Brazil becomes 50th country to crack the sovereign GSS+ market

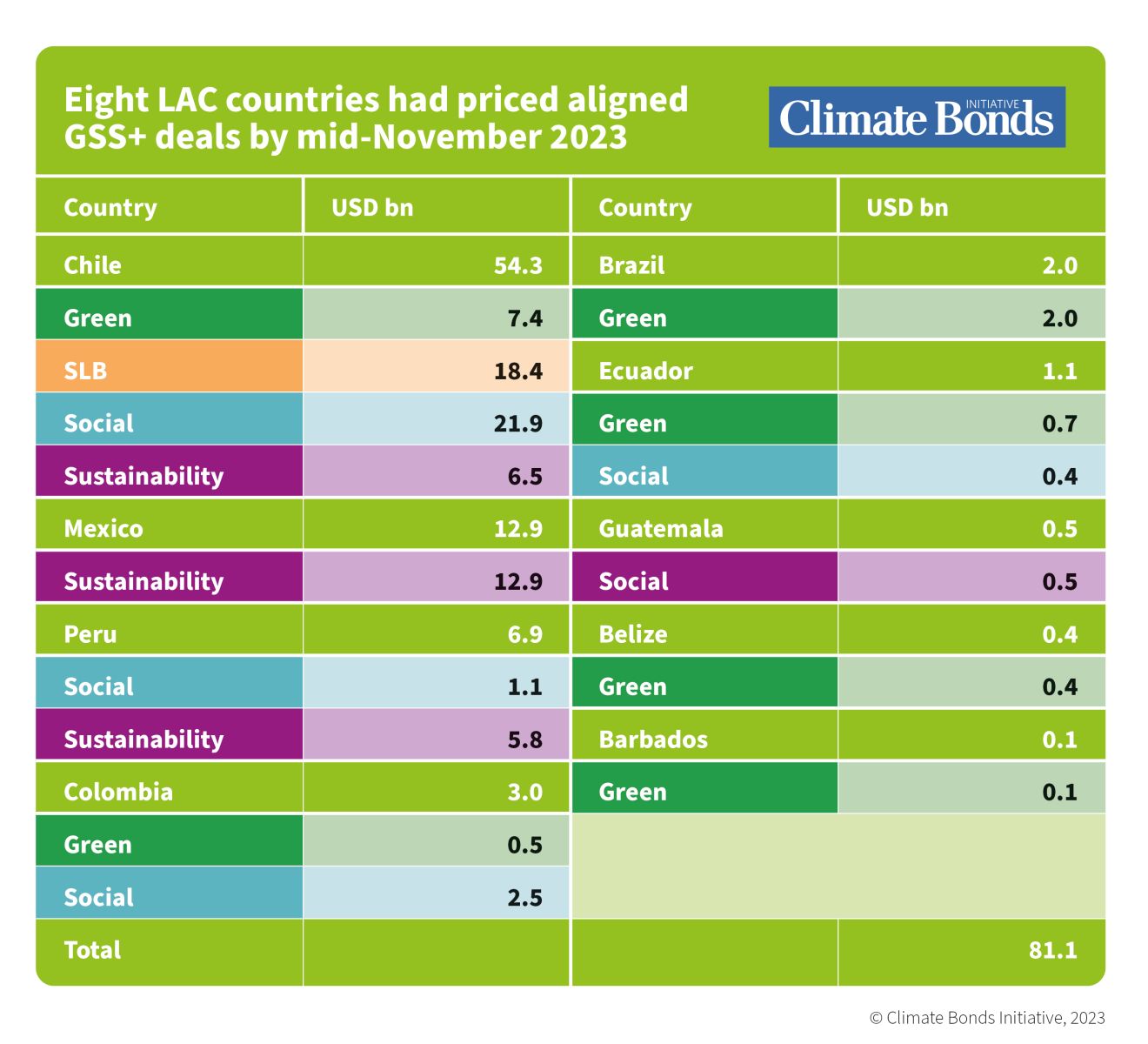

On 13 November 2023, Brazil became the 50th country to price a GSS+ (green, social, sustainability, sustainability-linked or transition) sovereign deal in alignment with Climate Bonds’ Database Methodologies (aligned). Up to 60% of the Use of Proceeds (UoP) of the USD2bn, 7.5-year, sustainability bond were earmarked for expenditures in the environmental categories listed in Brazil’s Sovereign Sustainable Bond Framework.[i] The Framework included nine eligible project categories with environmental benefits, and five with social benefits.

