Creating a Benchmark for Issuer’s Climate Performance

A new AIIB-Amundi Climate Change Investment Framework launched by the Asian Infrastructure Investment Bank (AIIB) and Amundi, Europe’s largest asset manager. This benchmark investor tool will for the first time holistically assess climate change risks and opportunities in line with the three objectives of the Paris Agreement at the issuer-level.

Endorsed by Climate Bonds, the CCIF was formally launched on 9th September at our annual conference.

Focus on the three key Paris Objectives

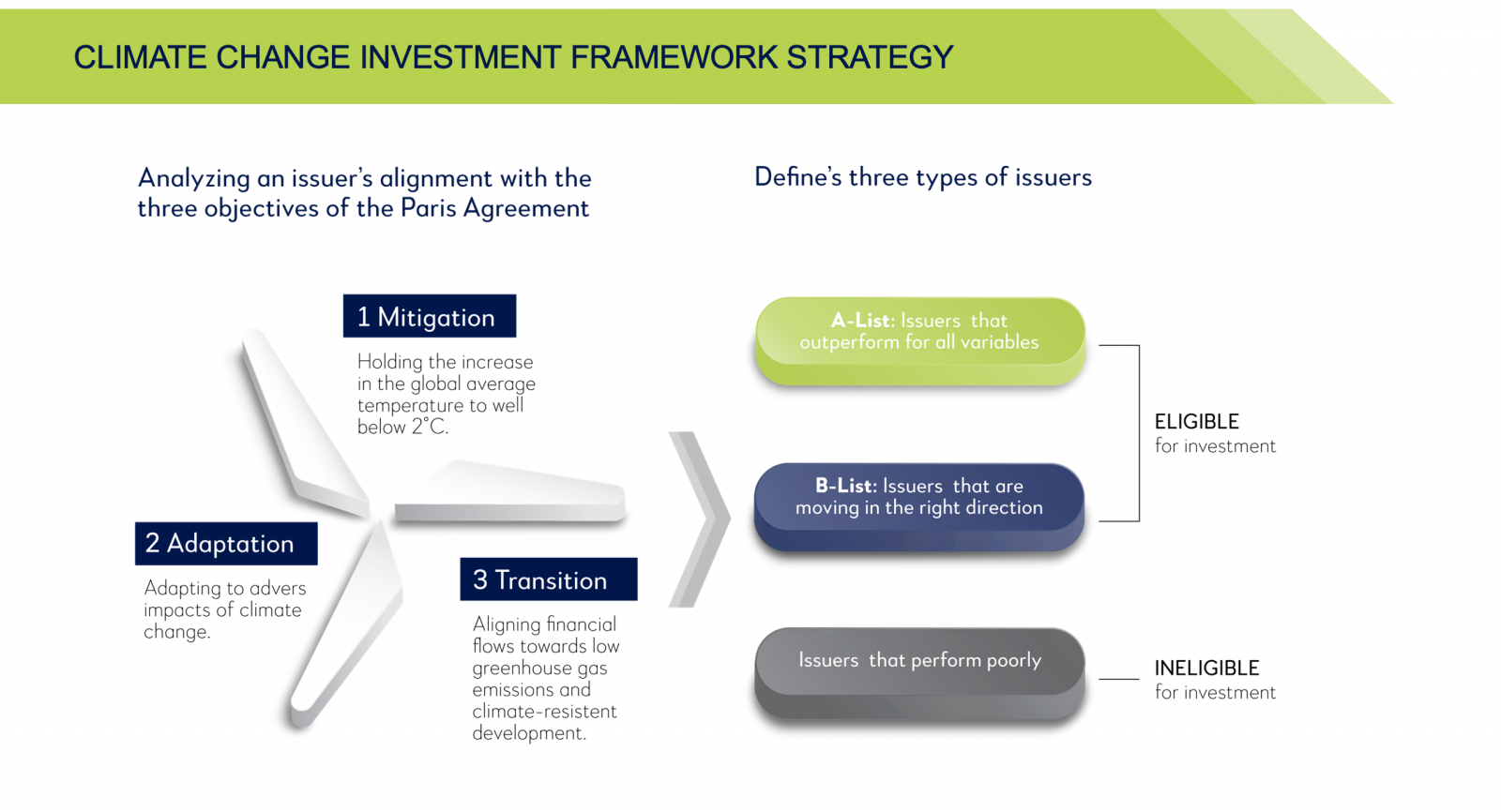

AIIB-Amundi Climate Change Investment Framework translates the three key objectives of the Paris Agreement into fundamental metrics, equipping investors with a new tool to assess an issuer’s level of alignment with climate change mitigation, adaptation and low-carbon transition objectives.

