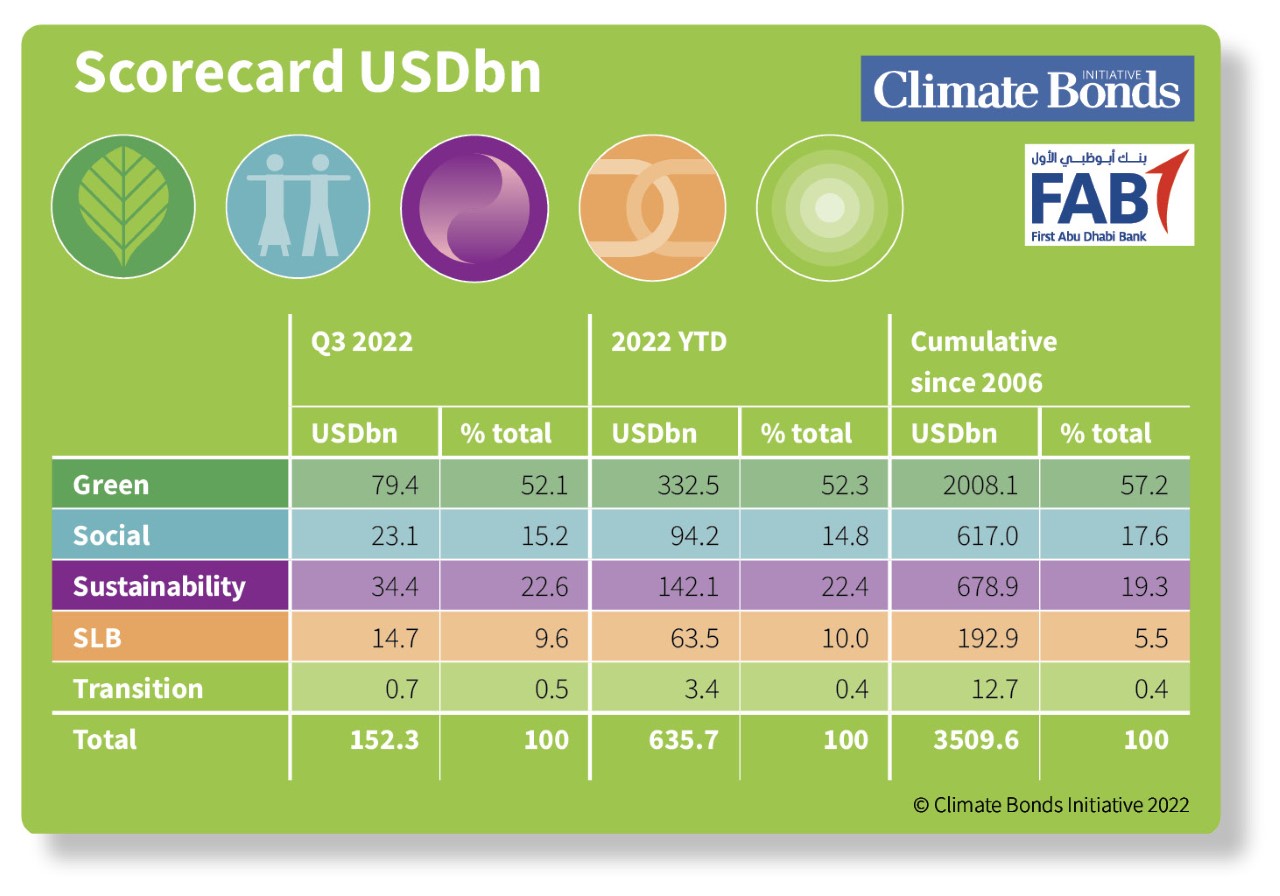

USD3.5trn in total issuance across Green, Social, Sustainability, Sustainability-Linked and Transition labelled bonds to date

Climate Bonds’ Market Intelligence has revealed that USD2trillion in green bonds have been issued to date. Unlike other data sets on green bonds, Climate Bonds screens self-labelled bonds issued globally and only includes bond issuance demonstrating climate ambition aligned with the Paris Agreement in its Green Bond Database.

