Expanding scope from energy to infrastructure: Certification for individual debt instruments to whole entities: one global standard applicable across diverse jurisdictions, sectors, and instruments for a greener future

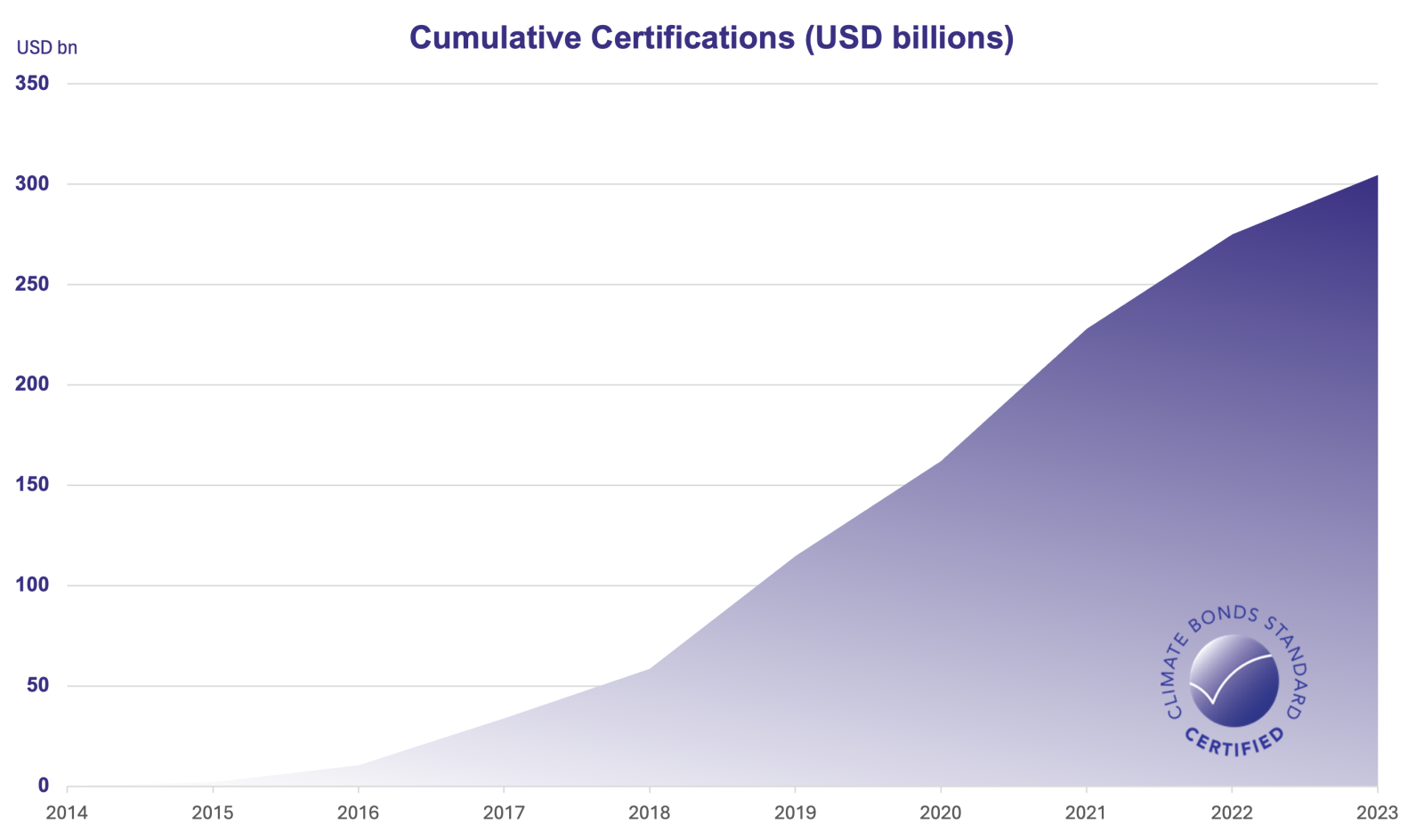

By the close of 2023, Certified Climate Bonds have reached USD 300 billion, reflecting the Climate Bonds Standard and Certification Scheme’s role in setting benchmarks for climate investment.

