Framework applicable for both whole entities as well as their activities, aimed at a broad range of financial products including use-of-proceeds and sustainability-linked debt

Climate Bonds and Credit Suisse have published the ‘Financing Credible Transitions’ paper, a document that presents a framework for defining ambitious and credible transition pathways for companies that will collectively reduce global emissions and deliver the goals of the Paris Agreement.

Climate Bonds and Credit Suisse have published the ‘Financing Credible Transitions’ paper, a document that presents a framework for defining ambitious and credible transition pathways for companies that will collectively reduce global emissions and deliver the goals of the Paris Agreement.

Without a unifying definition of ‘transition’ in the market and with investor concerns around greenwashing, this transition framework has been established to assist in the mobilisation of global capital flows towards activities that enable the transition to a Paris Agreement-aligned economy. The aim is to support the rapid growth of a transition bond market as part of a larger and liquid climate-related market and deliver confidence for investors, clarity for bankers, and credibility for issuers.

To date, green finance frameworks and capital flows have been principally directed at activities that can be considered ‘already green’. There has been significantly less investment in transitioning activities and assets that are associated with the highest carbon-emitting industries and businesses.

Economy-Wide Focus

The white paper promotes an economy-wide transition in which companies should transition away from existing activities towards better alternatives. For some, low or zero-emission solutions are possible. For others, there are no such solutions so substitute low-emission activities are in development.

The Framework, which is applicable for both whole entities as well as their activities, goes beyond the use of proceeds model common in the green bond market and is applicable to a broad range of financial products including use of proceeds and sustainability-linked debt.

Marisa Drew, Chief Sustainability Officer and Global Head of Sustainability Strategy, Finance and Advisory at Credit Suisse:

"While much of the focus on the capital markets has rightly been on green and sustainability bonds, we see transition bonds as being a significant game-changer in terms of broadening the universe of issuers who can begin to transition towards sustainability. This paper represents an important milestone in the development of the sustainable finance markets and one which helps us all transition to a low-carbon economy.”

Sean Kidney, CEO, Climate Bonds Initiative:

“We have a tough job ahead to achieve our Paris Agreement targets and avoid catastrophic climate change. We’ve started, with clean energy, EVs, and of course green finance. Now we must tackle hard to abate sectors, like steel, oil & gas, plastics & cement. We need to transition them, quickly. Financing them with Transition Bonds. This paper sets out the pathways for that transition investment market to grow.”

