Middle East & Africa See Sustainable Finance Progress Ahead of COP28

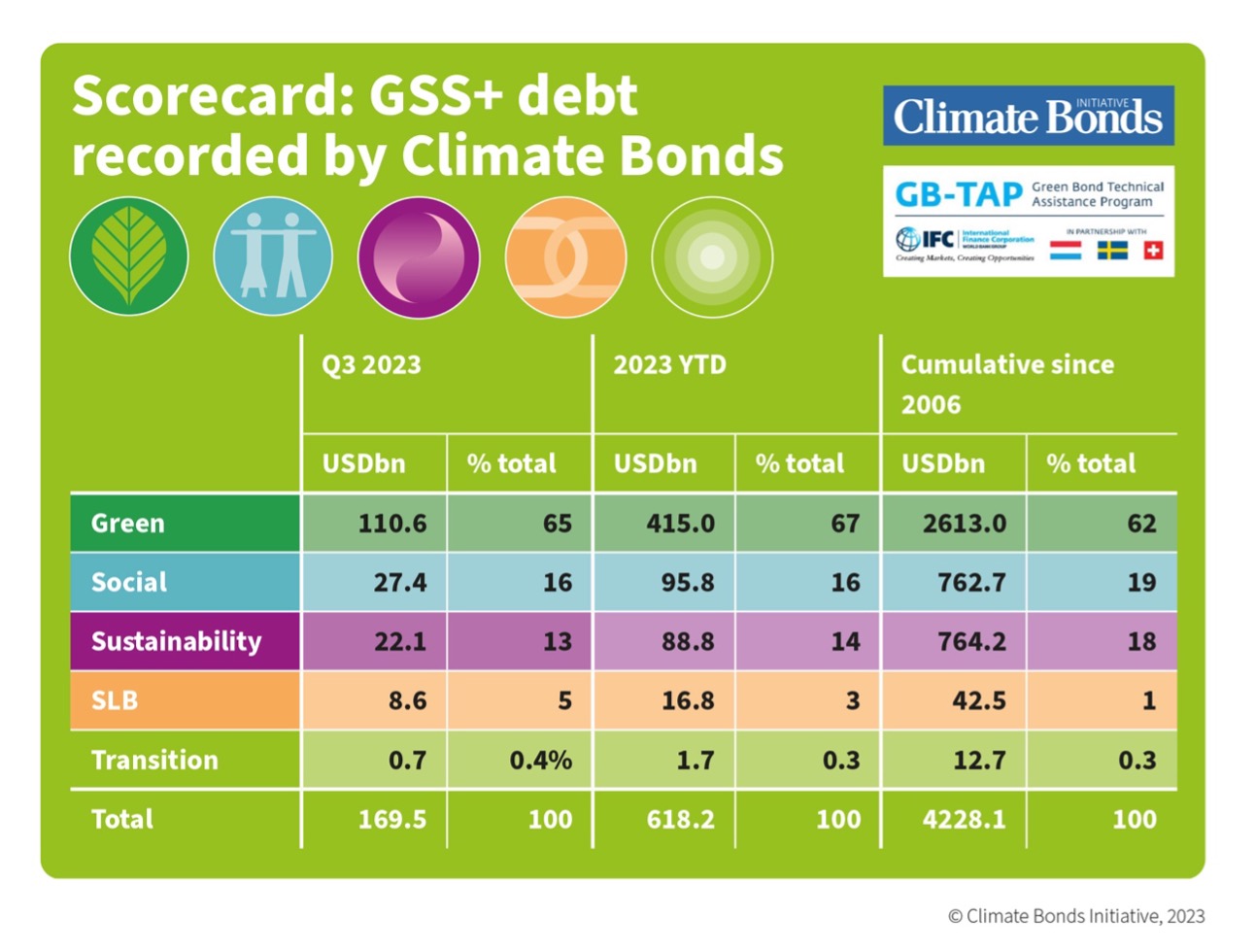

There is reason for optimism in Middle East and Africa. Regional sustainable finance is growing quickly to spur positive development impact at both company and community levels. By the end of Q3 2023, the Climate Bonds Initiative (Climate Bonds) had recorded cumulative volume of USD4.2tn of green, social, sustainability, and sustainability linked (GSS+) debt in alignment with its screening methodologies (aligned), plus a further USD12.7bn in unscreened bonds bearing the transition label.

