From NASA with love? Lessons from the moon-shot decade

Transition Finance Webinar: 30th November 14:00 GMT. Register here.

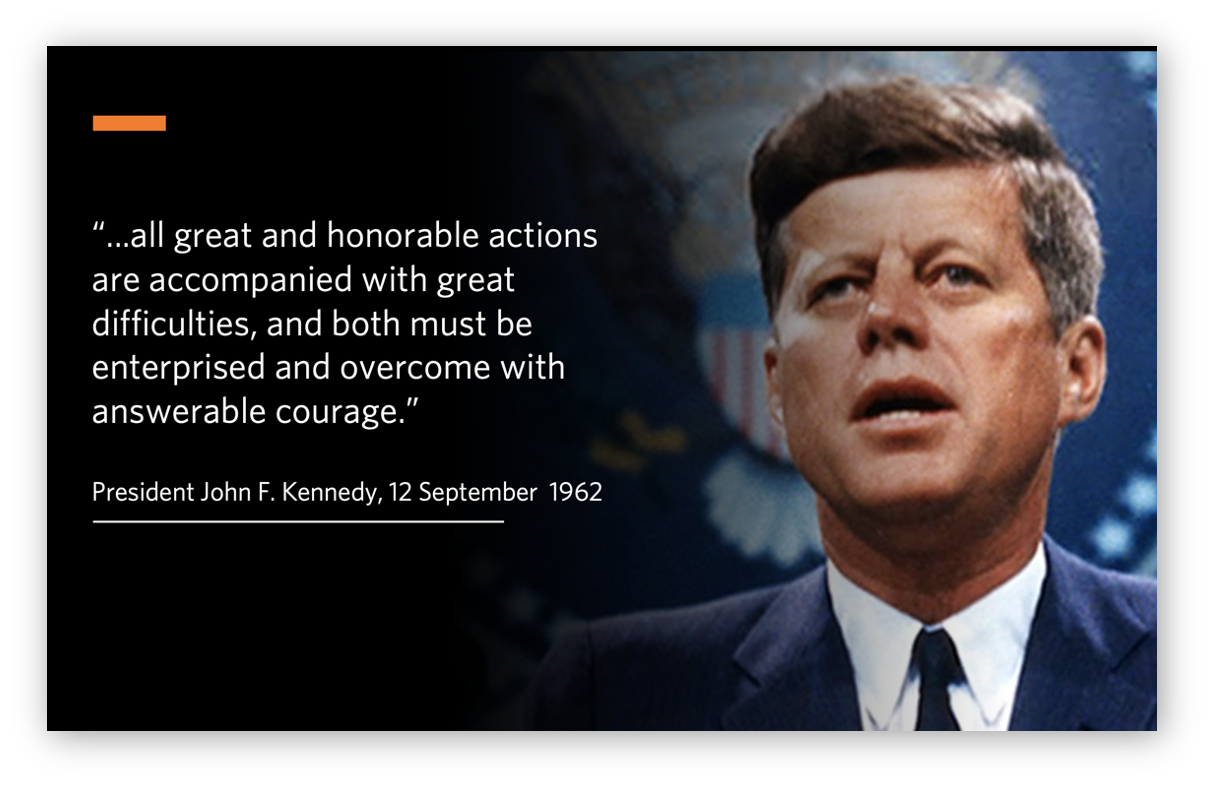

For many people, the enormous challenge of emissions reduction of 50% by 2030 and then reaching towards Net-Zero-by-2050 seems as unachievable as putting a man on the moon was back at the beginning of the '60s. John F Kennedy’s seminal 1962 Rice University address, aspiring to reach that goal by the end of the decade did not shirk at the size of the challenge, nor was it lacking in confidence that it could be met.

As JFK said in quoting William Bradford from way back in 1603:

“...all great and honorable actions are accompanied with great difficulties, and both must be enterprised and overcome with answerable courage.”