This huge milestone arrives in our latest quarterly market update report, offering a comprehensive breakdown of labelled bond issuance and a look ahead to what we can expect from the crucial COP-27 climate summit.

The green milestone unites with the rising crop of sustainable bond labels (social, sustainability, sustainability-linked and transition), to reach a combined lifetime USD3.5trillion volume at end of the Q3. The news comes as Climate Bonds calls for the market to scale labelled issuance to a volume of USD5trillion per year by 2025 to fight climate collapse, which looms large after years of inaction.

USD2tn green milestone arrives in tough year for global bond market

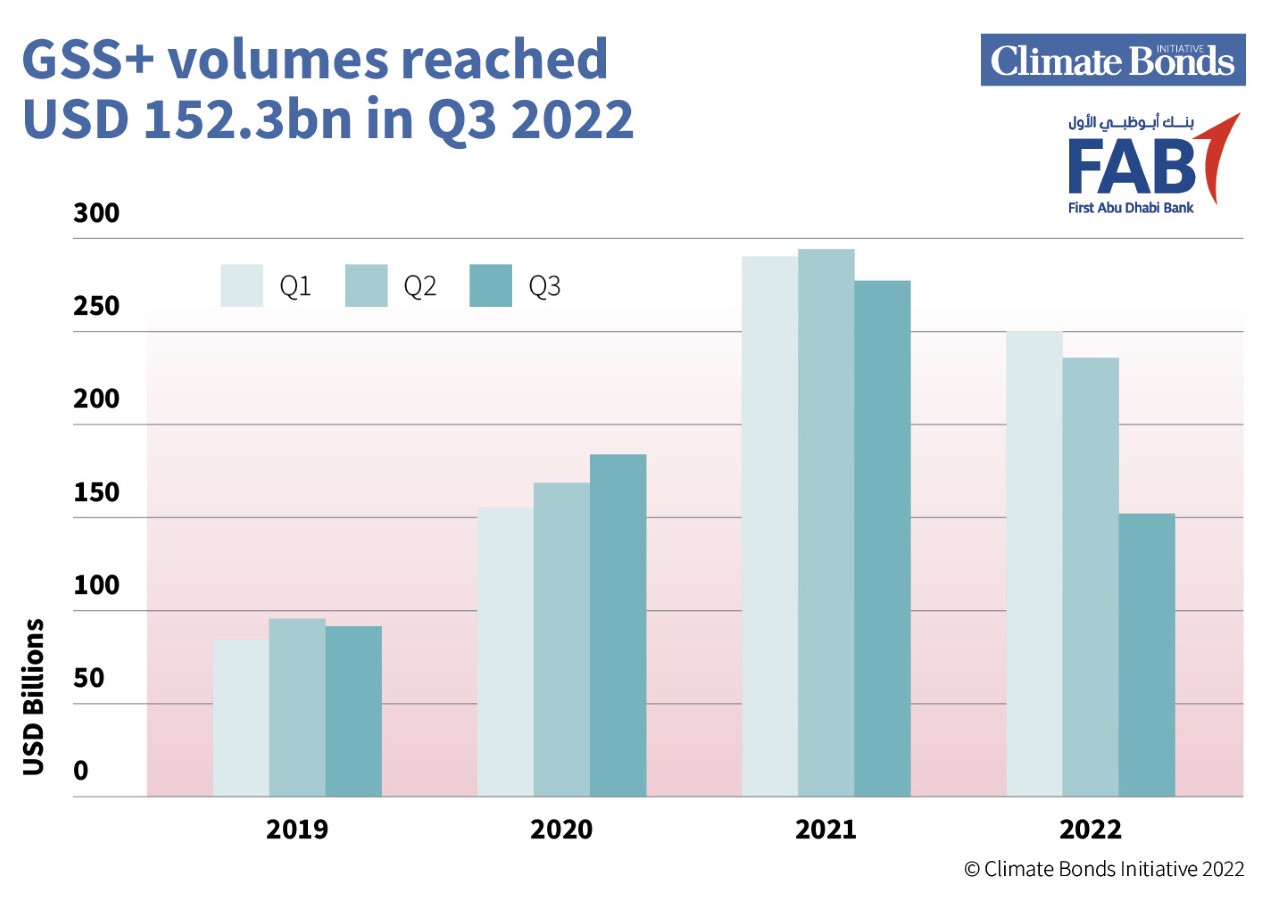

The geopolitical tensions and rising inflation that have emerged this year have stunted the global bond market and contributed to a drop in issuance across the board. In 2021, a record year for GSS+ issuance, labelled debt constituted 5% of all debt issued. Though 2022 has seen a decrease in global bond volumes, the share of GSS+ issuance has remained unchanged from the 2021 contribution. It is hoped that labelled debt, which has consistently drawn strong investor appetite from the market, can offer resilience in trying economic circumstances.

The total green, social, sustainability, sustainability-linked (SLB) and transition bond (GSS+) volumes reached USD152.3bn in Q3 2022, a decline of 35% compared to Q2 2022, and 45% compared to Q3 2021.

Year-to-date volumes of GSS+ debt had reached USD635.7bn by the end of Q3. More than half of the total (52%, USD332.5bn) came from green bonds. Sustainability bonds supplied 22.4% (USD142.1bn), social 14.8% (USD94.2bn), SLBs 10% (USD63.6bn), and transition comprised the smallest share at 0.5% (USD3.4bn).

