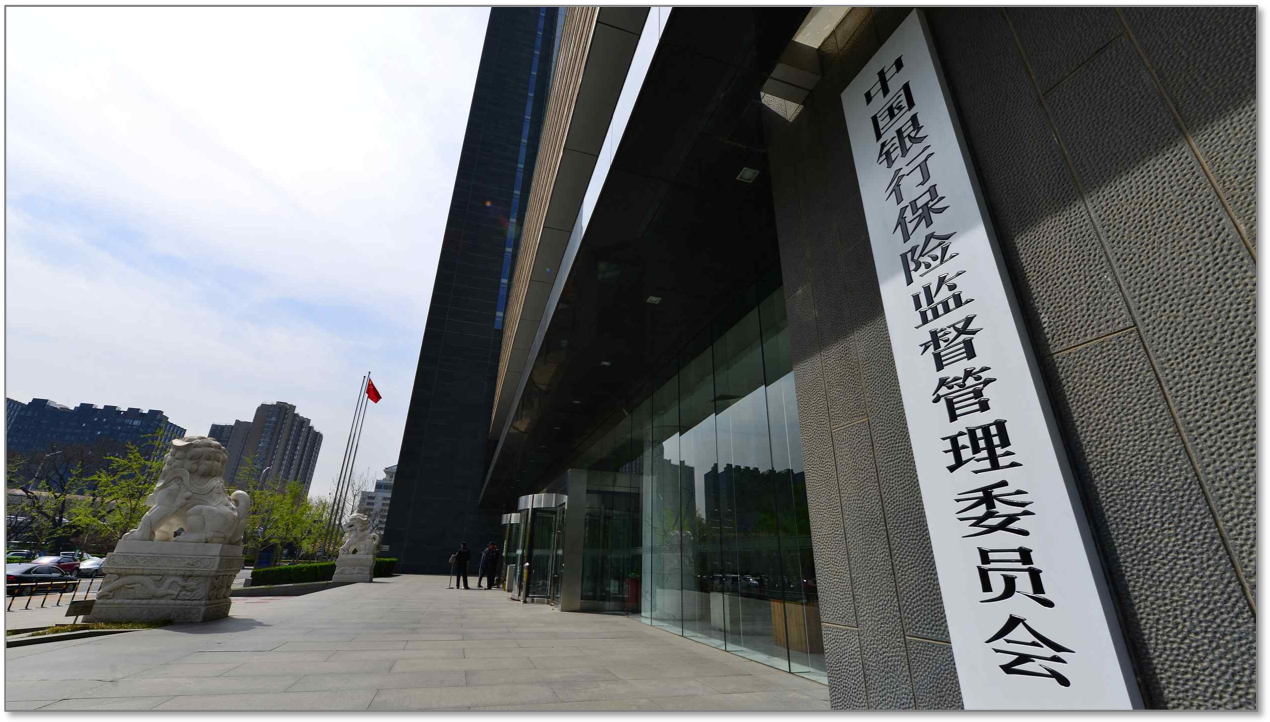

China Banking & Insurance Regulatory Commission make new moves to support greening of financial system

China’s Banking and Insurance Regulatory Commission (CBIRC) has been pushing banks for more than 10 years to stop lending to companies with environmental infringements and to develop green financial products.

On 3rdJanuary, 2020, they upped the ante, issuing, “Guiding Opinions of the China Banking and Insurance Regulatory Commission on Promoting the High-quality Development of the Banking and Insurance Industry.”

The Guidance (we would call them instructions) calls for China-based banks and non-banking financial institutions to:

- establish and improve environmental and social risk management systems,

- incorporate environmental, social, and governance (ESG) requirements into their entire credit granting process, and

- strengthen ESG-related information disclosure, reporting and interaction with stakeholders.

These are part of the regulator’s attempt to enable the “high-quality development” of the banking and insurance industry, as a response to China’s economic slowdown and rapid rise in bond default rates.

Excellent. But they went further...

Green Branches, Green Bonds, Green ABS

The regulator wants banks to also:

- Improve their professional service and risk management capabilities in green finance through the establishment of dedicated green finance divisions and branches, and

- Put an emphasis on the development of green financial products such as energy efficiency credits, green bonds and green asset securitisation.

Potential Impact

China's green term loans have increased significantly in recent years, surpassing CNY 8 trillion (USD 1.15tn) in 2018, thanks to the financing of a large fleet of wind, solar and low-carbon transport projects. However, those green assets are mainly just sitting on the balance sheets of commercial banks and have poor liquidity.

Through securitisation tools such as Asset-backed securities (ABS) and collateralised loan obligations (CLO), a considerable part of these green credits can be turned into tradeable assets for insurance companies and pension funds, allowing banks to recycle that capital into new lending.

This would release a large quantity of much-needed liquidity into China's green bond market — fast-growing but still a tenth of the size of outstanding green loans. Given scale and higher returns compared to developed economies, Chinese green ABS and CLOs are also likely to be attractive to foreign institutional investors,

Despite the great promise, a number of legal, regulatory, documentation and market barriers are yet to be overcome for foreign investors to fully access this section of the market.

The directive from the CBIRC offers an unequivocal signal that the Chinese regulators are committed to set the change in motion.

Harmonisation and Risk Measures

The Guidance also suggests that China will:

-

Speed up the conversion of household savings into long-term funds in the capital market:

-

This is an important and necessary macro-economic shift. China has the world’s largest pool of household savings, with the bulk in poorly paying bank deposit accounts (bank deposits are equivalent to over 50% of GDP). A lack of more regulated capital market opportunities has fueled an unstable wealth management and housing bubble in the past ten years.

-

-

Further open up the financial market to international capital:

-

International Integration will help with needed capital inflows as well as to educate local actors.

-

-

Support banks and insurance companies to "Go Out" in a green and low-carbon approach, by referring to and adopting international standards:

-

Taxonomy afficianados, please note.

-

-

Establish a diversified risk management policy framework, including asking all China-based financial institutions (policy and commercial banks, asset management firms, insurance companies, etc.) to further reduce the hidden debt risks of local governments, and standardise their support for local government bond issuance:

-

i.e. clean things up. This isn’t just about clearing out bad debts, important as that may be, it’s also about introducing risk frameworks that will allow more efficient stimulus when needed.

-

China arguably saved the world’s economy with its massive Keynesian stimulus in 2008, but it was very inefficient, with a large chunk going to poorly designed projects in provinces. A more sophisticated risk-based system will be able to absorb both shocks and stimulus, when they inevitably occur, without such a high level of wasted capital.

-

Development Directions

The Guidance goes a step further suggesting that China establish a green development fund and “explore” innovative green financial products such as carbon finance, climate bonds, blue bonds, environmental pollution liability insurance, climate insurance in order to support the development of green, low-carbon and circular economies and the fight against pollution.

Summary

According to the Guidance, “By 2025, the financial structure will be further optimised and a multi-layered, widely covered and differentiated banking and insurance institution system will be formed” — so there’s more to come.

All up, a new bar is being set for other banking regulators to consider.

‘Till next time

Climate Bonds

By Xie Wenhong, Climate Bonds China Project Manager

Further Reading:

CBIRC: “Guiding Opinions of the China Banking and Insurance Regulatory Commission on Promoting the High-quality Development of the Banking and Insurance Industry” (03/01/2020)

Xinhua: 银保监会发布《关于推动银行业和保险业高质量发展的指导意见 (06/01/2020)

Yicai: 银保监会:促居民储蓄转为市场长期资金 (O6/01/2020)