Issuance of green debt doubles in Southeast Asia USD8.1bn in 2019 from USD4.1bn in 2018

Increasing diversity supported by new regulations and guidelines, 39 green bond, loan, sukuk issuers

2019 sees Singapore lead issuance & with Malaysia positioning as green and sustainable finance hub

Climate Bonds Initiative, supported by HSBC, have launched the ASEAN Green Finance State of the Market 2019 report[1], an analysis of the issuance of green bonds and green loans in Southeast Asia. The report also focuses on policy developments amongst Southeast Asian nations relating to green debt issuance, including the ASEAN+3 Bond Market Forum and ASEAN Bond Market Initiative.

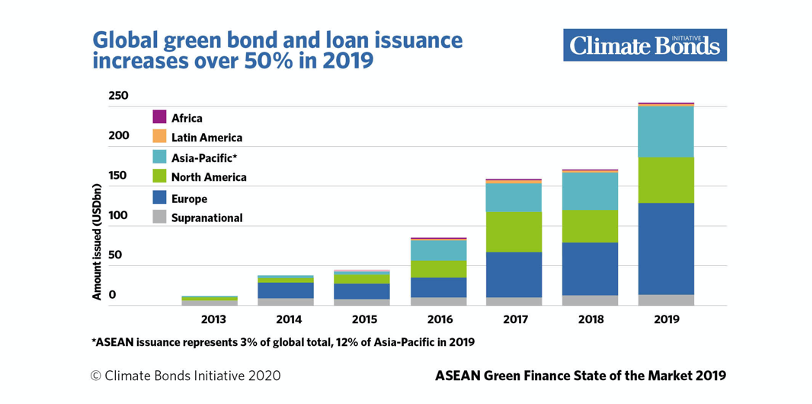

- Globally, the volume of green bond and loan issuance rose sharply by over 50%, from USD171bn in 2018 to USD258bn in 2019, buoyed by strong interest from both investors and issuers.

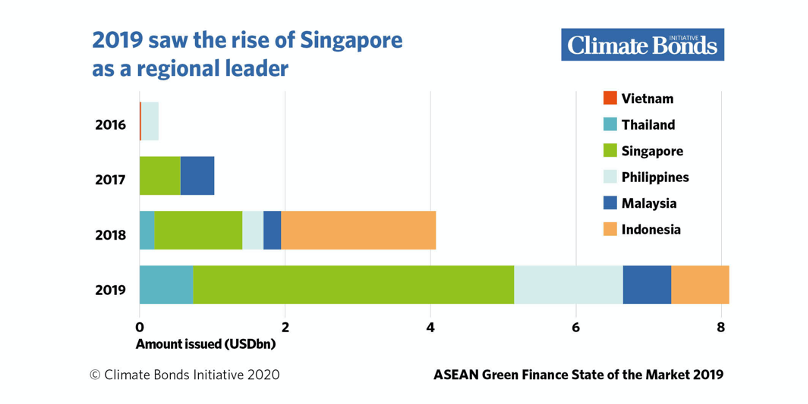

- ASEAN issuance almost doubled, reaching USD8.1bn in 2019 from USD4.1bn in 2018, supported by new regulations and guidelines. Two-thirds of the proceeds are allocated to the Buildings and Energy sectors.

- ASEAN issuance represented 3% of the global total and 12% of the Asia-Pacific region in 2019, up from 1% and 5% in 2018, respectively.

- Cumulative ASEAN issuance since 2016 stands at USD13.4bn as of December 31st 2019.

- 2019 saw the rise of Singapore as a regional leader, contributing to 55% of the ASEAN green debt issuance in 2019, up from 29% in 2018.