This figure extends over 16 sectors and 20 types of debt instruments (inlcuding bonds, project bonds, securitisation bonds, loans, green deposits, green repos, commercial paper, CRA, RMBS, sukuk, revolving credit facilities, convertible bonds, covered bonds, private placement, to name a few), highlighting the broad applicability and growth of the Climate Bonds Standard.

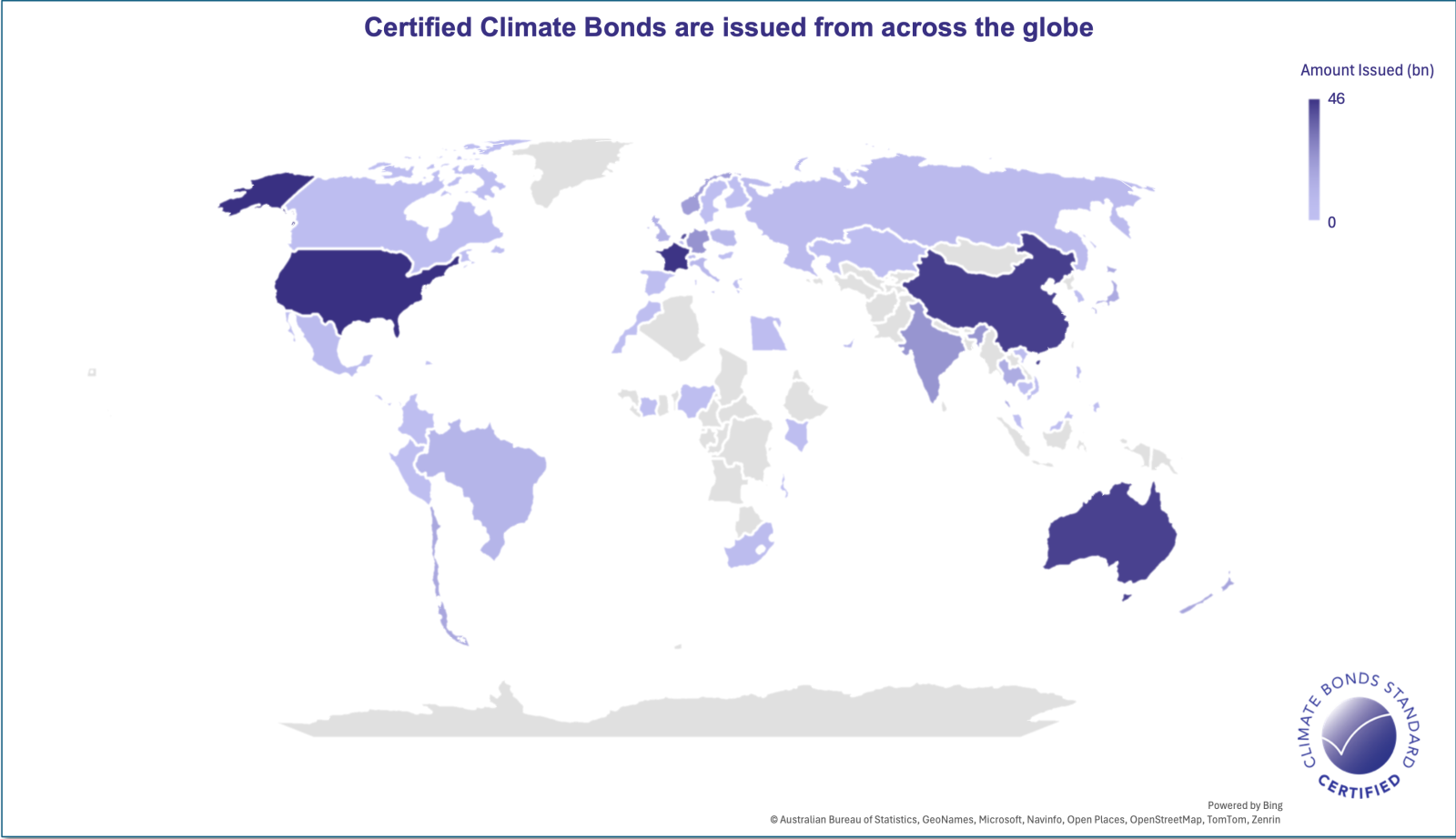

The Climate Bonds Standard, with certifications in 52 countries from 294 issuers, covers an extensive array of climate-focused debt instruments. This includes sovereign and sub-sovereign bonds, prominent banks, and major issuers in sectors such as transport, energy, buildings, and water, reflecting its broad sectoral adoption.