COP 27: Spotlight on Middle East and Africa

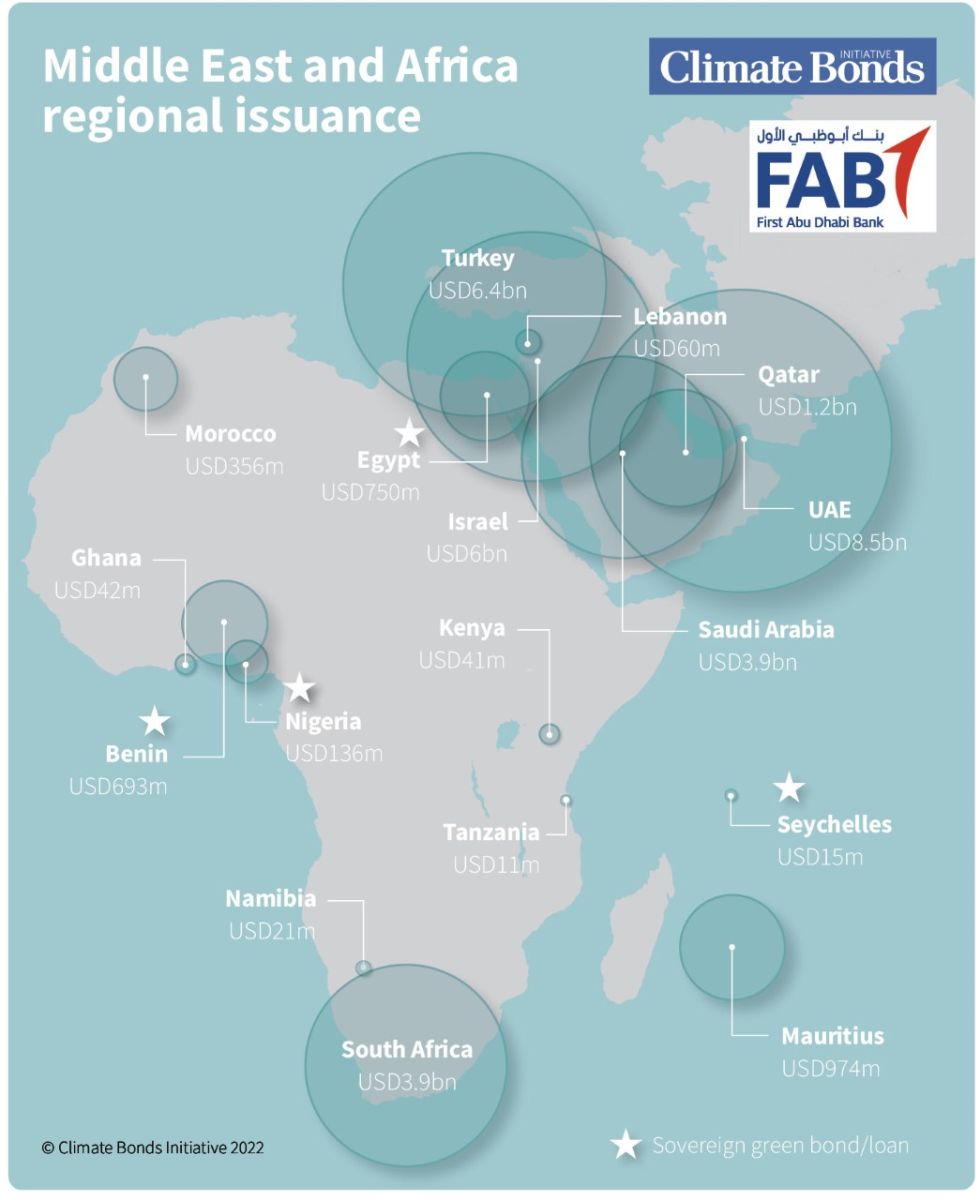

The upcoming COP-27 will highlight the massive investment required to tackle climate change in emerging markets (EM) including those in the Middle East and Africa (MEA). As the host country, Egypt’s location in the Northeast corner of Africa will bring renewed focus to the region which, having been hit particularly hard by the ramifications of COVID-19, is also suffering the economic impacts of the Russian invasion of Ukraine.

For the first time, Climate Bonds has analysed the shape and size of the MEA GSS+ debt market. Climate Bonds had recorded USD33.2bn of thematic debt originating from the region. While growth over the last four years has been steady, cumulative volumes are less than 1% of the global GSS+ market, indicating vast potential for growth.

Governments can play a leading role, and to date, sovereign GSS bonds have originated from four nations in the region. Overall, green is the dominant theme taking 56% of the cumulative volumes. SLBs are responsible for the second largest share at 23%. Instruments have been issued in 14 currencies from 17 countries.

Climate Bonds calls for issuance to reach $5trillion a year by 2025

Climate Bonds is pushing for at least USD5tn in green bonds alone to be issued annually from 2025 onwards. Its recently published 5 steps to 5 trillion manifesto suggests five actions that we must take collectively to achieve this ambitious target.

The fifth action is to boost emerging markets, by supporting the flow of capital to the right places to address climate change. Poorer nations urgently need finance to switch from dirty activities to green alternatives. Unfortunately, western private capital is not doing enough, with blended finance on the decline in recent years, despite increasing urgency.

