Green Bonds Show Pricing advantages for Both Investors & Issuers in Strong Start to 2021

Pricing dynamics of green bonds have long been one of the markets most fascinating aspects. In the opening half of what is set to be a record-breaking year for market volume, green bonds have once again demonstrated pricing benefits in market performance when compared to vanilla equivalents.

In our 12th and most recent study, Green Bond Pricing in the Primary Market H1 2021, we analysed 56 EUR and 19 USD denominated benchmark sized green bonds with a total value of USD75.9bn issued between January and June 2021. The findings follow our continued series of pricing reports, reflecting pricing differentials in the market.

On average, both EUR and USD green bonds achieved higher book cover and greater spread compression than vanilla equivalents. Investors describing themselves as green were allocated two thirds of the deals, and those that incorporated the EU taxonomy criteria into their frameworks noted that this helped to attract dark green buyers.

Greenium still visible

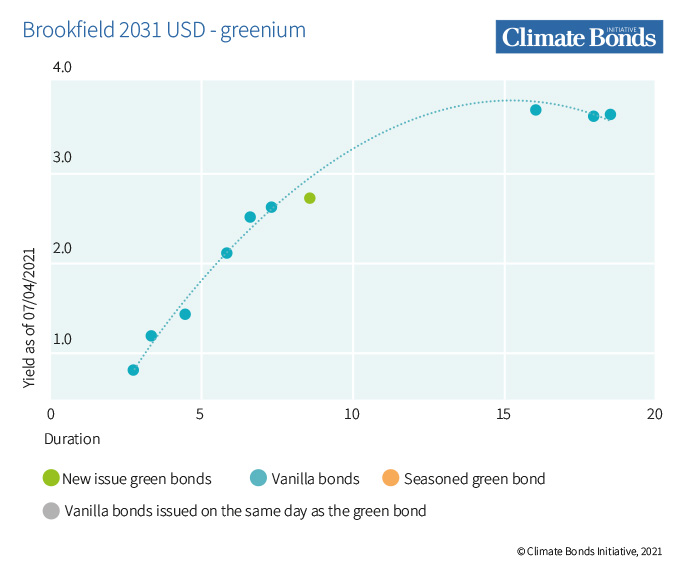

Sometimes, a bond may be issued with a higher price, and thus have a lower yield compared to outstanding debt. The bond will price inside its own yield curve. This is known as a new issue concession; when present in a green bond, we have termed it “greenium”. This is an excellent outcome for any issuer because it means that it costs less to fund its green bond compared to its vanilla debt. Even when a bond prices on its yield curve, this is still the absence of a new issue premium and therefore positive for the issuers cost of funding.

In H1 2021, yield curves were available for 36 green bonds and 80% of these priced on or inside their yield curve. This is a continuation of the strong investor support we witnessed in H2 2020.

Similar to H2 2020, USD bonds showed consistently strong pricing outcomes with all eight bonds in our admittedly small sample pricing on or inside their own yield curves. These included North American non-bank financial institution Brookfield Asset Management which priced its first green bond in April 2021.

Sovereign Green Issuance

In H1 2021, the EUR or USD denominated green bonds of five sovereign issuers were added to our database: Germany, France, Chile, Indonesia and Hong Kong. All five of the issuers have visited the green bond market before.

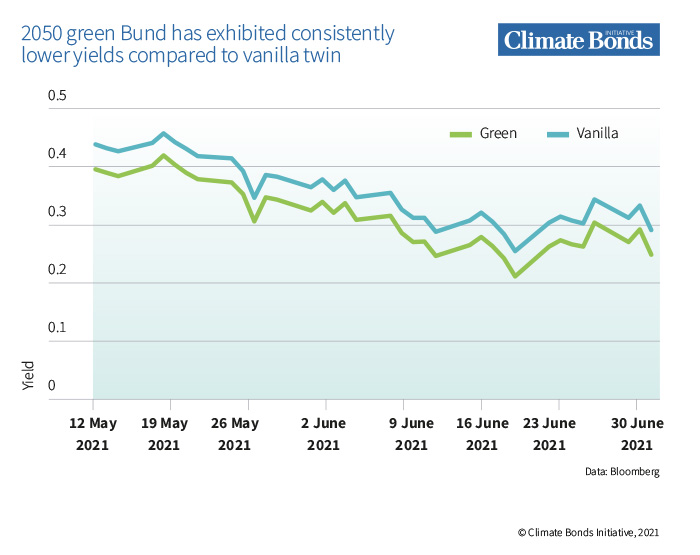

In May 2021, Germany priced its third green bond, a Bund with a maturity of 2050 and an initial size of EUR6bn (USD7.3bn). The issuance exhibited consistently lower yields over the sample period between May and June when compared to a vanilla twin.