A Holistic Approach for Effective Climate Action

While groups of leading institutional investors have responded to the climate challenge by integrating climate change into investment processes, the Framework developed by AIIB and Amundi takes a holistic approach that current private-capital mobilization efforts lack. Equity capital markets currently focus on thematic funds and commonly face strong sector bias, while low-carbon indexes have a pronounced focus on mitigation efforts. In fixed income, green bonds have been the main climate finance solution for debt capital markets, but they do not consider exposure to climate investment risks and opportunities from the viewpoint of an issuer’s entire balance sheet.

Meeting Paris Agreement Requires 'Urgent Multilateral Action'

“The global climate challenge is a huge threat to our world and urgent multilateral action is needed to address this crisis and help our members meet their commitments to the Paris Agreement,” said AIIB President and Chair of the Board of Directors Jin Liqun addressing the conference. “In launching this Framework today, we and our partners show our commitment to playing an important role in the battle against climate change, by contributing to strengthening market capacity and driving the green agenda in Asia.”

Benefits for Investors

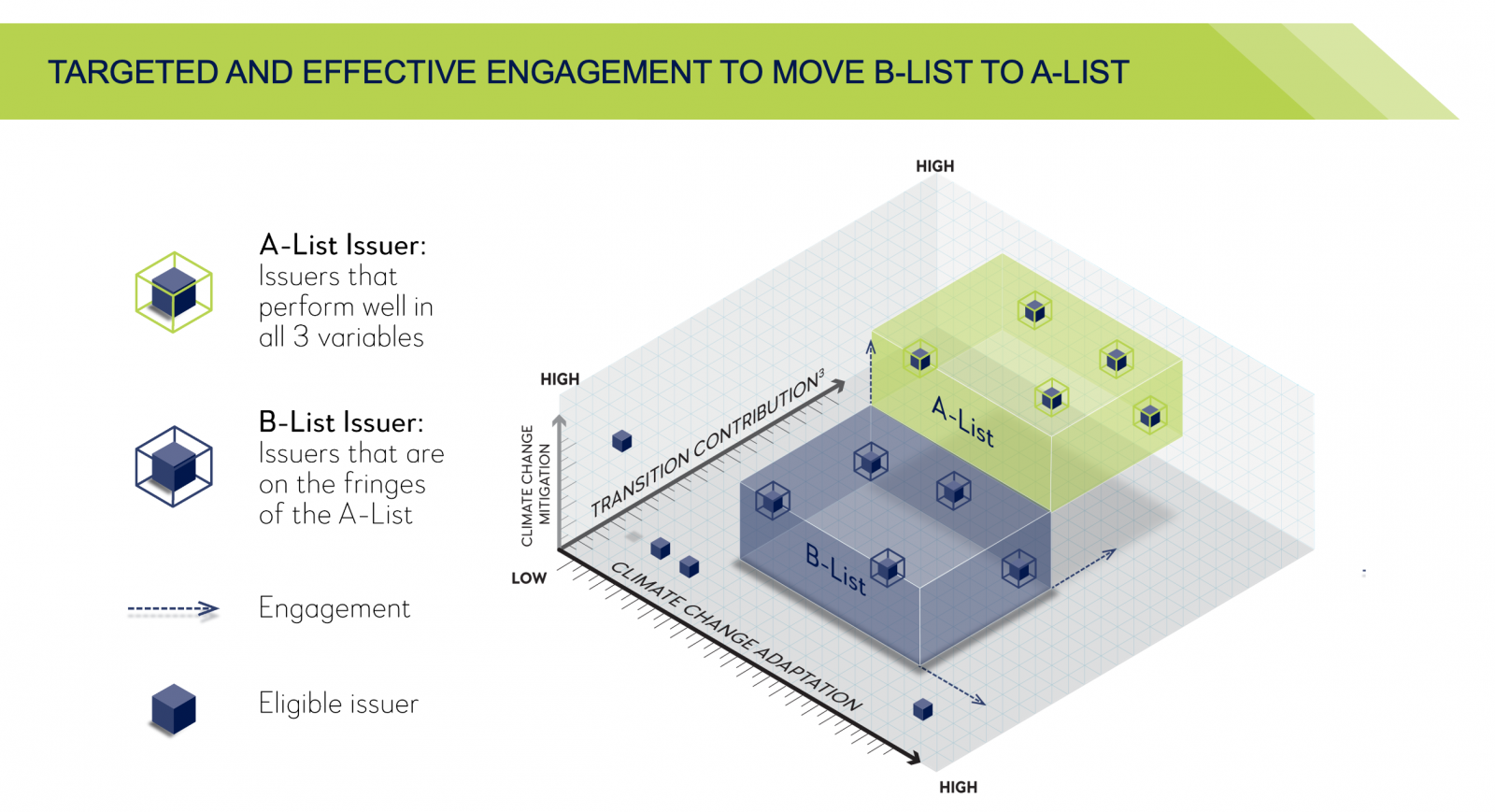

Investors can expect portfolios aligned with this Framework to deliver a potential financial impact by benefiting from any future repricing of climate change risks and opportunities in the capital market. The Framework allows investors to measure issuer performance against the three objectives of the Paris Agreement. This allows investors to systematically include A-list issuers (those that are already performing well on all three objectives) and B-list issuers (those that are moving in the right direction but are not A-list issuers yet) into their investment portfolio.

An investment strategy targeting both A and B List issuers should be more resilient to climate change risk and more exposed to opportunities not yet priced in by the market.

In addition, the Framework also delivers extra financial impact as it is designed to encourage the integration of climate change risks and opportunities into business practices by targeting the engagement of so-called “B-List” issuers to help them transition to “A-List” credentials.

"We continue to make strides in the field of climate finance"

