H1 2019 green bond issuance 48% up on H1 2018: 3 new members in sovereign green bonds club: Chinese banks increasingly active in emerging market underwriting

Climate Bonds has launched Green Bonds Market Summary – H1 2019 report. It focuses on labelled green bonds and the latest market developments.

Climate Bonds has launched Green Bonds Market Summary – H1 2019 report. It focuses on labelled green bonds and the latest market developments.

The report identifies issuance trends in the first half of the year and highlights topics of special interest, including sovereign green bonds and green asset-backed securities (ABS).

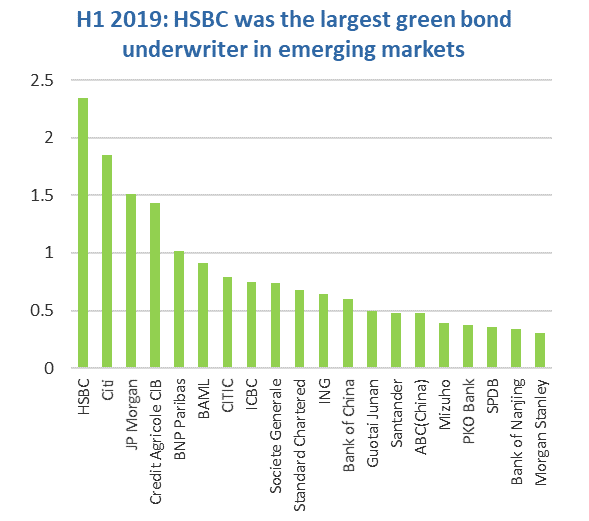

H1 2019 highlights

Global green bond market:

- Labelled green bond issuance: USD117.8bn (up 48% on H1 2018)

- Non-financial corporates lead with 26% of volume, followed by financial corporates at 19%

- Emerging markets make up nearly a fifth (19%) of issuance with China’s lead

- Sovereign green bond issuance growing: 3 new issuers enter the market bringing total to 12

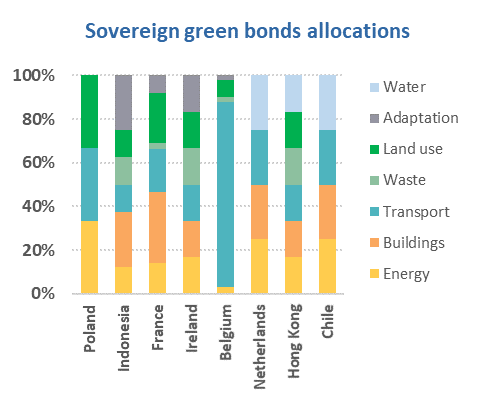

- USD12.3bn sustainability / SDG / ESG bonds and loans financing green and social projects

- USD5.7bn social bonds financing social projects

- USD11.9bn additional bonds, which do not meet the Climate Bonds Green Bond Database screening criteria

- The Dutch and Chilean governments issue Certified Climate Bonds

Green Sovereigns: The start of a boom?

