Climate Bonds Initiative publishes Korea Climate Bond Market Report

First analysis on South Korea’s green bond market

Potential as growth driver in regional green bond markets

LONDON: SEOUL: 19/03/18 14:00 GMT: The Climate Bonds Initiative has released its first report exploring Korea’s green bond market and prospects for development. The report contains a host of recommendations to lever the potential in South Korea’s existing bond market that has annual issuance volumes of USD700bn, making it one of the largest in the world.

The Korea Climate Bond Market report was commissioned by SK Securities and will be launched in Seoul and at the Climate Bonds Initiative annual conference being held in London on 20-21st March.

Domestic Issuance

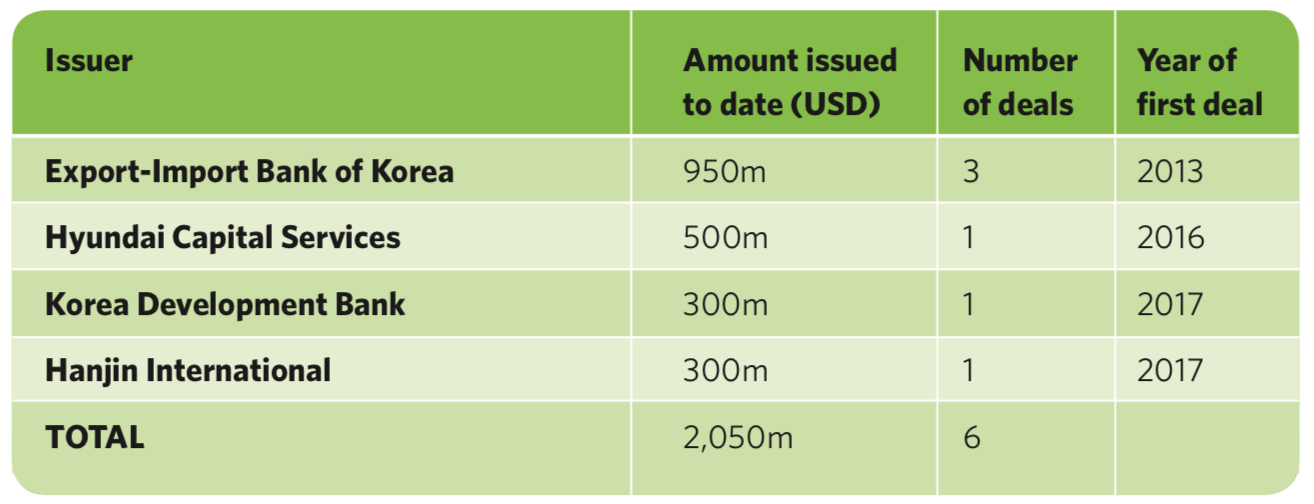

Korea Export-Import Bank (KEXIM) was the first issuer to come to market in 2013 and the only repeat issuer to date, accounting for 46% of total issuance. 2017 has seen two new issuers: Korea Development Bank and Hanjin International, signalling increased engagement within Korea’s governmental institutions and corporations.

Korea’s positioning in the regional green bond market

Korea’s green bond market is still small compared to the global context, with only six green bonds coming from four issuers and totalling USD2.05bn to date. The country’s market characteristics provide an opportunity of climbing further up the ranks.

However, when analysing the Asia-Pacific region, Korea at USD2.05bn is the fifth largest cumulative issuer after China on USD47.7bn, India USD6.6bn, Japan USD6.1bn and Australia USD4.6bn. In the last six months, green bonds have also emerged from Fiji New Zealand, Fiji, Indonesia, Malaysia and Singapore.

Growth Potential

The government’s commitment to a 37% GHG emissions reduction by 2030, combined with the country’s emission trading scheme implemented in 2015, provide a policy environment that can effectively support the further development and expansion of the country’s green bond market.

A total universe of USD18bn outstanding bonds that are not labelled as green but are financing projects/assets aligned with a low carbon transition has been identified for Korea.

The country’s growth potential could be even greater, since this measure doesn’t capture financial institutions and property, which could become important issuers of green bonds in the future.

Korea’s overall bond market size, one of the largest worldwide, financial system stability and strong industrial economy, issuance from key state-backed institutions, strong climate commitments and a large local investment market are hallmark factors that makes the ROK a prime candidate to lead new regional and global growth in green and climate bond issuance.

In order for the market to reach its full potential, actions can be taken by government and regulators as well as investors.

Korea Climate Bond Market makes a number of recommendations to assist the development of climate and green based finance and capital markets:

- Strategic issuance from sovereign or public entities to mobilise the scale and liquidity needed to encourage trading and facilitate price discovery.

- Development of national green finance guidelines to promote best practice, raise awareness, and build investor confidence.

- Provision of tax incentives for investors in domestic green bonds.

- Strong market signals from central banks to encourage market development.

- Advocate for scale-up of green bond issuance to engage investors and ensure thatinvestments meeting their criteria are available.

- Support market standards to strengthen transparency around green projects and facilitate decision making on future infrastructure investment.

Kwangyul Peck, Senior Advisor, SK Securities:

“Our support for Korea Climate Bond Market report is a reflection of the partnership between SK Securities and the Climate Bonds Initiative and our joint goal of growing climate based investment in Korean financial markets. The report gives stakeholders, market participants and regulators a valuable resource to help stimulate debate as we position for the future.”

Sean Kidney, CEO Climate Bonds Initiative:

“There are vast investment opportunities to implement climate resilient infrastructure both domestically and in the wider region. The capital re-allocation to meet climate and emissions targets must be accelerated. The report points to the policy shifts in support for green finance can help create the investment momentum needed in the region.”

“Korea’s bond market has grown at a rapid pace to become one of the largest in the world. Korea Climate Bond Market report demonstrates how some of this scale and development could be replicated to stimulate domestic investment in climate and green based finance.”

<ENDS>

For more information:

Andrew Whiley

Head of Communications and Media,

Climate Bonds Initiative, London

+44 (0) 7914 159 838

andrew.whiley@climatebonds.net

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

A copy of Korea Climate Bond Market report is available here.

About SK SECURITIES: SK Securities Co., Ltd. is a Korea-based financial service provider specialized in the securities market, with a focus on clean energy, carbon emissions policy analyses, and carbon credit trading in Korea. Business lines include investment banking which provides acquisition and project financing services, as well as wealth management services. For more information, please visit http://www.sk.com/.

Disclosure: In November 2016, SK Securities and Climate Bonds Initiative signed a MoU to jointly promote green market growth in Korea. More information is here.

Ends