The news arrives in a new Q3 State of the Market Report, sponsored by IFC, which assesses the market outlook for labelled issuance across the globe.

The green label’s lifetime total has passed the USD2.5trilliion milestone to reach USD2.6trillion, the social label reached USD762.7bn, the sustainability label stands at USD764.2bn, sustainability-linked debt has a USD42.5bn total and transition accounts for USD12.7bn

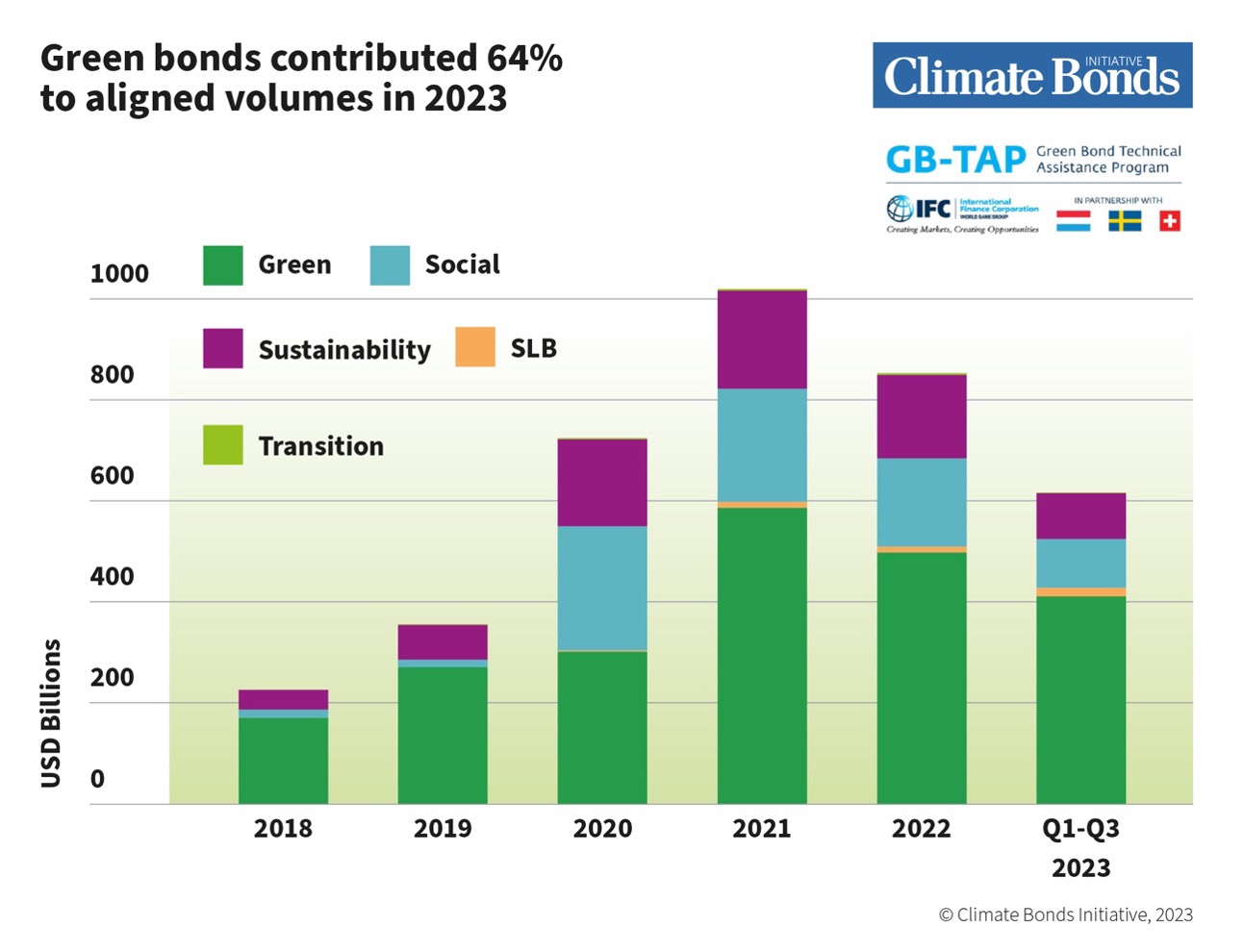

The new market report details the state of green and other labelled debt up to the end of Q3 2023. Year-to-date (YTD), aligned GSS+ bonds (including transition) accounted for USD618.2bn, recording a 10% decline as compared to USD685.8bn for the same period in 2022. Despite the decline, aligned GSS+ as a percentage of total issuance volume remains at 5%.

