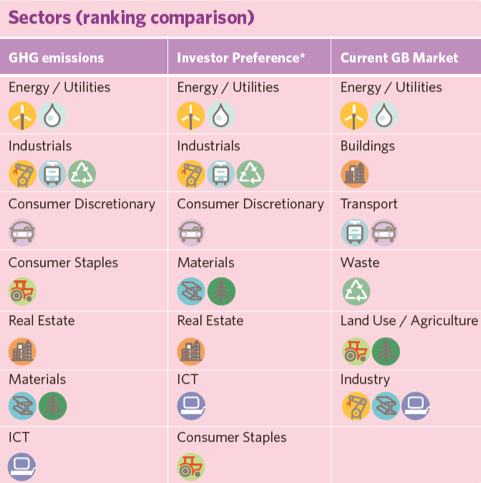

Table 1: Sector Ranking Comparison

Comment: Respondents highlighted Industrials, Energy and Utilities, Consumer Discretionary, and Materials as the top sectors of interest. Greater sector diversity would be a welcome development. From the top five bond issuers in the top five sectors – i.e. out of 25 bond issuers – only six have issued green bonds. This points to significant potential for unmet demand to be fulfilled through scaling up green bond issuance.

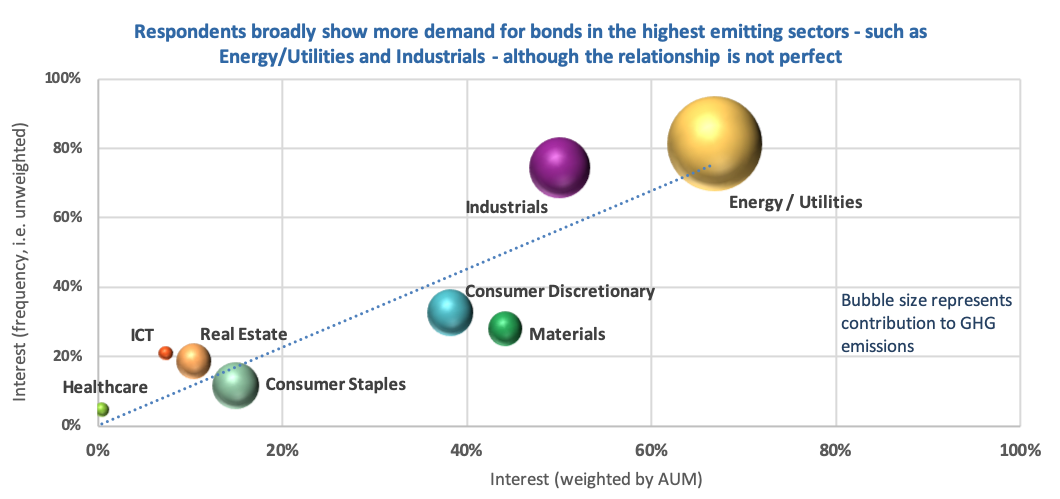

Figure 1: Respondent demand

Comment: There is a broad positive correlation between the level of interest in sectors with their GHG emissions. This is likely due to the higher need for green investment being precisely in the most polluting sectors, and the fact that green bond issuance is severely lacking in some high-emission sectors like Industrials and Metals/Mining.

Materials – and to some extent Industrials – garnered relatively more interest from respondents than their emissions would suggest, whilst Consumer Staples (e.g. agriculture) seems to be less demanded relative to its level of pollution. It is also noteworthy that Consumer Discretionary is considerably more in demand than Consumer Staples, despite similar GHG emissions, due to substantial demand for automotive bond exposure.

****************************************************