2023: Expansion of Climate Bonds Standard with Version 4.0 and Beyond

Building on the momentum of reaching USD 300 billion milestone in certified bonds, 2023 was a landmark year for the Climate Bonds Standard. The release of Standard Version 4.0 marked a significant 'structural expansion' of our certification scheme. This evolution has broadened the scope far beyond traditional debt instruments such as green bonds and sustainability-linked bonds (SLBs). For the first time, entire company entities can now be certified, revolutionising the way organisations can demonstrate their green credentials. For the first time, companies as a whole can achieve certification, ensuring their entire operations adhere to the best practice standards in the market.

This holistic approach provides investors with a more comprehensive assurance that their investments are not only supporting individual green projects but are also backing entities wholly committed to sustainable practices. This entity-wide certification serves as a robust indicator of genuine, across-the-board adherence to green principles, offering investors a higher level of confidence in the legitimacy and impact of their sustainable investments.

Moreover, 2023 saw the Climate Bonds Standard extend its reach not only across various debt instruments and entity certification but also into more diverse sectors. This included hard-to-abate sectors like Cement, Chemicals, Hydrogen, and Steel, which are critical to global decarbonisation efforts. In addition, we are gearing up to introduce new criteria for Deforestation and Conversion Free, Agri-Crop and Livestock, Electrical Utilities and Critical Raw Materials.

This expansion reflects our commitment to continuously evolving and adapting to the needs of a rapidly changing global environment, ensuring that the Climate Bonds Standard remains at the forefront of sustainable finance.

The full list of sectors available for Certification can be found here.

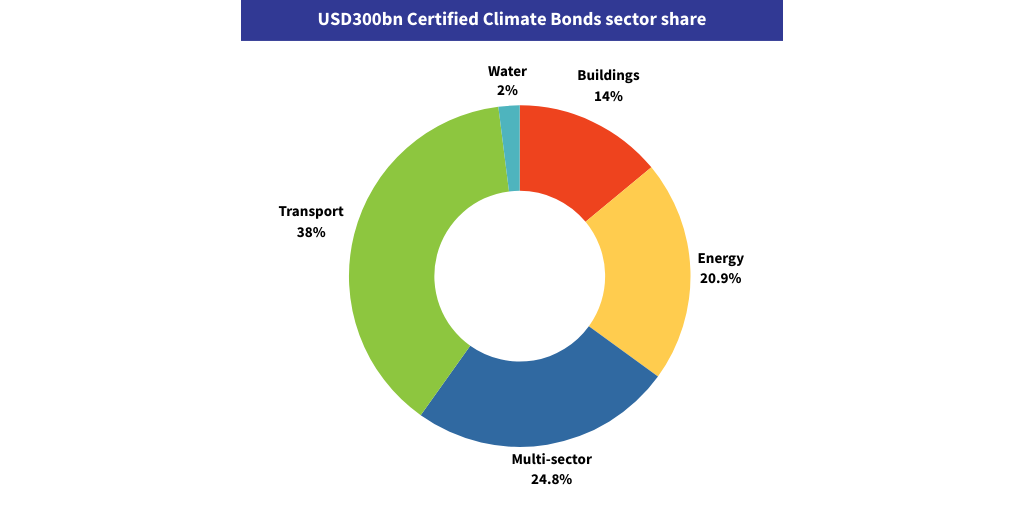

Sector Share

Below is the snapshot of the USD300bn issuance by sector as of the end of 2023. The largest share of issuance comes from the Transport sector at USD115.9bn, followed by Energy at USD63.7bn, then Buildings at USD42.6bn and Water at USD6bn. The remaining share is across multiple sectors amounting to USD76.5bn which includes prominent sectors such as Industrial USD330m, Waste USD289m, Shipping USD247m, and Forestry USD109m.