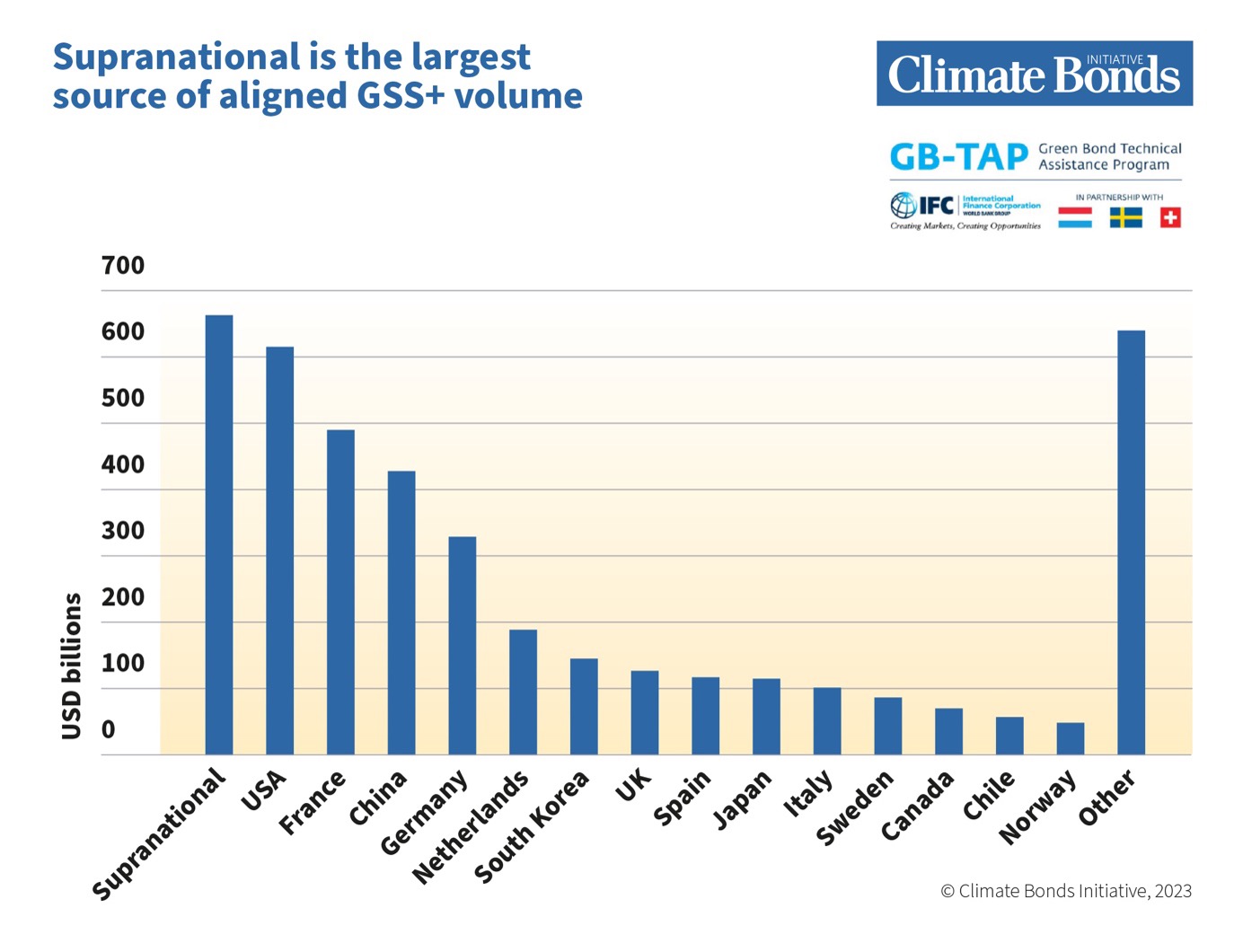

At the end of Q3 2023, Climate Bonds had captured lifetime GSS+ volume of USD4.2tn, which has originated from supranational plus 103 countries. Supranational remains the largest source of aligned GSS+ volume (USD660.7bn), with the USA (USD612.6bn), France (USD488.2bn), and China (USD431.28bn) being the largest country sources.