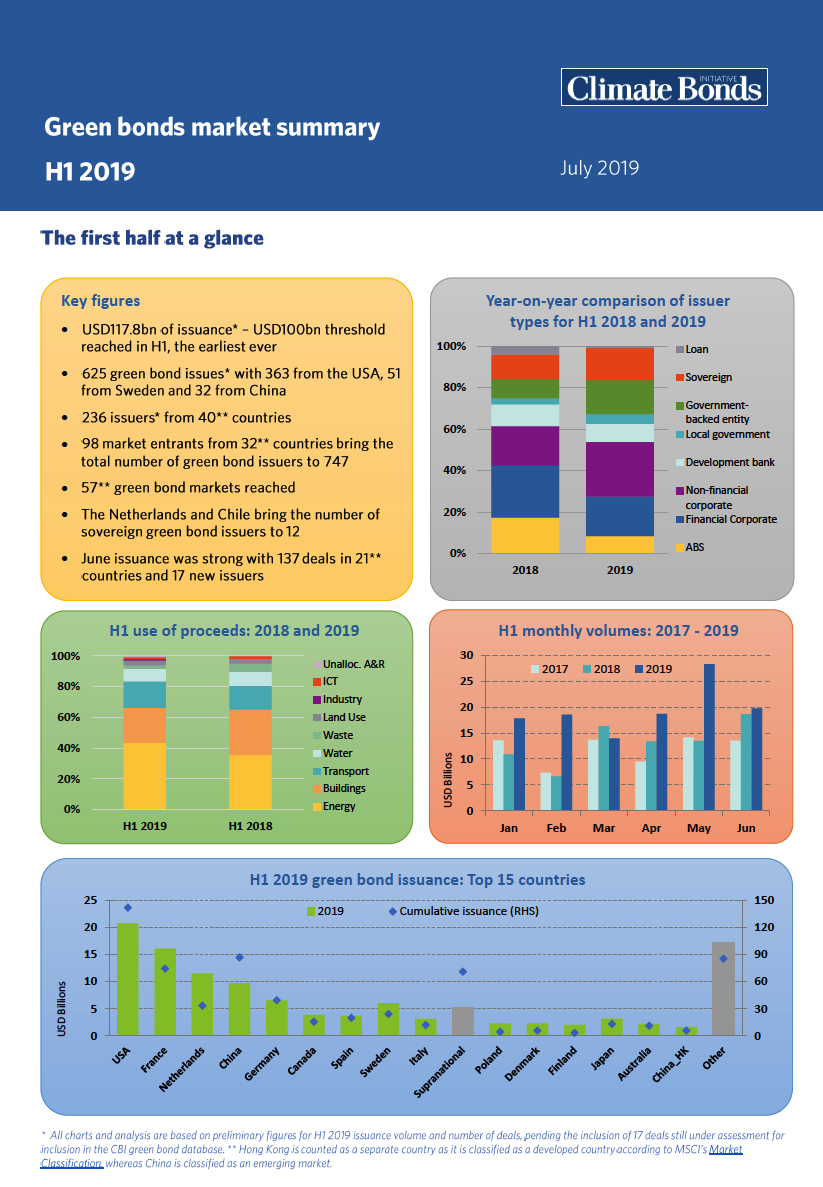

The first sovereign green bond was issued in December 2016 by the Republic of Poland. Since then, 12 governments have issued 23 green bonds totalling USD47.5bn. Almost 40% of that amount (USD18.4bn) was printed in H1 2019. This boosted the proportion of sovereign bonds of the total from 12% in H1 2018 to 15% this year.

The Netherlands, Hong Kong, and Chile issued debut green bonds in H1 2019. Poland, Indonesia and Nigeria returned to the market, and the French green OAT was tapped twice.

Highlights from the sovereign spotlight section

- Most of the financing from sovereign bonds goes to low-carbon transportation, but the proceed allocations are diverse

- Our pricing research finds that 50% of the 10 bonds for which we have comparable data attracted a larger order book than vanilla equivalents during the primary pricing process

- For the same basket of bonds, 91% achieved larger spread compression during the book-building process than comparable baskets, and

- Sovereign green bonds from France, the Netherlands, and Chile 2050 exhibited a “greenium”

Looking ahead, Sweden, Germany, Spain, Egypt and Peru have all signalled 2020 issuance. This would take the sovereign green list close to twenty, which is a positive, but there’s still room for more.

The wider labelled universe: sustainability bonds, social bonds, SDG bonds, blue bonds …

The labelled bond market continues to expand beyond green bonds. The first half of 2019 saw sustainability/SDG bonds maintaining their place in the wider labelled market with USD10.3bn of transactions as issuers and investors continued adopting policies and strategies linked to the UN’s 17 Sustainable Development Goals. Social bonds also maintained visibility with USD5.5bn of issuance within the labelled market which totals a healthy USD145.4bn for the half year.

Climate Bonds supports the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15.

Notwithstanding this, Climate Bonds remains focused on green bonds, which are specifically linked to climate-change mitigation, adaptation and resilience. Consequently, the proportion of proceeds allocated to social projects which are not also green, needs to be no more than 5% for inclusion in the Climate Bonds Green Bond Database.

Underwriter league tables

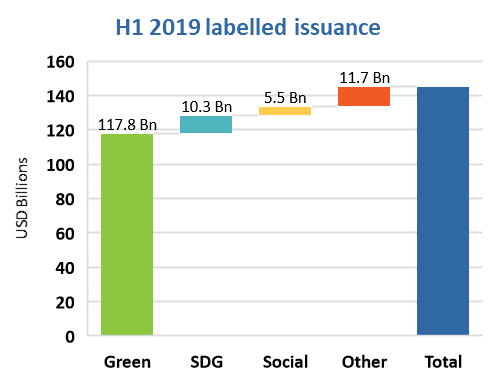

In H1 2019 HSBC took the top spot from BAML for global green bond underwriting, where BAML shifted one rung to second place. The largest underwritten deals for HSBC included the USD1.48bn sovereign Certified Climate Bond issued by the Republic of Chile and the EUR1bn Certified Climate Bond from Société du Grand Paris (SGP).

Despite the change in order, the top 5 underwriter composition is similar to H1 2018: Credit Agricole, JP Morgan and BNP Paribas took 3rd, 4th and 5th places (2nd, 5th and 3rd last year, respectively).

HSBC also topped the Emerging Markets (EM) underwriter league table. The EM Top 20 includes 7 Chinese banks, with ICBC leading this sub-group at 6th place overall. We expect China’s dominance in green bond EM issuance and underwriting to continue overtime. Poland’s PKO Bank is also noteworthy, which issued a Certified covered bond in June 2019, taking 16th place in the rankings.

Emerging Markets Underwriter League Table H1

The Last Word

The first half of the year has seen an upswing in market growth after the disappointing end to 2018. The USD100bn mark was passed in late June, the first time the milestone has been reached during H1, and outlook for 2019 remains positive.

Climate Bonds’ January estimate of up to USD250bn in annual issuance for 2019 remains unchanged.

We’ll give you another update at the end of Q3.

Till next time,

Climate Bonds