Issuers say label offers resilience in market turmoil, as well as pricing benefits

New analysis of labelled bonds priced in the choppy market period of late 2022 revealed strong investor support for green bonds helped get deals over the line as rising rates caused deals to crumble. The news arrives in the the 15th iteration of a leading report series analysing the pricing dynamics of green bonds, examining how these instruments offer pricing advantages for issuers and investors.

For the first time, the ‘Green Bond Pricing in the Primary Market Report’ also assessed the pricing performance of the entire labelled landscape including social, sustainability, and sustainability-linked bonds (collectively GSS+). The researched revealed that every label offered pricing benefits when compared to vanilla equivalents, as well as a host of other key findings.

The full version of this report is available on our website here. This blog takes a dip into five of the key highlights.

1. Strong green investor base making green bond deals more resilient

Climate Bonds calculated green bond allocations to investors describing themselves as green or socially responsible reached a record 67%, on average. Multiple issuers reported this unique source of support helped get deals over the line in a period of high volatility in which deals were collapsing and stretches of days passed without new deals being priced.

Climate Bonds has been surveying this data since 2017 on a semi-annual basis, and allocations have ranged from 45% in H2 2017, climbing to a record 67% in the most recent observation period, having been within two percentage points of that since H1 2021. This suggests that issuers can rely on a dedicated following of investors, the demand from which has also undoubtedly contributed to the strong pricing dynamics we have seen for green bonds in recent years.

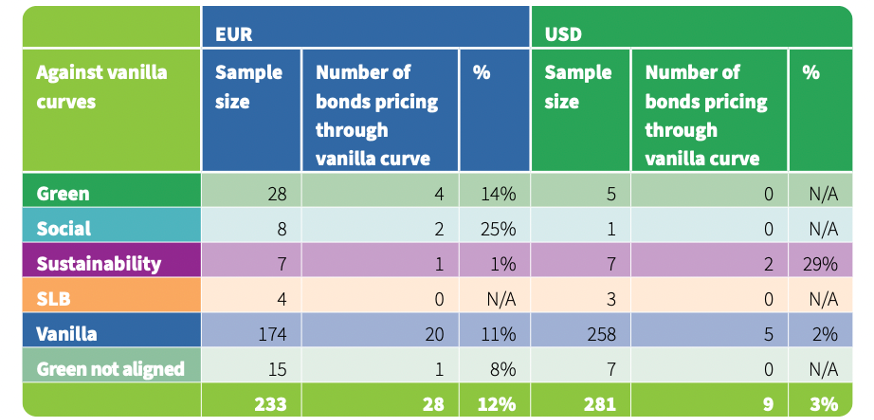

2. Every GSS+ Label Offers Pricing benefits

The report also includes a primary market pricing study of over 500 EUR and USD denominated bonds priced between 01 July and 31 December 2022. The results indicate bonds bearing thematic labels price tighter to their respective yield curves when compared to vanilla equivalents. While there was sparse evidence of any bonds pricing through their yield curves during this period, the analysis suggests that, on average, bonds bearing thematic labels achieved better pricing than those that did not. Of all the labels, green bonds, the largest group in the sample, exhibited the greatest benefits with an average spread of 48bps compared to matched vanilla equivalents.

3. Green bond ETF assets achieved net growth of 11% on the prior period

At the end of H2 2022, Climate Bonds was aware of 14 EUR or USD green bond ETFs with combined fund assets of USD1.9bn, a net increase of 11.2% on the prior period. The preceding two periods had accumulated small contractions, the first net outflows experienced by green bond ETFs.

During H2, six funds increased in size, while seven contracted, and one did not have data available. The Franklin Liberty Euro Green Bond ETF grew its net assets by the largest amount (132%), while the Lyxor Green Bond DR UCITS ETF (-46.5%) experienced the largest contraction.

4. Auto Manufacturers Pile into Green Lane

The latest report includes six bonds from three auto manufacturers: Renault, Volkswagen (VW) and French car leasing company, ALD Automotive. These deals were strongly supported by investors describing themselves as green with eventual allocations for ALD, Renault, and VW reaching at least 80%. Issuers remarked that the success of the deals was helped by the green label.

Seasoned debt issuers with strong sustainability strategies operating in the auto sector can magnetise investor interest for green bonds. As noted in the H2 2020 iteration of this paper, auto-makers are now entirely focused on clean solutions hence there is huge potential to relabel existing debt as green as it rolls off. We also expect that the affordability of low carbon vehicles to facilitate a deluge of green auto loan ABS deals over the next few years.

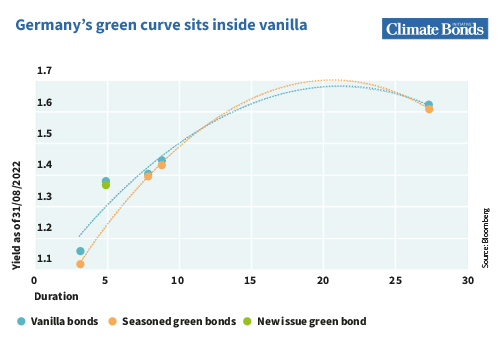

5. Germany’s Green Curve Sits Inside Vanilla

Germany uses a twin structure to price its green bonds, issuing a vanilla bond, and later a green version, sharing similar characteristics. Germany’s fifth green bond, a second 5-year deal (Bobl), was priced in August 2022 via syndicate. The target size of the deal was EUR6bn (USD6bn) and the book closed at EUR14bn. The spread was revised down by 2bps, and the deal size was set at EUR5bn (USD5bn). The twin curve was slightly outside the green curve as of 31 August 2022 and the new Bobl priced inside its twin with a greenium of 1.25bps

Sovereign green issuance "sends a powerful signal of intent around climate action and sustainable development to governments and regulators", said Sean Kidney, CEO of Climate Bonds, in late 2021, as he called for sovereign labelled bond issuers to double from where it then sat at 20, to beyond 40 nations. "It catalyses domestic market development and provides impetus to institutional investors", Sean added.

This call to reach forty issuers was actioned in 2022, as governments took advantage of the demand and subsequent pricing benefits offered by the green label. Now in 2023, Climate Bonds is calling on this momentum to continue with sovereign green issuance nearing the 50 milestone.

The Last Word

While the prevailing market conditions of last year did not favour bond markets, our analysis demonstrated that green bonds continued to experience relatively strong pricing dynamics. In 2023 Climate Bonds expects that the green bond market will continue to support the accelerated transition to clean energy kickstarted by the Russian invasion of Ukraine, particularly in Europe. In our recent market blog, Climate Bonds predicted 5 Big Directions for Sustainable Finance in 2023 noting that the US Bipartisan Infrastructure Laws (BILs), which will provide tax cuts and grants for clean energy will facilitate a new raft of investment to green projects.

For more coverage of this report and to hear from the author Caroline Harrison, head over to the Climate Bonds Cafe' Podcast on Spotify.

Stay tuned for our upcoming launch of Climate Bonds Standard V4! The launch brings best practice standard for Sustainability-Linked Bonds and opens the door to Entity-Level Certification.

‘Til next time,

Climate Bonds