Climate Bonds has been on a long-term mission to rally sovereign GSS+ issuance across the globe, as it is understood such deals send a strong policy signal and can catalyse local market growth. The first sovereign green bond was issued by Poland back in 2017, and only 6 years later, the number has climbed to 50.

Brazil's sovereign sustainability deal expected to accelerate local market growth

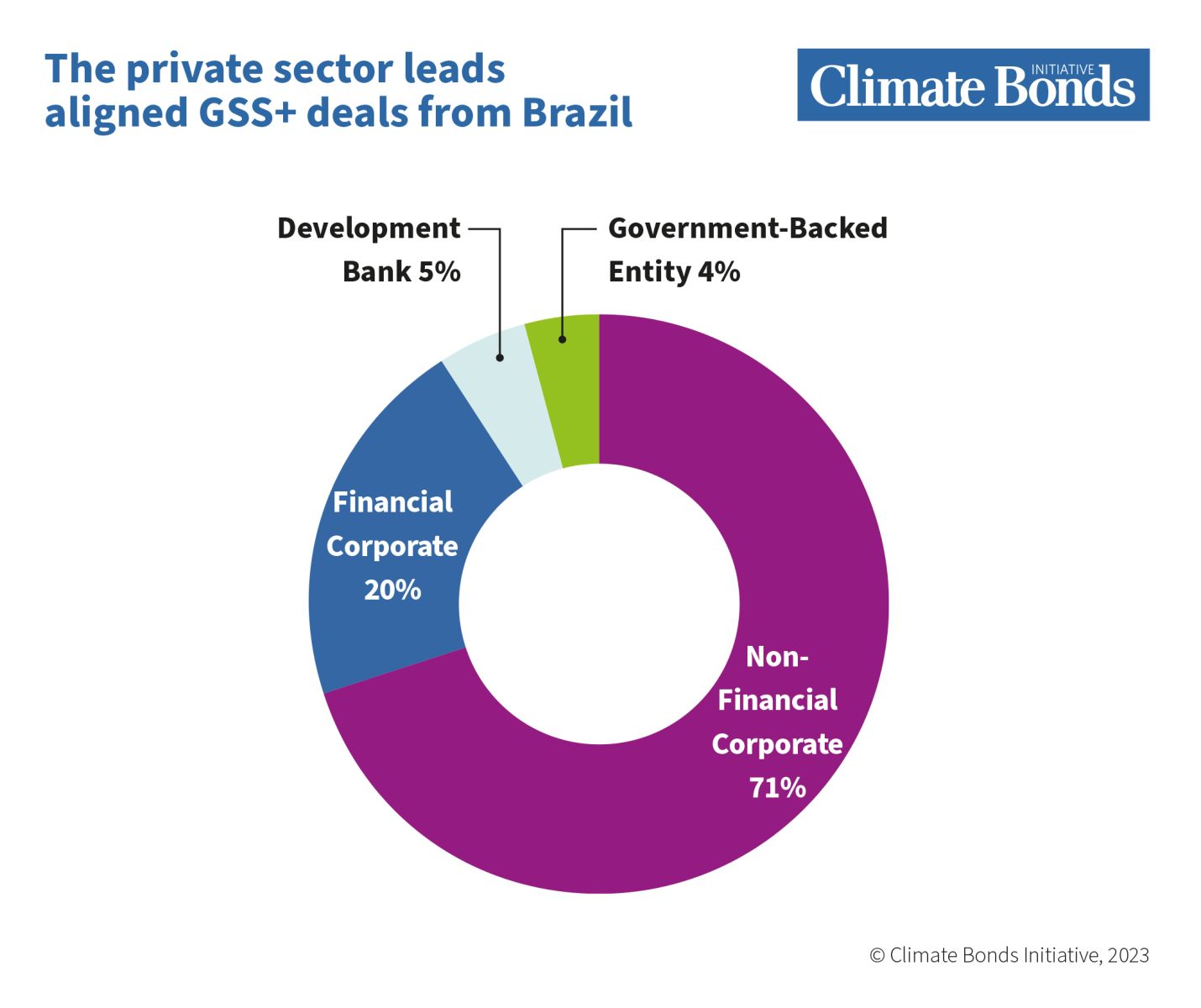

This benchmark is expected to accelerate issuance of aligned GSS+ debt originating from Brazil which reached USD25.4bn in cumulative volume by the end of Q3 2023. The market has been dominated by the private sector, responsible for 92% of the aligned debt, with an average deal size of USD111m.