Chart 1 - Global green issuance 2013 - 2019

Chart 2 – ASEAN green issuance 2016 - 2019

Issuer Snapshot

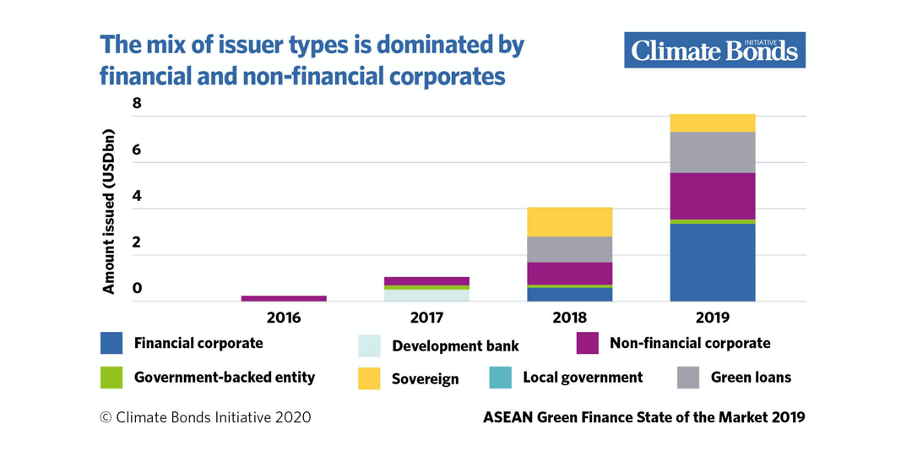

ASEAN now has 39 green bonds/loans/sukuk issuers cumulatively, with 20 issuers issuing 32 green debt instruments in 2019, up from 15 and 16 in 2018, respectively. Financial corporates have become the largest issuer type of green bonds in ASEAN, representing 29% of the total, overtaking non-financial corporates with 27% and sovereign issuers with 15%.

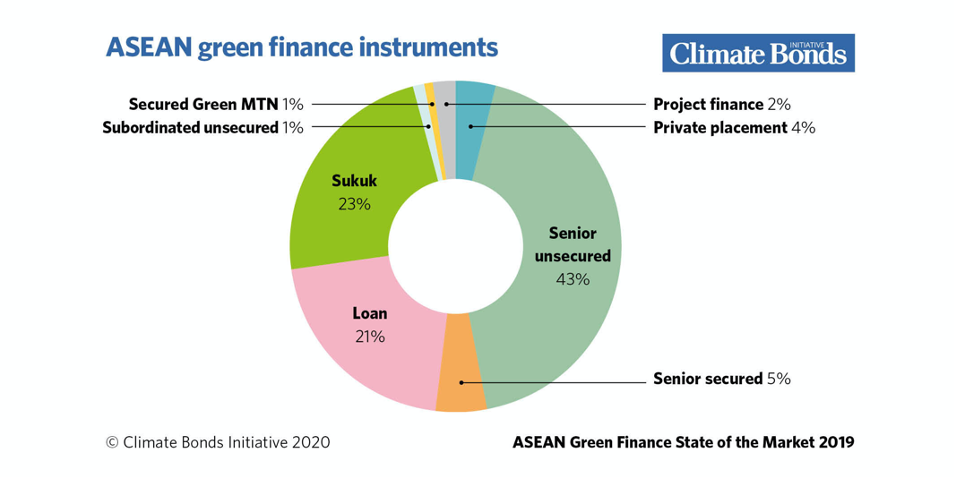

Green loans also feature strongly in Southeast Asia, with USD2.9bn issued, representing 21% of the total, largely related to Singapore’s real estate sector.

Chart 3 – ASEAN issuer types 2016 - 2019

Chart 4 – ASEAN green finance instruments 2016-2019

Denomination

ASEAN issuers continue to favour USD denomination for their green bond issuance but, with 41% issued in the local ASEAN currencies, the regional markets offer attractive investment opportunities for domestic investors and foreign funds looking to invest in local currencies.