Transition Ambition & Investment to 2030

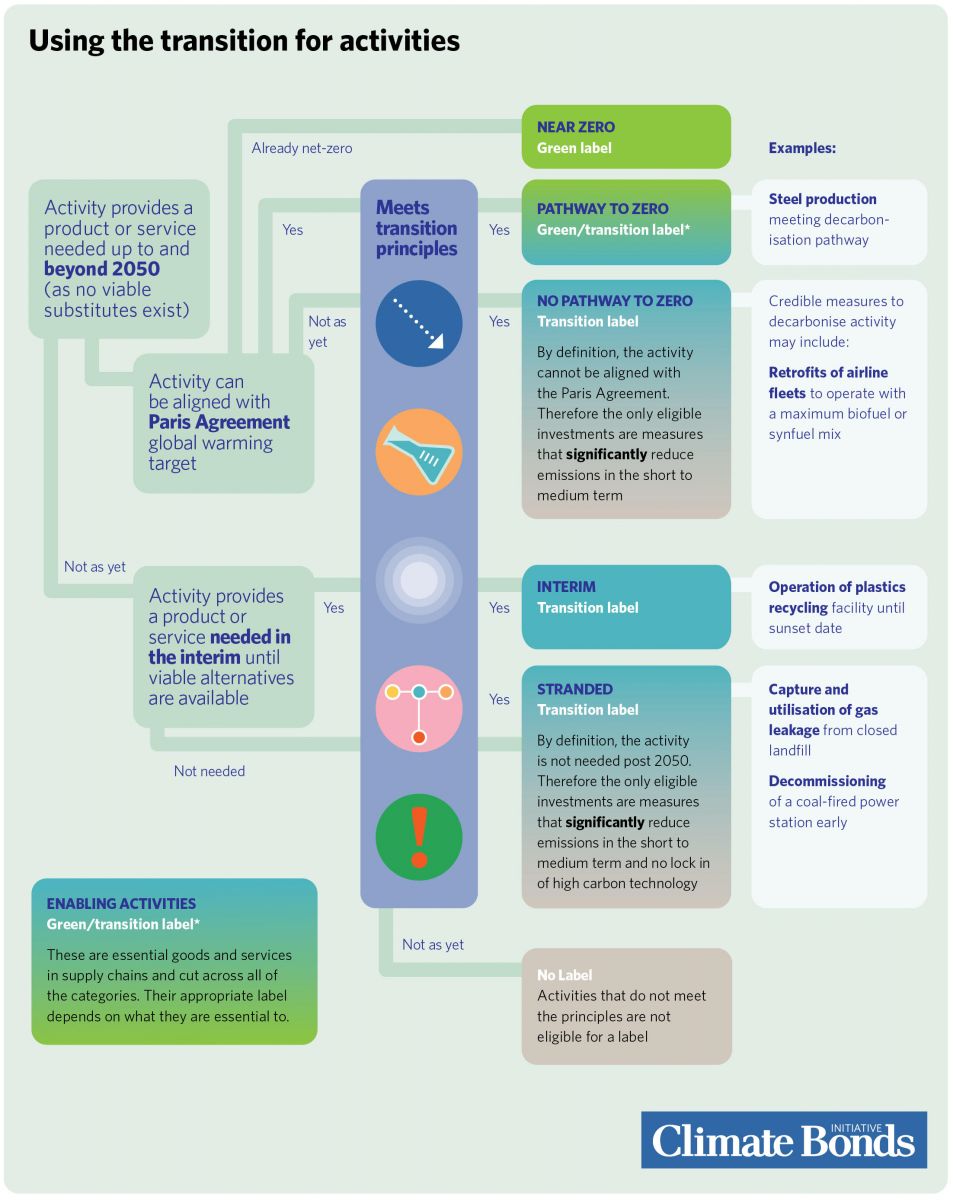

The speed and manner in which every sector transitions to align with the goals of the Paris Agreement are crucial. For some sectors, this will mean sunsetting high emissions activities and switching to activities that can play a part in a net zero economy. For others, it will mean entities adopting new technologies quickly.

Instrumental to any such shift will be mobilising the capital required. Kennedy spoke of a billion dollars for the space race, comparing it to the amount spent annually in the US on cigarettes and cigars. The climate race however, will be won with trillions, in part from investment and capex shifting away from high carbon processes and new incentives for low carbon business models and technology.