Brazil is the ninth country in the Latin America and the Caribbean (LAC) region to issue an aligned sovereign GSS+ deal. While green-labelled bonds dominate Brazil's GSS+ market with 63% of issuance volumes, the choice of a sovereign sustainability bond aligns with broader regional trends. Across LAC, sustainability bonds hold a 43% share, highlighting a rising preference for combining environmental and social expenditures in a single instrument. This emerging trend reflects issuers’ inclination to support a just transition in both Brazil and the wider region.

Brazil’s economy is largely reliant on natural resources and has a relatively clean energy matrix.[i],[ii] This move from the government is expected to attract crowding in from the private sector and should encourage more benchmark sized deals with the required transparency and disclosure.

The sovereign sustainability deal is aligned with national priorities on sustainable development and its credentials are compliant with international sustainable finance standards. The Brazilian Ministry of Finance recently initiated efforts to develop a national Sustainable Finance Taxonomy. These two initiatives will help to protect investors against greenwashing in the Brazilian market and showcase the country’s commitment to a just transition.

Climate Bonds recommends sovereign GSS+ issuance

Sovereign issuance is a crucial policy for governments and sends a clear signal on their long-term commitment to climate and sustainability goals while galvanising the local sustainable finance market.[iii]

Impacts can be far wider than expected. Beyond enabling access to low-cost capital, which can support increased sustainable expenditure, it can have a domino effect on the market, ramping up sustainable investment across the economy.

A large sovereign GSS+ bond can encourage local investors to commit capital to sustainable investment strategies. Among issuers, it demonstrates an appetite for such bonds, and provides benchmark pricing and liquidity, enabling them to estimate demand and pricing for their bonds, and inform size of issuance. A sovereign GSS+ bond also sends an important signal of government commitment, giving other issuers the confidence to commit expenditures to net-zero goals. Within government, it can encourage departments to tilt expenditure to green to access this funding.

Now that it has cracked its debut deal, Brazil can build on the momentum. It can implement other policies that can tilt the economy to green such as guarantees, green public procurement, subsidies, and other highlighted in Climate Bonds 101 Sustainable Finance Policies.[iv]