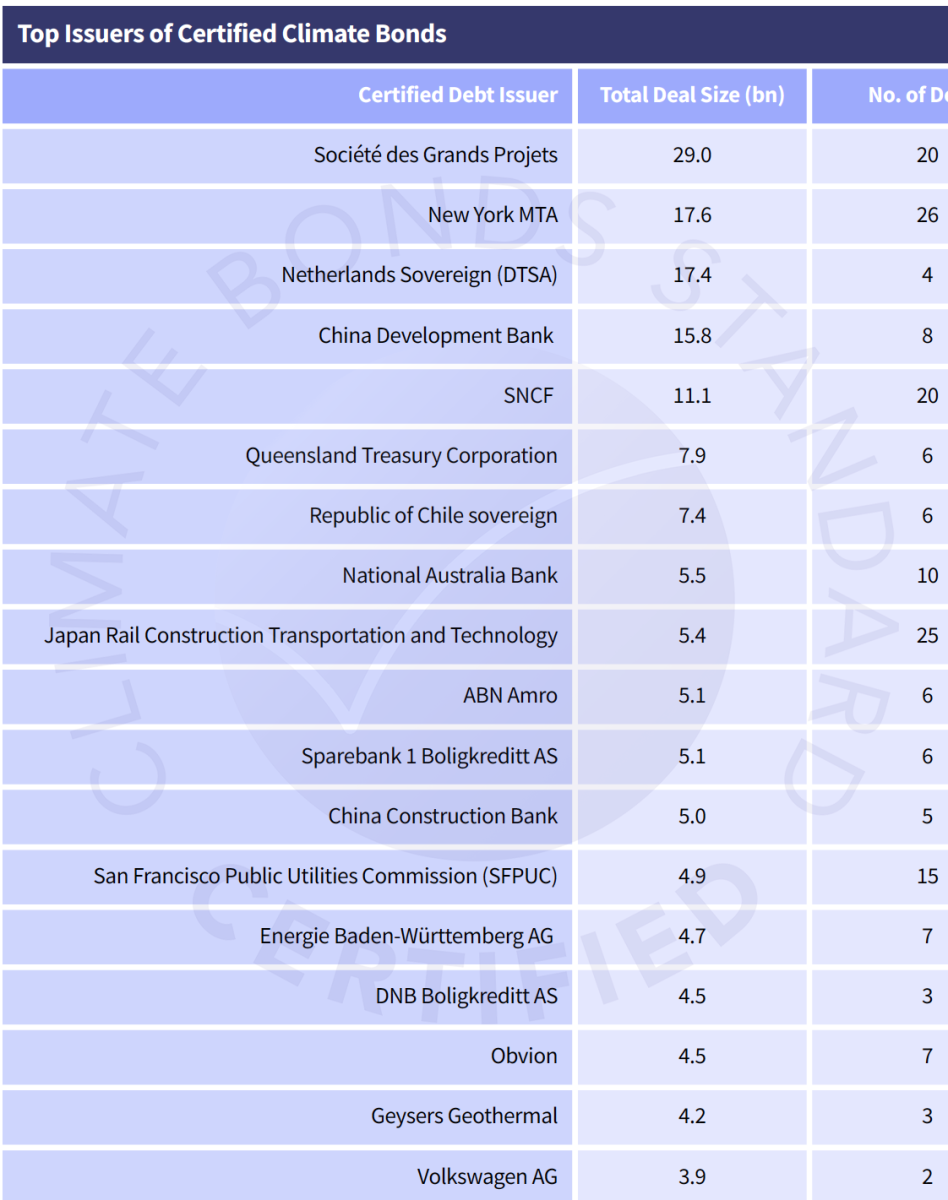

Top Issuers

The roster of top issuers contributing to the USD 300 billion in Certified Climate Bonds reflects a wide range of participants. This includes transport sector leaders such as Société des Grand Paris, Japan Rail Construction Transportation and Technology (JRTT), New York Metropolitan Transportation Authority (NY MTA), SNCF, and Volkswagen AG, alongside major financial institutions like China Development Bank and sovereign issuers including the Netherlands and Chile. The diversity of these issuers illustrates a global commitment to adopting market best practices. To access the full database of Certified Climate Bonds follow here.