Other than China, South Korea (USD149bn) and Chile (USD53.4bn) are the only emerging markets (EM) to appear in the top 15 most prolific countries. In all three cases, strong policy support has contributed to the growth of robust local and international markets.

If you look at annual issuance in 2023 alone, Mexico has led the sustainability bond charge, ahead of Japan (which leads) on transition finance, France, USA, and South Korea. Supranational issuance ranked as the 3rd highest source, and Brazil also ranked in the top 10 even before joining 49 other sovereign issuers with its debut sustainability bond, priced in November.

50 Sovereign issuers

At the end of Q3 2023 Climate Bonds had recorded aligned GSS+ bonds from 49 sovereigns with a combined volume of USD435.5bn, a 36% increase YTD. Green is the largest segment with USD348.3bn (80%), and France retaining its crown as the largest source of aligned GSS+ sovereign debt with USD66.3bn in cumulative volume. Last month Brazil became the 50th sovereign to come to market with its debut USD2bn sustainability deal.

Sustainability Spotlight: Middle East and Africa

The Middle East and Africa (MEA) has experienced 158% growth in 2023, driven by renewable energy deals from the Middle East. The upcoming 28th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP28) will be hosted in Dubai, the most populous of the seven United Arab Emirates (UAE), which is one of the top ten oil-producing nations.

Two MEA nations priced debut sovereign deals in 2023, taking the total number of GSS+ issuing nations in the region to seven. All but one have issued in hard currency, with Nigeria pricing in its local currency to capitalise on its domestic investor base. Israel came to the market with its first green bond in January, and Sharjah (UAE) issued a sustainability bond in February. For countries that can bring sovereign deals, a sovereign GSS+ bond is a strong signal of the sustainability commitments of the issuing country.

In the MEA region, sustainability bonds are currently 17% of the GSS+ market; the report highlights the opportunity to scale up issuance to tackle social and environmental challenges simultaneously. Support is needed to bridge the gap between issuer financing needs and investor risk tolerance to direct capital flows to the most vulnerable communities. It is also acknowledged that GSS+ deals are urgently needed to finance adaptation which currently falls well short of the required funding.

The Last Word: COP28 must Catalyse

Sean Kidney, Climate Bonds, CEO: “As we embark on COP28, it is important to commemorate the importance of government action in the fight against climate change. This is well evidenced in the world of sustainable finance which has spread across the globe with trillions of issuance spurred onby sovereign issuers, which has been crucial in catalysing climate capital.

“We urge that bigger and bolder initiatives need to emerge from COP28 to stoke capital flows to climate projects, particularly in the most vulnerable regions, ensuring this decade keeps us poised to meet the Paris Agreement and avert catastrophic demise of our planet.”

Veronica Nyhan Jones, Global Head of Climate Capacity & Inclusion, IFC: “As the world turns its gaze on COP28 in Dubai this week, it is most timely to accelerate the global effort of combating climate change and ensuring a just transition, especially through the participation of developing countries. The Middle East and Africa region possesses tremendous green and social potential for sustainable finance investment opportunities. While the region’s sustainable debt market is currently led by a handful of major issuers, IFC and GB-TAP with numerous partners have been building capacities and helping local issuers to come to market with labelled instruments that often realize green and social co-benefits. Despite their size, it is through these medium and even small issuers – who frequently make up a large share of local economy – that we mobilize capital, unlock investment potential, and create the most meaningful impact.”

We’d like to thank our sponsor, IFC Green Bond Technical Assistance Program (GB-TAP), for their support in this market report. You can read it here

By Caroline Harrison and Veronica Nyhan Jones