Half a trillion dollars is the next milestone

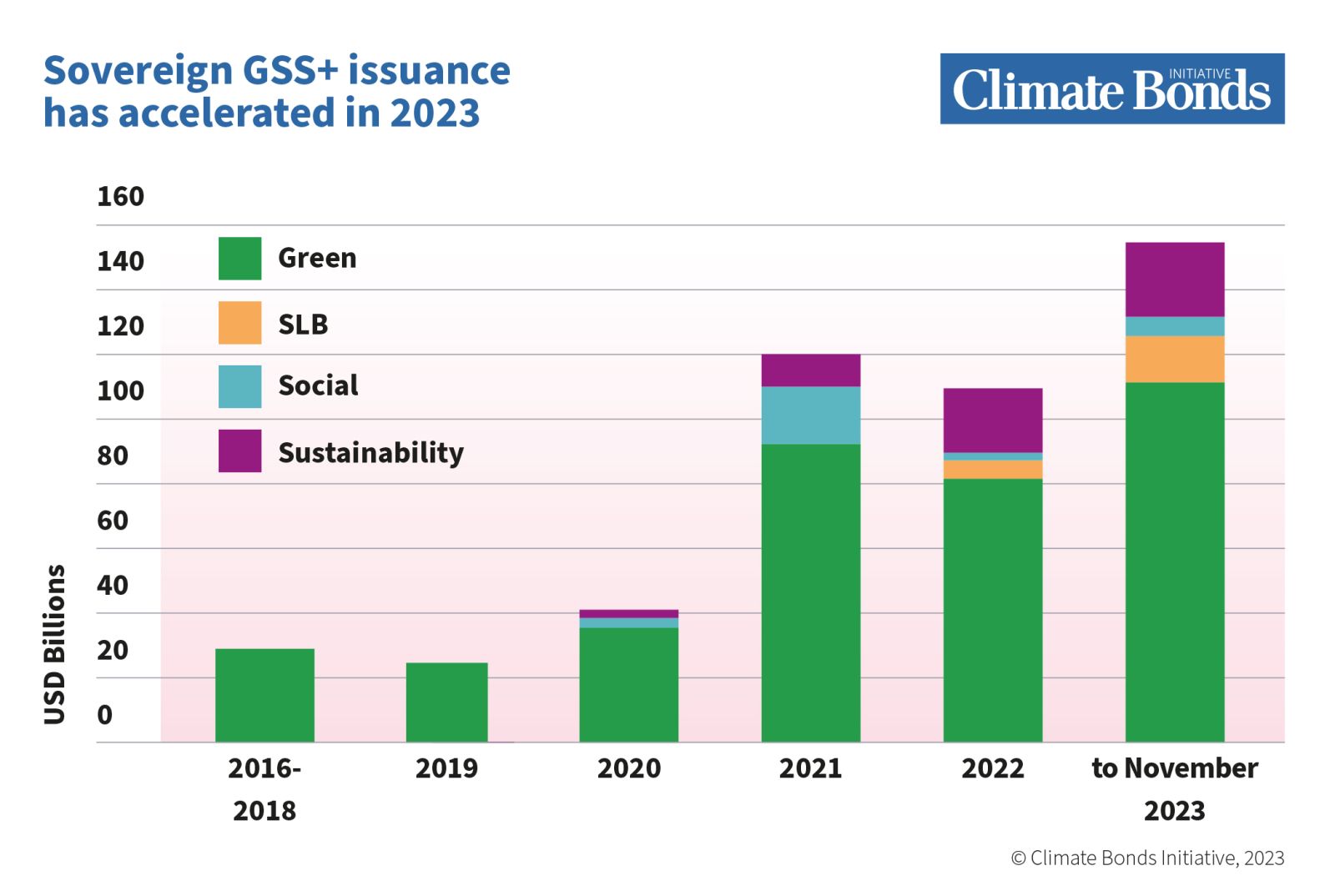

By mid-November, Climate Bonds had recorded cumulative aligned sovereign GSS+ volumes at USD480bn. Nineteen developed markets had priced 68% of the total, with the remaining 32% coming from 31 emerging markets.

Issuance has accelerated in 2023, with 31 countries pricing USD154bn (30% of the total) in either new deals or taps. Half a trillion dollars is within reach, and there is massive opportunity to scale this market further. Bloomberg records USD54tn of outstanding sovereign debt from 165 countries with GSS+ deals currently contributing less than 1%. Among the top three largest sovereign issuers, Japan has committed to issue a Green Transformation (GX) bond next year, while the USA and China are yet to announce plans. The biggest and best is still to come!

The Last Word

We are delighted to have seen the 50th sovereign issuance only 6 years after the very first! It really demonstrates the ground that sustainable finance has made in recent years, although, the movement still has a long way to go.

Look out for our forthcoming Q3 market update, arriving this Wednesday. The report breaks down all of the latest sustainable finance market analysis, with a special focus on Africa and the Middle East.

'til next time

Climate Bonds

[i] The World Bank in Brazil, Brazil Overview: Development news, research, data | World Bank

[ii] BEN Summary Report 2023, Federal Government of Brazil, Apresentação do PowerPoint (epe.gov.br)

[iii] Sovereign GSS Bond Survey, Climate Bonds Initiative, 2021, Sovereign Green, Social, and Sustainability Bond Survey | Climate Bonds Initiative

[iv] 101 Sustainable Finance Policies for 1.5oC, Climate Bonds Initiative, March 2023, cbi_101_policyideas.pdf (climatebonds.net)

[i] Brazil’s Sovereign Sustainable Bond Framework, Brazil National Treasury, Ministry of Finance, September 2023, Arcabouco Ingles v1 (1).pdf