Spotlight of Climate Projects and Solutions

Trailblazers across sectors are setting precedents in their regions by directing their Certified Climate Bond proceeds towards pioneering climate solutions. Here are some we have spotlighted and to see the full database of Certified Climate Bonds, follow here.

Agriculture Sector: Fs Bionergia, Brazil

Fs Bionergia, in Brazil, distinguishes itself as a Certified Programmatic issuer and the first plant to produce 100% corn ethanol through a sustainable business model.

Fs Bionergia, in Brazil, distinguishes itself as a Certified Programmatic issuer and the first plant to produce 100% corn ethanol through a sustainable business model.

Committed to increasing global demand for renewable energy sources, Fs Bionergia focuses on reducing greenhouse gas emissions.

This innovative and sustainable approach positions Fs Bionergia at the forefront of renewable energy production, setting a benchmark in the industry.

Buildings Sector: Oberlin, USA

For Oberlin College, achieving Certification aligns with its strategy to attain campus carbon neutrality by 2025.

For Oberlin College, achieving Certification aligns with its strategy to attain campus carbon neutrality by 2025.

The Bonds issued are partially financing the college's Sustainable Infrastructure Program (SIP), anticipated to cut campus greenhouse gas (GHG) emissions by 66%.

This funding is supporting key projects such as implementing energy conservation measures, transitioning the campus steam system to a more efficient hot water system, and installing a geothermal heat pump, all pivotal in reducing the college's environmental footprint.

Energy Sector: Noor , UAE

This was the first certification to come from the Middle East region, and an OPEC member country. When completed in 2022, this was the largest Concentrated Solar Power (CSP) facility in the world, with a design capacity of 700MW.

This was the first certification to come from the Middle East region, and an OPEC member country. When completed in 2022, this was the largest Concentrated Solar Power (CSP) facility in the world, with a design capacity of 700MW.

This development is the fourth phase of the Mohamed bin Rashid Solar Park, which is due to complete development in 2030, with a final design capacity of 5GW.

Forestry Sector: EcoAgro, Brazil

In the Forestry Sector, EcoAgro in Brazil stands out with its innovative application of bond proceeds. As part of Eco Securitizadora de Direitos Creditórios do Agronegócio S.A., the Use of Proceeds from their Bonds is dedicated to financing advanced fire detection systems. These systems involve high-resolution cameras mounted on communication towers, each covering a 15km radius (70,000ha) and equipped with automatic detection capabilities. Utilizing AI algorithms, these systems can detect fire outbreaks more rapidly than satellites, pinpointing the exact location of a fire outbreak within 3 minutes. This technology represents a significant advancement in forest fire management and environmental protection.

In the Forestry Sector, EcoAgro in Brazil stands out with its innovative application of bond proceeds. As part of Eco Securitizadora de Direitos Creditórios do Agronegócio S.A., the Use of Proceeds from their Bonds is dedicated to financing advanced fire detection systems. These systems involve high-resolution cameras mounted on communication towers, each covering a 15km radius (70,000ha) and equipped with automatic detection capabilities. Utilizing AI algorithms, these systems can detect fire outbreaks more rapidly than satellites, pinpointing the exact location of a fire outbreak within 3 minutes. This technology represents a significant advancement in forest fire management and environmental protection.

Industrial Sector: Hybar, USA

Use of Proceeds from the Bond will go towards to building and operations of a state-of-the-art scrap metal recycling steel rebar production facility in Osceola, Arkansas. This facility is designed to produce an impressive 630,000 tons of rebar annually.

Hybar is set to achieve a ground breaking milestone in North America by utilising a direct connection to a nearby behind-the-meter solar installation to exclusively generate steel with 100% solar energy. By switching to clean energy, Hybar aims to keep its carbon emissions to a minimum, becoming a pioneer in low-carbon steel manufacturing.

Multi-Sector: Barclays, United Kingdom

Since 2017, Barclays, as a Programmatic issuer, has been actively issuing bonds and commercial paper in the UK, aligning with their 2050 net-zero target. The proceeds from these bonds span various Climate Bonds sectors:

- Low Carbon Buildings: Their green bond issuance focuses on financing and refinancing residential mortgages for buildings among the top 15% in terms of low carbon intensity in England and Wales. This initiative has led to a significant reduction in CO2 emissions, approximately 5,663,951 KgCO2, compared to the national EPC average.

