Germany firms position in global top 5 - Could a Green Bund be on the way?

Franktfurt at night

Climate Bonds launched the Germany Green Finance State of the Market – 2019 (GGF 2019) in Munich earlier this week focussing on green bond issuance, policy developments and market growth in the world’s fourth largest national green bond market in 2018.

Also, the week is ending with the Financial Times reporting on German Finance Ministry’s moves towards issuing a green bund for 2020.

GGF 2019

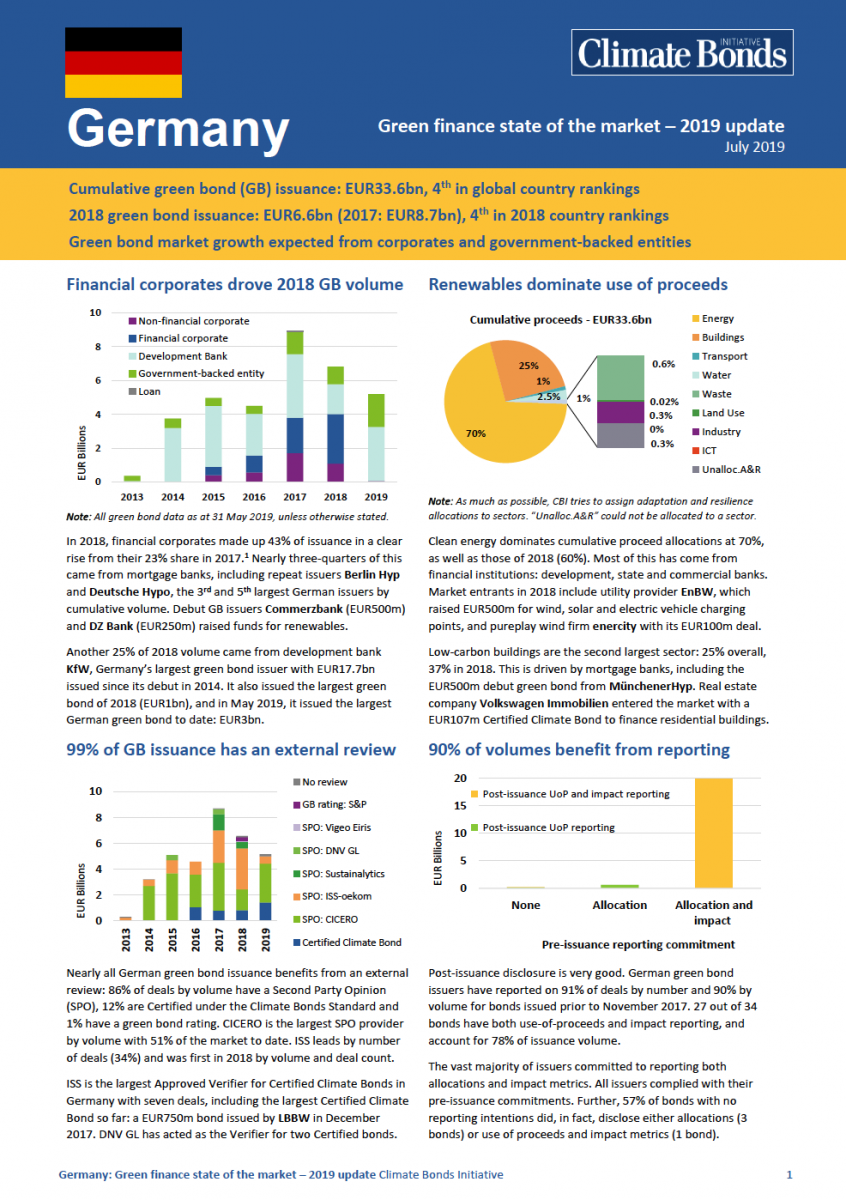

Produced with the support of DZ Bank and DekaBank, the GGF 2019 report calculates total green bond issuance of EUR6.6bn (USD7.6bn) in 2018, placing Germany fourth in annual country rankings.

Produced with the support of DZ Bank and DekaBank, the GGF 2019 report calculates total green bond issuance of EUR6.6bn (USD7.6bn) in 2018, placing Germany fourth in annual country rankings.