Use of Proceeds

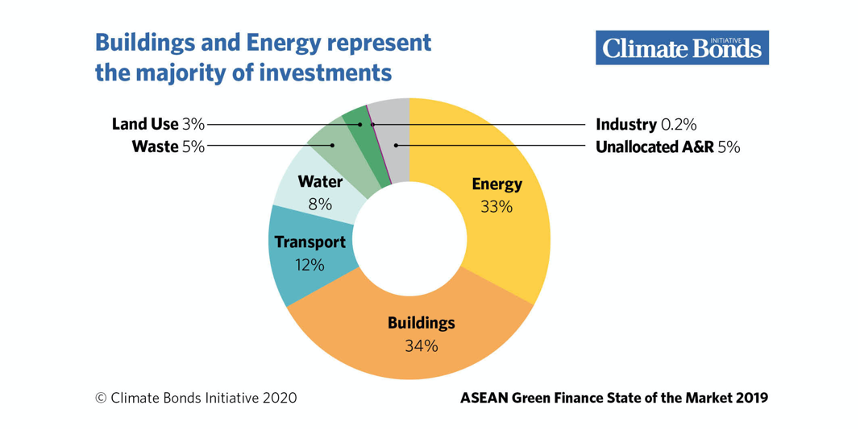

Green buildings topped Use of Proceeds (UoP) at 34%, followed by renewable energy at 33%, transport 12%, water 8%, waste 5%, with Land Use & minor sectors comprising the remainder.

Chart 5 – ASEAN Use of Proceeds 2019

External Review

Standards such as the ASEAN Green Bond Standards and the Climate Bonds Standard require an independent review that the UoP is green. Different types of external review include Second Party Opinions (SPO), Verification, Certification and Green, Social and Sustainability Bond Rating. SPOs were the most common type of review in ASEAN, representing 63% both in 2019 and cumulatively.

Increase in Climate Bonds Certifications

Certification under the Climate Bonds Standard – requiring the highest governance levels - was obtained by three issuers in 2019, an increase from 2018, representing USD1.6bn in total amount issued: AC Energy in the Philippines (against the Solar, Wind and Geothermal Criteria) and from Thailand, BTS Group (Low Carbon Transport Criteria) and Energy Absolute (Wind Criteria).

Significant Transactions in 2019

Southeast Asia saw a number of significant transactions:

- First perpetual green bond in ASEAN, issued by AC Energy, a subsidiary of the Ayala Group in the Philippines. Listed on the Singapore Exchange, proceeds of the USD400m bond will go towards solar, wind and geothermal projects.

- The first green bond under Thai Securities and Exchange Commission (SEC) green bond notification was achieved by BTS Group in Thailand, who in turn received a subsidy for the listing fees from the SEC.

- The first mini hydro sukuk, issued by Telekosang Hydro One Sdn Bhd in Malaysia.

- Bank of the Philippines Islands raising CHF100m in the Swiss markets at a coupon of 0% and a yield of -0.02%, the first negative-yielding green bond in the region.

Regional initiatives to drive green bond market development

Along with the national authorities of ASEAN+3 (ASEAN plus China, Japan, and South Korea), the Asian Development Bank (ADB) introduced the technical assistance (TA) programme in March 2020 to create the necessary ecosystems for green local currency bonds for infrastructure development in ASEAN+3.

One of TA’s key initiatives is to promote the use of the ASEAN+3 Multi-Currency Bond Issuance Framework (AMBIF), a common regional bond issuance programme that allows issuers to issue bonds in multiple jurisdictions through universal procedures. To date, seven markets have already adopted ABMIF, namely Cambodia, Hong Kong, Japan, Malaysia, Philippines, Singapore and Thailand.

Jonathan Drew, Managing Director, Sustainable Finance, HSBC Asia Pacific:

“It’s heartening to see that green instruments are on the rise in Southeast Asia as it demonstrates that the region is responding to issues linked to environmental degradation. However, the findings also reveal the disparity between nations and the enormous amount of work still to be done. There is no doubt that our exposure to sustainability issues and climate change has the potential to inflict even greater disruption on societies than that which they have to date.