Every sector - Alignment in the 2020s

Race to net zero by 2050 requires all sectors to play a part. The first stage is alignment towards 2030 targets. For some sectors, how to decarbonise is clear, for others it is not yet known for example aviation. There are activities that will be needed for some time as we transition, but ultimately have no role in a net zero world. In the paper, these are termed ‘interim’ - such as energy production from municipal waste (which hopes a circular economy will develop that negates the need for such a facility).

Every sector, whether currently ‘green’ or ‘brown’ or ‘grey’, needs to define their own transition pathway.

Aiming high - At Net Zero

It will not be enough to reduce emissions or to make polluting industries a little less bad. To achieve the real shift necessary to deliver net zero, many sectors will need to completely reimagine how they operate. Emissions reduction needs to be the defining measure that underpins the business strategy of every sector. Not solely the promise but real alignment with the Paris Agreement, and the delivery of real change measured through operating performance.

Green Finance to Transition Finance & Transition Bonds

The investment capital can be mobilised by learning lessons from the now well-established green bond market which provides a roadmap through transition-related bonds and other instruments. This may mean going beyond the use of proceeds model, common in the green bond market, and incorporating a wider range of financial models.

Like early space explorers found, new territory bears new problems and new dangers. Yet amidst the risks there are opportunities too. Climate Bonds learned from multiple investors earlier in 2020 that there is a readiness to come to market, a desire for investors to play their part.

Financing Credible Transitions- Five Core Principles

Whilst change can be delivered in a number of ways, a robust framework needs principles that signal the credibility of transition. Our, Financing Credible Transitions paper, launched in September with Credit Suisse, is the very first body of work that establishes five Core Principles for Transition. These Principles lay the groundwork for a Transition label that will move investment decisively and enable investors to easily find climate-proof investments (and avert potential criticism of greenwashing). And furthermore, we aim to develop criteria that define credible and ambitious transitions.

Whilst change can be delivered in a number of ways, a robust framework needs principles that signal the credibility of transition. Our, Financing Credible Transitions paper, launched in September with Credit Suisse, is the very first body of work that establishes five Core Principles for Transition. These Principles lay the groundwork for a Transition label that will move investment decisively and enable investors to easily find climate-proof investments (and avert potential criticism of greenwashing). And furthermore, we aim to develop criteria that define credible and ambitious transitions.