Mechanisms to get capital flowing from richer to poorer such as blended finance to absorb junior capital tranches, de-risking guarantees, and larger sized deals, must all be multiplied. Economic development must build in mitigation from the start, and large projects should be financed through the capital markets to encourage dedicated investment

The Last Word

As the coming COP-27 summit approaches, so does the sense of urgency to deliver climate outcomes. The latest UN Climate Change Report shows countries are bending the curve of global greenhouse gas emissions downward but underlines that these efforts remain way off-track to limit global temperature rise to 1.5 degrees Celsius by the end of the century.

Sean Kidney, CEO, Climate Bonds Initiative said, "The Egypt COP is a bridge to COP28 in UAE, a unique opportunity for the region to show its potential to offer climate investment opportunities and unlock its true potential in this global race to tackle climate change."

“To stand a chance of meeting the Paris Agreement’s 2050 targets we must slash emissions in half this decade. This means scaling capital flows to climate causes at speed, starting with an annual $5trillion of sustainable finance being issued by 2025.”

Without the long overdue response to the climate crisis being realised, history will forever look back upon this moment as a monumental failure for mankind. We at Climate Bonds await the outcomes of COP-27 with baited breath.

You can find us at COP27 for Climate Bonds’ coverage of the event! More info here

‘Til next time!

Climate Bonds

Climate Bonds would like to thank the sponsors of the report, First Abu Dhabi Bank (FAB).The collaboration with FAB on the quarterly report coincides with a joint event at COP27 in Sharm El-Sheik, Egypt. ‘Scaling sustainable finance: A perspective in the Middle East’, on 11th of November 4pm (EET). ‘Scaling sustainable finance: A perspective in the Middle East’ will take place at the UAE Pavilion (Blue Zone) and can be streamed online via Office of the Special Climate Envoy’s YouTube channel