“Action now, to re-start economies on a lower carbon pathway, is the key to avoiding a climate crisis and the associated costs of crisis response and bring about the huge benefits of a better quality and more resilient future of opportunities. Cooperation between governments, institutions and corporates across Southeast Asia can deliver this and finance has shown it has a critical role to play.”

Sean Kidney, Chief Executive Officer, Climate Bonds Initiative:

"This is Asia's century, without a doubt. And it's looking like it will be a green bonds century. Citizens know this has to be a green era - from Jakarta to Delhi to Beijing. Some governments are now acting, in Europe, China and Singapore. These policy shifts will have an impact. Regional governments, companies and banks have to get ahead of that wave of change.

"In the meantime, we have to prepare for the shocks that we know will become the new normal. Climate change will flood cities and deltas. Typhoons will be more intense as will droughts & fires. Pandemics will emerge, partly as a result of degrading ecosystems.

“That means heightened investment in adaptation and resilience: health systems, social protection, along with coastal protection and water management. All fundable with bonds in the fastest growing asset class on the planet: green bonds.

“The report clearly reflects that platforms now exist to green infrastructure, economic development and national growth paths across the region. Watch this flower blossom.”

The last word

2019 was a solid year in SE Asia. Relevant regulations and mechanisms now in place at the regional level via the ASEAN Green Bond Standards the ASEAN+3 Bond Market Forum and ASEAN Bond Market Initiative and domestic guidelines are in place in Thailand, Indonesia, Malaysia and Singapore.

Efforts by Singapore and Malaysia to grow their presence as green and sustainable finance hubs are also a healthy sign.

Conditions exist for green and sustainable bond markets to develop further. Indonesia has issued a sovereign green bond, Other governments acting would signal to private sector bond market participants the importance of developing the market.

At an institutional investor level, the landmark 2019 agreement between Government Pension Investment Fund (GPIF) and the ADB, where the pension fund supports green project financing through investments in ADB’s green bonds is a model that could be replicated and expanded to help grow regional markets.

Australia, with its proximity and pension funds with an appetite for infrastructure and Canada with its global size retirement funds are obvious prospects. There is also a growing potential for MDBs and DFI's to play an increasing role in supporting initial issuances and building global pension fund engagement in green infrastructure and transition and climate investment.

Transition and opportunity

ASEAN is highly exposed to the impacts of climate change. Higher temperatures, droughts, floods, extreme weather patterns, is set to experience increase severe economic and social impacts. Rapid increases in green investment and capital allocations towards climate resilient and adaptive infrastructure is one of the responses required for sustainable low carbon growth paths.

National and local governments, as well as financial and non-financial corporates and local institutions all have a responsibility to face the climate challenge as part of national development policies and directions.

By building green finance markets, establishing green finance hubs promoting green bonds, loans and sukuk as financial instruments of choice to attract long-term capital, ASEAN nations will be preparing their economies for a better, safer future.

‘Till next time

Climate Bonds

Acknowledgements

Climate Bonds Initiative would like to thank HSBC for their support in the production of this report and the Asian Development Bank (ADB) for their contribution.

ASEAN Green Finance Report 2019 Resources:

- Download Report

- Webinar Launch Recording & Slides

- HSBC Centre for Sustainable Finance website

- Joint HSBC - Climate Bonds Media Release

Coming Up! More focus on Asia

Later in April we will publish our inaugural Vietnam Green Infrastructure Opportunities (GIIO) report. (Date and Webinar TBA) New reports on green finance in Hong Kong, China and Japan are also in the pipeline. Follow @ClimateBonds on Twitter or Climate Bonds Intiative on LinkedIn for updates.

[1] Full Report - ASEAN Green Finance Report 2019: Climate Bonds website / HSBC Centre for Sustainable Finance website

Disclosure: The original Blog Post of April 15th listed a total 2019 green debt figure for ASEAN of USD7.8bn. This has subsequently been adjusted to USD8.1bn. All other figures are as previously posted. Apologies for any confusion that may have been caused.