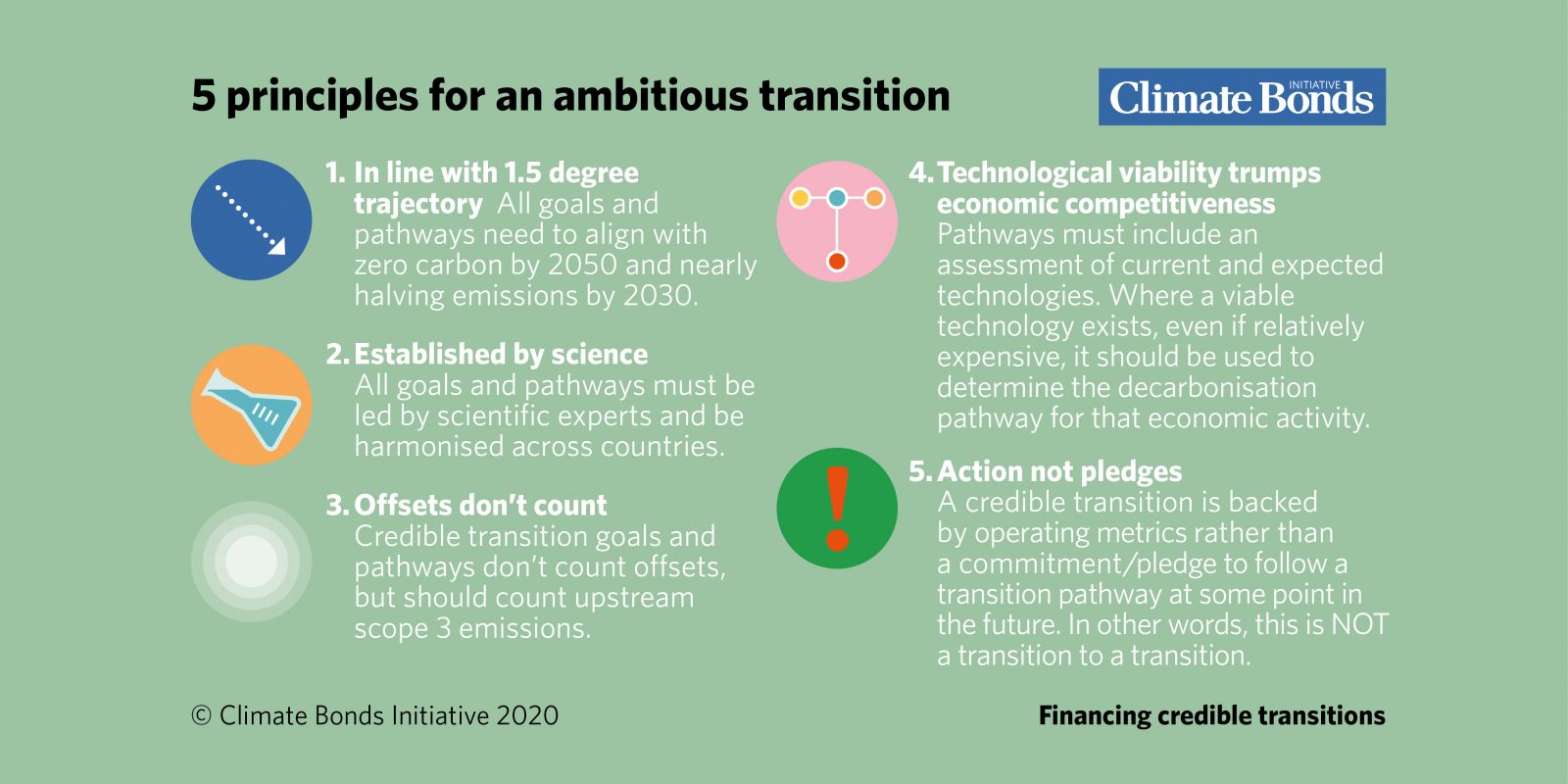

Five principles for ambition transition

The paper, which is the result of a collaborative effort between Credit Suisse and Climate Bonds, has established five principles for an ambition transition. All goals and pathways need to:

-

Align with zero carbon by 2050 and nearly halving emissions by 2030;

-

Be led by scientific experts and not be entity- or country-specific;

-

Be sure that credible transition goals and pathways don’t count offsets;

-

Include an assessment of current and expected technologies which can be used to determine a decarbonization pathway;

-

Be backed by operating metrics rather than a commitment or pledge.