- Solar, Wind, Marine Renewables: Barclays has contributed to the generation of 27,933.90 MWh of renewable energy through various assets in the UK and Ireland, reinforcing its commitment to sustainable energy sources.

- Low Carbon Transport: The green bonds have also been channelled into financing energy-efficient vehicles, supporting the transition to a low-carbon transport sector.

Transport Sector: Société des Grands Projets, France

Since 2018, as a Programmatic issuer, Société des Grands Projets (formerly Société du Grand Paris) has played a pivotal role in enhancing Paris's metro infrastructure. The company has financed the construction of nearly 200 km of new metro lines, augmenting the existing 400 km network in the Ile-de-France region.

Key projects include extending Metro Line 14 and establishing four new lines: 15, 16, 17, and 18. The ambitious expansion also encompasses 68 new metro stations and 7 technical centres.

Crucially, the entire network operates on electric power and is expected to support high passenger volumes, aligning seamlessly with the Climate Bonds Standard Low Carbon Transport Criteria.

This commitment to sustainable transport not only improves connectivity but also significantly contributes to the region's environmental goals.

Transport Sector: JRTT, Japan

As a Certified Programmatic Issuer, Japan Railway Technical Transport (JRTT) has been issuing Certified Climate Bonds since 2019 for low carbon rail transport. The proceeds from JRTT Bonds are channelled into pivotal projects that redefine clean and efficient transportation. These include enhancing urban railway convenience under the Urban Railway Convenience Improvement Law in Eastern Kanagawa, expanding transportation capacity in metropolitan areas such as the Keiyo line, and mitigating traffic congestion during peak hours on lines like the Tobu Isezaki and Minatomirai. Furthermore, JRTT's initiatives extend to major construction projects under the Act on Special Measures concerning Integrated Promotion of Residential Land Development and Railway Construction in Major Urban Areas, notably the New Joban line (Tsukuba Express). These projects collectively contribute to building essential, cost-effective, and eco-friendly transportation infrastructure, marking a significant step in sustainable development and urban mobility.

Waste Sector: PET Refine, Japan

Use of Proceeds for the Bonds will be used to finance investments in a PET (polyethylene terephthalate) bottle recycling factory in Kawasaki City, Japan.

Use of Proceeds for the Bonds will be used to finance investments in a PET (polyethylene terephthalate) bottle recycling factory in Kawasaki City, Japan.

The factory had been operating between 2009 to 2017. These investments have upgraded and refurbished the factory in order to resume its operations in the 2021. The factory has been using an innovative chemical process to recycle the PET materials into the same quality as virgin PET materials, so that they can be turned into new bottles of the same quality.

The factory produces 22,600 tons of recycled PET resin annually.

Water Sector: SFPUC, USA

San Francisco Public Utilities Company, as a Certified Programmatic Issuer, has successfully issued Use of Proceeds Bonds to fund significant water infrastructure projects.

These bonds are directed towards financing water treatment projects, including replacing and upgrading existing facilities, improving sewer collection systems, and enhancing stormwater management.

Their treatment plants play a vital role, treating 80% of waste flows for a population of 890,000, demonstrating the company's commitment to sustainable water management and infrastructure development.

