Downloads:

- Standard V2.1

- Standard V3.0

|

| Climate Bonds Standard V2.1 |

| Standard V2.1 - Chinese Translation |

| List of Debt Instruments (English and Chinese) |

The current version available for use is Version 3, which was launched in December 2019.

The previous Version 2.1, can be downloaded from the menu on the right.

Please contact our Certification Team if you would like to find out more about certifying debt instruments.

The development of this latest version is based on feedback from green finance markets stakeholders, similar to the processes used to develop previous versions.

Version 3.0 incorporates the most recent Green Bond Principles (GBP) 2018 to reinforce a framework with global and widespread applicability. It also harmonises with other regional and international approaches, such as the Green Loan Principles, the EU Green Bond Standard (draft) and the ASEAN Green Bond Standard.

The structural changes clarify the alignment with the GBP 2018 structure and also includes smaller changes to the actual requirements of the Standard regarding characteristics of green bonds and assets, to establish international consistency in the green label.

What are the main changes?

- Increased requirements for disclosure, in line with GBP 2018.

- More clarity on reporting requirements, before and after issuance of the bond.

- Further flexibility for issuers with staged allocation of proceeds.

In addition, Version 3.0 has a clearer definitional approach to the core elements of the Climate Bonds Standard:

- Pre-issuance requirements,

- Post-issuance requirements,

- Green definitions, and

- Certification process.

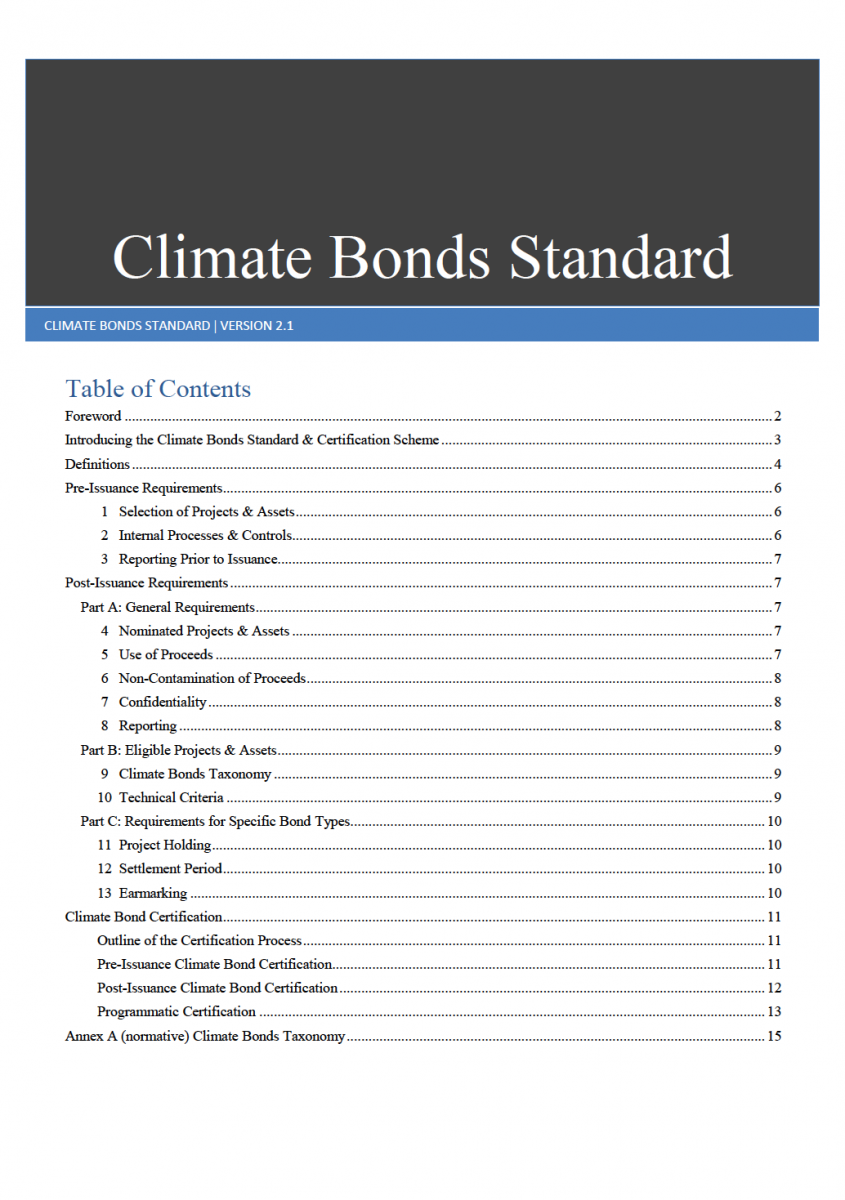

Version 2.1

Standard Version 2.1, released in January 2017, incorporated a range of process improvements including an expansion of the range of debt instruments that could be Certified under the Standard and the inclusion of a Programmatic Certification option that streamlined the verification process for regular issuers with large portfolios of eligible assets.

The Programmatic Certification option has been very popular among large multiple green issuers including global banks, US municipalities, transport operators and energy companies.

This revised version of the Standard is based on all the valuable feedback we received from issuers, verifiers and existing partners as well as on the need to adapt to the demands of the fast-growing green bond market. It also fully integrated the 2016 update of the Green Bond Principles.

V2.1 includes two main additions to V2.0:

- The expansion of the Range of Debt Instruments that can now be certified under the Standard;

- The inclusion of a Programmatic Certification option that will streamline the verification process for regular issuers with large portfolios of eligible assets.

Version 2.0

Standard 2.0 was released in December 2015, in order to provide the investment community with improved guidance for climate and green based investments following the success of Paris COP21.