“We are proud to launch this Framework with AIIB as we continue to make strides in the field of climate finance" Yves Perrier, CEO Amundi stated. Mobilising key stakeholders in supporting the Paris Agreement in Asia is in line with Amundi’s commitment to ESG investing and reflects our extensive commitment to the region. This new Framework will further help the investment community address climate change through the mobilization of capital to emerging markets where it is much needed.”

"A New Foundation"

“Action on climate means action on investment and private sector involvement to create green capital markets," said Sean Kidney, CEO, Climate Bonds Initiative. "With this Framework, AIIB and Amundi are laying a new foundation for the development and growth of climate finance and transition investment in the region.”

AIIB & Amundi Catalysing Change

This Framework builds upon AIIB’s climate finance milestones to date. In 2019 AIIB’s climate finance amounted to USD1.7 billion or 39 percent of total financing approved—an increase from USD2.5 billion or 35 percent of total financing approved over the previous three years combined (2016-2018).

In 2019 the Bank launched the USD500 million AIIB Asia Climate Bond Portfolio to accelerate members’ climate action, catalyse emerging market investment and address the underdeveloped climate-aligned bond market, providing a working model for the Framework. The portfolio will also function as the investment case for the Framework.

Amundi has been at the forefront of Climate Finance development, creating innovative solutions to bring new large-scale funding dedicated to financing the low-carbon economy across asset classes and geographies. As a responsible investor, Amundi seeks to fulfil its role by supporting investor mobilization and market development through flagship initiatives (such as the Portfolio Decarbonization Coalition) and partnerships with multilateral finance institutions. As of June 2020, climate finance solutions represented EUR19 billion in assets under management.

The Last Word - Shared Language on Sustainability

Serious action on climate change requires a shared language on sustainability that operates across borders. The work of the Climate Bonds Initiative and our partners help build cooperation to achieve this, while inspiring market confidence that investments are truly climate conscious.

Aligning investment with the principles of the Paris Agreement is imperative to the green agenda and market transformation in the region to meet the climate challenge.

Keep a lookout for more industry leading developments as the CCIF progresses.

'Till next time,

Climate Bonds.

Download AIIB-Amundi Climate Change Investment Framework