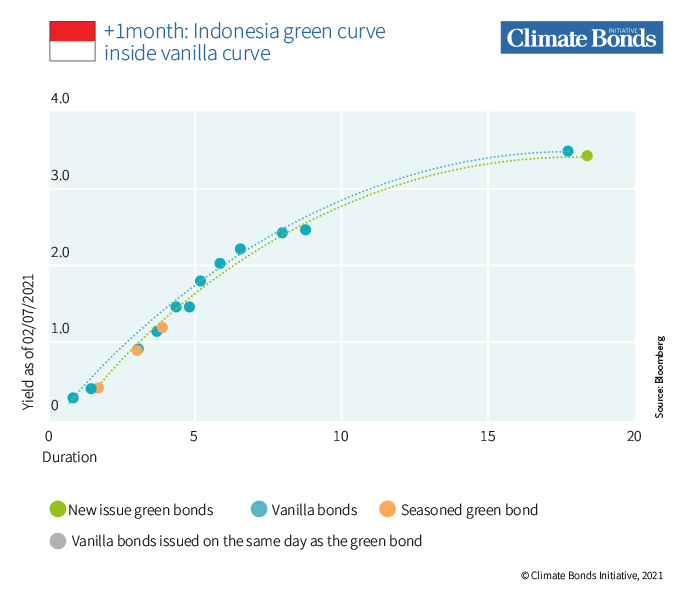

In early June 2021, Indonesia priced its fourth USD green Sukuk, a USD750m Sukuk maturing in 2051. Like previous Indonesian green Sukuk, the bond enjoyed strong dynamics in the primary market. It achieved book cover of 4.5x and priced with a greenium. A month later, the green yield curve remained inside the vanilla curve.

Sovereign green issuance benefits local green bond markets in different ways, such as increasing liquidity and providing strong market guidance.

Sovereign green issuance benefits local green bond markets in different ways, such as increasing liquidity and providing strong market guidance.

Learn more about the previous German green bonds and the other four sovereign issuances of H1 2021 in our report.

Greenium to Investors

The report reveals that green bonds can offer investors more flexibility in the secondary market which may help to justify the greenium, where present.

In the immediate secondary market, green bonds performed well, on average tightening more than indices after seven days, and both indices and comparable baskets after 28 days, emphasising that green bonds can offer value to both issuers and investors.

Seven days after pricing, 46% of green bonds had tightened more than comparable vanilla baskets, and after 28 days this increased to 57%.

Spotlight: The green label and secondary market liquidity

For the first time, our study explored the trading behaviour of green bonds in the secondary market to determine how liquidity compared to that of vanilla equivalents.

The findings demonstrate that, on average, during 2020 green bonds in the sample traded more frequently, and offered narrower bid/offer spreads, in other words green bonds maintained higher liquidity in the secondary market compared to similar bonds without the green label.

This observation held true during March 2020, which presented some particularly difficult market conditions as the scale of the COVID pandemic became clear. These conclusions could help to justify the primary market greenium, where present.

The Last word

Climate Bonds’ Market Intel has continued to attract attention for its pricing series. The work reveals exciting truths about the characteristics of investing in the low-carbon economy. As green finance soars, analyses on pricing and market performance of green bonds will increasingly gain more importance.

The green labelled market stood at USD227.8bn in H1 2021, more than double the volume of COVID-19 impacted H1 2020 (USD91.6bn).

Climate Bonds re-forecasts the market to reach half a trillion in annual Green issuance for 2021.

“Institutional investors are looking for quality green debt product and this structural trend in demand has only intensified,” according to Climate Bonds CEO, Sean Kidney.

“2030 targets and net zero commitments will drive corporate transition and new investment opportunities. Policy makers face continued pressure to green the financial system in addressing the climate emergency. These factors will continue to combine and drive more greenium in debt capital markets.”

We are looking at an exciting second half for 2021, as green finance raises momentum, bolstering in size and significance, to take centre stage as world leaders gather for the Glasgow Climate Summit.

We will return with more as we countdown to COP26!

‘Til Next Time!

Climate Bonds