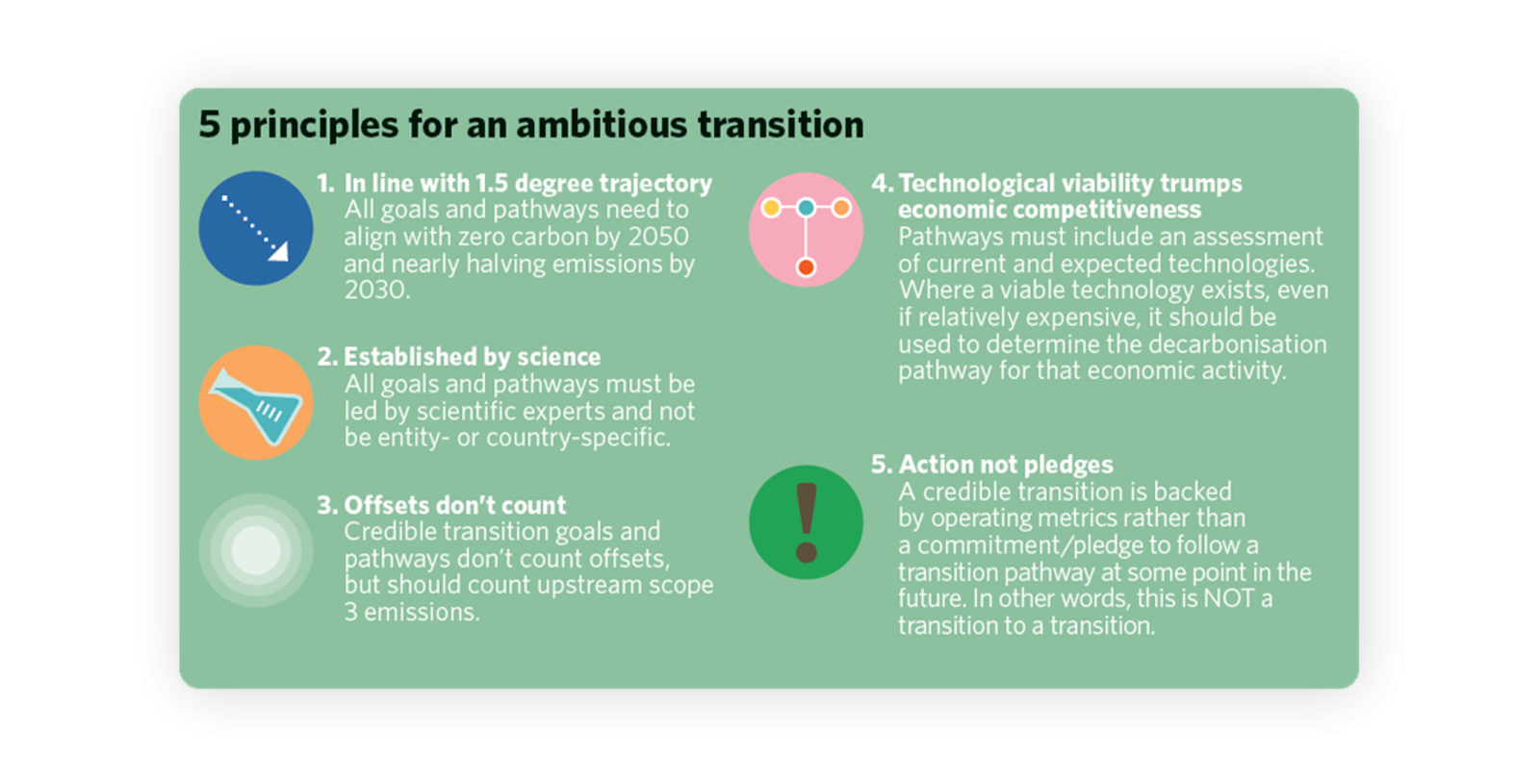

Climate Bonds proposes the following 5 Principles for a transition with impact.

All goals and pathways need to:

- Align with zero carbon by 2050 and nearly halving emissions by 2030;

- Be led by scientific experts and not be entity- or country-specific;

- Be sure that credible transition goals and pathways don’t count offsets;

- Include an assessment of current and expected technologies which can be used to determine a decarbonisation pathway;

- Be backed by operating metrics rather than a commitment or pledge.

Setting the Scene for Transition

Over the last decade Climate Bonds has shaped a whole new asset class in Green Bonds and Loans and can expand this to form a single, liquid investable market by setting standards for credible transitions.

The structures and processes are in place to convene experts to work collaboratively on defining what transition looks like. The existing science-based process created by Climate Bonds for developing the Climate Bonds Standard and underlying Sector Criteria for green bonds, loans and sukuk can also be used to set criteria for assets, activities and projects in transition.

A logical expansion would then be to set the criteria for a whole entity – to detail the ambition a whole business should encompass when setting out its transition strategy.

Climate Bonds is now gathering experts, scientists and technical innovators, along with industry voices and investor representatives to define what these guide rails look like.

We’ll have more to say in 2021 as we add Transition to Climate Bonds forward program and also expand the umbrella of our existing green criteria and extend our data analysis capabilities around social and sustainability bonds.

The last word

We have the Core Principles, the guidance framework and soon we will have the Criteria to facilitate investment towards green transition.

It requires all of us; corporates, regulators, asset owners, and managers, to assess and address what JFK described as the ‘new ignorance, new problems and new dangers’, and to deliver the ‘breath-taking pace’ required to deliver net zero.

We need not just the optimism of the early space race, but the readiness to take on the challenge and the drive to win. Like JFK led NASA way back in ‘62, so too for us in 2020: we choose to tackle climate change because:

‘...the challenge is one we are willing to accept, unwilling to postpone and one we intend to win.’

'Till next time,

Climate Bonds

![]() Climate Bonds & Credit Suisse will be discussing Transition on 30th November 14:00 GMT You can find out more and Register here.

Climate Bonds & Credit Suisse will be discussing Transition on 30th November 14:00 GMT You can find out more and Register here.