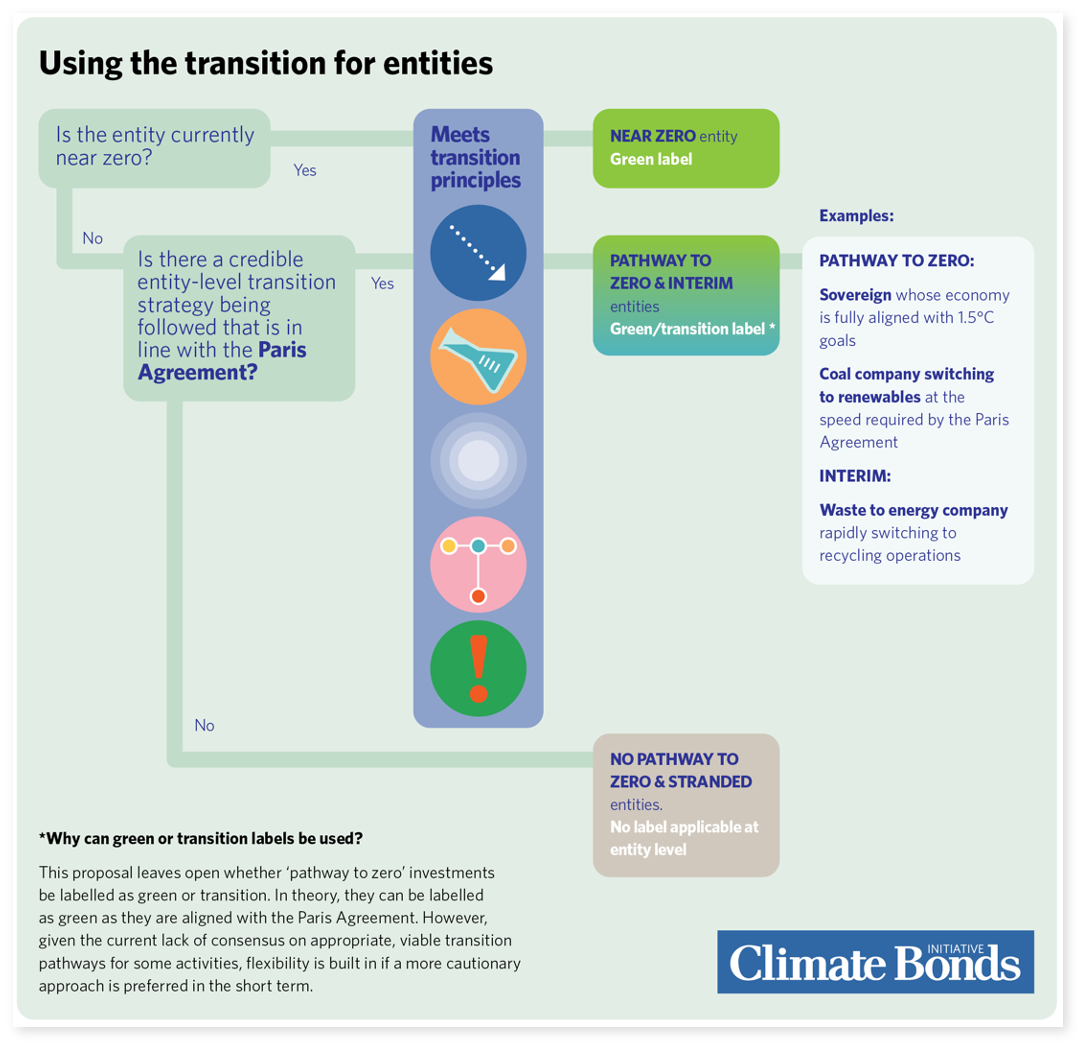

Transition flow for entities

This is a flexible framework, applicable to whole entities IF they are following a credible transition pathway. How do they know they are following a transition pathway? They can see this flow chart (and if the transition isn’t applicable for this as an entity, they can use the activity flow chart - see below.)

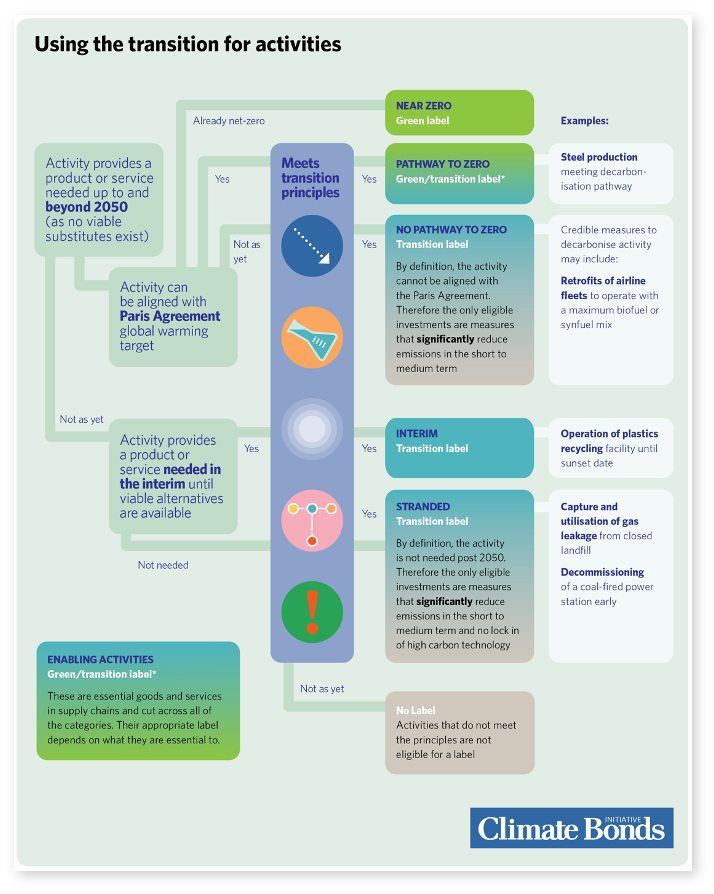

Transition flow for activities

For some high-emitting activities, low/ zero-emissions solutions are available - transition should be towards those solutions. For others, there are no such solutions but substitute low-emission activities exist and so the transition should be towards better alternatives. The nature of transition differs depending on the need and potential to decarbonise them. How do you know if a transition label is applicable to an activity? They can use the flow chart below.

The last word – Large emitters and transition investment – A market opportunity

The green and sustainable bond markets have seen incredible growth in recent years, with a broadening number of government entities and corporates engaging with investors to finance debt while making an environmental or social impact.

However, large emitters are still largely absent and present an opportunity for the markets to aid their sustainable transition. In order to fill this gap, the ‘transition bond’ concept and label has emerged for those bonds that do not meet the criteria and market adopted standards for green bonds but which are associated with issuers who are transitioning to decarbonised business models and are particularly targeted at the high carbon-emitting sectors.

Keep a lookout for our upcoming Transition Webinar Series!

‘Till next time,

Climate Bonds