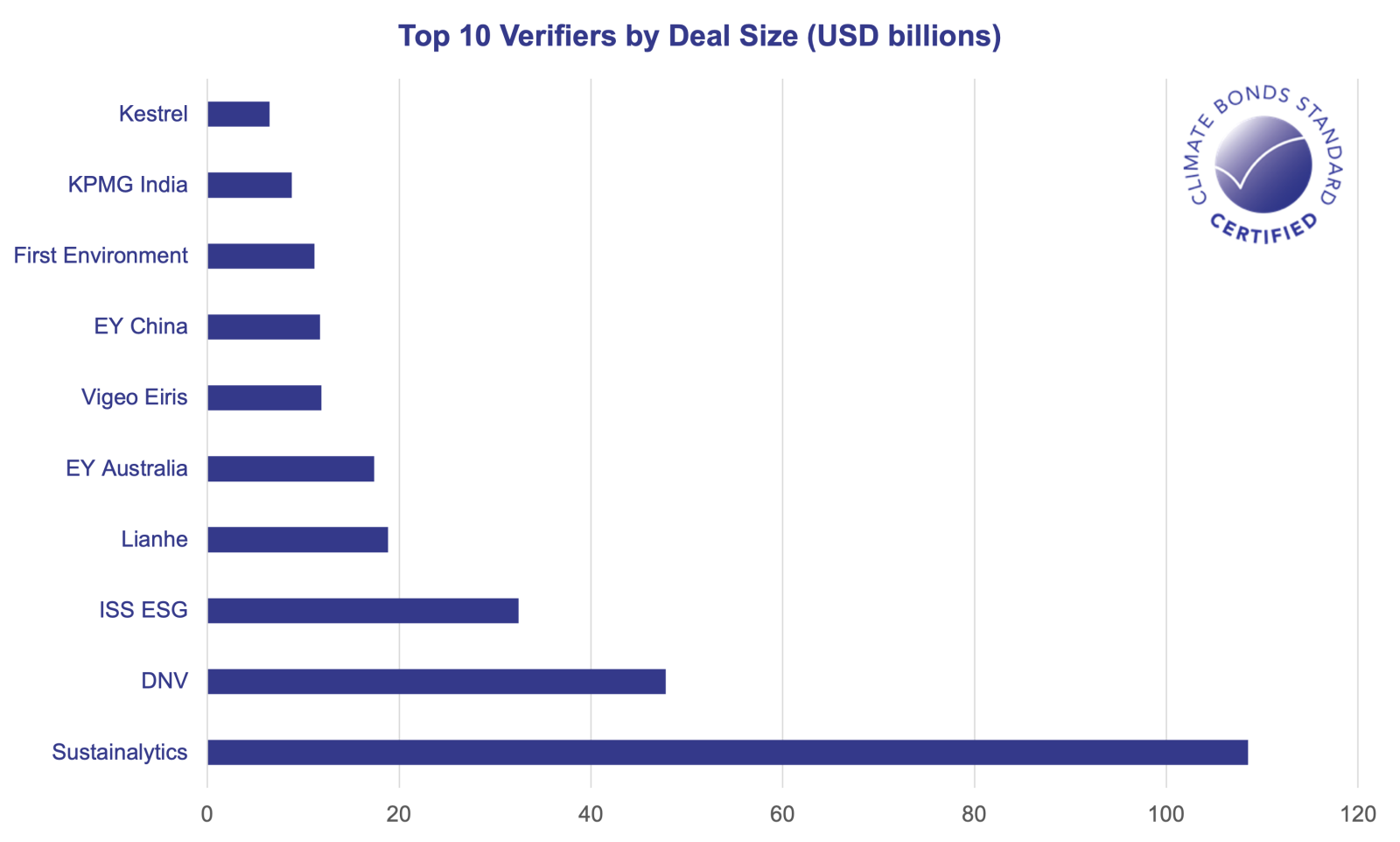

Top Verifiers by deal size

Assurance is a cornerstone of the Climate Bonds Standard & Certification Scheme, maintaining the integrity essential to investors and stakeholders. At its core are the Approved Verifiers, tasked with the rigorous assessment and validation of Certified Climate Bonds. Notably, last year, Kestrel verified the World’s first Steel Sector Certification by Hybar. Furthermore, Kestrel and ISS Corporate Solutions can now carry out Entity-Level Certification under the Climate Bonds Standard, marking a significant advancement in the scheme.

For the complete directory of Approved Verifiers, follow here.

The Last Word

As we look back at the Climate Bonds Standard's progress, surpassing USD 300 billion in certifications is a compelling call for urgent, collective action in the market. This milestone, set by issuers who have proven that investing in credible climate solutions is not only achievable but also a path for others to follow, demands attention. The commitment of these issuers, coupled with the foresight of investors and the thorough verification by industry experts, has not just met targets but has also fuelled a growing movement in green finance.

Moving forward, our focus remains unwavering in our mission to innovate and expand. We are committed to ensuring that the Climate Bonds Standard continues to be synonymous with rigour and credibility in climate investment.

For issuers and verifiers looking to engage with us on Certification, please follow the link here for more information.

‘Til Next Time,

Climate Bonds.