Renewable energy tops use of proceeds followed by low carbon buildings and low carbon transport. The three biggest green bond issuers were KfW EUR1.6bn (USD1.9bn), Berlin Hyp EUR1.0bn (USD1.2bn) & Deutsche Hypo EUR0.6bn.

KfW has also issued the largest domestic green bond to date in 2019 with their May EUR3bn (USD3.4bn) offering. Use of proceeds are committed to renewable energy and low carbon buildings.

2018 also saw a 20% rise of financial corporate issuance as more banks including Commerzbank and DZ Bank entered the market with green instruments financing renewable energy. German issuers also continue to lead in providing transparency to the market: 99% of cumulative issued volume benefits from an external review.

2018 Annual Highlights:

- EUR6.6bn (USD7.6bn) green bonds were issued in 2018, which was the 4th largest amount globally after the US, China and France

- Renewable energy dominated use of proceeds with 60% in 2018, low-carbon buildings (37%) and transportation (2.6%) the next largest categories

- Financial corporates dominated the issuer type mix with 43% - a 20% year-on-year increase

- 89% of 2018 green bonds were EUR denominated up from 69% in 2017. The second most popular currency after EUR is USD with SEK third

Cumulative Market Highlights:

- 12% of the overall market is Climate Bonds Certified

- 99% of all German green bonds to date benefit from at least one external review

- 91% (by number) also provide post-issuance disclosure with 78% publishing both use of proceeds as well as impact reporting**

- Renewable energy leads cumulative use of proceeds at 70%, with low-carbon buildings next at 25% and transport at 1%. Water, waste, land use and ICT comprise the remaining 2.5%

- 87% of cumulative issuance is bonds of EUR500m or above, indicating a healthy pipeline of green assets and projects and further head room for growth

Our Four Catalysts for Accelerating Green Growth:

- Issuance of a green sovereign and public sector green bonds; Signalling to the market to support green finance growth

- Awareness-raising and stakeholder dialogues; Implementation of EU TEG outcomes and supporting sustainable finance activities

- Policy framework development; Sustainable finance hub development and strategies

- Accelerated energy transition (Energiewende) financing;

Who’s saying what?

Viktoria Gerling, verantwortlich für Sustainability Bonds im Kapitalmarktgeschäft der DekaBank:

“With climate change turned from a threat into an acute emergency, we need to deploy and finance ambitious climate mitigation and adaptation projects and assets at scale, at speed. Germany has already shown tremendous leadership at home, in Europe and beyond. We now need to bring that leadership from the political and energy utility space into the finance space. This report depicts the status quo, lessons learned and opportunities going forward.”

Marcus Pratsch, Head of Sustainable Bonds & Finance bei der DZ BANK:

“DZ Bank is excited to work with other market players and the Climate Bonds Initiative to further deepen and broaden national and international climate finance. Cooperation is the way forward to tackle the challenges in front of us, and we invite all other influential players to come to this exciting climate finance space and make the largest possible contribution.”

Manuel Adamini, Head of Investor Engagement at Climate Bonds Initiative:

“Germany is already a global voice on climate action at COP, the OECD and G20. Its domestic banking, finance, technology and industrial sectors provide a platform to cement a leading role in the area of energy transition (Energiewende) and green finance. The GGF 2019 report reflects these strengths and opportunities for Germany in an expanding market for sustainable investment that supports the shift towards zero carbon.”

The Last Word

Germany joining the sovereign green bond club would attract global attention given the central role it plays in EU and global finance. Membership currently includes Poland, France, Fiji, Nigeria, Ireland, Belgium, Holland, Lithuania, Seychelles with a blue bond and Chile. Plenty of room for more amongst G20, OECD, EMEA and LATAM nations.

Meanwhile the GGF 2019 report reveals the extent to which German banks and corporations are already acting on green finance. Movement at a national and regional level from the public sector would add considerably to domestic momentum. We also expect the impetus arising from the EU TEG process which Climate Bonds has been participating and contributing, to be a positive force. Through the remainder of 2019 and into 2020 our best estimates are that Germany will remain in the leadership group as one of global top 5 of national green issuers.

‘Till next time,

Climate Bonds

Available in English and German, Germany Green Finance State of the Market 2019 is the second Germany report in an ongoing series from Climate Bonds analysing green finance developments in Europe.